[#22] How is the world (not just India) innovating on real time payments?

We’ve all been reading about how UPI is taking over India, and the world. Recently the news came that India’s NPCI has inked an MoU with Lyra Network in France, and another MoU with UAE, to allow UPI to be used for international payments in these countries. And this news article here, which talks about how India is engaging with the USA to establish a real time payments link with the USA version of NPCI . It has already been adopted in Sri Lanka, Mauritius, Nepal & Bhutan.

But what about around the world? India can’t be the only country that is innovating on real time digital payments. And it isn’t. Here’s an analysis of the different types of models that are coming up for real time payments around the world. The nuances of each, from sign up, to the actual payment rails, and processing might be different, but they broadly fall into the 4 broad categories.

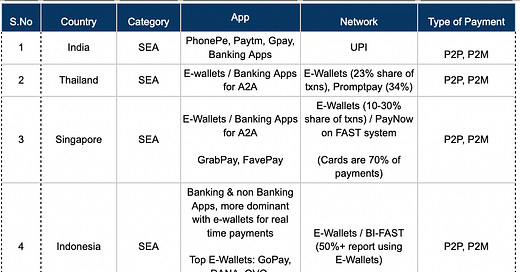

Here’s a table below which shows the different countries, and the real time payment methods that exist there. You can check out the detailed table with insights at this link here.

Glossary:

A2A: Account to Account (like UPI, where the money is transferred from account to account)

SEA: South East Asia

B2B: Business to Business

P2P: Peer to Peer (individual to individual)

P2M: Peer to Merchant (individual to business)

NFC: Near Field Communication (tech that powers tap & pay for example)LATAM: Latin America

Based on the analysis of the sample, the four categories have evolved below:

1. Fast payments enabled as a feature within an existing banking app: Twint, Pix, Osko, Bizum, Zelle, Promptpay, Blik, Fednow. Although Fednow seems to be more tailored towards B2B solutions (there is a monthly fee of $25 per routing number, and Fednow payments are initiated using the recipient's bank account number and routing number, rather than the mobile number, which could hamper consumption

2. Private apps which power real time payments: Venmo, the UPI Apps in India (PhonePe, Gpay, Paytm, CRED), Tikkie (only P2P), Swish

3. Wallets which store credit & debit card details and allow P2P & P2M payments: ApplePay, MobilePay

4. E-Wallets: Predominantly in SEA, (like how you had to transfer money into the paytm wallet, and then link that to payment methods, and scan & pay): GoPay, ShopeePay, GrabPay are the main E-Wallet apps that are used.

So how are these models monetized across the world?

Broadly, the monetization model is that the service is free to use for the end user, and the merchant / entity is charged some % of the transaction amount as a fee (Pix charges 0.33%, while Twint charges 1.3%).

Blik is different: BLIK charges merchants $0.10 per transaction and $0.75 per transaction for businesses with over 2 locations. It also charges consumers $0.15 per transaction plus 1% of the value of each purchase. (Source: here)

While the models differ from country to country: pure A2A payment transfer costs are usually NOT borne by the end customer (to enable scale up), but are borne by the merchant and / or the financial institution / fintech powering the transaction.

So what are a few trends that can immediately be seen?

1. Mobile numbers as an identifier: In almost every model here, the mobile number, (while bank accounts might be needed for set-up), is being used as the identifier to send money. This is especially useful in the case of P2P payments (or micropayments to friends and family), as one can scroll down the contact list, select the number, and send the payment.

2. Scan & Pay wins over Tap & Pay: This is primarily a P2M innovation. In India we’ve been hearing a lot about Tap & Pay using NFC enabled devices and cards. And this is an option, especially in Europe & USA (Swish, and ApplePay) where customers can use their NFC enabled devices to do contactless payments. But the majority of devices (both smartphone, and POS) are not NFC enabled, and this would be an added cost to the device at a stage when merchants are moving to lighter, more cost optimized devices. And that is probably why around the world, not just India, QR codes are taking over. It’s pretty clear, we seem to be more inclined towards “Scan & Pay” not Tap & Pay. Of course, if we evolve into not just using phones, but other devices to pay (such NFC enabled payments using Apple Watch for example), then this could change, but my own view is that this would still be a small section of society, and the majority would be powered through QR codes.

And here are some region - specific observations:

1. SEA: At a high-level, SEA (Indonesia, Vietnam, Thailand) seem to be where India was before UPI became the monster that it is. E-Wallets are one of the most popular payment methods for real time payments: You add money to a wallet through your bank account, and then use that wallet wherever the merchant has enabled it. And, to think this through a little more, even though real time A2A payments are enabled through the respective mobile banking apps (similar to Indian banks), it is possible to encourage users to shift to A2A vs E-Wallet (exactly like India). Current E-Wallet providers will need to be enabled to be non-banking participant apps of the real time payments system. And since E-Wallets providers have already solved for the critical mass of customer base and customer experience piece of the puzzle, this is what could eventually help scale up real time payments.

2. Scandinavia: Finland, Norway, Denmark (although Finland is sometimes not considered a part of Scandinavia, for the purposes of this analysis, I’ll include it here) is what is included in this section. MobilePay (or Vipps) is one of the leading payment methods for instant payments. (Denmark: ~70% MobilePay, Finland: ~36% MobilePay, Norway: 77% Vipps). But to clarify, MobilePay is not really an A2A method, but it is more like a wallet that stores all your card details (debit & credit), and enables you to pay through a simple PIN set up, instead of remembering your card details

3. Rest of Europe: Apart from Swish, used in Sweden, the model here is different. Instead of having a standalone app, this service is integrated as a feature in an existing banking application, or in the case of Twint, there is a separate Twint app for each participating bank. So if I used Bank X, I would have to download Twint for Bank X, while if you used Y, you would have to download Twint for Bank Y.

4. LATAM: Real time A2A payments are still evolving in LATAM. Three major infrastructures / apps that have been set up are Pix in Brazil, PLIN in Peru, and Yape, also in Peru. The model is evolving - while Pix and PLIN sit within the mobile banking section of the banking app, Yape is a standalone app. Mexico, which I expected to have some sort of A2A real time payments network, does not have one, or if it does, it is not very popular as far as I could find. E-Wallets, such as PayPal are quite popular, with 27% of payments happening through E-Wallets, and ~45% payments happening through a payment method that is NOT a card. And for these reason, LATAM along with SEA, are two regions which can expect a lot of innovations of real time payments, and A2A offerings

What is the % of the population that is banked (i.e. has a debit & credit card), and what is the % reliance on cash?

Source: The Global Economy

If we look at the table above, it is mostly LATAM and SEA that are relatively much more unbanked than the Europe / USA / Australian population. (I’ve taken debit card penetration as a proxy for this). And there could be some reasons for the evolution of payment models:

If a big part of the population is banked, then 2 things will happen:

Digital wallets for cards instead of A2A transfers: Almost everyone will have some sort of card for payments, and so the model will evolve to an ApplePay or a MobilePay, where it is a more convenient way of making card transactions - by using a PIN, instead of remembering card details, or carrying the card around. Like Scandinavia for example, which has 97-99% of its population having a debit card, or the US, where ~82% of its population has a debit card.

Disproportionate Credit Card (CC) & Debit Card (DC) base gives a big Buy Now Pay Later (BNPL) opportunity for real time transactions: In India, where UPI apps were able to hook customers with their customer first approach, which banks did not capitalize on, it seems that in European countries, that wasn’t the case. Atleast for payments, the population might have more preference to go to their own banking apps, instead of a third party. Where third party apps could have an opportunity to play is those regions where a majority of customers have debit cards, but the same proportion do not have credit cards. Let’s look at the Netherlands for example, where 95% of the population has debit cards, 51% has credit cards. There could be an opportunity for new age credit players to come in, and apart from payments, provide these other services as a hook. And maybe that is why Klarna, Afterpay, In3, are becoming more and more popular, and the real time payments infrastructure - iDEAL is going to introduce a BNPL option for customers using it to pay. Even in countries such as Malaysia (DC: 83%, CC: 7%) and Indonesia (DC: 35%, CC: 1%), BNPL will be a big opportunity for real time transactions. The reason I’ve indexed on BNPL is because credit is a big hook. After getting the customer on the application, that is when it can become a super app of sorts, expanding into payments, cab booking, bill payments and other.

2. Wherever there is an unbanked population, there is more reliance on cash, which is why E-Wallets, and A2A payment rails are being innovated on, to make more of the population digital

I’ve done an analysis on the % of population that is banked, vs the cash reliance of the population.

As expected, there is a negative correlation, that is, the more of the population that is banked, the less reliance there is on cash. And countries have incentives to make everyone a digital customer, and reduce cash transactions. New customers who are banked, then begin to use their banks’ products, resulting in a significant decrease in time and increased savings deposits. And for the customer, digital payments are more convenient than cash and cheaper than debit or credit cards, it creates an incentive for the unbanked population to open accounts. (Of course a lot of this also depends on the strength of the financial institutions, and trust in the banking systems, but here the assumption I’ve taken is that these real time payment innovations will happen only in regions with strong banking systems.

In countries like this there is a bigger opportunity for third party players, as compared to where a majority of the population is already banked.

1. Opportunity for third party players: Because a large piece of the population is unbanked, (either cannot, or doesn’t want) I actually see an opportunity for third party players to come in, and streamline the adoption process. Since these customers aren’t really customers of any bank yet, third party providers can actually act as a lead generation for the unbanked population. Normally third party apps innovate faster than banks, so there is value in real time payments networks partnering with them to hasten adoption: India is a great example of this. And this could be the opportunity in SEA & LATAM, for start-ups building in this space to come in, and occupy a large share of mind of the customer, or for E-Wallets in the case of SEA, who already exist as a payment method.

From an Indian context, there is a view that PhonePe would not have been as successful if banks were tech savvy. PhonePe’s CEO, Sameer Nigam has been quoted saying that the UPI model itself was all about the experience layer and building robust, scalable technology, something that banks don’t really focus on. As the real time payments scales up in respective countries, there will be more of an opportunity to build tech that can scale this, especially in highly populated countries, which banks may not be able to do. (LATAM, SEA). On average European countries are less populated, which probably result in less transactions, and less load on the payment systems, which is why mobile banking apps work efficiently enough, for now. Finland for example has a population of 5.5M, while Denmark has a population of 5.8M. Mexico has a population of ~130M, Brazil of ~213M, and Indonesia has a population of 278M. The needs of more highly populated countries with more cash dependence will evolve into a need for payment systems & apps that can handle this load seamlessly with high success rates to build trust and scale consumption.

2. Create a digital footprint for the unbanked customer: There is a bigger opportunity here - to create a digital footprint for those customers who may not have a bank account for whatever reason: YapeCard (Peru) does exactly this: they allow customers to sign up on Yape using just a mobile number, and get them to “seed their account” by encouraging them to get money sent to them through Yape. (Here’s an excellent substack that gives a deep dive on Yape). Once they have money in their account, they can send it, receive money, and even withdraw it, but up-to a certain limit. And this can create a digital footprint of the customer, which they can then use to get a savings account, access to credit, and other financial products.

So broadly, if I had to create a mind map for what models will work where, this is how I would think about it (based on the sample set.)

Where majority customers are banked and have a credit card: Digital wallets for ease of card payments & mobile banking app preferred for A2A transfers. Ex: USA

Where majority customers are banked, but do not have a credit card:Banking apps already provide A2A payments, but there is an opportunity for third party apps to give BNPL and other non-payment offerings as a hook (wealth-tech, crypto investments) that a bank may not current support, or have optimized for

Where majority customers are unbanked with high cash reliance: Opportunity for 3rd party apps / e-wallet providers to build a customer facing experience for the new to bank customer, provide seamless onboarding journeys, and create a digital footprint, which can then be used to cross sell other products (investment, credit etc). SEA (India, Thailand, Vietnam). There is a big opportunity here for these apps to also become super apps of a sort.

Population size: This is an overarching theme that will define the structure of the product: i.e. more or less leaning towards traditional banking rails / systems, or the need for innovative tech through third parties to account for the increased load that real time payments will bring

If we use this model, to compare to South Africa, which I’ve not sampled in the above list, we’ll see that the population of South Africa has ~85% who have a bank account, so there will be more reliance on a mobile banking app. And that is the case - PayShap, operates similar to Twint , or Pix, where it can be accessed within mobile banking. In other countries in Africa, where a large population is underbanked, or unbanked, there are 3rd party apps, such as M-PESA for example that enable money transfers through mobile phones. (M-PESA allows money to be stored in an account on the mobile phone, and they can deposit and withdraw money from a series of agents). While M-PESA was launched in 2007, it has now launched a consumer super app, and a merchant facing app.

So then, if each region has their own A2A payment network, how will international real time payments work?

Problem 1: How do I send money internationally from my Indian account to someone in France, with an account in a French bank (P2P)

This is a problem that has already been solved through international money remittances through solutions such as Xoom by PayPal.

How to make it more convenient would require: Integration of banks, and third party apps to be able to send money through mobile banking. And then money conversion during transfer. So for example, through my Paytm App, I should be able to send dollars to someone from india. Which would require me to convert it through the app, and then send it to someone who has a mobile banking app / third party app / banking account that has some direct bank rails or cross border rails. And this would require the wallet to have the ability to hold multiple currencies, not just the local currency. Some services like this already exist: For example, the Wise App. Wise allows customers to hold multiple currencies in the Wise app, and allows transfer into the Wise account through bank transfer, credit card, debit card or ApplePay. Wise allows sending and holding more than 50 currencies, and receiving money in 21 different currencies, at the mid-market exchange rate. But the scale is still small: there are about 16M users of the Wise App across the world. And that makes sense, the KYC & compliance required to do this would be quite strict: Wise KYC requires PAN & Passport submission.

Problem 2: How do I pay using UPI internationally and vice versa, how do foreign tourists pay using their payment method in India?

Interoperable QR codes powered by agreements between Instant Payment Rails of countries: For tourists at-least, they would do most of their transactions at a POS system, and since we’ve established that the world has moved more towards scan & pay vs tap & pay, there needs to be foreign payment enablement on QR. This is something ASEAN has already done, they have launched an interoperable QR code system. ASEAN has signed bilateral cross border agreements and pilots with other countries (can be seen below), for Real Time Payments, and included QRs as an extension of these to enable payment in local currency, without using something else as an intermediary. There is an exchange rate that you pay, but it is normally less than what is paid on cards. According to a quote from a BCG report:

More competitive foreign exchange (FX) rate and lower fees compared to credit or ATM withdrawal.. Cross-border QR payment linkages are enabled with Local Currency Transaction (LCT). LCT can improve external resiliency by reducing dependence on hard currencies. LCT also uses direct quotations to provide more competitive exchange rates and faster, cheaper, and more efficient transactions. Transactions using cross-border QR payment linkages will be less exposed to fluctuating exchange rates”

Source of the above quote and image: BCG Report

So, atleast the way I think about it is that after signing bilateral agreements, if I scan a cross border QR, or enter the phone number of an individual who is in another region, which has a partnership with India, since mobile numbers are the key identifiers in almost every model evaluated internationally, that will show up as a model number that money can be transferred to.

So what’s next for real time payments?

After interoperable QR codes, acceptance of UPI / other Real Time Payment Methods as a payment method: Apart from the real time payments linkage of different geographies, another step will be to have acceptance of these international payment methods by global & local PA / PG players - India has signed an agreement with Lyra Network, which offers PG services in France to accept UPI payments. International players such as Adyen, & Stripe already have acceptance of payment methods such as Blik. And maybe that is something that will need to be done - identify local & international players present in geographies, and build a payment acceptance flow with them. However, this is easier to do online than offline, and that is why QR codes become the easiest way of enabling these payments

Multi-Currency E-Wallet for international scan & pay transactions: Expansion of local 3rd party apps as a key mode of payment internationally may be unlikely. And that's because like we saw, a lot of these payment methods and apps evolved based on the specific needs of the population. While overall the methods are similar, there are nuances that may not fit in a foreign environment. However, what can be a possible play is a multi-currency wallet, similar to a forex card. So for example: If I am traveling to the US, I would want to have dollar reserves. But I don’t want to use a card since that would be more expensive. Instead, I buy dollars through my App, and hold it in a wallet, and then scan & pay internationally. So a Wise app, but with a scan & pay feature which Wise has already started rolling out.

Travel Apps could expand into Cross Border Payment Apps: There could be an opportunity for cross border apps (travel start-ups such as Scapia, Atlys come to mind) and of course, EaseMyTrip & MakeMyTrip. They are anyway playing in the cross border space through ticket bookings, visa bookings etc. As a customer, I’d want all my international requirements handled in one app, such as international payments, currency wallets, and virtual card storage. And maybe this could be an opportunity to sell UPI TPAP SDK (Juspay) , TPAPPro (Razorpay), or multi-currency e-wallet / virtual card capability to merchants which enables them to operate as payment facilitators / TPAPs .

Regulatory Approvals & Cross Border Licensing is Key: While the first steps to create an environment where real time account to account payments are possible is signing cross border agreements with other countries real time payment processing rails, licensing of this will become even more important. While RBI has introduced a PA-CB license for cross border payments, this is more from a P2M perspective, helping connect domestic / foreign merchants to domestic / foreign customers. Apps enabling Indian tourists to do A2A / E-Wallet transfers in foreign locations, through scan & pay, or through mobile number identifier and vice versa will probably require some advanced form of KYC / hold some time of license/ or even require a wholly owned subsidiary incorporated in these countries enabling them to do so. That will be a key road block / toll gate in international payments