[#31] Nubank: Decoding user growth of the LATAM neobank amidst credit disbursals

Are the numbers as good as they look?

Over the last couple of weeks, I’ve been reading about how Nubank, the biggest Neobank in LATAM, has hit 100M users. So I thought I’d dive deeper to understand what’s happening, and how they're making money. Lets dive in:

Nubank hit 100M users in May 2024, but the majority still sit in Brazil, despite expansion to Mexico in 2022 and Columbia in 2020:

They hit 100M users in May 2024. Out of which 82M are active customers. The active NuAccounts are ~73M. The active credit card customers are ~41.2M. And the active unsecured personal loan customers are 7.9M. So, a fairly big and growing base, although most of this base is currently in Brazil, even though they have expanded to Mexico and Columbia. 92M of their users are in Brazil, 7M in Mexico, and 1M in Columbia, and 94% of their revenue comes from Brazil

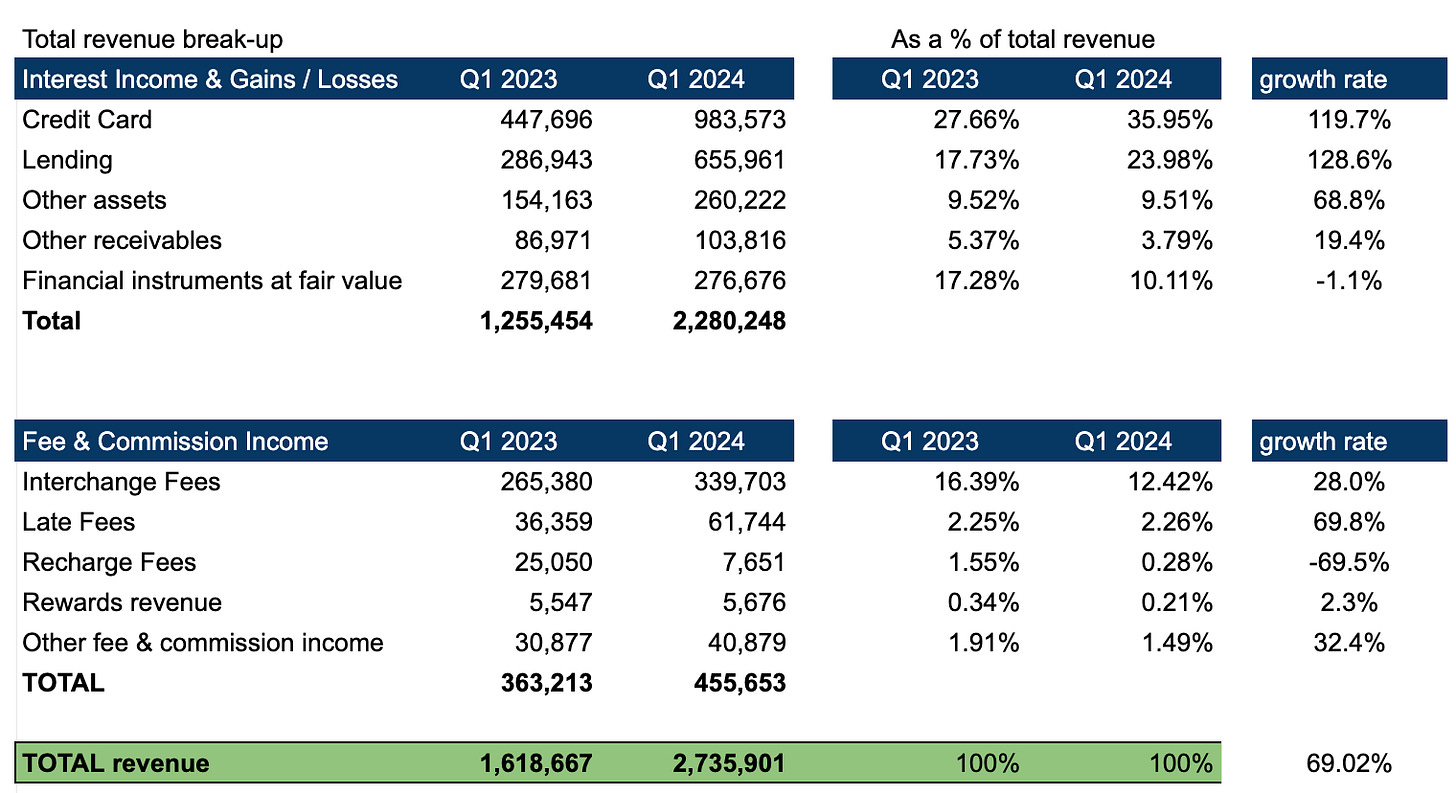

Their total revenue grew by ~68% to $2.7B in Q1 2024, but the majority proportion is interest income that comes from credit cards & personal loans.

As per their financial statements, their total revenue (Q1 FY24 ended 31st March) in Q1 2023 was ~$1.6B, which grew by ~68% to $2.7B in Q1 FY2024. But what is important to note here is that majority of its income comes from interest income, and gains on financial instruments. And this has increased from a 77% proportion of total revenue in 2023 to 83% of total revenue.

Interest income, in a bank usually is from any sort of credit product they give out, such as personal loans, or it’s also by the spread between the interest they pay to their depositors and the interest they lend out the depositor money at (usually at a higher rate than the interest promised to the savings account holders).

Where does revenue come from?

Majority revenue comes from interest on lending, which was ~44% in Q1 2023, and has grown to ~60% in Q1 2024 (included credit cards and lending) - explained in the next section

Interest from other assets, receivables, financial instruments etc was at a total of 31% in 2023 of total revenue, and is now at 22% of total revenue

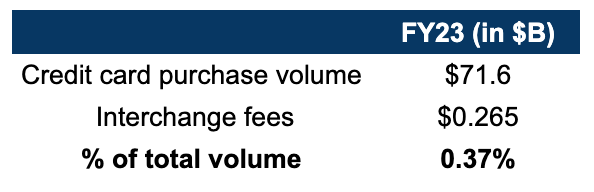

Interchange fees: the fees that Nubank gets when a customer pays using a credit card has decreased as a % of total from 16.39% to 12.42%, but has shown overall growth of 28%. According to this article, the credit card interchange fee charged is 0.7%, of which Nubank seems to keep more than 50%, or 0.37% on total volumes.

Late fees: While this is a small proportion of the overall revenue pie (~2%) this has grown by ~69%, from $36M in Q1 2023 to $61M in Q1 2024!

The interest income from credit cards has increased by 36%: Either interest rates are higher, or more customers are delaying paying their full credit card bills:

In the case of NuBank, majority of their revenues come from interest income on Credit card, and lending, which is increasing:

Credit Cards from 27.66% of total revenue went to ~36%

Lending went from 17.73% to ~24% from Q1 FY23 to Q1 FY24

And with credit cards, usually the interest rates come in when there is some payable balance at the end of the month that has been carried over to the next month: Example - if you’ve tried to pay your credit card bill, you’re usually shown two options: To pay the amount in full, or to pay the minimum balance amount. If you pay the minimum balance amount, or don’t pay any amount, the remaining outstanding balance is charged an interest rate. By seeing the increasing interest income from Credit cards, while great for the bottom line, could also mean that there is essentially more of this balance that customers are not paying, but are instead carrying forward month on month. And if this is not done carefully, it could explode.

Nubank’s interest earning portfolio of credit cards has grown by 62% from Q1 FY23 to Q1 FY24, so it seems like more customers are carrying forward their credit card bill

Take a look at the IEP (Interest earning portfolio) of the credit cards. This is a snapshot from the Q1 FY24 report released in May. The light purple is the interest bearing portfolio proportion of Nubank, and the light blue is the comparative market numbers.

From Q1 FY23 to Q2 FY24, the proportion of the IEP of Credit Cards has increased from 16% to 26%, a growth of ~62%.

Nubank’s credit card interest earning portfolio vs market (From Q1 24 earnings report)

Nubank’s Non Performing Loans have increased over the years, and as of Q1 FY24 are trending at all time highs:

And even NPLs (non performing loans) which include both cards and loans, are trending upwards from 2017 to 2024. Infact, Nubank’s 90+ NPLs are at 6.3%. While this is still lower than the country NPL’s on Credit Cards: According to this report: in Brazil, 90+ day NPLs have risen from 6% in 2019 to 8.3% in Jan 2023. So Nubank is lower that the national average, for now.

NuBank NPL (from Q1 FY24 earnings report)

The interest rates that Nubank & Brazil charge on credit cards are reportedly very high: upwards of 400 % APR!

If you have a regular credit card, you’ll pay between 2-3% interest per month on it, which usually comes to 36 - 42% per annum. In Brazil this number is ~455%! Take this article by the Washington post which states that the average APR on credit cards in Brazil is ~431%. Which is probably why there is so much focus by Nubank to grow its credit card lending portfolio: the interest rates it can earn are very lucrative. But there is a downside to all this. Will the customer be able to pay all this back?

The credit loss allowance expense has increased as compared to the total lending portfolio:

Growth in lending portfolio from Q1 FY23 to Q1 FY24

Q1 FY23: $12.8B

Q1 FY24: $19.6B

Growth in lending portfolio: 53%

From Nubank’s Q1 24 Earnings Report

Growth in the debt the Nubank is expecting not to recover (credit allowance):

Q1 FY23: Credit loss allowance: $474M

Q1 FY24: Credit Loss allowance: $830M

Growth in credit loss allowance: 74%

The growth in the losses that Nubank is expecting is 40% more than the growth in the lending portfolio. Which could raise questions about sustainable growth of the credit portfolio.

Nubank cost & profit for Q1 FY23 and Q1 FY24

But Nubank is doing something right. It is profitable: it made $1B+ profit annualized in FY23, which is no mean feat

1) Their revenue in Q1 FY23 was $243M which grew by 237% to $578M in Q1 FY24

2) They are operating at PAT margin % (of revenue) of 13.85%, which is up from 8.76% in the comparative profit of the previous year, which is probably attributable to the increase in their lending portfolio

3) Marketing expenses have increased by 142% - there seems to be a lot more focus on acquiring customers. Previously Jag Duggal (the Chief Product Officer at Nubank) has said that 80-90% of Nubank’s growth has been through word of mouth, customer acquisition is something that are doubling down on. In fact, while users have been increasing, user growth is slowing, (which is expected), which is probably another reason to ramp up on marketing expense, especially as they look to scale in Mexico and Columbia.

Take a look at the graph below. Users have been increasing, but user growth has been declining, from ~5.82% in Q1 FY23 to 5.75% in Q1 FY24.

While there are significant positives, the revenue proportion, and the trends in the credit portfolio are a bit concerning

There are significant positives:

User growth is slowing - but this isn’t that big of a red flag, since Nubank is operating at a big scale now, so it is natural that growth rates will slow.

Annualized net income of $1B +

But the quality of the credit portfolio is a concern:

Interest income on credit cards & lending is increasing drastically, which means that Nubank is lending more, and that more people are carrying forward their balance (in the case of credit cards), this was ~60% of total revenue in Q1 Fy24

Proportion of Interest Earning Portfolio on Credit Cards has increased from 16% to 26% : More people are going past the 30 day date of paying back their utilized balance

NPLs (both 15 - 90) and 90+ days have increased from 5% (for 90 +) to 6.3%

Late fees income has increased by 69%: More customers are unable to pay no time, and this have to pay an additional late fee

Loan portfolio grew by 53%, but credit loss allowance grew by 79%

Nubank seems to be a product for the underbanked: there is a high chance they don’t understand credit products very well

Nubank reportedly reaches 44% of Brazil’s population. According to reports, in 2021, 10% of the population held 80% of the country's wealth. So there will be a significant base here, of ordinary people, using Nubank for their convenience and their credit products. This base will use a credit product if it is offered, and may not really understand the match behind these interest rates. And the APRs on cards in Brazil are traditionally very high, so there is a big chance of customers withdrawing a lot, and then being unable to pay back the interest rates.

Promising scale, but monitoring needed

My own view? I think the growth is great. The fact that they are on track to do annualized $1.5 - 2B worth of profit in FY24 (based on Q1 numbers: PAT of ~ $378M) is very promising. I do think Neobanks have a lot to offer, especially since traditional banking still has a lot of pain points. But if we dig deeper into the Nubank numbers, and their lending portfolio, I'd temper my excitement with some trepidation.

It’s easy to grow credit businesses but they have to stand their test of credit cycles, so the jury is out

Thanks for sharing this Ambika.

Waiting for your write up on India’s digital lending landscape.