You’ve probably seen the news lately. Payment Aggregator (PA) licenses are being handed out to a lot of players, and it seems like everyone has applied for them also. Let’s look at the approved list from the RBI website. This is defined as all the entities who have received a Certificate of Authorization, and are fully licensed PA players. They have full authorization, and can onboard merchants and conduct operations. This is important, since there are also players (such as PhonePe) who have received an in-principle authorization, with final approval pending. Then within that segment there are certain players who can operate and those who can’t. And then there are merchants who’ve had their application returned (Ola being one of them).

For the detailed lists across segments, their core business operations, how I’ve classified them, and their website links, you can check out this Notion page here

Note: Data is as of 1st Feb 2024, so there might be some minor changes to this list

Segment 1: Have received Certificate of Authorization (Fully licensed) and can onboard merchants

I’ve looked at this with two perspectives.

1) What are their core business operations? For example, Zomato is essentially a Food Delivery Marketplace, while Zoho is SaaS.

And then 2) I zoomed out and looked at it more broadly: Are they core PA players, are they Payments / Payments adjacent, are they a Non Payment (but a) Fintech, or are they not Fintech at all. Let’s look at the data below:

Out of the 15 entities who have received authorization:

1. PA: 33% who’s core offering is, or will be PAs (Razorpay, Cashfree, Tata Pay, Stripe, Paymentz).

2. Non Fintech players: 33% (Digio, Arthpay, Reward360, Zomato, Zoho)

3. Payments fintechs: 20% are such as Juspay, Gpay, Decentro

4.Fintechs, but not in the payments segment: 13% such as Open, and Olympus (Enkash)

Segment 2: Then we’ve got those players who have received and in-principle authorization, with final approval pending, and who can still onboard merchants

There are 38 entities who have in-principle authorization. But the key PA players here who have in-principle authorization are Billdesk, Adyen, Amazonpay, CC Avenue, Pine Labs, PhonePe, Jio Payments, Mobikwik, & Easebuzz, while CRED & PayU have their application under process, and cannot onboard merchants currently. I’ve done a similar analysis on this set, just as I did on the authorized segment. Let’s take a look below: (the detailed table is in the notion link at the start)

1. 50% of the players who have not received a full authorization, but an in-principle authorization are PAs. (Billdesk, CC Avenue, Easebuzz)

2. 23% are payments related fintechs (PhonePe, PineLabs)

3. 13% are non payments but in fintech (Paymate - prepaid cards, Paysharp - recon)

4. 13% are not fintech at all (Ex: Udaan, a B2B Marketplace).

Note: PhonePe and PineLabs have PA offerings now. This classification is done based on the core product of the company - PhonePe was a payments app before it got into building a payment aggregator

Segment 3: Those with an in-principle authorization but who cannot onboard merchants

There are 28 entities who have received an in-principle authorization for a PA license but cannot operate

1. Non Fintech: 11% (Ex: Integra Systems)

2. Non Payments Fintech: 14.3% (Groww, Hitachi, Khatabook, KredX)

3. PA: 29% (Nium, Payglocal, SBI Payments)

4. Payments: (BharatPe, Sodexo, GoKwik)

Segment 4: Those who had their applications returned. There are 71 players who have had their application returned. Broadly, the major players who have had their application returned are Ola, Flexmoney, Twid, and Setu (Although Setu was acquired by PineLabs, so it doesn’t really need its own license). Interestingly, Twid (a rewards player) applied, but got its application returned, which is interesting, since a competitor Reward360 has a fully operational license. But Reward360 builds for Banks, while Twid is more merchant facing so maybe that’s why. And Rapyd, which is a big cross border payments player got their application returned as well. Here’s how the breakup of the entities who got their application returned looks like:

Apart from a few bigwigs (called out), when I was trying to figure out who these players were, most of these entities did not have very well set up websites, and 6 of them didn’t have websites at all. 2 of them had been incorporated 4 months ago. Their SEO was not optimized - I had to find out about them by going to their Linkedin page, and hope that their website was linked, or by going to sites such as ZaubaCorp and hope that there was information there. One of them had only been incorporated 4 months ago. Going by this atleast, and using this as a proxy for their business operations, I’d say for the majority of these cases, operations were probably a question.

So. There are a some key takeaways / questions that I have from this:

Everyone wants to get into payment aggregation: Right off the top of my head, if I were a PA player, I’d be a bit worried. The fact that other Fintechs, and even non-Fintechs are going after a PA license (regardless of if they’ll be able to scale operations and produce a product which is the equivalent of a Razorpay / Stripe for example), seems that the predictions are right. Every company in the world will eventually become a payments player.

But what’s the business model? Businesses are barely making money. And there is a lot of pricing pressure, further driving down these revenues. So the bet isn’t on the revenue take rates, but on the volumes. And if we expand this thought out further, if GMV is the bet, then tomorrow potentially every Enterprise level player will look to not just build their own payments team in-house, but also have their own payments aggregator. Especially in the case of Zomato, whose annualized GMV in FY24 will be ~$6B (Q3 FY24 results show GMV trending at $1.5B per quarter, and growing YoY at ~26%) even if they’re currently paying ~5bps on payments, if they route all their payments through their own , it is a savings of ~$3M annually. But more than that, it brings the checkout experience, the most important part of any buying process within their control. After owning the PA layer, they can then build on payment ++ features on top of that, to create a closed / semi-open ecosystem for their products.

It also seems to be a big opportunity for marketplaces, because they can tap into both the B2B & the B2C angle (in the case of Zomato). In the case of pure B2B players like Udaan, they can tap into the buyer and the seller needs. Let’s look at Zomato, a B2C player. While they have customers, they also have restaurants, some of which are cash strapped. They have Hyperpure, which delivers raw produce, and kitchen products to restaurants. They are also getting into merchant lending. And if the merchant lending happens through their platform, then that’s an opportunity to route more GMV through their PA, and earn more bps.

An example of an Enterprise building their own payments in-house is our very own Tata. They can use their PA for processing payments of all group companies - Titan Jewellery, Tata Neu, Coffee, Hotels, and Tata Neu, their super app. Amazon is another example; AmazonPay has got an in-principle approval. Groww as well - it has an in-principle authorization but cannot operate just as yer. And this is only the start. Slowly more Enterprises will look at having their own PA’s in-house.

International / Cross Border players have applied for this license: Players like Stripe, Nium, Payglocal, Adyen etc have all applied and have an in-principle approval for this license. Rapyd, a cross border player has also applied, but has had its application returned. The message is clear, this is obviously a market where they want a piece. Stripe & Adyen are already present globally - Stripe is present in 46 countries, while Adyen (according to its website) accepts payments in ~100 countries. A reason for these international / cross border players to apply for a PA license in India is because usually local acquiring has a higher success rate. (Local acquiring means that the merchant acquirer - which is the entity processing the payment on behalf of the merchant, and the customer bank - the issuer are in the same country.) This is because if the acquirer and the issuer are in the same region, the familiarity increases success rates, and also allows for cost optimization, because the payment can be processed as is, without having to go through any sort of extra authentication / authorization or conversion. And that is probably why Adyen has local acquiring licenses across Europe, North America (including Canada), Brazil, Hong Kong, Australia, New Zealand, and Singapore. Getting a local acquiring license (in this case, the PA license) would level the playing field for these international players, and allow them to offer competing rates with Indian PAs. There could be an emerging threat since they may be pre-existing relationships with global enterprises which they can leverage to negotiate for better rates.

But what is interesting here is that the RBI introduced another license called PA - CB (Payment Aggregator - Cross Border) in October 23. This for those entities in India who facilitate the money movement across import & export flows. There are 3 types of licenses under the PA - CB: Import only (money going outside India), Export only (money coming to India from outside), and Import & Export. Historically RBI only comes in when this use-case starts becoming big, and especially with the announcement of this license requirement, it’s probably a fair assumption to say that this space is going to see a lot of growth. But more importantly, this now becomes another license for cross border players to apply for if they want to facilitate payments through a corridor where India is a party.

At least, by the data, if we look at those players who have received a certification of authorization, or are in -principle approved, there doesn’t seem to be some massive skewing to already existing PAs or payments players

While PAs are, quite obviously the most represented in this set, there is a fair representation of non-payments fintechs, and non-fintechs. That is to say, it’s not just one or 2. Together, out of the set, ~30% are in this category. Out of which ~30% (7) are approved. Which further adds to the risk to the current PAs. It seems like that the risk to the current PAs is not just from other payment operators, but actually the Enterprises who aren’t into payments, but process large amounts of GMV, or have a large merchant base already (in the case of Zoho). And maybe PAs need to start building a plan in which most of the Enterprise Companies have their in-house PAs, and don’t need a third party operator.

But then there is another question. If we assume Enterprise companies such as Zomato, Amazon etc will have their own PAs, then why do non- fintechs want to get a PA license?

There are still a lot of payment adjacent companies, and non payment fintechs who’ve lined up to get a license. Which is a challenging prospect. Even if you get a license, you’re competing for a smaller share of the market, and brand recall does matter a lot.

Let’s look at the numbers. If we just look at the list from RBI, there are 32 PA players who are operating a payment aggregator in some capacity. And another 21 who had their application returned. So there were close to 40 PAs who were operating in the market. But it’s still only 4-5 (Razorpay, PayU, Paytm, Cashfree, PhonePe, PineLabs) who are top of mind. It’s clear - the online market is finite, and saturated. And there’s another angle. These players hold 25-30 % of the market, and even then are not profitable / or if they are it is break-even. So by simple math, the market in its current state can only support 3 - 4 profitable players. The ability to make money is limited. And because there are multiple players in the market, there is a lot of pricing pressure driving down the bps earned.

But there could be another way to look at this:

1. Get the license first, apply later: Getting a PA license is a time-consuming affair. Razorpay & Cashfree were stopped from onboarding merchants for close to a year. So then the thought process could be, let’s get the authorization first, and then once we get the license, then start the business for real, without any hiccups like this on the way. Sort of like, apply first, and think about what to do later once the application is approved. It also opens up potential opportunities for these smaller players, and apart from that, makes them more valuable as acquisition targets.

2) Could give more control to niche fintechs with PAs: One way this solves this is at checkout, some merchants give an option to customers to pick which PA to pay through. If fintech offerings, especially those built around themes such as (let’s take BNPL as an example) BNPL have their own PA, they can be shown as an option to the customer to pay through. But this is for merchants who do not have a payment orchestration layer (this is routing payments to PAs based on pre-defined rules such as payment method, success rates, cost etc)

3) Industry evolution to multiple PAs with expertise in 1-2 unique payment methods each: Another way to think about it is this could reduce dependency of these smaller payment methods on PAs and make them more valuable to merchants. A lot of new payment methods talk about their growth plans being to integrate with PAs to get access to their merchant base. Now, if they have their own PA, they can directly go to merchants with a more compelling pitch, and show that while they have certain payment methods that are their core offering that they can optimize for the merchant (such as BNPL for example), they also have the standard payment methods such as Credit Card (CC), Debit Cards (DC) & UPI. And this isn’t a new playbook. It’s exactly what PhonePe is doing. They have a PA, and they have your standard payment methods available, but their core offering is (they claim) offering best in the industry UPI success rates, and most of the payments that happen through the PhonePe PA are UPI. I’m just expanding that thought out further, and saying that going forward, it’s possible that each unique payment method (apart from your standard CC / DC ) has its own PA.

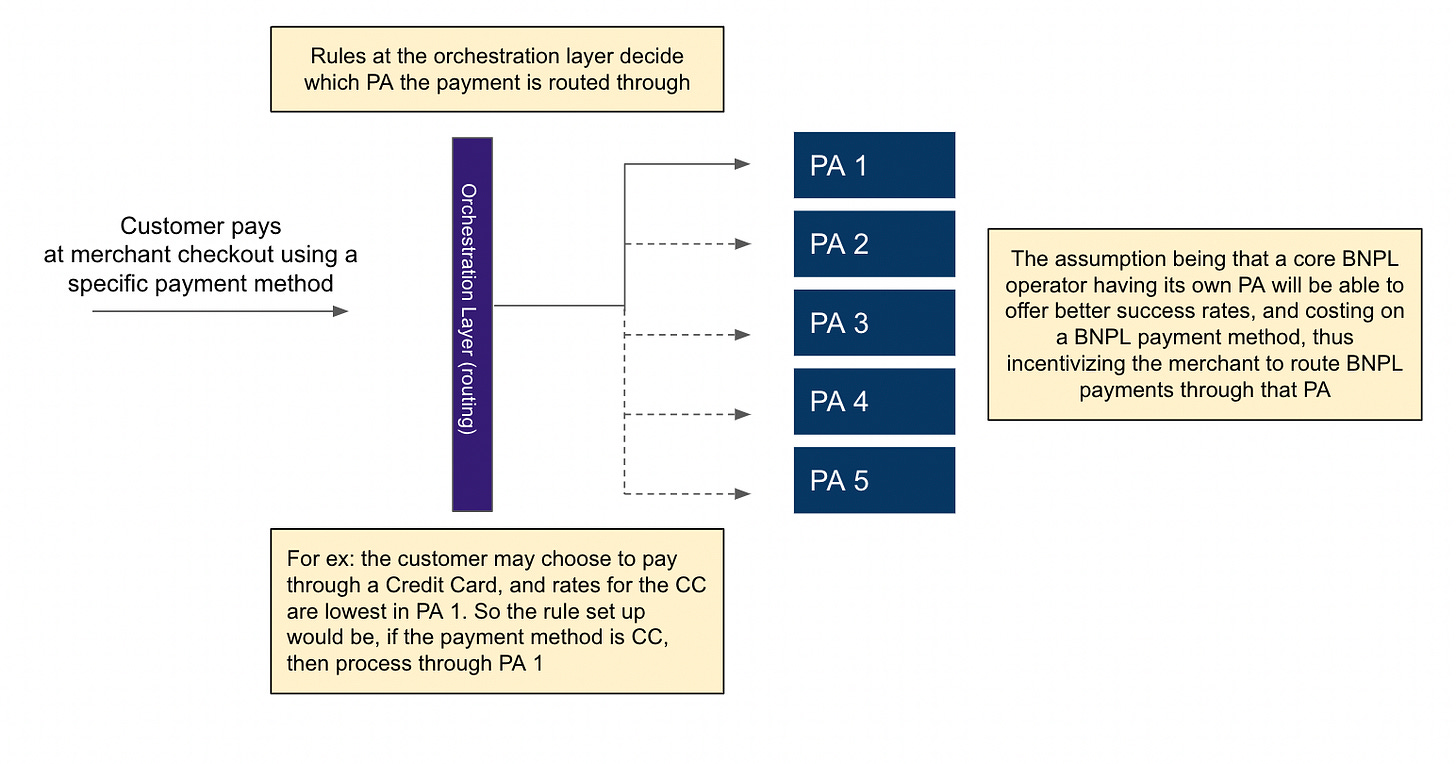

4) Payment Orchestration becomes a must win: Following on from the previous point. Most of your big merchants operate with multiple PA’s (for example, Merchant X will have integrated with Razorpay, PayU, and Cashfree). And there are Payment Orchestration softwares available in the market, such as Optimizer (Razorpay) , Payments Router (Juspay), which enable a merchant to route payments to different payment gateways / aggregators depending on parameters such as payment method, success rates, and pricing. So all a merchant would need to do is add those rules into their payment orchestrator. (for example: if a customer wants to pay with method 1, route to PA 1, if method 2, then PA 2, and so on, and these methods can be things such as pay with reward points, which is what Twid does, or pay using a BNPL method, such as Flexmoney) . Think of it almost as a decoupling of a sort. Earlier, the advantage that a Razorpay had was that it offered all these multiple payment methods through its PA. But now, because each payment method will have its own PA, and can integrate with the merchant, payment routing is what becomes a “must win.”

But this is a hypothesis, and we’ll have to see how the product flows, and the costs play out. Here’s a visualization of how this could look like below:

So then comes the million dollar question. What do the original PA’s need to do to stay ahead of the curve?

Apart from sticking to the basics such as 1) best customer experience 2) limited down times 3) high success rates, for India, and from a monetization perspective, the themes that everyone seems to be betting on are:

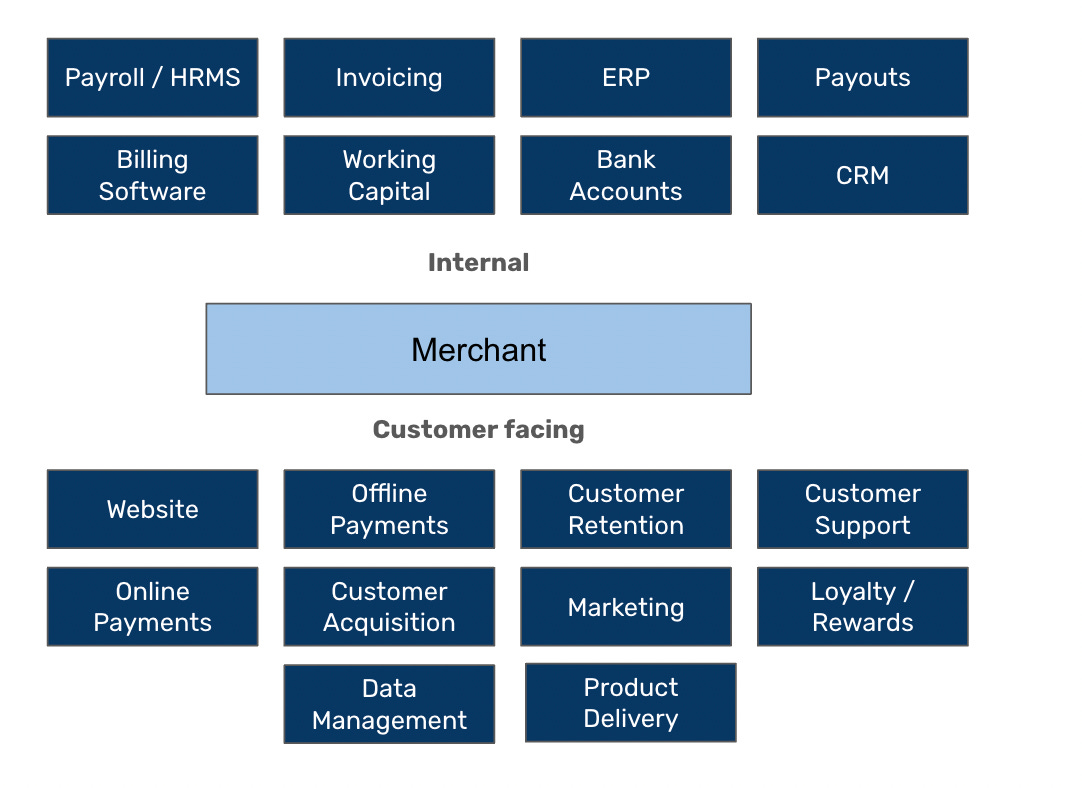

1) Going beyond payments: An obvious theme is PAs expanding into other offerings, using a build vs buy approach to strengthen an existing offering to tap into a new opportunity. Another theme is international expansion. Let’s look at Juspay as an example. It doesn’t have a PA yet, but has received a license. It recently acquired LotusPay to strengthen its recurring payments stack. It’s also going deep into the affordability segment with its HyperCredit offering. Pinelabs is another example. It started with its offline POS, and now is expanding online. It acquired Setu to strengthen its infra layer. It also acquired Qwikcilver back in 2019 for the loyalty and Giftcard piece. If I had to use an analogy, this could essentially be the strategy that Microsoft used to win against Slack. Slack is a way better tool to use, it’s more convenient, and more user friendly. But what it doesn’t have is an end to end stack like Microsoft Office. It’s easier for companies to integrate with one tool giving multiple offerings, instead of 3-4 different tools. And maybe that’s what existing PA/ s need to do, and will probably evolve into, to boost their value add and their revenues. They will not be just payment processors, but beyond payments, and solving for all needs of the merchant. Not just limited to customer facing, but also internal operations. Here’s what a potential “all in one offering” would need to cover:

There’s also a segment play here. And this can differ based on the type of merchant. For example, the ERP & Billing required for a grocery store would be very different from a QSR (Quick Service Restaurant). And the payroll / HRMS could differ based on the type of industry - shift workers vs full time. So eventually (and I’m not saying we’re there yet), to be able to offer a wholistic beyond payments solution (seeing that everyone is a PA now), where we all are headed seems to be verticalization. Toast is one example of this: It’s a Restaurant POS & Management system, and apart from payment acceptance it has verticalized offerings such as: a kitchen display system, self ordering kiosks, payroll, loyalty programs, customer acquisition & retention schemes, and table management, just to name a few.

2) UPI as the “checkout of the future”: UPI in India will continue to be the story and building the infra & experience around UPI (which is what PhonePe has done) is what will set a PA apart over the other, just because of the sheer volumes coming through this payment method. It is expected to power ~90% of digital payments by FY27, and with Credit Cards & Credit Lines & PPI on UPI opened up, in the future, it’s possible that every payment method will be linked to UPI. International UPI payments also seem to be a theme - NPCI announced a partnership with the French payment company Lyra networks to enable UPI payments in France. PhonePe has recently hired a CEO for their international payments division.

3) Cross border payments: A World Bank report says that India’s market for inward remittances (Money coming from international regions to India) grew 12.3% to $125B in FY23. (this would be a combination of B2C, B2B, and P2P). Infact, India is the highest receiver of inward remittances. And the revenue opportunity is also higher. Let’s look at it this way: Current PAs charge 2-3% per transaction (what they keep as net revenue is a fraction of this amount, the rest is distributed to other players in the payment process). According to the World Bank, the average cost of a cross border payment is ~6.2%! That’s 3x the revenue TAM. But to do a cross border payment, a fintech needs to have the respective cross border payments license in both the countries that are involved in the payment. So Indian PA’s need to start the process of acquiring the cross border licenses in countries where the money flow to and from India is the most. According to this source: in FY23, US, the UK, and Singapore accounted for ~36% of remittances to India, and UAE was ~18%. These could be potential countries to start off with.

4) Local Acquiring Licenses in International Regions: International expansion to power domestic payment flows in foreign countries could be another opportunity. Adyen for example (based out of Amsterdam, Netherlands) is in the process of acquiring local licenses in other countries to optimize for domestic payments in international countries, and they’ve already acquired quite a few (mentioned previously). These licenses are moats in itself, since they take time to be approved. If we use this as an analogue, then that is the next step for PAs in India. Start the process of acquiring local licenses abroad.

Here’s a visual representation of when the local and cross border licenses are needed below:

5) An opportunity to build for banks / partner with banks / become a bank: Banks are the backbone of the payments & fintech industry. They power everything. From a payment perspective, a bank needs to provide terminals to enable payment processing. From a lending perspective it needs to supply the credit. It needs to be the underlying support to the account that is opened through a neobank. (And especially in India, where the current view is that while the RBI sees value of digital banks (an online subsidiary of a bank), it is still cagey about neobanks. (a digital ONLY bank)).

Selling to banks is tough - they are quite conservative, and take time to make a decision, but there is opportunity here in recurring revenue. I’ll give an example: Finacle, which is an Infosys product, and a leading Loan Management System software reportedly has a topline of $200 - $300M YoY. And that’s why we’ve seen fintechs such as Slice (merged with North East Small Finance Bank in 2023) & BharatPe (along with Centrum launched Unity Small Finance Bank in 2023) merging with banks. And why Paytm getting the license to become a payments bank was such a big deal, and now potentially losing it is an even bigger one. It’s a big part of winning the PA battle, and the larger fintech war.

6) Win payments orchestration: If every payment option has its own PA, and they integrate with merchants to optimize their core payment offering, then it is not the PA game that needs to be won, but the payment orchestration game. And maybe that’s why every PA is going after this - not just the aforementioned Optimizer by Razorpay, and Payments Router by Juspay, but Paytm with its AI powered router and FlowWise by Cashfree have also entered the fray.

7) Offer PA’s as a service: It is unlikely that new PAs will be able to scale upto a Razorpay or a PayU capability. This could actually be an opportunity for the original PA’s to offer whitelabeled payment aggregators as a solution to the new licensed PA players. And maybe thats where the original PAs need to focus on. Becoming a whitelabeled solution for new PAs.

One thing is clear. Payment aggregation in its existing form looks like it is on its way to being commoditized. 15 players with who are fully authorized PAs, another 38 (who can operate), and 28 (who cannot operate) who have in-principle authorization. The payments market in its current state can only support 4-5 players who are profitable, and there will be more pressure on the bottom line because of the new players entering this space.

Who will aggregate the aggregators?

Love this piece, informed our own thinking at Climes :)

Thanks for the detailed research!

Well written Ambika, this article made things pretty clear to me about PAs.