The User Wars: Where is the next wave of growth coming from?

There’s an interesting story that emerges when you look at the Media Partners Asia’s entertainment report, the EY FICCI entertainment report FY 22, and the market share and revenue of the current OTT platforms.

What’s the problem?

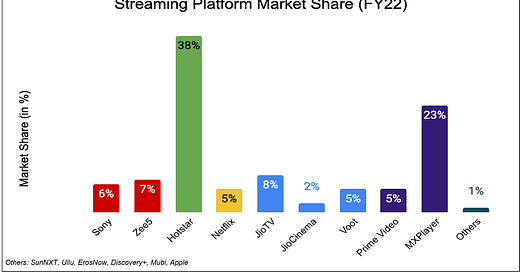

Basically: there’s some cause for concern if you look at the market share of leading platforms, and compare it to their profitability. It’s not a pretty picture. Hotstar operating at a gargantuan 38% market share last year, made a loss of 343 Cr. MXPlayer, operating at 23% market share, made a whopping 800 Cr loss in FY22. (This was probably why it was sold to Amazon for Rs. 400 crore.)

Why is this a problem? It’s because the data is saying that in the current state, even at a ~40% market share, a standalone streaming platform cannot operate in a profitable fashion.

At what percentage does a platform become self-sustaining? 50%? 60%? There is not enough space in the market for the current 10+ platforms to operate then, atleast, not in a profitable manner. In the current state it is in, the market could support maybe, 3 or max 4 players. (25-40% share x 4)

Companies need to become profitable by generating more revenue, not cutting expenses

The content game is pricey, and the cost of investing, creating and acquiring content is very high. Cutting these expenses to become profitable could result in a drop in users.

So to become profitable, these platforms need to start generating more revenue. Let’s put it this way: there are two types of revenue that a streaming platform earns. One from the premium or paid subscriber, which is subscription video on demand (SVOD), and the second is the free subscriber, where revenues are generated through ads i.e. advertising video on demand (AVOD), which generates money through ads. Why this is relevant, is because as mentioned before, all the streaming platforms in the market right now, are operating at significant losses.

Current revenue models that exist in the market

When it comes to revenue models, there’s a spectrum of OTT players, which starts at MX Player - almost completely AVOD based, and Netflix - which is totally SVOD based.

MX Player plays on the free content concept. ~95% of its revenues come from ad revenues. They made a loss of 800 Cr in FY22

Netflix, which till FY2021 catered only to the SVOD customer, and had no ad revenue. Made a loss of 77 crores in FY21 (they later shifted to an SVOD + AVOD, which reportedly increased their bottom line, and grew revenues by 25%).

Hotstar: The AVOD vs SVOD subscriber base split is 75-25, but the revenue split is 50-50. Basically: 25% of Hotstar’s user base generates 50% of its revenue. SVOD users are almost 2.5x more valuable than AVOD subscribers (ARPU = ~Rs100 vs ~Rs 250). Made a loss of 343 Cr in FY22.

The data is saying that the current model of ad based and premium subscriptions is not profitable for any platform. It’s not profitable when it’s totally free, ie, all of it is ad revenue (MX), and it’s not profitable when it’s all paid either (Netflix). It will have to be some combination of both. Logically, this means that you add more SVOD users ( a more valuable segment), generate more revenue from the existing SVOD user base, and add more AVOD users.

The AVOD Vs SVOD User in India

Since the SVOD user is so much more valuable, this would be the ideal consumer to go after. Except, the paid subscriber market is saturated. (~80% penetrated already) The top 50 - 60M people in India willing to pay for a subscription are already on 3-4 different subscription platforms, and you can’t expect them to pay more for existing content. (Hotstar for example already has 57M paid subscribers).

Generate more revenue from existing SVOD users. Except India is a price sensitive market, and you can’t get this user to pay more for the same content, when they are already on 3-4 other streaming platforms. One option could be to cross-sell other products which is where Netflix seems to be headed with its gaming vertical.

Get more AVOD users on board.

What is clear is that the battle for the AVOD user is just beginning.

Streaming platforms are adopting own strategies to increase market share

Netflix has announced that they are planning to build a strong presence in Tier II and Tier III cities to target the AVOD regional user, and subbing and dubbing of content is how they intend to do this.

Hotstar is attempting to attract this user by strengthening its Malayalam and Telugu slate.

But SonyLiv & PrimeVideo are doing something different. SonyLiv has decided to penetrate the Indian heartland, and increase its market share through merging with Zee5.

A bit about SonyLiv - it’s made a name for itself through its award winning, critically acclaimed SVOD content slate - from Scam 1992, to Rocket Boys, to Tabbar, which swept the critics choice awards last year. Zee5, on the other hand, has a formidable AVOD content slate, chock full with regional offerings. A pair up between the two is coming out to a significant ~27% of the market share (according to Ken). And this year, PrimeVideo acquired MX player. This is another SVOD - AVOD pairing. It’s not a coincidence, and it ties into what we called out earlier. The OTT market can only support 2 - 3 big players, hence the slew of acquisitions. And by itself, only SVOD, or only AVOD models don’t work.

What’s going to happen next?

The market is headed towards consolidation, with more possible M&As in the future, as platforms focus on sustainable growth and profitability

The battle for the AVOD regional user is beginning. Content created with a regional focus, dubbing to make content accessible to other segments of users are things that platforms will focus on, as each battles to become the preferred content hub for these users

The SVOD user conundrum: To get existing subscribers to shell out more, or get a free user to pay for content, you have to make it worth their while. Better content, innovative engagement strategies, and creating worlds within which users can engage with each other and the content better (gaming, metaverse, and AI comes to mind), are all possible ways to do this.

To tap into an entirely new user base, it’s possible that some platforms will set their sights outside India and focus on international expansion. This could be a big play for platforms who are focusing on building out original content. (SonyLIV comes to mind).

What’s certain is that this industry is set for upheaval. With Apple Originals rumored to throw their hat in the ring in the fight for India’s paid subscribers, in the near future, the focus will be even more on the AVOD user. It remains to be seen who will win the user wars.

Authors: Devki Pande and Ambika Pande

Sources: Inc42, Business Standard, EY FICCI Entertainment Report, MPA Indian Online Report, The Ken (Sony Zee Merger), Exchange4Media