Building for banks seems to be the new frontier for fintechs. Open banking is taking over the world, and so are banking infrastructure focused fintechs. Constantinople, a “bank in a box” fintech, raised a whopping $50M in its Series A round in 2024 to scale its product, which aims to simplify operations for its client banks.

Well firstly let’s take a step back. What do we mean by next generation banking? Well this can mean 2 things:

1. Building internal systems for banks:

This can be loan origination / loan management / card management systems, it can mean core banking systems, treasury management, and of course, KYC, risk / data modules. This has more to do with how the bank works internally. Legacy systems in banks are not flexible to handle the new financial products that consumer facing brands & fintechs are innovating. These are important to be able to lay the building blocks for innovation, since at the end of the day, the banks power the financial ecosystem.

2. Open banking / embedded finance:

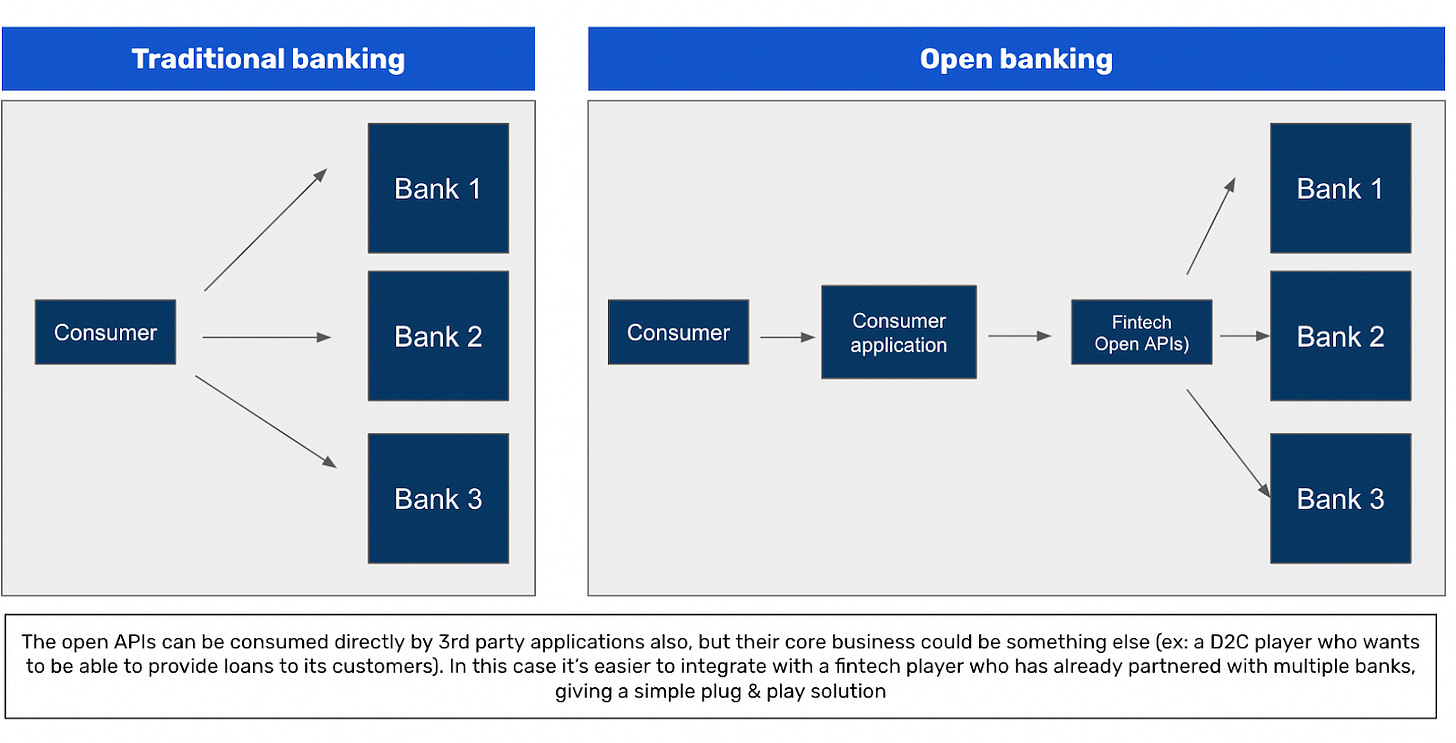

This is embedded finance, and what is being called open banking or “Banking As a Service.” Third parties which could be non banks / non financial companies can access customer financial data from banks to provide a better experience, more innovative products, and essentially allow customers to access banking / financial products through non-bank parties. Examples of this are: 1 click KYC / onboarding (where APIs are used to communicate with banks and access the pre-approved customer profile within the bank system). Account aggregation / payouts / loans through third parties are all examples of open banking, because in this case 3rd parties have accessed financial data from banks / allowed access to be able to give a service / better experience to the customer.

And I call this “building for banks” because it can enable them to reach more customers, and provide a better experience for its existing ones. In fact, even neobanks (Jupiter, Open, Fi) in India are technically open banking players, since they do not have banking licenses of their own but partner with banks at the backend to acquire & onboard customers, and then cross-sell financial products to them. But a key point here is not every 3rd party can access this information from banks (and rightly so). For this, you have to be a licensed account aggregator (AA).

Here’s an example of what traditional banking vs open banking looks like:

And by the way, these products aren’t just limited to banks. If the prediction is true and in the future every company will be a fintech company, then it’s not really building for banks, but building for everyone. But that’s a separate story.

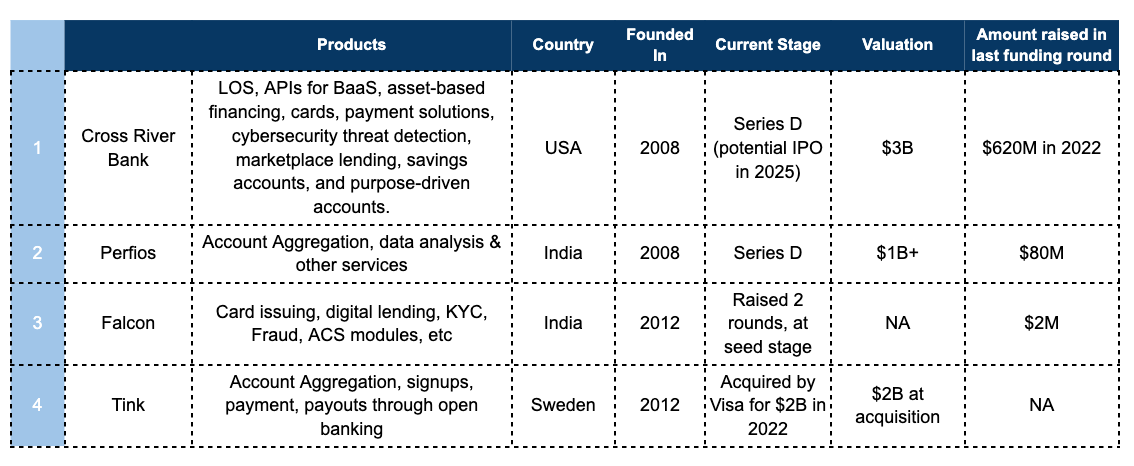

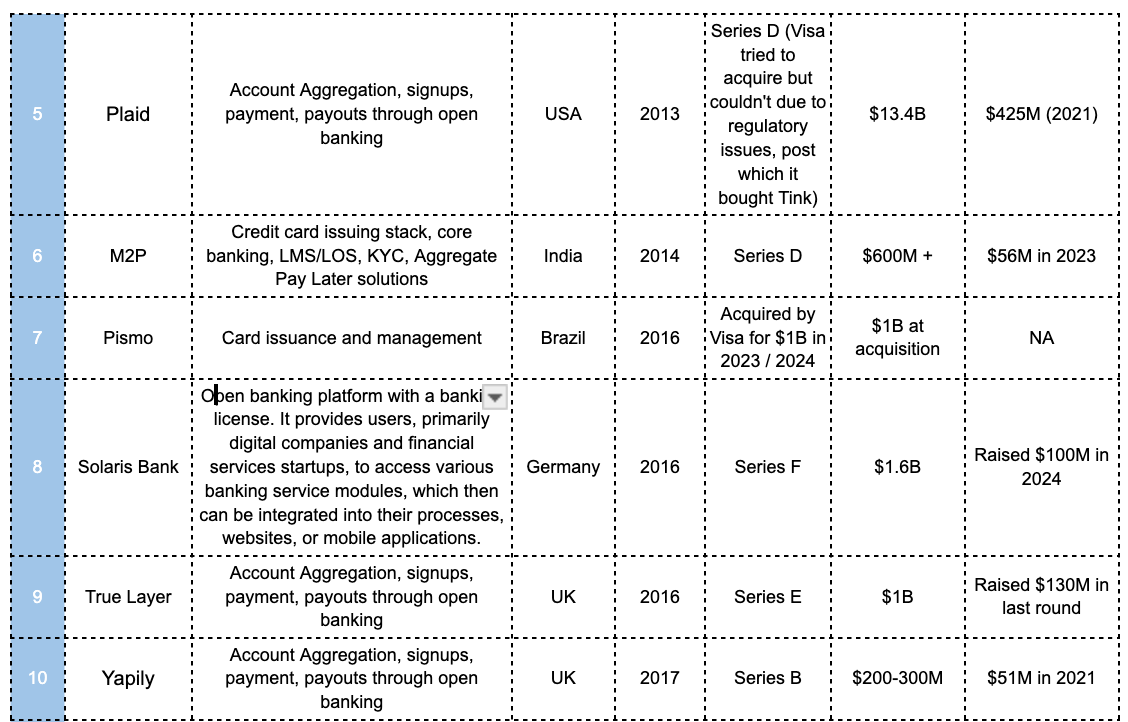

I’ve taken a look at a sample of companies who build banking related solutions. There are quite a few in India, and across the world. Let’s take a look at the data below, in order of founding date. I’ve tried to sample as many Indian companies as possible, and see what they’re building, and what they’re valued at.

Broadly the type of products fall into the following categories:

1. Internal systems:

This could be software for co-lending / banking / LOS / CBS / LMS software - for bank / fintech internal operations. Ex: Lentra, M2P, Pismo, and Constantinople.

2. Tech / payment infra:

Cross River Bank - US based, and projected to IPO in 2025 (which has partnered with the likes of Stripe to enable early wage access to delivery partners), and Solaris Bank, which has a banking license and is based out of Germany. I’d also place M2P in this segment, since it does a lot of payment infrastructure work

3. Account Aggregators / Open Banking:

Perfios (India), M2P, Tink (Sweden), Plaid (US), True Layer (UK), Yapily (UK). These platforms offer “open banking” which is being able to access customer bank / financial data and smoothen customer journeys. An example could be a customer who has to enter their bank account number to make a payment, which can be quite annoying since customers don’t memorize bank account numbers. Tink in this case would, through an API (which could be linked to an identifier like the mobile number) can auto-populate bank account details, which has been fetched from the banks it is partnered with. It has other use-cases, especially around KYC, digital lending, and risk management.

4. Auxiliary modules:

This could be related to KYC verification, alternate credit scores, risk management, document verification, but usually this is something that would be combined with Account Aggregation as a theme OR even banking systems since these are products that can be built on top of that framework (Ex: As an account aggregator, I can fetch and verify data from multiple sources, I case use that to create risk scoring, and thus manage risk, or as a LOS player I want to be able to also plug in KYC modules in the onboarding journey)

So what are some key insights?

1. Most of the banking infra fintechs in India have come in the last 5-6 years:

Firstly what seems to be the case is that India (with the exception of M2P) is still early in this space. In fact, a majority of the banking focused fintechs in India seem to have been founded in the last 5-6 years. M2P was founded in 2014, and then in the list that I’ve sampled, Lentra came ~4 years later. Swiffy Labs (founded by ex-Zestmoney founders) reportedly raised $100M from Jio for financial infrastructure in 2024. And these companies will probably continue to scale. Legacy bank systems are not equipped to handle new innovative financial products that fintechs / consumer brands want to offer. As a result of this, there is a ton of manual reconciliation & costs that pile up, and fintechs have sensed an opportunity to come in and streamline these operations, making them more flexible, and automated, and cut costs exponentially.

2. Indian fintechs focused on Credit Card Issuance & Management

As a theme seems to be something that Indian fintech founders are building for, and fintech folks see this as a problem statement to be solved - ex: the ex-Juspay founder is the founder of Hyperface, a credit issuance & management product. My own take is that this is an outcome of loyalty as a theme growing, and co-branded cards are gaining more prominence. The process of launching a co-branded card with customized features, and rewards points directly with a bank could be tedious, and thus fintechs see an opportunity to be able to support some of this. And that could be because credit cards / credit lines in India are still quite underpenetrated (~5-8% Credit card penetration), and the opportunity to build solutions to be able to tap into that market could be quite lucrative.

3. LATAM as a theme is coming out again here:

In one of my previous articles I talked about how we’re seeing innovation come out of LATAM such as Nubank (Neobank), d-local (Xborder PG), Yape, PLIN, Pix which are all Real Time Payment Rails in Peru and Brazil. And now here as well - Pismo, a credit card issuance and management system coming out of Brazil, and Pomelo, again focused at credit card management, out of Argentina.

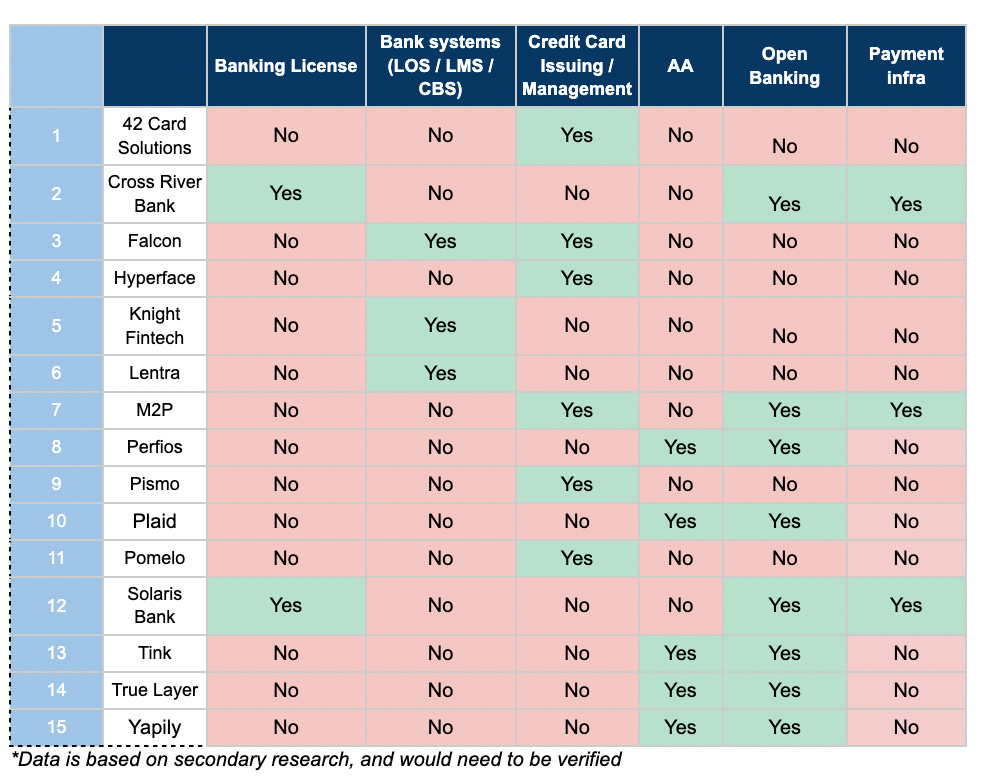

I’ve also done a high level feature analysis of what these platforms offer:

1. Bank systems & credit card management systems seem to be two separate offerings:

Bank systems are separate and credit card issuance and management are separate. Credit card issuance and management seem to be offered to not just banks but fintechs & consumer brands to launch their own co-branded cards. Hyperface for example caters more to “building a customized co-branded solution.”

2. Banking infrastructure focused players can be acquired by banks as an exit option:

This caters to not just LOS / LMS solutions, but also features such as CBS, co-lending, and in the case of Knight Fintech, treasury management & supply chain financing modules, which can be plug & play features, and eventually be invested in and absorbed by the bank itself. An example is Cashinvoice, a supply chain financing solution which raised a $4.3M round in 2024 led by HDFC Bank. Lentra is another: a leading LOS / LMS player that has been invested in by HDFC bank

3. In India atleast, open banking still has to scale: Most of the fintechs focused on banking operations seem to be building more for bank systems such as Lentra (LOS, LMS, and other modules), Hyperface (Cards), Falcon & Knight (cards, treasury management, co-lending etc).

But why hasn’t open banking scaled in India?

1. No compulsion on Indian banks to share customer data with 3rd parties

Even though the India stack is scaling (Aadhar being a key component of this), there is no requirement for banks to share their data with 3rd parties. In Europe, the Open Banking regulations, that stemmed from the PSD2 regulations came into the picture in 2015, and were designed to increase competition by creating a level playing field for both banks and non-banks by removing the monopoly banks have on the use of customer data, allowing other businesses to use that data as well, with the customer’s permission. PSD2 forces banks to offer dedicated APIs for securely sharing their customers’ financial data for account aggregation and payment initiation. (however there are other issues here - banks are reluctant to maintain APIs for 3rd party sharing which has led to limited adoption, and maybe that’s why 3rd parties have scaled). In India, according to this article, there is no compulsion on the bank to share their data with 3rd parties, they can choose to onboard themselves as a Financial Information Provider (FIP) or a Financial Information User (FIU) on the AA network and now with the DPDP (data privacy law) coming into play in 2023, banks are even more cagey about sharing personal data.

The India stack (Aadhar, Digilocker, UPI) has already begun to solve some of the issues around onboarding, consent, and payments. Its not perfect, and there is still a way to go. But it is only a matter of time.

2. Bank infrastructure has a long term lock in and high switching costs

Bank infrastructure could also have a moat, primarily because of high switching costs. While it is a tough sell, it is a lock in of a few years, since it can take 2-3 years to change systems (switching cost is very high). And the revenue potential is also compelling. Finacle (Infosys product, loan management systems) reportedly has a YoY ARR of $300M+. Other players: be it open banking, payment processing, API technology revenue generation rely on metrics such as number of transactions or payment volumes. Core banking licenses usually cost a one time fee, and then some % per month as maintenance, through a SaaS subscription model. Of course, models are changing, but that’s probably another compelling factor.

New age companies generating most revenues are tech enabled banks - Solaris & Cross River, who play in the payment infra & open banking space, not bank infrastructure

Here’s a view of the revenue being made by the different fintech start-ups in this space. It’s not apples to apples since the date of founding ranges from 15 years to 5 years ago, but gives a view of the scale that these companies have reached. Bank systems players are newer but the potential could be huge, as mentioned before, Finacle makes revenues which is upwards of $200-300M+.

Tech enabled banks seem to be open banking platforms (powered by APIs from bank partners) which support fintechs and consumer / SME facing companies. Take Cross River Bank for example (which is planning an IPO in 2025). It is valued at $3B, and raised a whopping $620M in its Series D in 2022.

CrossRiver has heavily leaned into building for fintechs: In an interview with Mckinsey the founder mentioned how they want to work with banks & fintechs to craft customized solutions for them. They also have a financing division where they invest in emerging fintech companies. In fact, they recently set up an investment banking unit to guide fintechs in M&A decisions. And from what I could make out from their website, their APIs are something that forms the base of all their products. Solaris Bank, a German fintech (valued at $1.6B) with a banking license is similar. They have white-labeled products, and APIs that allow any company to offer financial services.

And maybe this is the lucrative opportunity for fintechs, to build technology / payment infrastructure for fintechs. (Consumers could be either customers or businesses). The closest Indian equivalent to this would be M2P, who doesn’t have a banking license, but plays in the embedded banking and payment infra space (UPI switch, Core Banking System etc). They also seem to have a cross border offering, where through a single API integration they are able to offer merchants access to their distribution and partner network across the globe.

Because there is no regulation compelling banks to share data with 3rd parties, open banking in India will not be a standalone offering, but will have to be a ++ offering of fintechs who have specialized in other areas:

So fintech players who are in lending (which involves multiple KYC hops, and needs customer information), and payments (which requires multiple hops for authorization) are possible personas who could apply and benefit from an AA license, which would then enable it to do open banking for a smoother checkout / lending journey.

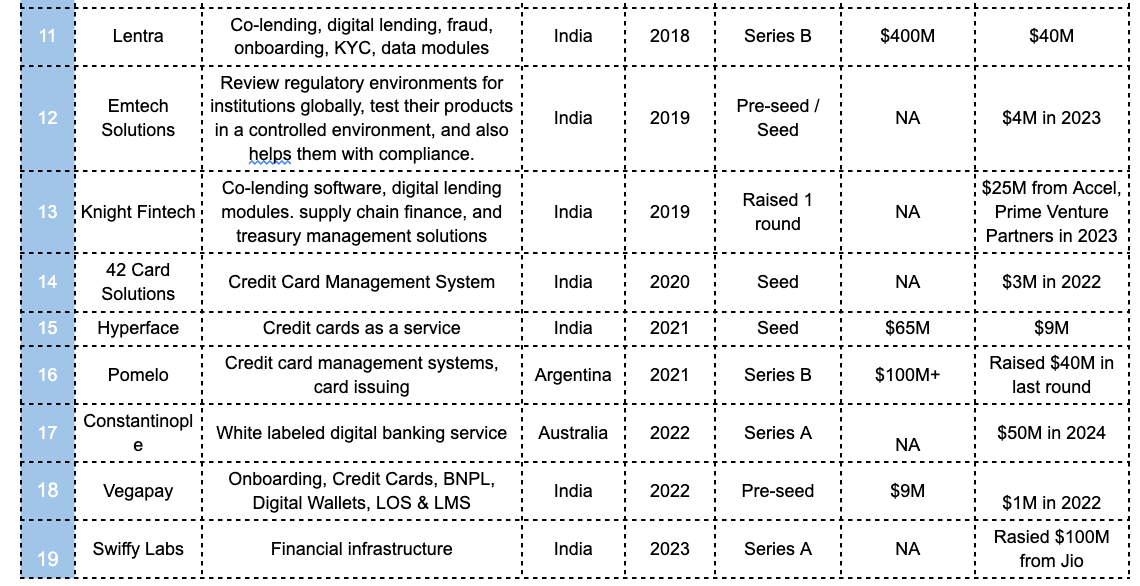

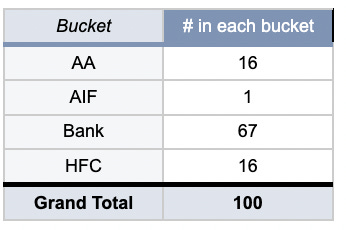

I took a look at the licensed Account Aggregators in India. There are 100 licensed AAs in India, and out of these 83 currently are banks & housing finance companies. This makes sense - for lending, and other core banking activities, being able to access customer information from other financial institutions will definitely help underwrite better. Non-financial AAs include players like Perfios, and Policybazaar.

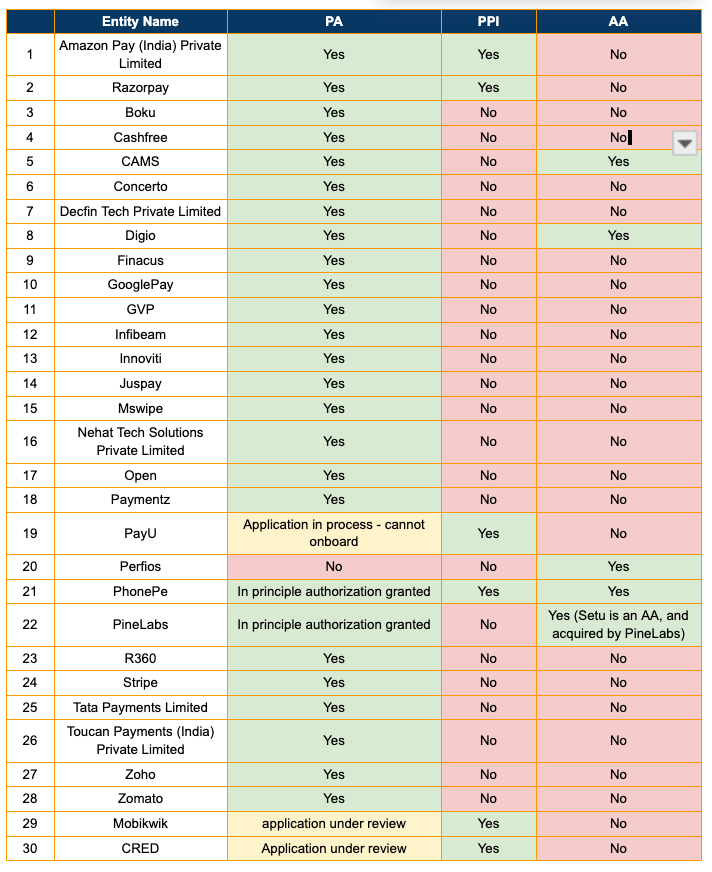

As of 13th April 2024, there are 24 fully licensed payment aggregators in India. Out of them, 4 have an AA license: PhonePe, Digio, PineLabs (through Setu), and CAMS. While CAMS and Digio are still nascent in the PA space, the fact that PhonePe and PineLabs, two big players in the payments space (apart from PayU, Razorpay & Cashfree), seems like this could be a play to further strengthen the payments ++ stack. PayU, Razorpay & PhonePe have a PPI license. CRED seems to have been at this for a while, they reportedly acquired Hipbar in 2021 for their PPI license, and has applied for a PA license, though currently its under review. According to a 2022 article, they were also looking to apply for an AA license.

So while it’s still early days for the newly licensed PAs, old hands such as PayU, PhonePe, Razorpay, and PineLabs seem to have a strategy in play, and it won’t be surprising if we see any one them apply for / get an AA or other licenses to enhance their offerings. Of course, a lot also depends on where they are incorporated - Razorpay is currently domiciled in Singapore, and is moving its domicile to India. PhonePe completed its reverse flip in 2022, and got its AA license in 2023, so thats’ probably a requirement to get an AA license in India

Here’s a comparison of the fully licensed PA players, and other licenses they currently hold.

Visa seems to be going all in this space:

Visa is betting heavily on the open banking space & banking infra space. Visa has already acquired Tink for $2B (account aggregator / open banking, out of Sweden) in 2022, and Pismo for $1B (Card management out of LATAM) in 2023. It made a bid for Plaid (the AA in US) in 2020 for $5B, but that transaction failed due to some regulatory issues. For context: Visa’s income in 2023 was ~$17-$18B. For it to spend 5-10% of its income (not revenue) on these acquisitions, signals its focus in this space.

Visa is expanding from just a payment processor to a payments ++ solutions as well. Its Pismo acquisition will enable it to form deeper relationships with fintechs & banks, and its Tink and (maybe other) AA acquisitions will enable it to provide embedded financing & open banking solutions to both fintechs & merchants. And as India scales and grows, who knows, we may see a billion dollar Visa acquisition in India in the future.

But the conclusion is - fintechs are here to stay:

Banks are already seeing the advantages of fintechs in India. Here’s a great podcast link by Ajay Rajan - Country Head of Yes Bank. Some examples he mentions are: loans that would take days to disburse now take minutes. Credit decisioning has becoming better, allowing more customer acquisition. And banks are realizing that they don’t need to do everything themselves. They can focus on the business of banking, and leave the innovation and the tech to fintechs.

Fintechs have helped create financial & operations efficiencies for banks.