[#64] Innovation at the edges, stagnation at the core: Why India needs neobanks for true financial inclusion

Fintech innovation at the fringes can only go so far — it's time to rebuild from within. Fintechs & apps are modern, but the banks & engines behind them are decades old and it’s starting to show

A few months ago I had talked about neobanks, and why India needs some structure that allows neobanks to function in India. You can check out the article below:

TLDR: what I had tried to highlight is the fact that in a fast growing digital economy, you need your financial ecosystem to keep up with the needs, and scale of the customers. And banks sit at the heart of this ecosystem. But the way traditional banks (in India) atleast are, there are fundamental issues as to why they are unable to keep up with the pace of innovation.

But why do we need Neobanks, and what are traditional banks not able to provide? Let’s dive deeper

Banks are the core of the digital financial ecosystem. You need to make a payment? Route it through a bank switch which connects to payment rails. Open an account? Bank. Get access to customer data. Bank. All information, payments, data, monies all flow through a bank. So when you want to innovate, build new products, you need the banks to support. Traditional banks have failed to keep up with the needs of the digital economy. There are multiple reasons for this, but it boils down to 2 major ones:

1) Lack of incentivization: For a bank that’s making INR 50k Cr in profit per year, giving them INR 2k Cr in subsidies doesn’t really drive them to make any real changes. (UPI Rebate). They’ll do it because it’s a mandate by the RBI, and because massive volumes are flowing, but to what extent? Probably the bare minimum needed.

2) Lack of ability: You need flexible systems that can support new product types, utilize bank data effectively for personalized experiences, and an innovation first mindset. Legacy systems, not built with integration or flexibility in mind cannot support the needs or the scale of the digital economy (i’ve outlined this out in detail below)

India did have a wave of Neobank’s that were founded in 2019, but RBI doesn’t like Neobanks.

RBI doesn’t like neobanks. So what the wave of neobanks in India tried to do was build a wrapper around existing banks - while the UI / UX looked super pretty, and onboarding + CX was better, they weren’t really able to optimize the actual service, the traditional banks still called the shots. And being risk averse, with no real motivation to actually build innovative products, service the underserved, why should they take any risk?

Take a look at the top 4-5 banks in India, and their customer base, revenue, and profitability metrics.

Traditional banks in india, such as HDFC, ICICI, SBImake revenues of ~INR 300k Cr (~$35B) per year, and profits of INR 50k Cr per year (~$6B)

They’re all public. So it’s not like they need to make back investor money by passing the baton to clueless retail customers (aka us). They’re making thousands of Crores of profit every year, so it’s not like there’s a certain “desperation” to become profitable here. So that’s where banks are at.

And then, when you look at the innovation front: there’s limited to no monetization available to them in terms of supporting new innovations such as UPI (free, apart from subsidies, although CC on UPI & PPI on UPI is priced), and Account Aggregators (according to RBI, banks cannot monetize per data fetch). And they’re also heavily regulated.

So. they don’t NEED to make back money for anyone. They’re not loss making and fighting for profitability. There's no massive opportunity for monetization. And they already have a customer base which is upwards of ~50M. (and this is most of your HNI & affluent individuals). They have everything. So why should they innovate and stick their necks out, especially when there's no way to make money?

And because the RBI has not supported neobanks, or even incentivized the CORE of the financial system to actually support these innovations, it has become a very “innovate at the fringes” type of approach, while keeping the core the same

But there are fundamental issues why traditional banks, even if they wanted to, cannot keep pace with new age financial services, like neobanks can

And when I say neobanks, I don’t mean banks with a digital presence, like how we’re seeing aspiring neobanks such as Jupiter & Slice merge / make attempts to acquire some % stake in banks, but digital first banks. Like a Nubank, or a Revolut.

Existing banks are powered by legacy systems: The bank’s tech architecture is 20 years old. And it doesn’t lend itself well (excuse the pun) to new age needs for underwriting, lending (and others). Even simple innovations that fintechs want to bring in. I’ll give a few examples. Take BNPL for example. To drive adoption, and make it more customer friendly, BNPL fintechs introduced innovations such as partial cancellations, and grace period for interest payments. The systems that banks use aren’t flexible enough & when they were developed, a lot of these new use cases weren’t really even thought of. So, it results in a lot of manual to and fro. So even if you have a bank with a digital presence, it doesn’t solve this

Bank architecture is monolithic, and makes even minor changes very painful. What does this mean? Well think about it this way - all modules or components are very tightly coupled together, so it’s very hard to update only one part of the system. Instead you’ve got to coordinate across teams, and make sure even a tiny change is coordinated across the whole stack. It makes any change really painful and requires buy-in from multiple BUs

Banks currently run on siloed systems, and are unable to use the data they sit on to personalize products: Think of it this way. You’ve got a bank CBS - which is a core banking system. This is the source of truth for your account balances, transactions, customer profile & so on. But it doesn’t have visibility on current loan applications that sit in the Loan Origination System (LOS). It doesn’t know about credit card spends or limits. It doesn’t know about loans taken. That’s the LMS (Loan Management System) and thee CMS (Card Management System). And it doesn’t know about user behaviour, app sessions (since all banks have apps now), that sits in the CRM. While basic matching data exists in the CBS, (I would assume stuff like EMI debits etc, existence of a card and so on) it’s completely data blind to the LOS, CRM & LMS.

AND. Logically you’d say - hey! It’s fine if there are different systems. Let’s pull all the data together in one system. But there’s another problem! The legacy systems weren’t really built with integrations in mind. And, they also track different pieces of data as customer identifiers. Example: the CBS may look at account numbers. The CMS may look at card details. The CRM may look at mobile number, and so on. And a lot of these systems are by different vendors. So while conceptually pulling all this data into one system is possible, realistically this is a very painful exercise that would require a lot of fuzzy matching, which may not even be super accurate.

Now, there are new age systems coming up -> Vegapay, Hyperface, Falcon, Constantinople which are all building systems which are not monolithic but on microservices, giving better & more insightful analytics. But getting bank to shift to these systems is a whole another story.

1) While the credit on UPI story is what a lot of players are using to sell their systems to banks, it’s really tough to get banks to adopt anything. Especially these systems that form the core of what they offer. Ex: Vegapay launched a Credit Line on UPI system with Yes Bank. Zeta with HDFC. And so on. And it’s working to some extent. But the rollout will be slow.

2) The issue of data migration: There is a lot of data that exists in current systems. I’m hoping AI has solutions to this, but moving this data to another system is a massive task, and probably one that will take years. So even if a bank decides to switch systems, this is another hurdle.

3) Replacing existing systems such as CBS especially is a 2-3 year process, and someone’s job (and neck) is on the line to make sure this happens successfully. The risk - reward ratio is totally off.

The fintech first mindset matters. And the traditional banks of yesterday may still be good for the HNI base, but they aren’t meeting the mark for your new age customer, and new age financial services.

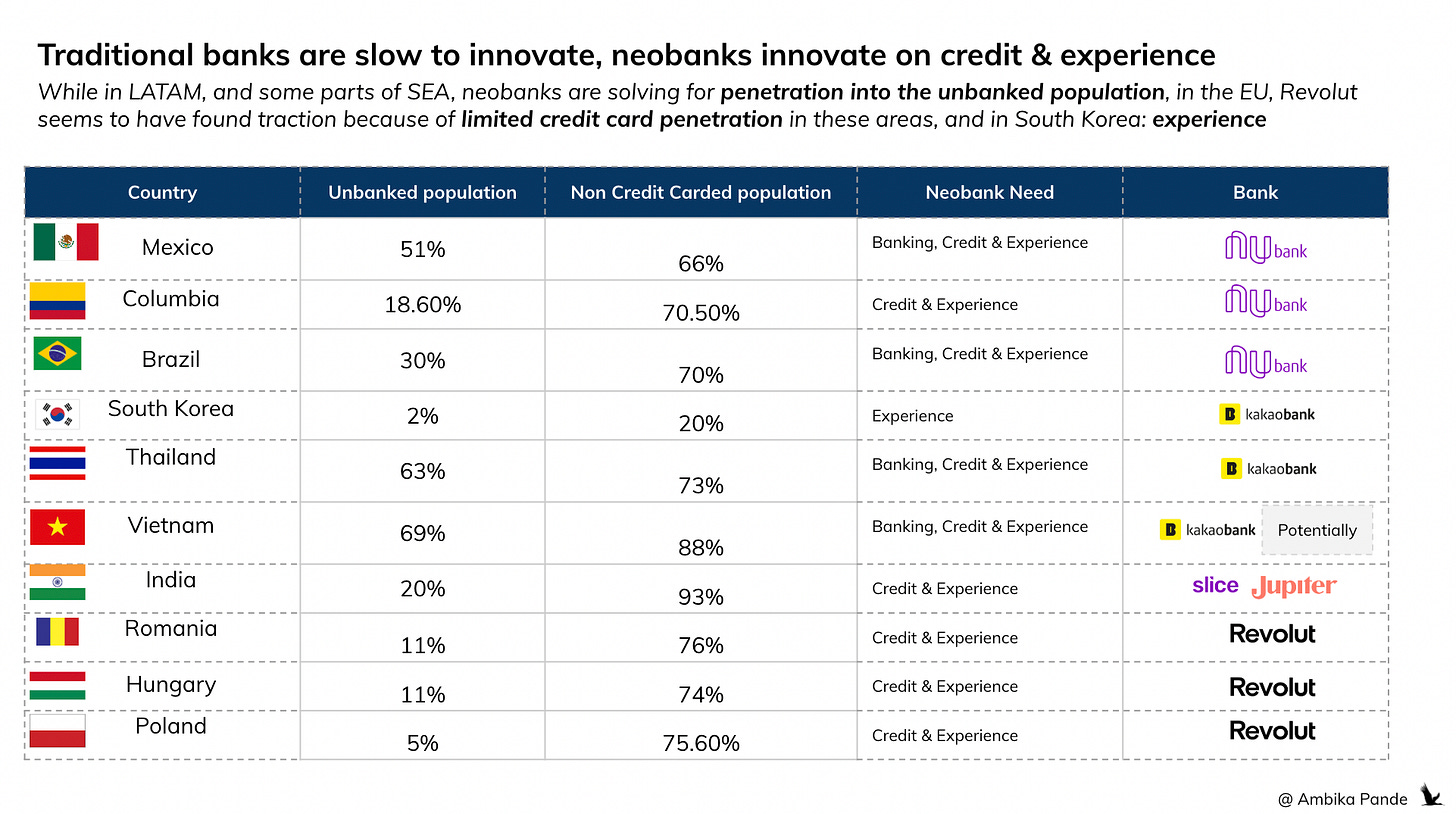

Neobanks across the world have shown success in tapping into new customer bases, optimizing internal systems for best in class service, and championing innovation

Globally, US, Europe, Korea, and now even South East Asia seems to be adopting / have adopted Neobanks. NUBank is in LATAM (Brazil, Columbia, Mexico). Revolut is across Europe, UK, US. Chime in in the US. Kakaobank, based out of South Korea has scaled to ~24M users, and is expanding to Thailand. In April ‘25, Kakaobank(in a consortium with SCB X - owner of The Siam Commercial Bank Public Company Limited, and China WeBank) was granted a digital banking license in Thailand, and aims to launch a digital branchless bank in Thailand by 2026.

And it works. They’re profitable. They’re able to serve the underserved, and even though they have a higher risk, they’re able to manage it. Take a look at Nubank’s stats below:

$11.5B in revenue and $1.7B in profit in FY2024 These are not small numbers. It clearly shows that they’re doing something, and doing it perhaps better than traditional banks.

In fact, ~20% of Nubank customers reportedly did not have a bank account before they opened one in Nubank.

They’re also able to manage their risk and reward better, they take on more risk, but profits are proof of sustainability.

Neobanks have scaled first is because of the “innovation & customer first” mindset. They’ve seen what the customers need, and accordingly built products to solve for that need. Their risks are higher, which we can see through their NPL (Non Performing Loan) numbers & their Late Fees. Their Interest Bearing Portfolio is also increasing (across Credit Cards & Loans), from 45% in FY23 to 54% in FY24. But this isn’t necessarily a bad thing, if you’re going after a customer base which didn’t have a bank before. It’s just a risk that needs to be managed & accounted for, which traditional banks currently seem unable to do.

Take a look below:

And the proof is in the user growth - while growth rates are decreasing, that is a function of the base. Nubank has been consistently adding users, and as of Q4 FY24, sat on a user base of 114M users! And, in 2023 NPS reportedly was 90! This is higher in comparison to consumer first companies such as Apple (~70), Amazon (~65) and Netflix (~68)!

A lot of existing neobanks grew, because they were able to solve a gap in the market that banks just don’t -> things such as onboarding, experience, transparency, and credit.

That’s not there in a bank first model. You can barely upgrade your credit card in India unless you know someone in the system, and even then, good luck to you. Traditional banks aren’t really the ones to pave the way for groundbreaking innovation. Rather - they’re the wait and watch type. Take UPI for example. It was around for a while. India had a chance to scale this with its existing banks. Banks just never picked it up. Then PhonePe, Paytm & Gpay came in and really drove the customer adoption of this, to a point where we’re targeting 90% of digital payments to be powered by UPI in 2027.

Monzo has a really cool example. Apparently, they built a parallel / shadow bank that acts as a back-up generator, so when their infra is experiencing downtime, instead of failing the payments, they’re able to route it to their back-up infa (Monzo - Stand in)

Monzo Stand-in is an independent set of systems that run on Google Cloud Platform (GCP) and is able to take over from our Primary Platform, which runs in Amazon Web Services (AWS), in the event of a major incident. It supports the most important features of Monzo like spending on cards, withdrawing cash, sending and receiving bank transfers, checking account balances and transactions, and freezing or unfreezing cards.

Traditional banks haven’t built systems like Monzo Stand-In because their infrastructure is rooted in legacy architecture that’s neither cloud-native nor designed for modular failover.

Their disaster recovery plans tend to be operational and compliance-driven rather than built for seamless, user-facing continuity. “Good enough” is usually the standard. In contrast, Monzo, as other fintechs do, approach this from a customer first mindset → cloud-first, with microservices and observability baked in, allowing them to engineer real-time resilience as a product feature, not just a backend requirement. And that’s another point, you need to be cloud first, and modular to be able to build flexible systems like this. Legacy banks have on-prem systems that are not as scalable, and as I mentioned before, aren’t modular but monolithic.

It’s a difference in both tooling and mindset.

And that’s where I feel we’re hitting a plateau with fintech.

To really drive financial inclusion (a higher % of banking penetration, steps towards a cashless economy, access to credit) and innovation (driving the next wave of growth in UPI, wealth management, open banking) we need innovation in the bank’s themselves.

And this brings me to my point: all innovation that is happening now is on the fringes - and we’ve solved that to an extent. To drive the next wave of growth, we need innovate at the core

Till now we’ve solved for things around banks. In payments for example: things such as PA / PGs, and now the Cross-Border flows, where the fintechs are coming and playing a greater role in terms of onboarding merchants, holding and transferring money, and now building the tech (such as payment switches) that are deployed within the bank infra. We’re at the point now, where a lot of these problems are solved, or atleast in the process of being solved by fintechs. It’s the core of financial services & fintechs - the bank’s themselves that now need an overhaul.

Until RBI starts giving out digital banking licenses (OR incentivizes banks, but problems will still exist, and this has to be relative to the revenue & profits they’re making now) there will always be limited innovation in this space going forward. The distribution game to an extent has been won (UPI apps in B2C, and PA / PG players in B2B), and everyone is expanding into full stack services.

And I’m not saying start handing out banking licenses like how they’re handing out PA licenses, there still needs to be a process for the same. But until that happens, there’s only so much further financial innovation and growth that CAN happen. And right now in banks, innovation is happening at the fringes, where bank partners are leveraging fintechs with TSPs, and distribution. And yes, this will optimize operations to some extent. But what I’m saying is that the whole system needs an overhaul. Take a look below → these are some of innovations, which are all important & beneficial. But in my mind, it won’t solve for the core issue, that of banks. It’s like treating the symptom, and not the illness itself.

Bank system innovation: LMS / CBS / LOS: New age banking systems. It is much needed. But it’s a long sell, and while smaller banks may still be quicker to adopt these systems, the bigger banks: Your HDFC, Axis, ICICI’s which actually have a large customer base will take their own time to move on this (if they ever see a need to do so). What exists now is that some part of the portfolio - which could be consumer durable lending, or something else that will sit in a new age CMS / LMS. Not their whole system. And the issue of data visibility & having the chops to use that data to launch new products is a big question, and the existing issues of having visibility of data ACROSS systems is still a big question mark

TSP route: This can optimize certain things, but only to an extent. Take payments → if the bank is down, then the TSP can help optimize by having integrations with multiple banks, maybe have some sort of routing to work around this, but at the end of the day, this sits with the bank. Take the Account Aggregator Network → You’ve got TSP’s (such as Setu, Perfios) which are doing a great job, but the same issue remains: if the bank declines, or refuses to share data, or has some sort of downtime, there is really nothing you can do.

Distribution: BNPL & lending fintechs do this, where they act as the merchant & lender aggregator, and connect the lender to the lendee. Of course, subject to the lender’s risk appetite and policy. NBFC’s are still more willing to take some risk. But banks are not. And they call the shots on who to lend to. So here again: the fintech’s are optimizing for the distribution and the customer reach, but until something is changed intrinsically on the bank / lender side, then you’ll probably end up lending to the same group of customers. Nubank is an example of how a neobank has optimized its systems and analytics where they take more risk, but are able to manage it sustainably.

Collections tech: I can give better data, and put field agents to collect on the bank’s behalf. But who to lend to, which segment to give how much to is still something the bank takes a call on. And how much are they incentivized to go after new customer bases? And because these are TSP’s, unless you’re part of a bigger play, there is probably limited monetization potential you have here.

The US, UK, Europe, South Korea, LATAM, and now Thailand all have some sort of digital banking license that they’ve created, or given by the authorities through an exception (Nubank in Brazil).

And that’s because they see for themselves the advantage and benefits thes neobank’s have been bringing. Banks are key to the entire financial ecosystem: not just lending, but access to online services, digital payments, personalized services, credit and so on.

Below is the persona of banks in India right now. The Payments Bank originally was supposed to solve for what neobank’s are globally solving for. I’d say that there’s still a lot of work to be done.

Until you have better equipped, tech-first banks, you won’t have financial inclusion. And from an investment perspective, you’re better off probably investing in banks & NBFCs themselves. Which is what has started happening. Existing fintechs have gone for, or will at some point go after a banking license. Take a look below.

The “neobanks” in India, after realizing that simply a wrapper isn’t enough, have gone or are trying to go the bank route: Slice → NE SF Bank, Jupiter → Trying to get a stake in SBM Bank. But non neobanks also went for banks to streamline their services, and get scope for more innovation. BharatPe → Unity SF Bank, Paytm → Paytm Payments Bank. And Zerodha applied for a banking license that got declined.

Even investments into the traditional finance institution models seems to be increasing:

Shivalik Small Finance Bank: It raised INR 100 Cr from Lightspeed, Sorin, Accel & Quona Capital

Nainital Bank: Bank of Baroda owns 98% of Nainital bank. In May ‘24, Premji Invest was reportedly in advanced talks to acquire majority share. In ‘23 Zerodha, Multiples, Gaja, and Mobikwik reportedly were also showing interest

AU Small Finance Bank: Zulia Investments, a unit of Singapore's state-owned investment firm Temasek, has received approval from the Reserve Bank of India to increase its stake in AU Small Finance Bank up to 7%. As of Dec ‘24, it held ~1.37% stake

Svatantrata Microfinance (NBFC): In March 2024, Advent International and Multiples Private Equity invested $230 million in Svatantra Microfin, a non-bank microfinance lender in India.

Mannapuram (NBFC): In March 2025, Bain Capital agreed to acquire an 18% stake in Manappuram Finance for $508 million.

We're seeing a shift in investor interest, away from consumer-facing fintechs that have struggled to monetize despite large user bases, and toward NBFCs and banks that offer clearer revenue models, like interest spreads and fees, with stronger unit economics. This isn’t a contradiction, but a signal: the future of financial services in India lies in owning or building regulated, tech-first platforms—not just distributing financial products through sleek apps.

But here’s my view: If India wants to avoid stagnating innovation and truly serve the next 500 million, we need to stop trying to retrofit outdated infrastructure.

Through bank & fintech mergers, or investing in these traditional banks / NBFCs with the hope or perspective that they’re actually tech-first, I don’t know how much of the problem is actually being solved for.

While traditional banks remain essential pillars of the financial ecosystem, their legacy systems and risk-averse, non-tech-first mindsets often make them ill-suited to drive innovation at scale, especially in a country as vast and diverse as India.

Neobanks, built ground-up with technology and customer experience at their core, offer a compelling alternative. They can solve for inclusion, personalization, and agility in ways traditional institutions often cannot.

If India wants to avoid stagnating innovation and truly serve the next 500 million, we need to stop trying to retrofit outdated infrastructure. We need to build new systems from the ground up, platforms that integrate compliance, product innovation, and customer centricity by design. That’s the promise of neobanks. And that’s where we should probably take a leaf out of the books of Europe, Brazil, South Korea, and now Thailand, who have all granted digital banking licenses to fintechs, and there is proof of benefit and financial inclusion.

Without enabling the rise of neobanks, through a new licensing framework or proactive regulatory support, India risks falling behind, both in innovation and in inclusion.

And maybe this is the push the big banks need. By opening this up for fintech’s - in a structured regulated way, not in a “operating in a grey area” sort of way, this could pose a big enough threat to the traditional legacy banks and push them to innovate & revamp their services.

![[#40] The case for neobanks in India: what can we learn from global successes such as Nubank?](https://substackcdn.com/image/fetch/$s_!G8yT!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F3d81c4d2-68c0-4341-8025-90f2bcf45e1e_1600x896.png)