[#38] Is the battle for the ubiquitous UPI app over? : What do the next few years look like for UPI Apps?

What do the trends in Sep'24 look like, and how will this space evolve?

A lot of the pieces I’ve done have been payment aggregator backwards: where I’ve focused on the key PA’s and worked backwards from there. This time I’ve tried to look at this UPI App backwards.

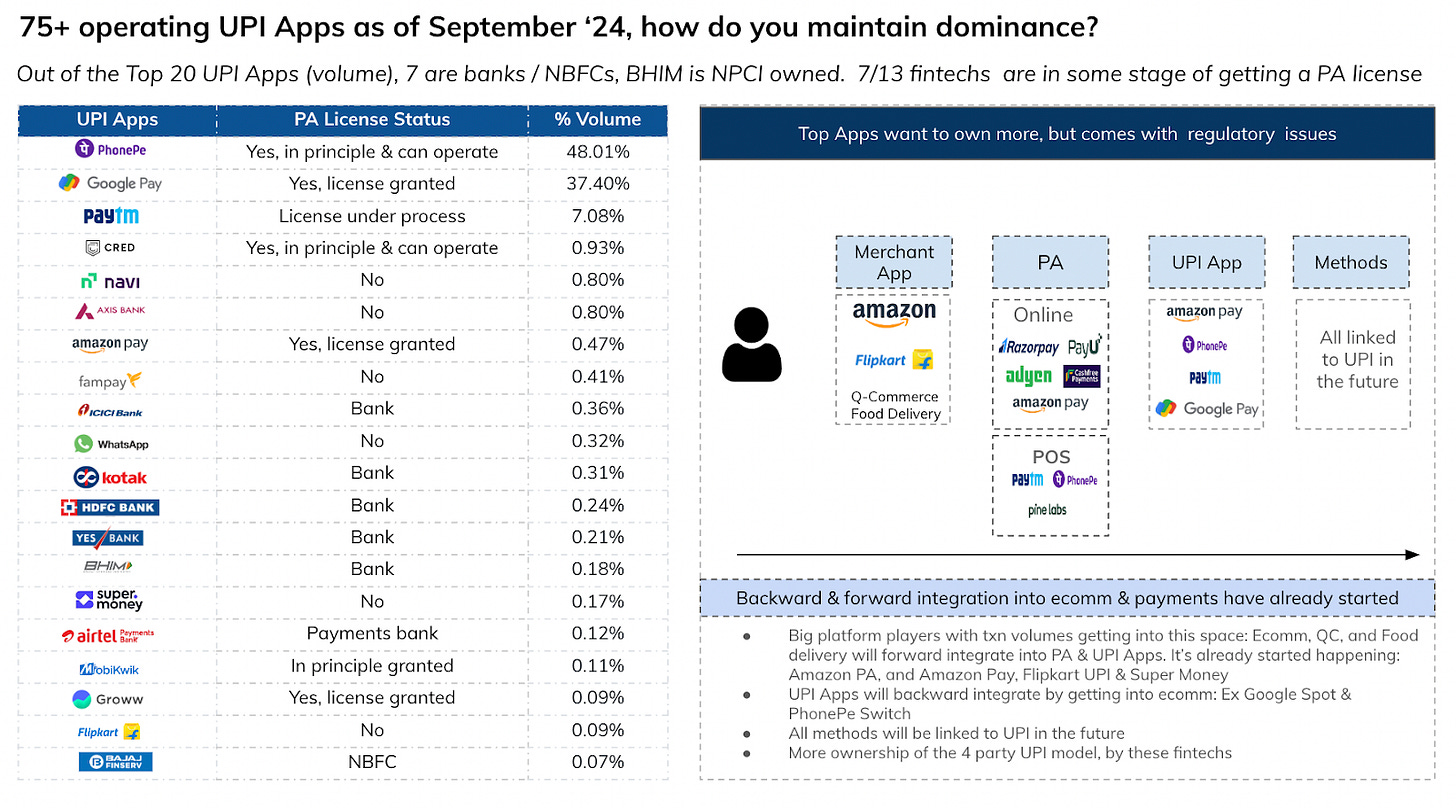

Some stats: UPI processed ~20 Lac Crore of volumes in Sep ‘24, and ~15 Bn worth of transactions. ~94% of these came from PhonePe, GooglePay, Paytm, and Cred, and very heavily skewed towards the top two, which are responsible for ~86% of value and volumes. I’ve looked at the data and tried to see if there are any insights. There were ~75+ UPI Apps operating as of Sep ‘24.

Top insights from the data: below the Top 4 apps, the rankings based on value, volumes & AoV differ quite significantly

1. In terms of volumes processed, you’ve got all your fintechs vying for top spots, with only 2 banks in the top 10, for September ‘24. Axis Bank coming it at #6 with 120 Mn transactions processed, and ICICI at #9 with 54 Mn transactions processed

2. In terms of value, the story becomes a bit different. Suddenly you have 3 banks in the top 10: ICICI at #5 with ~20k Cr, Yes Bank at #6 with ~10k Cr, and HDFC at #8 with 9k Cr.

3. In terms of AoV per transaction, this again is flipped on its head. Here you have 4 banks in the top 10, 5 if you count Bajaj Finserv, which is an NBFC! The average AoV per transaction for UPI (P2M transactions) is ~Rs 1500. Groww tops this list, with an AoV of ~7.1K, but this makes sense. Groww is primarily an investments app, and the average value of a SIP on groww is upwards of ~6k, so this seems to be in line. ICICI AoV on UPI is at ~4k, Yes Bank is at ~3.1k.

What’s also interesting is that just because the app is processing the highest volume of transactions, doesn't mean it’s processing the highest value.

4 apps remain the same: Phonepe, Gpay, Paytm & Cred, all process the highest value and volumes. But If I look at the rest in volumes in terms of # txns, versus value, there is a difference.

Some data:

Navi: #5 in terms of volumes, and #11 in terms of value

Fampay: #8 in terms of volumes, #19 in terms of value.

Grow is the opposite: #7 in terms of value, #18 in terms of volume.

The Groww point especially to me is super interesting, because Groww is a fairly new UPI App. It’s safe to assume that there were users of UPI Apps, probably on PhonePe, and Gpay before Groww came into the picture. These users probably still use PhonePe & Gpay, considering that ~95% of volumes flow through these apps. But Groww’s high AoV suggests that there is a very specific use-case that customers are using Groww for, and it introduces an interesting dynamic: positioning itself as a UPI App for specific categories in the customers mind.

From the challenger UPI Apps (excluding Bank Apps), Groww, Navi, and Super.Money stand out

Navi, from #12 in terms of volumes processed in May ‘24, has climbed back up steadily to #5 position in Sep ‘24, processing ~120 Mn transactions. It’s also made significant strides in its volumes: from #20 in April ‘24, it’s now at #11 position in terms of volumes processed, climbing from 1k cr in April ‘24 to ~7k Cr in Sep ‘24. I also expect them to double down, and perhaps even compete with Cred for the 4th position for volumes in the coming months, since the RBI circular came out this week asking Navi to cease and desist disbursal of all loans until further notice! Just for comparison: Navi processed 0.8% of volumes in Sep ‘24, and Cred processed 0.93%. However in terms of value Cred is still far ahead: at 2.32% of total UPI volumes compared to Navi’s 0.32%.

Super.Money is another: backed by the flipkart group, which has an estimated GMV of ~$29B per year, this app has a lot of potential to process a lot of the volumes coming from Flipkart - even if it is a fraction, it is still significant. It launched its Beta App in June ‘24, and officially launched in August ‘24. In a month, it was already in the top 20 UPI Apps; #15 in terms of volume of transactions processed: 25 Mn txns in Sep’24, and #18 in terms of value processed: INR 1131 Cr

But even though these Apps are coming up, the question still remains, what are they competing for?

Majority share is held by the Top 2 Apps, PhonePe & Gpay, which control ~86% of value and volumes.

Lets say a Super.Money wants to actually compete here, and by that i mean, get into the Top 5-8 apps used, since competing with the Top 4 right now may be out of reach.

Current Super.Money:

25 Mn transactions

1000 Cr per month

Value targets:

Current 5th App in terms of value: ICICI, doing 21,000 Cr per month

Current 8th App in terms of value: HDFC, doing ~8990 Cr per month

Volume Targets:

5th App in terms of volumes: Navi @ 120 Mn transactions per month

8th App in terms of volumes: FamPay @ 61 Mn transactions per month

It’s possible that Super.Money is able to step up, and maybe get into contention for the number of transactions processed. But a 20x increase in terms of volumes processed seems to be a little far right now.

It’s possible that the battle to be the “UPI App for everything” has been lost, when you look at the significant volumes that PhonePe and Gpay are processing ~86% of total! Maybe the opportunity now is to have UPI Apps for specific categories, which is where the Groww thesis seems to take shape, where majority of the volumes Groww is processing is through its SIP transactions.

So then UPI App for everything has been won, and newer UPI Apps are positioning as either category specific, or to drive volumes for specific ecomm / high volume apps & merchants.

And the remaining smaller apps / merchants who want ownership of the UPI journey - UPI plug-in seems to be a possibility

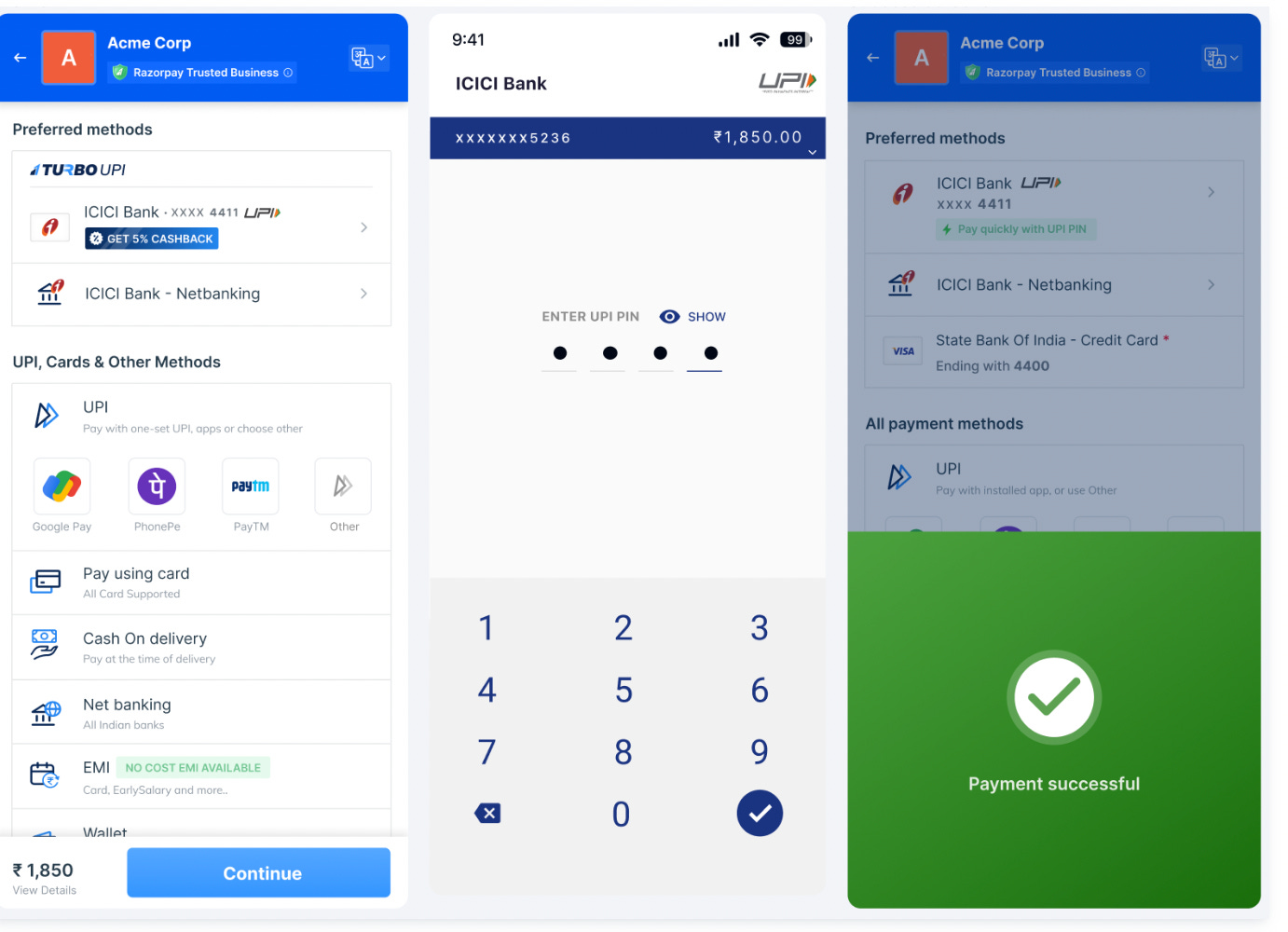

And for non ecomm / quick commerce merchants & apps who want more ownership in the payment journey is where the UPI plug-in concept comes into play. In this case, the ownership is more, and the journey is more seamless because through the plug-in, the customer, instead of being redirected to the 3rd party UPI App, can complete the UPI App natively through the merchant app. And maybe thats where this is going: For ecomm & platform merchants who process large amounts of GMV through their platform, having a UPI App may still make sense. But for smaller merchants, who just want more ownership, and a seamless transaction experience will go in through the plug-in route.

You can check out the Razorpay Turbo UPI product here.

Analysis of UPI Apps over the last 6 months (in order of highest volumes processed)

Analysis of Apps over the last 6 months (in order of most number of transactions processed):

So if there’s all this concentration, and there are challenger UPI Apps surging, how do UPI Apps maintain their stronghold?

Well, firstly, let’s look at the entire consumer payments journey.

1) The customer comes in through their shopping / ecomm app. After selecting their items, they come to the checkout, which is controlled by the PA, which has aggregated the different PGs for different methods.

2) The customer selects the method, and goes through the necessary authentication steps.

a. Example: If its cards, then there is an OTP & CVV flow if the card is not tokenized, and if the card is tokenized, then just OTP. The authentication steps are taken care of by components such as MPI (merchant plug-ins) which connect with the ACS for card authentication.

3) After the authentication is done, the acquiring bank requests the funds from the issuing bank, where it is stored in a pool account, and then transferred to the PA escrow account, after which it is finally settled to the merchant.

Adyen & Stripe are owning as much as they can, in the infra play.

Players like Adyen & Stripe have their direct integration with card networks, their own ACS, MPI providers. Outside of India, in Europe & US, cards are still the primary way to pay, Real time account to account payments has not really taken off. And hence the investment in cards infrastructure. What they haven’t done is gone into consumer app payments.

In India, UPI is dominant. So we can probably expect more investment in this infra, similar to what Adyen and Stripe have done.

In India, apart from potential investment in the UPI Infra side of things, UPI Apps are also trying to own the checkout, for an additional layer of control.

Out of the top 20 UPI Apps, out of the 13 that are fintechs, 7 have applied, or have got a PA license. And if I look at it backwards: The top PA’s in India, which are Razorpay, PayU, Paytm, Cashfee, PineLabs, and PhonePe, 3/6 of these have their consumer app play. PhonePe, and Paytm obviously, and PineLabs with its FaveApp acquisition. So somewhere, contrary to the West, in India, these two offerings seem to be converging, to be able to own as much of the payment journey as possible.

You can check out my article on license aggregation here, where I’ve tried to do an in-depth analysis on which licenses different fintechs have.

Below is a list of UPI Apps, and the different status of their PA licenses.

Out of the 13 fintechs in the Top 20 list, 7 are in some stage of PA license approval.

My predictions for how this space will evolve are as follows:

Big platform players with a high number of transactions and volumes will forward integrate into this space. We’ve already seen this happen with Amazon & Amazon Pay, and Flipkart, Flipkart UPI, and Super Money. The next big category I see getting here are the Quick Commerce Apps: Zepto, Blinkit, & Swiggy. The only issue here could be the regulatory side of things, which is why Zomato returned its UPI App license.

UPI Apps will backward integrate by getting into Ecomm or Quick Commerce: Example are: Google Spot & PhonePe Switch, which are like marketplaces within the PhonePe App, which integrate with Swiggy, Zomato, and other apps. The thought here being that if a customer wants to order food, they will go to PhonePe, instead of Swiggy, and access the Swiggy app within PhonePe. This has not scaled as they had hoped, but I expect this to continue being an area of experimentation. I also expect PA’s, and UPI Apps to look at logistics at some point. While initially if these players backward integrate into ecomm / quick commerce, they will have to do this through partnerships, at some point, they will have to invest in their own delivery & logistics fleet, which is a separate business altogether.

PA’s will have to figure out their play in the consumer payments space. Till now, mostly only UPI Apps have gone and got a PA license. The reverse (apart from PineLabs has not happened yet). PineLabs which was a PA-P (Payment aggregator - offline) first, and then went to online PA, and then acquired the Fave App. Other core PA’s, such as Razorpay, PayU, Cashfree, have not done this. Not sure how this will play out, but its possible that this is something we see going forward as well.

All methods will be linked to UPI in the future, and thus the rush of all apps to get into UPI. Mastercard, VISA, Diners, Amex as card networks, and BNPL players, where the customers are given an account funded by some sort of credit. PPI on UPI could make a comeback here as a “faux credit account” of sorts. This has already happened in the case of Klarna, where Klarna customers can link their Klarna accounts on Apple Pay, or GooglePay, and use that as a way to pay at checkout.

![[#37] Do all roads in fintech lead to license aggregation: Part 2](https://substackcdn.com/image/fetch/$s_!0EZL!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F2cc9aa1e-f79a-469c-9887-52c189f6637f_1634x918.png)

this is great read.

Surprising for me was fampay. CRED is understandable given their specific target audience. each fintech wants to build their ecosystem of sorts. also, superapp kind of thing does not really work in india as in china, so phonepe or anyone trying to integrate as many services onto their platfrom, perhaps, won't see much result.

my hypothesis is banks are yet to come with full force in the scene, and when they do, we will see lot more integrations or focussed services. what we saw in telecom perhaps may be seen here too in future.

utilities(gas, electricity)are yet to think through ownership angle here, their reliance on third party will be for some time given the nature of their ownership(govt. owned).