[#23] IPOs: A chance for extraordinary returns, or a scam for the retail investor?

And why has there been a recent slew of Bank / NBFC IPOs?

With the recent news of all these start-ups preparing for IPOs - PhonePe, Swiggy, Ola, Mobikwik, PayU, and Digit, I had a bigger question in mind. As an asset to invest in, how profitable is it for the retail investor? Is it worth investing in? Is the return worth the risk? Or is it better to just stay away?

I’ve approached this question in 2 parts. The first part talks about the IPO investment opportunity, and if it is really worth it. And the second part within the article takes a deeper look at why more Banks / NBFC have, and will continue to IPO.

Lets start with the key definitions first:

1. IPO issue price: This is the price at which shares are offered for sale when they first become available to the public.

2. Listing price: The price at which the shares trade on a stock exchange after the IPO. The difference between the IPO issue price and listing price is that the IPO Issue price is set by the company, while the listing price is determined by supply and demand in the market.

3. CMP: Current market price as of 16th Feb 2024

To understand the IPOs better, I’ve taken a look at the IPO data from 2010 till Feb 2024, to understand how many companies are trading above their IPO issue price, how many are trading above their listed price, and have delivered a positive result for their shareholders, how many are trading below, and would the investor would just have been better off if they had invested in FDs.

Broadly, there were 395 IPOs in India from 2010 to Feb 2024 (Source: Moneycontrol)

Let’s first look at the data from the perspective of an investor who got shares of a company at the IPO issue price

Based on the above data, ~64% of investors who got shares at the IPO issue price ended up having positive returns as of 16th Feb 2024. So slightly positive in the IPO Issue Price investor’s favour.

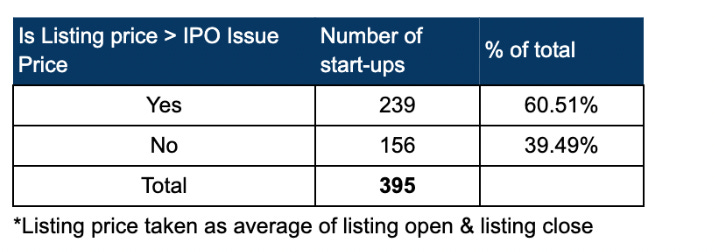

Then, I looked at the data to see if the Listing Price is > than the IPO issue price. I wanted to see in what % of cases, the investor coming in at the IPO issue price could sell at the listing price, and see returns fairly quickly.

The data here again is in the favour of the IPO issue investor, but the proportion has shifted slightly. Now, the listing price is greater than the issue price ~60% of the time. So in 60% of the cases, the investor could sell off their shares in a fairly quick turnaround time, and see positive returns on the share price.

But now let’s look at the retail investor who invests at the listing price

Immediately, while comparing positive and negative returns, we can see that an investor who comes in at the listing price is worse off than the investor who buys in at the IPO issue price. We can see the ratio has shifted a bit. For those investors who bought the shares at listing prices, on average as of 16th Feb 2024, they are at a positive return ~58% of the time, and in the negative 42% of the time.

And there’s another angle here. Investment is fine, but what is the quantum of return? Return has to be proportional to risk, as every one of us learns in investing 101. The more the risk, the more the return. An investment in a company at IPO is kind of a risky investment, when you compare it to an FD. So you’d expect an investor who invested in an IPO to make a much higher % of return compared to if they had invested the same amount into an FD. So that’s what I have done. I’ve looked at the return that investors have gotten based on the current market price of the share, and the return if they had invested the same money they had used to buy the stock, into an FD at 5%.

Let’s take a look at the data below:

We can see the ratio is even less here. 55% of companies gave a greater return as compared to putting the same amount in an FD at 5%, in the case of IPO issue price.

And in the case of the retail investor coming in at listing price, it’s even worse, and skewed towards FDs. Atleast in the case of an IPO issue price, it was skewed slightly towards buying the stock.

In the case of the investor coming in at listing prices, their return on the current market price was more than the FD return on the same amount invested ~only 48% of the time!

So broadly, what’s the takeaway from the above data?

1) 1 major insight that I get from this is that the IPO Issue price investor overall seems to have more positive results than negative, purely looking at it from a perspective whether the investment is in green or red. And this is the reason why early stage investments have not dried out - one of the goals for every start-up is to build a successful company, and especially if it is VC invested, take it to IPO, since that is a way that the VC investors can make returns. If just the IPO Issue price is less than the listing 60% of the time, anyone who comes in at Series A/B/C, which are priced lower comparatively, will make even more lucrative returns.

2) Unless you’ve done your in-depth research, IPO’s don’t seem to be a very good investment. In 60% of the cases, at IPO issues prices, at current market prices the return is positive. At listing price, the positive % of cases reduces to 58%. And as a retail investor who has limited time to spend in research, the answer seems clear. If ~40-50% of the time I’m making losses, and if I see better returns if I invested ina FD, then I might as well go ahead and invest in FDs instead of IPOs.

3) The % of positive returns, & the number of companies who have given higher returns in comparison to an FD isn’t that great. It’s hovering around the 50-55% mark. That is equal to the odds of a coin flip. Even for an investor who comes in at the IPO issue price, the current market price is greater than > FD return only 55% of the time. For the investor who comes in at listing prices, it’s 48%. So, the majority of the time, you’ll end up probably losing money in an IPO investment, if you account for the opportunity cost of investing that money into an FD. And FDs are one of the least risky investments out there, and it’s almost a guaranteed return year on year.

And for the retail investor who might get caught up in the hype, and excitement of start-ups listing, especially the new age ones, such as Zomato, Paytm, Nykaa and Delhivery, may end up losing money.

But we know this - risky investments could have larger payoffs. So then why is it still a sketchy investment?

Some folks may invest in an IPO with the assumption that they may make exponential returns. Yes. Possibly. But the folks who were going to make exponential returns have already done so. They’ve come in at seed rounds, and either exited, or will exit when the stock lists. So the scope for these exponential investments is much less for the retail investor, who is essentially coming in at the last funding round.

Let’s take a step back and ask, why do companies IPO? Usually for two reasons: Capital requirements (for various reasons, could be capital for growth, repaying loans, or business expansion), or returns to early investors. In the case of tech start-ups, these investors are usually VCs. And usually, the most public & highly marketed IPOs are those around start-ups. These are VC invested, at inflated valuations. So then is the story that VC’s make money, at the expense of retail investors true?

Well, not always. It’s hard to generalize. The Zomato IPO issue price was Rs 76. Its average listing pricing was Rs 120. That’s a 57% return, if the share was bought at issue price, and sold at the listing price. PeakXV (formerly Sequoia) made 10x returns on Zomato. That’s a 900% return. Everyone made money here, and VCs were compensated handsomely for the risks they took. But then you also have situations like Paytm, which at IPO was valued at $20B, allowing many VCs to exit and make great returns at the expense of the retail investor. Its IPO issue price was Rs 2150. Its average listing price was Rs ~1800. And even before the RBI debacle, it had dropped to Rs ~800, which is ~44% of what the average retail investor would have bought if for.

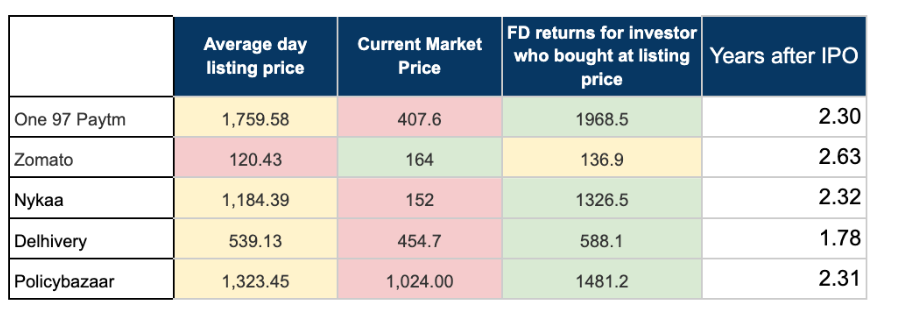

Let’s take a look at some of the stock performances of start-ups that have IPO’ed in the recent years. I’ve looked at Paytm, Nykaa, Delhivery, Policybazaar, and Zomato.

Scale: Red means lowest price, yellow is middle price, and green is the highest price. So Ideally you want to enter at red, and exit at yellow / green.

Note: Nykaa has undergone 2 stock splits a 6:1 since IPO’ing, so the view here for Nykaa may not be comparable to the other IPO’s.

What this data seems to say at least is that for the start-ups who raised VC money in the last decade and then IPO’ed, their highest price (green) is at the listing price when the market opens. So coming in at that point makes the LEAST sense for any investor.

Based on this view, it seems that from an investment perspective, if the retail investor wants to make quick money, they should bid to get a lot at the IPO issue price, and then sell it off on the first listing day when the market opens. But there is another angle here. IPO lots are usually quite oversubscribed. So I may apply for lets say Rs 1000 worth of shares. But so have N number of other retail investors. And so when the lots are issued, the individual investor usually only gets allocation in the IPO, at the IPO issue price, And this allocation is a fraction of the amount that they have applied for. And usually in cases of large oversubscription, lots are assigned on a lucky draw basis.

So, if I have applied for let’s say Rs 1000 worth, if the stock is oversubscribed,I will almost never get shares for that amount, and could get as little as 1/10th allocation. And. After I bid for the lots, this amount will be blocked in my account until the allocation date. Which could be 2-3 weeks. So if you account for the opportunity cost of putting this money somewhere else, and earning from that, instead of the money being blocked in the account and earning NOTHING, this further depresses the returns.

And then I have also taken a look at the stock performance of these specific companies, and compared the listing price, the current market price (as of 16th Feb), and FD returns at 5% if the same amount was invested into an FD.

Scale: Red means lowest price, yellow is middle price, and green is the highest price. So Ideally you want to enter at red, and exit at yellow / green.

Seems that for the retail investor buying during the regular trading day when the stock first lists, they almost always make more money if they would have invested in a FD instead (80% of the times). So the moral of the story seems to be: Buy at the IPO issue price, hope that you get allocation and sell immediately in the open market. And if you can’t get it at the IPO price, put the money into an FD / alternate investment and bide your time.

This seems to at least corroborate the story of companies IPO-ing at inflated valuations and giving their early investors returns at the expense of the retail investor. Since in 4 out of 5 of these cases, in 1-2 years post IPO, when the market corrects, the market price is almost always lower than the listing price. And in 60% of the cases it is lower than the IPO issuing price also. So holding these stocks for the long term and waiting for those big long term cap gains to come in doesn’t seem to be the case as of today.

Let’s take a look at the quantum of returns from an IPO. (If bought at issuing price and sold at listing price)

I’ve looked at the returns that investors have made from IPOs (over the last 15 years). And to keep it objective, and account for the market price fluctuations, I’ve looked at the returns made if they bought at the IPO issue price, and sold at the average listing price.

40% of stocks gave a negative return. And this seems to follow the 80-20 rule, where 20% (the long tail), has given exponential returns (relatively). Out of the 239 start-ups who gave a positive return, ~83% gave < 50% returns, and ~27% gave > 50%. And 20% of this concentration was in the <=5% bucket, which was the biggest concentration.

And this is in the case of IPO issue price investors. Just based on the data, the listing price investor is usually worse off, since if they want to invest, they almost always have to come in at a higher price. So the chance of having negative returns is higher, and possibility of getting exponential returns probably skewed even more towards the long tail

So what’s the conclusion on IPO investing? IPO’s seem to be way riskier than what the average retail investor thinks. And especially for someone who does part time investing, and doesn’t do their own research, probably best to look at other investments until you’re able to build expertise.

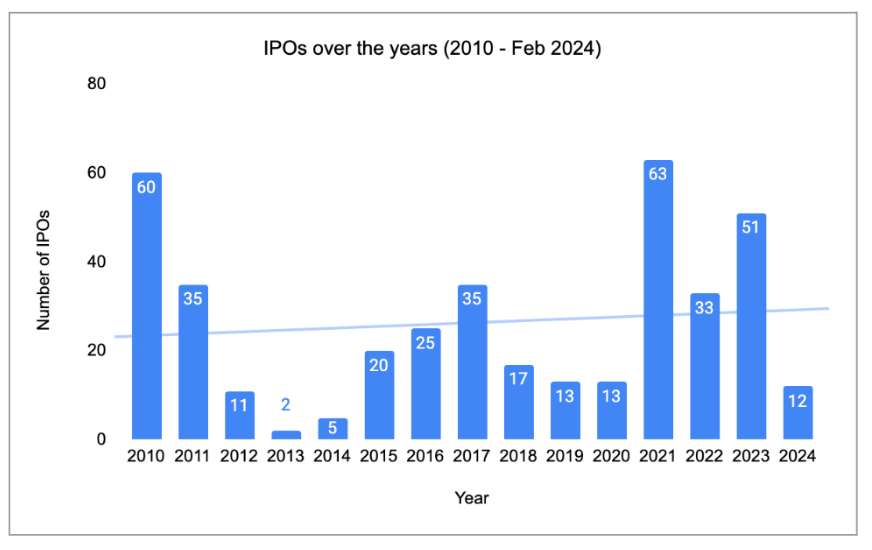

So what’s been the trend in IPOs?

There have been 395 IPOs over the last 15 years, but no major trend as such in terms of number of IPOs. However, what we can see is that over the last 3 years (2021 - 2023), the number of IPOs each year seem to be rising as compared to 2012 - 2020. In fact, 2024, with 12 IPOs is almost at par with 2019 - 2020. From a broader economic perspective, it could be promising. Multiple sources say that because IPO’s help smaller companies raise capital, it helps in job creation. A study done by the Kauffman Foundation in 2012 estimated that the 2,766 companies (in the US) that IPO’ed from 1996 to 2010 collectively employed 2.2M more people in 2010 than they did before they IPO’ed, and total sales among these companies increased by over $1T during the same period. It also boosts investor interest, because once a company goes public, suddenly everyone has access to information, so there is transparency and it’s not just insiders who can invest.

I also looked at the broad sectors that IPO’ed from 2018 - 2024 (Feb).

Bank / NBFCs top this list, with ~11% companies in this sector IPO’ing. Some examples here are Jana Small Finance Bank (IPO on 14th Feb 2024), and Capital Small Finance Bank (also on 14th Feb 2024). What is interesting is that 12 out of these 23 (~50%), have IPO’ed in the years 2022 and 2023.

Next we’ve got manufacturers of specialty chemicals, Pharma products, or ingredients for pharma products. Financial Services players such as Aditya Birla AMC in the asset management space, stock brokers, and wealth management. And then manufacturers of steel products, pipes, automotive parts, and also players in hospitals & healthcare.

All of this seems obvious. Most of these categories need a lot of capital to grow.

Part 2: But why are IPO’s highly concentrated in the banks / NBFCs sector?

And why have 50% of the IPOs come in the last 2 years? In fact, 2023 had 7 IPOs in this sector. More than any other year in the last 5 years. (Note: I’ve just analyzed data from 2018 - 2024 for sector specifics)

Well. One answer is simple. They need a lot of capital to grow and expand. But another reason could be something to do with the RBI circular that came out in October 2023, regarding risk weightages that banks have to keep in mind while lending to NBFCs. You can check out the document here.

Essentially the RBI circular is a crackdown on unsecured credit. Previously consumer credit (given by banks to the end consumer) had a risk weight of 100%. Now it has increased to 125% for those loans categorized as retail loans (excluding housing, vehicle, education, and loans against jewellery, and microfinance loans). This risk weight refers to the minimum amount of capital the bank / NBFC has to keep aside while giving a loan. This ensures that the bank can absorb potential losses without its financial stability being affected. So to put it in an example, earlier, if a Bank / NBFC was giving a personal loan, its risk weight was Rs 100, which means it had to keep Rs 100 in reserve. Now because it is 125%, this means that to give out Rs 100 as a loan, it needs to keep Rs 125 in reserve. This results in greater capital needs, which results in banks / NBFCs needing to raise more capital to meet RBI requirements. Now, if more capital is taken for the same amount of business, which in this case is that to do the same lending of Rs 100, I have to raise Rs 125, then the cost of capital (which is the interest I have to pay back for raising that Rs 125) is higher, because even though I’ve raised Rs 125, in actuality I can use only Rs 100.

So now we can see the cost of capital in the above example, i.e. is not 10%, but 37.5%. And now, because there is less capital, which has to generate more revenue, to pay back the increased cost of capital, this will result in lenders hiking interest rates to the end consumer, OR reducing exposure to unsecured credit completely. And hiking interest rates usually leads to adverse selection, so this will end up hitting the bottom line of lenders, either through increased NPAs, or cost of funds.

What is interesting though, is the fact that unlike increasing risk weight requirements on certain categories of loans, (which is what RBI has done for consumer credit given out by banks, the 125% risk weight is only for retail loans), the RBI has increased risk weights from 100% to 125% for bank lending to NBFCs across ALL sectors. Because of this banks could possibly limit credit exposure to NBFCs because of the increased capital requirements. And this will restrict the entire lending market further since NBFCs need to raise funds to be able to lend, and a large part of lending that NBFCs do has actually got nothing to do with retail loans. They do vehicle, home loan, heavy machinery, education loans, and lending to the B2B sector as well. Lack of availability of capital could possibly hamper ecosystem growth for SMEs. Take Aditya Birla Finance Limited (ABFL). As per their 2023 ABFL 2023 annual report, their unsecured business (unsecured + personal & consumer) only contributes to ~29% of their AUM. Majority of their business comes from B2B lending, and their secured business.

So, in a nutshell. Banks / NBFCs need to be able to raise more capital at lower cost to be able to expand their business, lend more. And this is true ESPECIALLY for NBFCs. This is either through debt (Banks through other banks, NBFCs through banks), or equity. The debt is becoming expensive. And maybe that’s why we’ve seen so many IPO’s in this sector. And it is possible we’ll continue to see more IPO’s, especially on the NBFC side. Northern Arc Capital for example, has filed papers with SEBI in Feb 2024 to IPO, to raise 500 Cr as capital for lending business growth.

So what’s the final verdict on IPOs?

1. It’s a riskier investment than it looks like, and retail investors should tread with caution, and not get FOMO, especially since in the next few years there is going to be a lot of buzz around some big start-up names going public. Especially since the data on the start-up IPO’s (Delhivery, Zomato, Nykaa, Paytm, Policybazaar) doesn’t seem too positive. And especially because start-ups are quite hyped, any IPO involving them will probably be oversubscribed, leading to allocation issues, and risk due to opportunity cost of having the money blocked in your account.

2. Buying at IPO, and hoping for long term gains doesn’t seem to be the strategy that works, Especially for the hyped start-ups in the case of the 5 sampled. In 1-2 years post IPO, when the market corrects, the market price is almost always lower than the listing price. And in 60% of the cases it is lower than the IPO issuing price also. The better option seems to be to buy at IPO issue price (if you get allocation), and sell as soon as the stock lists.

2. IPO investing seems to be a 50-50 game. And within the positive returns, it’s an 80-20 game, where ~80% of returns will come from 20% of your investments. In fact, only 4% (15 out of 395) investments, with investors coming in at issue price, and selling at listing price saw returns of greater to 100%. So if you’re looking to invest in riskier assets for potentially higher returns, and you want to invest in start-ups, then evaluate and see if you can invest in some of these start-ups early, through angel funds, or directly, if you have a relationship with the founder.

3. New age start-ups will raise not just for capital requirements, but also to give liquidity and returns to their earlier investors. So be mindful of that. While a third party (usually an investment banking company) works to set the IPO issue price, the start-up itself has a big say in this and the price is set based on the last valuation, and after discussion with investors. So even though the data on buying at the IPO issue pricing, and selling when the stock lists seems positive, tread with caution, and do your own research

4. Sectors with high capital requirements will continue to IPO - and top in these sectors, apart from Banks / NBFCs , are companies in manufacturing, hospitals & healthcare, and pharma. NBFCs in particular will continue to see IPOs as long as the risk weights are kept at 125%, in order to raise capital to grow their business.

5. We’ll probably see NBFC / Bank IPO’s slow down only when the risk weighting becomes more favourable. And for that, what NBFCs and banks will have to do is prove the success of their lending models, and show the strength of their underwriting mechanisms. Risk weights are increased because the RBI perceives this sector as risky, and wants to limit growth until it’s confident that the lending is being done sustainably. And this could be an opportunity for big fintechs, who have access to customer behavior and transaction data: to work with banks & financial institutions to slice and dice the data, and figure out where the pools of profitable customers lie.

Well explained!