[#50] UPI ecosystem developments in Dec '24: Whatsapp user cap removed, and PPI interoperability - too little too late?

Whatsapp has struggled to get to even half of the 100M user cap, and UPI killed PPI as a method, so does this actually help innovation, or is this lip service?

So in December 2024, some “exciting” new developments were announced in the UPI ecosystem. Three, to be concise:

1) The cap on Whatsapp being able to onboard upto 100M users only (from its 500M user based) on its UPI service was removed

2) PPI interoperability for full KYC wallets was announced. Currently, while UPI is interoperable (users can transact / send money despite being on different banks or apps), that wasn’t the case for PPI wallets. Here, both the sender and the receiver of the funds had to be using the same TPAP. Now that is not the case, because full KYC PPI wallets can be discovered on applications that have not issued the wallet. And subsequently, a user can transfer or receive funds through UPI in their PPI wallet using services from applications that have not issued the PPI, making it interoperable. And can be linked to UPI rails. So in an example: a PhonePe full KYC PPI wallet would be discoverable on a Paytm App. And because I’m linking my full KYC wallet on UPI rails, I can transfer money from my PhonePe Wallet to a Paytm Wallet. Or to a person’s bank account.

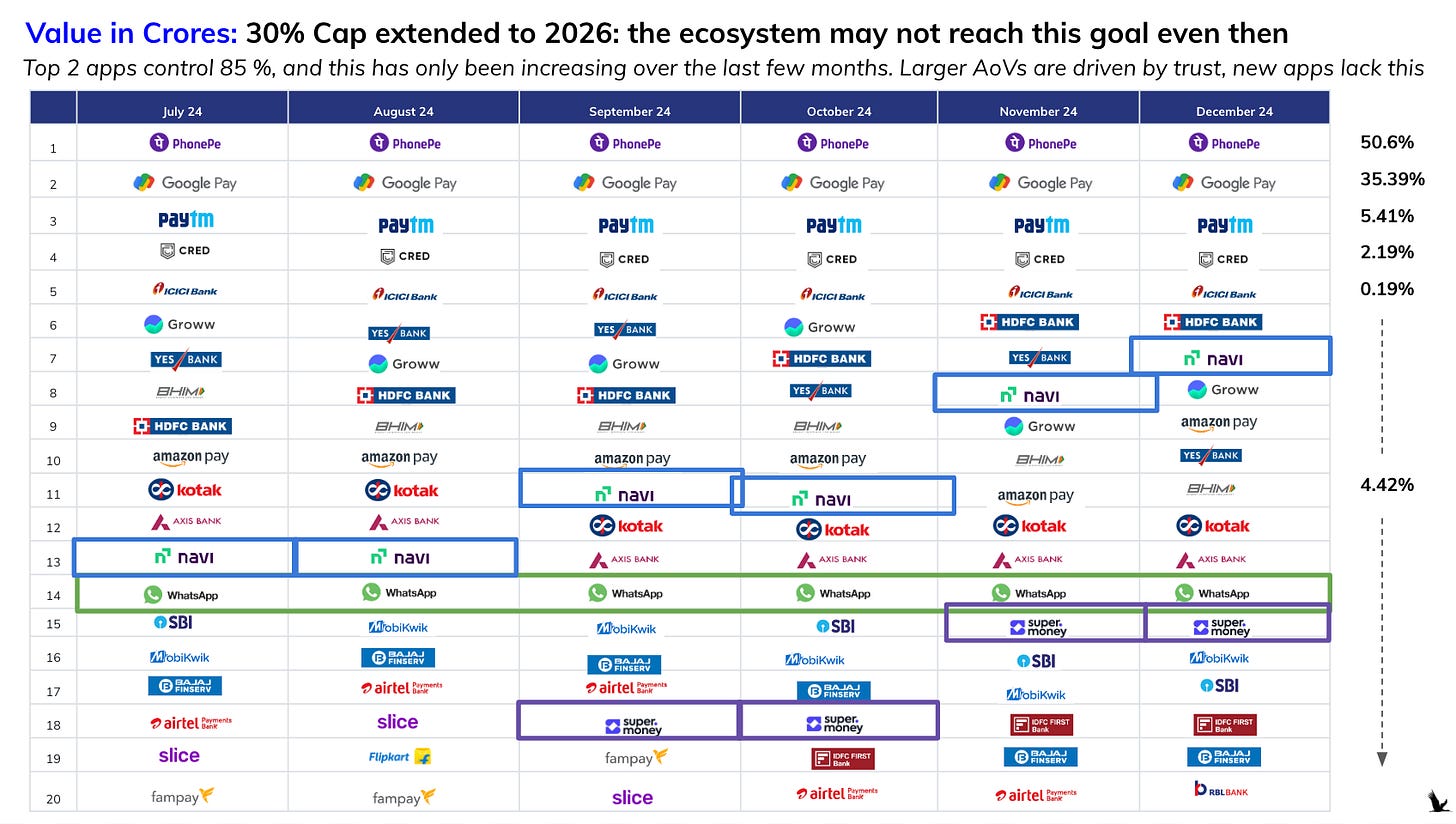

3) The cap on 30% market share per UPI App on UPI volumes, has been further pushed to December 2026. This was first introduced in 2020, and has subsequently been pushed out, due to the market share concentration predominantly lying with the top 3-4 apps, which control 95%+ market share in both value, and volumes.

Let’s unpack them one by one.

#1. The cap on Whatsapp being able to onboard only 100M UPI users has been removed

NPCI had capped Whatsapp to only allowing 100M users, of its base of 500M to be able to use its UPI services to keep an eye on “security & performance issues,” for the last couple of years. Now, in 2025, this cap has been removed, and Whatsapp can onboard all of its 500M users on its payment services. (and reportedly, this will go a way to help control the market share % of top players in the market). But its not that simple.

Whatsapp’s growth has been muted: it’s not even been able to reach the 100M user cap, and it’s been unable to leverage its P2P network to capture a majority of market share in that segment

Lets take a look at the data. While there has been steady increase in the volume of transactions, and the value processed, from 34M txns in April 2024, to 57.8M in December 2024, and valued processed of ~INR 2815 Cr in April 2024 to INR 4348 Cr in December 2024, considering the distribution Whatsapp already had, this is not that great. Compare it to challenger apps such as Navi, Groww, and even newer ones such as Super.Money.

Challenger apps such as Navi, Groww, and Super.Money, which have higher values processed than Whatsapp, are still able to grow at a bigger multiple, despite the bigger base, and fewer users.

Navi: # of txns grew by 13.4x, and values processed grew by 28x from April - Dec 2024

Groww: # txns grew 1.7x, and values processed also by 1.7x from April - Dec 2024

Super.money: # txns grew 10x, and values processed grew by 10x from April - Dec 24

And this is while having fewer users: Super.Money had 7M users as of December 2024 (reportedly they are targeting 30M), and Groww had 13.6M users. I’m not sure how many Navi has, but they’re definitely less than Whatsapp’s 500M user base, or even the 100M cap. And hence my doubts about the 100M cap being removed having any exponential growth affect. There are clearly other factors at bay: related to growth, strategy and product, and customer behaviour that have prevented user growth.

My own sense is, assuming that on an average, a user does 5 transactions per month on Whatsapp (PhonePe hass ~18 txns / month / user, which is derived from the 500M user base, and 7.9B total txns). Which would bring the total number of users of Whatsapp UPI to be ~10M, which is 1/10th of the 100M cap.

Assuming that Whatsapp’s market is primarily P2P transactions, even within that segment it only has ~1.3% market share in December 2024.

So lets say that Whatsapp has its real TG in the P2P segment, because of its messenger service. P2M may be tougher because of the UPI intent flow in the online P2M transactions, which Whatsapp doesn’t seem to have figured out yet, and in offline, the scan and pay, which lends itself better to standalone UPI Apps, which has also evolved through customer behaviour. The P2P market, while in terms of txns is ~38% of the total market, clocking in ~6.3B txns in December 2024, in terms of values processed is ~73% of the market, processing ~INR 16.9L Cr in December 2024. So there is a significant market for Whatsapp to play in, even if it just focuses on P2P.

There could be some scope for P2M as well → if they’re able to figure out intent payments on the online side. In offline, this becomes tougher. We’re all used to a seamless experience of opening the UPI App, scanning & paying. With Whatsapp, because it is first and foremost a UPI App, this becomes challenging, since the UI/UX is focused towards being a messenger chat, not scan & pay. On the intent flow, something could still be figured out. On scan & pay, this could be tougher, but if we remove the scanning step, and use some sort of NFC enabled payment flow to automatically open the Whatsapp App to make a payment, that still has potential.

But its been unable to capitalize on the P2P market opportunity as well. P2P AoV is higher than P2M AoV: Assuming things like rent payment is what skews it, but the P2P AoV is INR 2.5k+ while the P2M AoV is closer to INR 600.

Whatsapp AoV is over the last 9-12 months has been trending between INR 600 - 800. And while some of this may be low value P2M transactions that happen through smaller brands using whatsapp QR codes to pay, its probably a safer assumption to say that these are the low value P2P transactions. So Whatsapp has not been able to tap into the high value P2P transactions: which could probably be an issue around customer perception of trust, security, and convenience.

From a personal experience, I find that Whatsapp takes a few seconds longer to make a payment, and I’ve encountered enough failure rates to prefer a Paytm / Googlepay as my first choice of UPI payment. There was one feature that Whatsapp has removed, that I really liked: the visibility of the amount paid within the chat itself, which made it easier to track payments made through Whatsapp.

But Whatsapp has been unable to capture a significant share of the P2P low transaction market as well.

The number of P2P transactions within the INR 0-500 segment in August 2024 were ~56.8% of the total. And within the INR 501 - 2k segment were 21.7%. ~(I don’t have the December 2024 numbers, but August 2024 should serve as a fair approximation). So combined, in terms of the market size for # of txns, this is ~78% of 5.7B, which is ~4.4B

And while Whatsapp AoV was INR 750, I expect this to be skewed more towards the 0 - 500 segment, hence I’ve used 56% as a proxy.

Whatsapp, in August 2024, had 45M transactions. Even if we assume all of these were P2P low value transactions, this is ~1% market share of the P2P INR 0-2k segment. In a segment that Whatsapp should ideally be winning. And now of course, with customer behaviour, & customer preferences having evolved, it may be that Whatsapp is too late to the game, and even the relaxing of all of these caps may not be enough to turbo-charge its UPI story as NPCI hopes.

#2. The second major update is PPI interoperability.

To summarize again:

Currently, while UPI is interoperable (users can transact / send money despite being on different banks or apps), that wasn’t the case for PPI wallets. Here, both the sender and the receiver of the funds had to be using the same TPAP. Now thats not the case, because full KYC PPI wallets can be discovered on applications that have not issued the wallet. And subsequently, a user can transfer or receive funds through UPI in their PPI wallet using services from applications that have not issued the PPI, making it interoperable. And can be linked to UPI rails. So in an example: a PhonePe full KYC PPI wallet would be discoverable on a Paytm App. And because I’m linking my full KYC wallet on UPI rails, I can transfer money from my PhonePe Wallet to a Paytm Wallet. Or to a persons bank account.

But here are my misgivings. PPI wallets originally worked because they were a substitute to cash. When UPI, and other A2A payment methods came in, they essentially killed the major use case of PPI. Maybe some use-cases still exist: a wallet for recharges, for those folks who aren’t comfortable linking their bank account directly. Other use cases such as Fasttag etc. But overall, in my opinion, this is not a method that is very relevant, and hence I don’t expect this circular to change too many things in the UPI ecosystem.

The second point here is that: why would a UPI App, offer a competing app real estate on its payment pages? If a customer has opened lets say their PhonePe app, and decided to make a payment, then there is very strong intent to pay. Why would the app want to give real estate to a competing app, and take away some of that volume from its own method?

Not allowed currently, but in the future, if closed loop wallets can be linked to UPI rails, it has the potential to change the rewards & retention game for merchants

Where I DO think there is an opportunity is if there is a way to link closed loop wallets to UPI rails, and by definition, alternate currencies (such as Merchant X coins) on UPI rails. Right now thats not possible: the circular very clearly mentions that this interoperability only extends to full KYC PPIs.

Take a look at the second screen in the slide below: What if, when I scanned a QR, or was in the process of making a payment (after being redirected from the merchant website through an intent link), I had the option to pay via UPI, but using that merchant specific wallet, and rewards points / coins within that wallet?

For example: even though merchants have their closed loop wallets right now, its not the most seamless payment process possible. And also, its broken: it’s essentially two separate methods, where first, I use my merchant specific wallet, and then I trigger payment by another method, and in the case of UPI, a new app. Now suddenly, if I can access my closed loop wallet within my UPI App, it makes the payment a lot more seamless.

Of course, its not that easy. Other things will still have to be figured out, such as: can we use two separate accounts / methods to do one payment? Or alternatively, while paying through a UPI App, can I link my closed loop merchant wallet, and automatically apply the fund / coins contained in it as a discount, to avoid the hassle of using 2 separate methods?

#3. The third: the 30% market share cap being pushed by 2 more years to December 2026.

This was first introduced in 2020, and has subsequently been pushed out, due to the market share concentration predominantly lying with the top 3-4 apps, which control 95%+ market share in both value, and volumes.

Getting the market cap of all players capped at 30% still may be possible in terms of # of txns, but the real challenge is the #3 spot. Paytm at #3 has ~5x more txns as compared to the #4 spot. And Gpay at #2 has 6x more than Paytm.

Seeing how Navi has displaced CRED for 4th place, and Super.Money has risen from #18 in August, to #7 in December 2024, makes me think that from a # of txns perspective, this may be possible. But its not going to be easy. CRED at #4 was the low hanging fruit: ~140M - 150M transactions per month. Navi was able to outstrip CRED with ~201M txns in December 2024. But the real challenge is now: Paytm at #3 was at 1.1B txns in December 2024. Gpay at #2 was at 6B. And PhonePe at #1 was at 8B. #3 & #4 right now are at ~6.88% and 1.21% market share respectively. ~83% of transaction volumes is controlled by the top 2 apps.

Navi has to grow by 5x more, from a base of 200M to beat out Paytm. And from a 30% market share perspective: UPI saw 16B transactions in Dec’24. 30% of this is ~5.3B.

3B worth of txns need to be won from PhonePe to bring it to the 30% cap.

In terms of values, it becomes a bit harder.

This is because # txns is an input here. So while getting your txn numbers up may anyway be tough, there is another input here, that of AoV. Which seems to tie into trust. The concentration here is similar: 85% of values processed lies with PhonePe & Gpay. In December 2024 for example:

#1) PhonePe processed 11.7 Lac Cr of volumes.

#2) Gpay processed 8.2 Lac Cr of volumes (70% of PhonePe)

#3) Paytm was at 1.25 Lac Cr (15% of Gpay)

#4) Cred was at 50k Cr (40% of Paytm)

The next challenger App in line: Navi, is at #7, with 11k Cr processed. So its an uphill battle.

And if you break down value into # of txns x AoV per transaction, the market cap of 30% on values becomes more of an uphill task. And thats because for a lot of the challenger apps (with the exception of Groww, which seems to be more focused on UPI transactions for SIPs, which anyway have an AoV of 5k, which is similar to Groww’s AoV), the AoV is significantly lower. Navi: INR 558, Whatsapp: INR 751, and Super.Money: INR 379.

Informative as always! just a question: UPI Lite is similar to PPI wallets, and is already interoperable. I can use my UPI Lite balance on any QR anywhere. As a consumer, why would I just not use UPI Lite? How do you see this?

1. The transaction limit on WhatsApp is 2k per transaction - therefore no high value P2P. Same limit for QR code photos - this is for all UPI Apps.

2. I’ve used WhatsApp Pay a few times, mostly for amounts under ₹2k, like when scanning QR codes or sending money to some vendor I’m already chatting with. But I always end up looking for a way to check the transaction history or for the payment confirmation to show up directly in the chat, so I don’t have to send a screenshot. I didn’t even know they had this feature before—it’s hard to understand why they’d remove it.