[#27] Do all roads in fintech lead to license aggregation: Part 1

Is it a race to get licensed?

I had written earlier about how if everyone is becoming a payment aggregator, then what do the original payment aggregators do. That was in February 2024, and the number of fully licensed payment aggregators then were 15. In the last 2 months, that number has almost doubled, to 27. And while 12 of these are existing PAs (both domestic & international players), a fair few of them are not. You can see the full list of fully licensed payment aggregators below. The RBI link is here

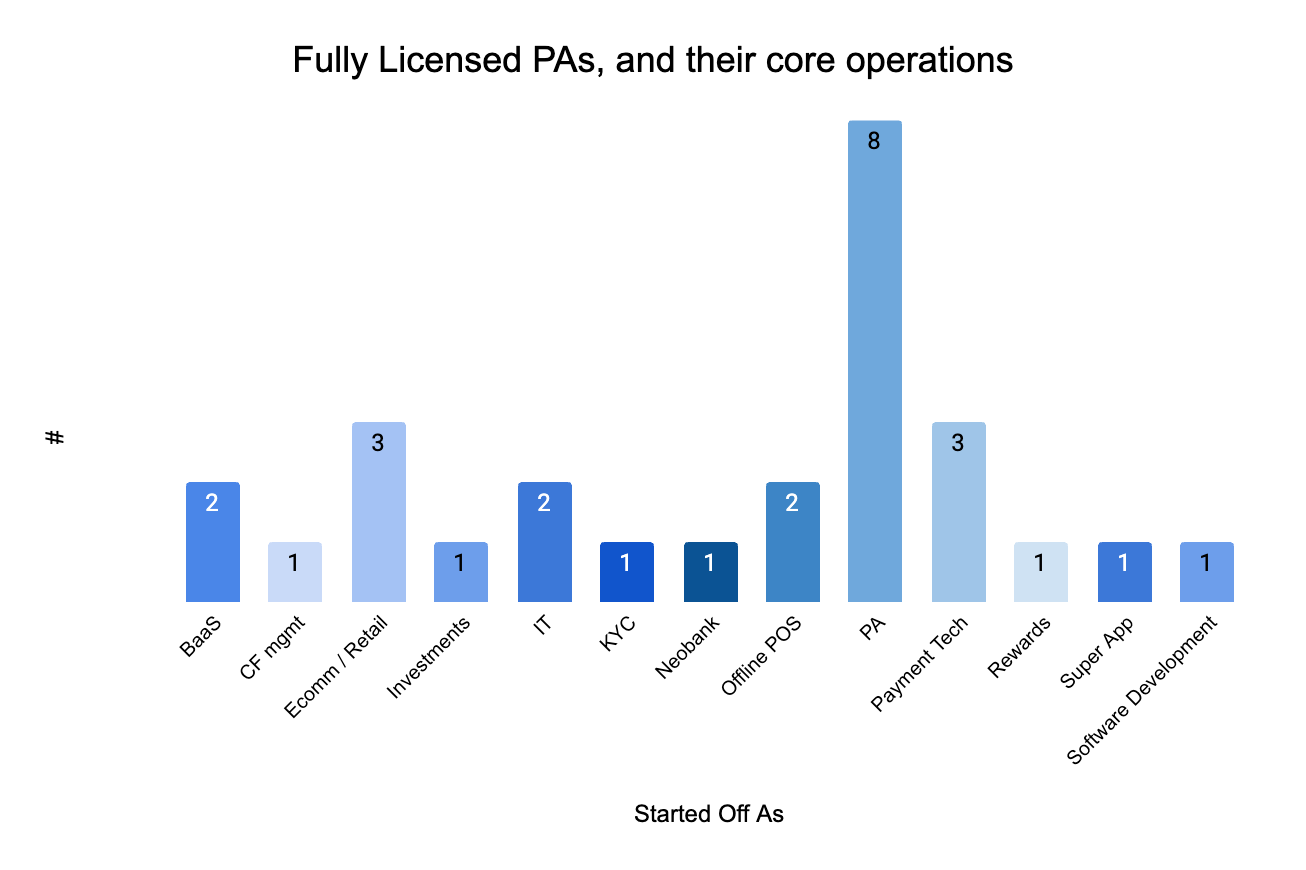

The distribution of fully licensed PAs, while concentrated on existing PAs, is spread out across the multiple segments. Ecomm / Retail players such as TATA, Zomato & Amazon, and Payments Tech players such as Juspay, Toucan Payments, & Concerto are the other major segments which have been granted a full PA license. The break-up of the segments that fully licensed PAs operate in are below:

Some of the new entities that have been given full licenses since February are:

CAMs, Toucan Payments, Concerto, Boku, Unlimit, Worldline, CC Avenue, Innoviti, Mswipe, Groww, AmazonPay & Finacus.

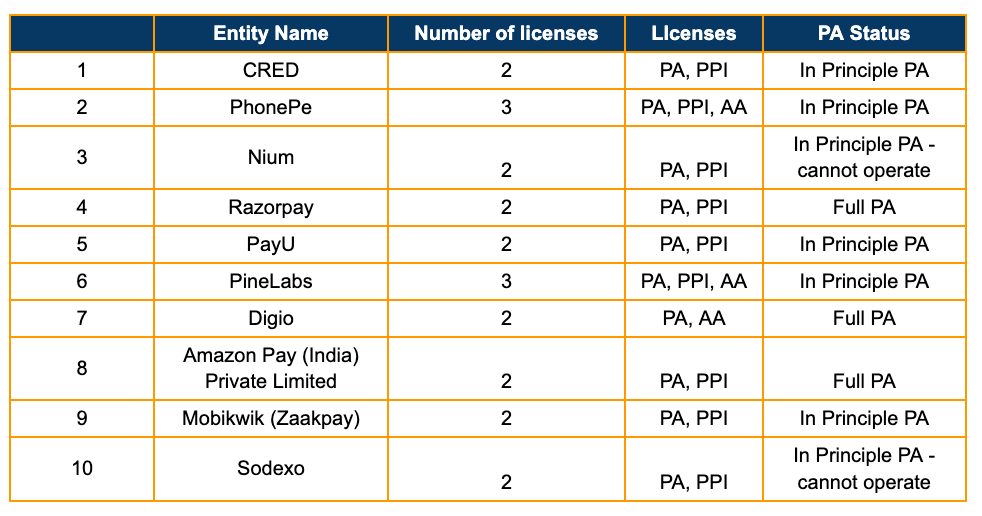

But there are a few other segments, RBI gives out these licenses in phases. While 27 are fully licenses and can operate, there are other entities who do not have full PA licenses, but have been given in-principle approvals, and can & cannot operate. The full list of in principle approvals are here.

There are some major fintech players who have been given in-principle approvals & can operate. There are also players who have an in-principle approval but cannot operate.

Major PA players such as PayU, Phonepe, and PineLabs, while can operate, actually only have in-principle approvals, and are yet to get fully licensed from RBI.

So. In total now. 27 fully licensed PAs. Another 33 who have in principle approvals and can operate. And 11 who have in principle approvals who cannot operate yet. Payments are being commoditized with pricing pressure reducing revenue opportunity. But maintaining a fully blown PA is not that easy.

And it is possible that atleast with the bigger ecomm players, getting a PA license is more along the lines of optionality - to enable them to negotiate better with PAs, and in the future build their own if PAs decide to start pricing higher.

But even if core PA operators will build, the market is still crowded.

But that just solves for those players who are not fintechs, and are not PAs. There are still 8 licensed PAs, who’s core operations are PA in India currently, and another 6+ who have in principle approvals to operate.

The fully licensed ones are: Razorpay, Paymentz, CCAvenue, Cashfree, Stripe, Worldline, Boku, Unlimit

The major in-principle approval & can operate: Adyen, Eazebuzz, PayU. And PineLabs & PhonePe, while their core operations are not PAs, they are still scaling up their business quite rapidly. And Juspay, which has experience in building payments tech.

And here’s another interesting insight: Out of the top 10 non-bank / NBFC UPI Apps, 6 of them are some sort of licensed PA

Take a look at the top 20 UPI Apps with the most volumes (# transactions) and volumes (in INR Cr) in March ‘24. Out of them 10 are bank / NBFC Apps (such as Axis, HDFC, ICICI. Kotak, and Bajaj). The remaining 10 are fintechs, such as PhonePe, Googlepay, Cred, Amazonpay, Fampay, Whatsapp, BHIM, Mobikwik, & Groww. Any of the names sound familiar? 6 out of 10 of these have applied for and been approved (some status) for a payment aggregator.

So then is the thesis that B2C Apps will start applying for PAs, and scale that offering? On the face of it, it makes sense, sure. That’s what PhonePe has tried to do. Build a brand on the B2C side, and hope that they are able to see some goodness about this on the B2B side as well. Whether they’ve able to succeed in this is something we’ll know only going forward, but the brand name on the B2C side definitely helps, especially when trying to acquire SMEs, and start-ups on their PG business.

And maybe that’s a play, and something that I’ve talked about in a previous article. Companies that start with a B2C model rarely stay that way, because it is hard to monetize the end user in India. Instead they expand into a B2C + SME play, so that they can monetize the business to subsidize the customer.

And maybe in the future, UPI apps down the list such as Jupiter (neobank), GoKiwi (CC on UPI App), Flipkart will all apply for PAs as well, in the hope of the B2C + SME (Flipkart is also an ecommerce giant, so they already have a viable business model, and may not need to go down the PA route, unless they are looking at payment optimization, similar to what Amazon has done.

So how will these PAs set themselves apart?

I’ve taken a look at a sample list of PAs, most of which are fully licensed, and tried to get an understanding of how they’re setting themselves apart. Product builds, especially for tech first companies may be a moat, but only for a period of time. So then what are possible moats? It could be licenses, which further limit the number of players in the market, and open up different business verticals.

One way could be to get licenses such as Prepaid Instruments (PPI) & Account Aggregator (AA) licenses. These can further add to the revenue opportunity & experience layers within payments.

For example: PPIs are a method of payment. They are instruments (such as giftcards, or wallets) that can be loaded with some money, and then be used to pay at accepted merchants. Account Aggregators are licensed entities which allow users to share their financial information with licensed institutions after user consent. Banks / financial institutions can choose to join the network, and AAs can share the data in an encrypted fashion for ease of lending, KYC etc.

While the majority of these players only have a PA license, there are a fair few who have acquired other licenses as well. Below are the PAs (in various stages of approval) who have multiple licenses:

The PA + PPI license seems to be most popular. Which is not to say that these entities have not applied for AA licenses. As per a news article in 2022, CRED intended to become an AA as well. Since it involved data, it’s fair to assume that the requirements to be an AA would be stringent, and also require the entity to be domiciled in India. And AA’s are most useful in the business of lending: customer information such as bank statements are needed most when authorizing loans, and in the process of BNPL payments. The revenue potential from BNPL payments is usually more than regular payments. And because PAs control the checkout, they can optimize for discoverability & experience, which could be the reason why PAs want AA licenses.

NBFC Licenses seem to be the crown jewel but RBI is reluctant to give them out

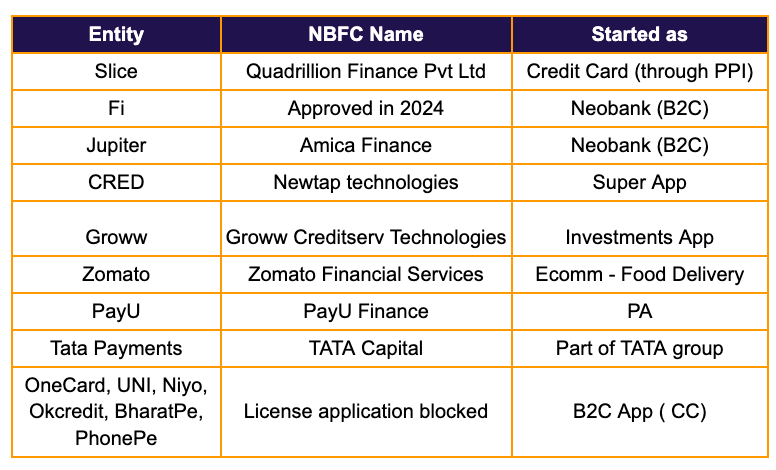

NBFC Licenses seem to be the jewel in the crown that all fintechs seek. It enables them to grow their own books through lending, which more and more seems to be where fintechs are pivoting in order to make money. There are more than 9500 NBFCs in India, most of which are dormant, and which fintechs are seeking to acquire. But RBI is reluctant to give them out.

Out of the PA list, CRED, Groww, Zomato, PayU & TATA have affiliated NBFCs. Others like Fi & Jupiter are neobanks, which makes sense from a banking perspective - if not a banking license then an NBFC license is the next best thing that can help fuel bank products such as credit cards & loans.

But why is RBI reluctant to give out NBFC licenses, or allow acquisitions? Well, according to this report last year, it is to do with overlapping owner structures. The same VC / PE firms have invested in multiple fintechs, some of which have already received NBFC licenses. The RBI generally is not in favour of the same entity holding multiple NBFC licenses, and seems to have extended that logic to investors also. And that’s probably why OneCard and others were rejected: OneCard for example has been invested in by Matrix Partners, which has also invested in Jupiter, which has an NBFC license.

After the new risk weights imposed on bank lending to NBFCs (125%) NBFCs are finding it harder to raise capital to lend. And this is because of 2 things: 1) banks have to keep more capital in reserve when lending to NBFCs 2) If banks have to keep more in reserve to lend out the same amount for business, they will expect to earn an equivalent sum on a lower amount, which will result in banks hiking interest rates to NBFCs, and NBFCs doing the same to the end customer. Higher interest rates usually lead to adverse selection, and hurts the bottom line.

There’s also the fear of fintechs doing disproportionate lending to offset their losses, and there could be a risk of building high risk books very quickly, due to investor pressure to increase revenue and valuations. Which could then put a risk on the system (Paytm payments bank being a prime example of this).

What is the conclusion?

Here’s my take on how this will play out:

1. Big ecomm players will continue to apply for PA licenses. They may build certain aspects of the PA itself, but this is more from an optionality perspective. Scaling to the offerings that established players such as PayU, Razorpay etc are at may not really make sense, especially with the pricing being what it currently is, especially for Enterprise players. It also gives optionality in case pricing increases in the future. However, the issue here is (and we’ve seen this with Zomato returning its PA license) is that payments is a regulated business. So only those entities who are really big, and see sustained advantages with having their own PA will invest in this, and risk the headache of RBO audits.

2. More International players (such as Unlimit, Boku, Stripe, Nium, Worldline, Adyen) will apply & get PA licenses: As Ecomm & digital payments in India grow, international payments are keen to get a piece of the local acquiring pie in India.

3. Product builds may not be a long term moat, but license aggregation could be:

For established PAs, it will them give a payment ++ offering, and an opportunity to further give a better experience on its platform vs others

For ecomm players - optionality

For payment tech players, yet another product in their software suite (Ex: Zoho). The strategy could be similar to Salesforce acquiring Slack & Tableau, and how Microsoft Teams wins over Slack - a full-stack play has a better chance of winning enterprise clients, which is where the money seems to be. And this is more from a right to win perspective, since enterprises usually have more than one PA, to solve for down times and success rates.

For smaller fintech players, it makes them more valuable as an acquisition target, and could lead to higher valuations, and may not necessarily be a threat to the full stack PA offerings that big players such as Razorpay, PayU have.

4. RBI will continue to monitor & restrict the NBFC licenses given out: They are already coming down strongly on NBFC, and as a result banks remain cagey about lending to NBFCs. And RBI also doesn't want to take the risk of disproportionate lending to offset losses done by fintechs who have raised VC funds.

5. The UPI App to PA movement still remains to be seen: I do believe that out of the UPI Apps, the B2C only players will move to an SME model. That may be PA, or some other B2B offering, but just B2C alone may not be enough for a sustainable business. Phonepe, Paytm are all examples of this, even after having majority market share, because the nature of UPI is that it is free, and even if pricing does come into the picture, it may be minimal, it is essential for B2C UPI players to find other revenue channels.

Appendix

Mapped list of fully licensed PAs, and select operators & non-operators, with respective licenses