I read a great article by The Ken some weeks ago - and it talks about the big problem with ONDC, that currently Juspay faces through its ride hailing apps (Namma Yatri for example). It talks about how, while ONDC as a platform allows entities to leverage its APIs and network to tap into the supply and demand that have been onboarded through respective apps, there is a catch. Even if an entity tomorrow builds something out on the platform, it doesn’t have control of the end-to-end experience. Here’s a better way to explain it:

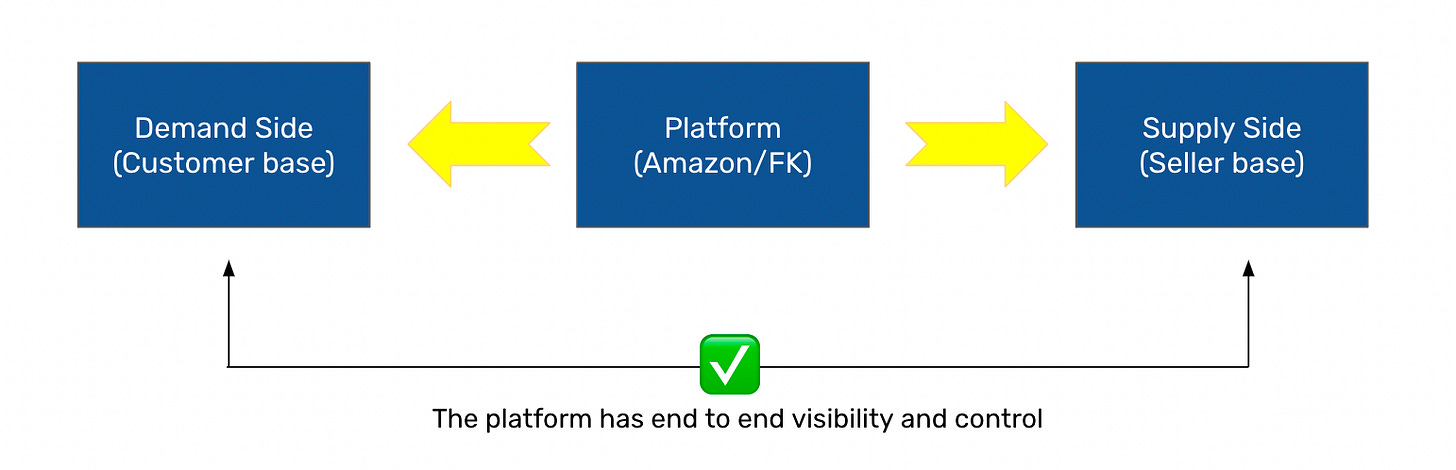

Current platforms:

Here, the platform has visibility of both the buyers and sellers, and an ability to control both.

ONDC

Now, the buyer side app, or the seller side app can plug into the gateway to allow discoverability of their services, or avail of said services. And then there are 3rd party offerings such as logistics, trust, etc which can be offered by other entities being plugged into ONDC. The picture below (source: Inc 42) illustrates it well:

On the face of it, it’s great. It allows smaller stores to be able to market their products to a broader base of customers, and break free from the monopoly that the Amazons and Flipkarts of the world have. But there’s one thing that we’re missing here.

Absence of levers across both supply & demand

What makes platforms really powerful? It is not just being able to create a two-sided marketplace but it’s about having access to levers to be able to influence both sides. Platforms are also about efficiently connecting buyers to sellers, and to be able to do that, visibility is required of both the buyers and the sellers capabilities. If you’re only able to influence one part of it, the model breaks down.

One example that the Ken article explains well, is the ability to influence the seller side to solve a buyer side problem. For example, while we all hate surge pricing, it is an efficient way of solving the problem of less cabs in an area. Uber & Ola institute surge pricing to incentivise more cabs to come when there is a lack of cabs in a certain area, in the face of heightening demand. But the only way that can happen is if there is control on both sides of the network. And that's the core issue with ONDC, and as the Ken article mentions, in the case of Namma Yatri. While Juspay has taken the effort to get auto drivers onboarded to ONDC, the supply side doesn’t belong to them. It belongs to the ONDC network - and that’s why there’s the absence of levers across both supply and demand. And tomorrow, theoretically, you could start your own buyer side app for ride hailing, and use the supply side by plugging into ONDC, which Juspay has taken great efforts to build.

So what is the problem?

The issue is not supply side aggregation. The benefits to the retailer are clear - get plugged into a network that allows discoverability by the end user no matter what platform they are using, as long as that platform is plugged into ONDC. If I had to articulate the problems simply, they would be twofold:

Problem 1: How do you aggregate demand?

Problem 2: If anyone can use the supply aggregated on the ONDC network, then who can actually build a sustainable business around this, especially in a market that is saturated by two sided marketplaces?

I don’t doubt that ONDC is a great initiative. We see promising transaction numbers every month. Of the 5.5 million transactions made via ONDC in December 2023, 3.4 million (63%) were in the mobility category while two million (37%) were in the retail category (Source link). But taken in comparison with the digital transactions India sees, it is nowhere close to scale. According to an Entrackr article, Ola did 1.5B rides in 2018 - 19. To put it in perspective, that's 125M rides a month. Flipkart (and this is back in 2021) reportedly did 2.5M orders a day, that's close to ~75M a month. That number will have only increased. In comparison to those numbers, ONDC powered applications still have a way to go.

How do ONDC powered applications scale, and who actually wins?

Trust + brand name is one solution: We use Amazon, and are willing to pay a premium because the amazon guarantee of delivery within the specified day is a very strong promise. But they’ve spent years building that up, and their entire business model is built around that guarantee. This isn’t something start-ups can immediately come in and start offering.

If ONDC got the Amazon & Flipkart base onboarded, then that would be a big win, because that's what would incentivize a lot of consumers to use ONDC powered apps. But that is probably not going to happen. Why would these e-commerce giants, having spent so much money, time and effort expose their seller / buyer base? What they will do, and reportedly are in the process of doing, is that they’ll look at this as a play for their software, and logistics departments, and enable some of the 3rd party offerings, like analytics and delivery. ONDC in its current form is more of an enabler for smaller apps and businesses who are either wanting to scale, or consumer facing apps, wanting to offer more VAS to their customers.

From my perspective? I’m still a bit bearish on the ONDC story scaling. I do think that it’s a great way to digitize SME’s in India. And I think there’s a bigger SaaS story here - opportunities to work with ONDC to enable its participants to do things like offer credit, and gift cards from a B2C perspective, as a few examples. There is a B2B angle here as well: opportunities to offer ONDC verified companies VAS products such as insurance, loans, payroll, accounting and other ERP solutions, enabling faster digitization. And maybe that’s the opportunity - working with ONDC to digitize and streamline processes of the SME base.

Right now, it’s the buyer side apps: such as Paytm, PhonePe, GooglePay that are the ones who will win. They have a captive consumer base, and this is yet another value add that they can offer to their customers.