[#37] Do all roads in fintech lead to license aggregation: Part 2

So, in May ‘24 I had written a piece on if all the roads in fintech lead to license aggregation, you can check it out below:

6 months later, I figured, hey, lets deep dive some more here. Whats happening, are there any major updates or trends that are emerging? And it appears that there are:

Firstly: Having multiple licenses seems to be key for fintechs, or atleast, that seems to be the perception.

I’ve taken a look the fintechs operating across PAs, neobanks, cross-border fintech players, and others, and tried to understand what’s happening, and tracked this across 6 licenses, that seem to be the most important in the fintech world. These licenses are:

PA (payment aggregator license)

PA-CB (like PA, but for cross border flows)

PPI (prepaid instruments, such as wallets)

AA (account aggregator)

NBFC

UPI App.

So, to numbers then. I took a look at a sample of 55 fintechs in India. Out of the sample of 55, these are the stats.

Distribution of fintechs across # of licenses: The distribution across 1 license and > 1 licenses is fairly even: 55-45 % split.

0 Licenses: 0/55, this section is included only because of ZomatoI’ve included this section here, since in the time I wrote the last piece, and this, Zomato seems to have given up all its fintech ambitions to focus on eating & entertainment. In 2024, it voluntarily returned its PA, PPI, and NBFC license. I’d written an article about their ambitions, and their Q1 FY25 results, that you can check out here:

1 License: (30 out of 55, or 54.44% of the total sample have 1 License)The smaller PA players are sitting here

Smaller PA players: These mostly consist of your smaller PA players, who have applied for a PA license such as CCAvenue, Eazebuzz, Paymentz.

International PAs: This category also has a smattering of international PAs, such as Unlimit & Boku who have gotten PA approval from RBI. In the future, I expect these players to move into the “2 license” category, by getting the PA-CB also.

Xborder players: Smaller players such as Skydo, Briskpe, and Xflow who play in the cross-border money movement space, and who are in line to get a PA-CB license. These players aren’t really building for domestic flows, and the single license they have applied for is the PA-CB.

Other fintechs: Other players who seem to be throwing their hat in the ring, such as R360, Juspay, Open and Mswipe, who operate in the fintech or payment space, but not necessarily as a PA, although they have acquired a PA license.

2 Licenses (12/55): 21.82% of the total sample have 2 licensesPA & PA-CB combo (5/12): The PA & the PA-CB combo seems to be the most popular (which makes sense, since if you’re a PA, might as well enable at cross border flows also). This accounts for 5 out of the total 12 entities who have 2 Licenses. These are Adyen, Billdesk, Cashfree, Payglocal, and Stripe

PA & AA: 2 have a PA & an AA combo: CAMS & Digio

PA & PPI combo: 2 sit here. Sodexo, which is a established player in the PPI market (you’ve probably used a Sodexo meal card at some point), and Nium, which while has received an in-principle approval for a PA, cannot operate just yet. Nium is a crossborder player, so this is another entity I expect to apply, if they haven’t already for a PA-CB license in India.

PA & a UPI App combo: Just 1 sits here, GooglePay. The other UPI Apps, such as PhonePe, CRED & even Navi have atleast 3 if not 4 licenses, but we’ll get into that as the article goes on

PPI & NBFC Combo: Ola sits here. While technically not a fintech, it in the past seems to have harboured fintech ambitions. Ola also had applied for a PA license, which was returned by RBI

UPI App, & NBFC: Navi, which started out as an app that gave out personal loans, and somewhere along the way jumped on the UPI bandwagon, and is growing aggressively after UPI and Credit on UPI.

3 Licenses (9/55), or 16.36% of the total sample have 3 licensesPA, PA-CB, PPI: Amazonpay & Razorpay

PA, NBFC, PPI: PayU, Tata Payments

PA, UPI App, PPI: Mobikwik

PA, NBFC, UPI App: Groww

NBFC, UPI App, PPI: Bajaj, Jupiter, Slice

So the UPI App, PPI, and NBFC piece seems to be the most popular combination here. Which seems to make sense if you look at it from an end customer perspective. Since monetization is a problem for UPI, your B2C apps such as Jupiter & Slice would want to invest in areas from which they can actually monetize the end customer, which are NBFCs, so that they can give loans on their own books, and PPIs, which are instruments that they can fund through their PPIs, as a medium of payment.

4 Licenses: Only 2 out of the sample of 55 have 4 licenses. PhonePe and Cred have 4 licenses each. This seems to be superapp territory.

PhonePe: Started out as a UPI App, and now operates as a PA and a PPI also. They also have an AA license. They were going after the NBFC license, but it was returned by RBI, probably because they were incorporated in Singapore. They’ve completed the reverse flip, and moved company incorporation to India in October 2022, so I assume they’ll plan to apply for the NBFC license again.

Cred: Started out as a Consumer App for Credit Card payments, and since then have expanded into a UPI App. They hold the PA, PPI, NBFC, and UPI App License / Certifications

5 Licenses (1/55): PineLabs holds 4, and is in-line to get PA-CB. Pinelabs is actually holding 5, (including the news that it’s in-line to get a PA-CB license). It doesn’t have an NBFC License.

So. License aggregation seems to be very important, especially since RBI is stepping in and putting regulations around all these activities. And to be able to operate, or atleast have the option to operate, players need to get licensed, or start the process as soon as possible, since this can take months.

But now let’s look at it in reverse. For the main businesses, a UPI App, an NBFC, and a PA, what seems to be the license that is being picked up the most?

The fintechs who are operating as UPI Apps also, are the following:

Cred

GooglePay

PhonePe

Navi

Groww

Jupiter

Slice

PineLabs (through the Fave app, which is actually a Malaysia based consumer tech platform, bought by PineLabs in 2021 for $45M)

Bajaj Finance: Started out as an NBFC

Mobikwik

Out of these 10, 9 of them are B2C players, (with the exception of Pinelabs) which is known for its offline POS machines. 7 have PPI licenses, and 6 have NBFC licenses. 6 also have a PA license.

PPI License: So for B2C consumer apps, a PPI license is a must (which makes sense I suppose, when you think about it, wallets & GCs are primarily a B2C use-case (although some B2B or B2B2C type use-cases may exist, for vendor payments, or gig worker payments and withdrawal). This license allows these players to issue open loop or semi-loop wallets which is a big use-case for the end customer. (Ex: a Paytm wallet can be loaded with money, and be used at approved merchants, almost like cash).

Monetization is a question since UPI is at 0 pricing: As a UPI App, the opportunity to make money through UPI is low, since UPI is not priced (although with credit cards and credit lines on UPI, MDR will be charged, which signals an opportunity).

And that’s probably why these players are creating this “nexus” of sorts with the UPI App, PPI and NBFC license. For NBFCs, the UPI App, and the PPI license provides an easier way for distribution of their loan products, and for UPI Apps, the NBFC license enables them to actually give loans on their own books, increase revenue opportunity size.

Why a PA license for a UPI App? Well, as a B2C App, you need to solve for 2 things:

Monetization, which is tough from a consumer standpoint, so if you extend a bit to the smaller B2B market: companies such as your freelancers, or your start-ups, there is an opportunity to make money through MDR, processing fees, if you go through the PA route.

As a B2C App, the goal is to eventually become a super app of sorts, where since you own the customer, you want your app to distribute products to the customer, like a marketplace. While this hasn’t been done successfully as yet: PhonePe has tried to launch what it calls the “PhonePe switch” where within the PhonePe app, Phonepe users can access their favourite app within the PhonePe app, instead of having to go to a separate app. Googlepay also tried to do this with Google Spot. While this is still to see success, the thought here seems to be, if you’re a superapp, and the long term goal is to process sales, investments, loans and anything else through your app, then it makes sense to own the payment aggregator layer also. And thats the logic that clearly Amazon was using, and Zomato had, before it pivoted and doubled down on the entertainment sector.

For bigger UPI Apps, being a PA provides more control over the experience. Let’s look at it this way: Majority payments in the future will happen through UPI (the estimate is 90% of digital payments happening through UPI by 2027) and UPI usually means through UPI Apps. 2 things will happen in the future.

Where you can save your card on your payments app (In India this is synonymous with UPI Apps), and then pay using your mobile, instead of your card. And because your cards are tokenized on the UPI App, this adds an extra layer of security. ApplePay, GoogleWallet, VippsPay (in Europe) already provide this functionality

All methods in the future, including VISA, Mastercard, Diners, and other networks will be linked to UPI. Just as Rupay cards can be linked to UPI.

For P2M payments, the payment originates at the merchant checkout page, which is controlled by the PA. The payment methods are shown at checkout, which is the PA layer, and then in the case of UPI payments, this is handed over the the customers UPI App. Owning both layers provides an extra layer of control, and a way to streamline the experience. An example is PhonePe Bolt, which allows PhonePe PA merchants to provide an in-app UPI payment experience to those customers who also use PhonePe’s UPI App (which is greater than 50% of the market). They’re able to do seamlessly because of ownership of both layers of payment here.

What about PAs? What sort of licenses are they going after?

Well, with PAs, the majority of the players seem to be operating on just 1 license. But as observed before, these are either smaller players, previously operating as PAs, such as CCAvenue, & Easebuzz, or other fintech players who have thrown their hat into the ring with the strategy of “lets get it first and then see what happens.”

The bigger PAs, who dominate the market, such as Razorpay, PhonePe, PineLabs, PayU, and Cashfree, are the ones who have multiple licenses. Out of those PA’s which have more than 1 license, which are 19 out of the total 45 PA’s in this list

10 also have a PPI license

8 have a PA-CB, or are in line to get a PA-CB license

6 are UPI Apps.

PA-CB is a no-brainer. Cross border has approximately 3x greater margins than domestic transactions, and every PA-CB at some point will want to own a piece of the bigger Xborder market ,and corridors to the UK, USA, and Middle East. . I see the next phase of this expanding, where the bigger PAs in India such as Razorpay, PayU, Cashfree, PineLabs eventually start going and acquiring domestic and cross border payment licenses in other countries. This has probably already started happening.

PPI License, because it allows for issuance of giftcard / prepaid cards for the end customer. It’s one more service you can provide to the merchant, and since PA’s already have merchants onboarded for their core offering, distribution, in part has been taken care of. (for ex: if a customer wants a giftcard, then a PPI account (which is a wallet or a card) has to be created for the customer, all credits, debits, balance management, and refunds need to be handled) And then, if the customer pays through this PPI on a PA which the same entity owns, there is a greater ownership of the flow, and more seamless integration.

Licenses are key for driving monetization and compliance, but there is a cost of compliance

The focus will always be monetization and improving customer experience. And aggregating these licenses are a means to that end. So it makes sense that the bigger & more mature players, will constantly look to do whatever it takes to give themselves an edge in the market. And as the smaller players mature, they’ll go after these same licenses as well.

But the challenge here will not just be getting approval for these licenses, which is a hard enough task. It will be to decide which license to pick up. There is a cost of application, maintenance, and compliance. And thats probably why Zomato gave its PA, and PPI license up. Somewhere they decided it didn’t make sense for them

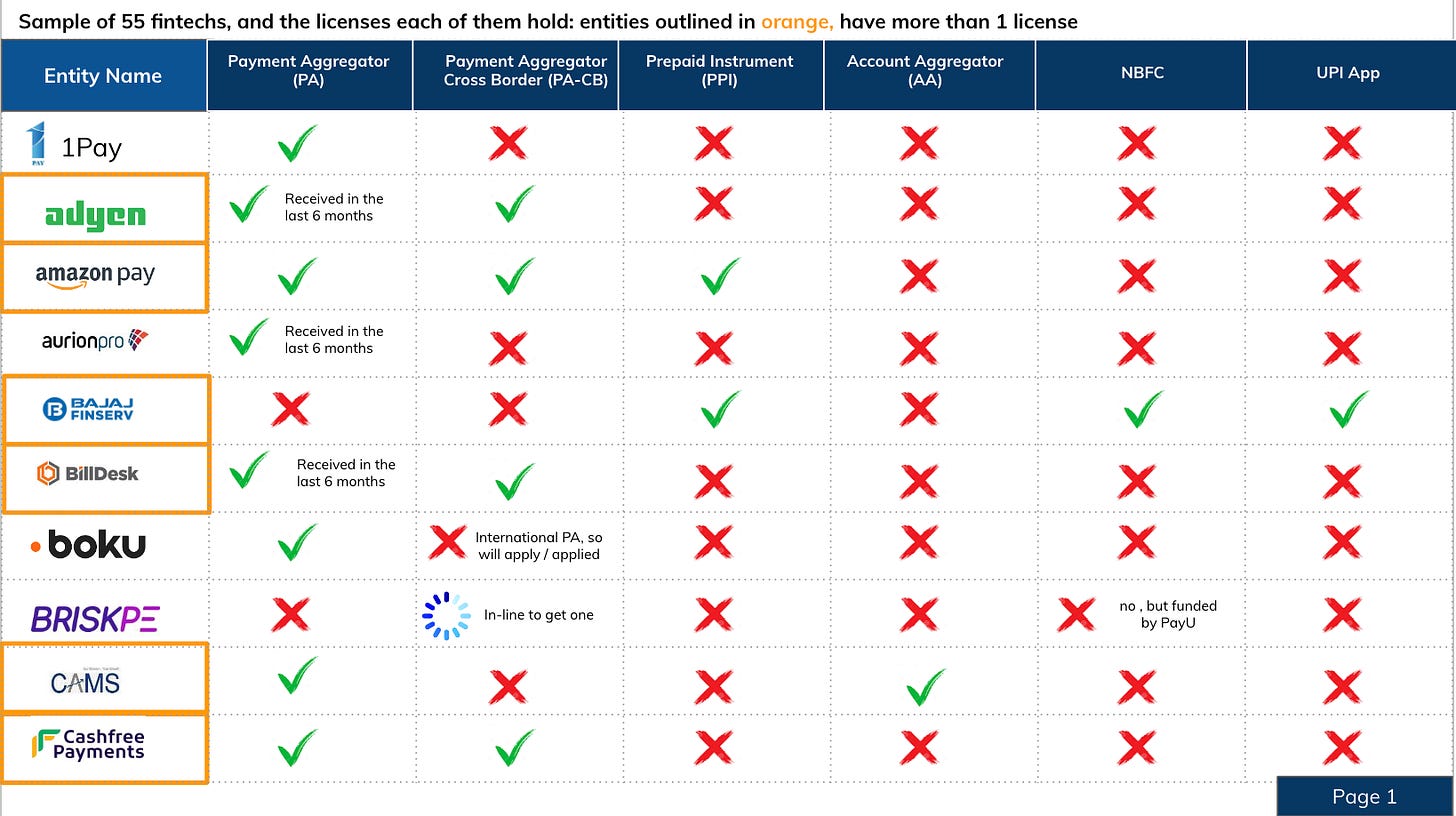

Appendix: Table of fintechs, and status of license

In alphabetical order

![[#27] Do all roads in fintech lead to license aggregation?](https://substackcdn.com/image/fetch/$s_!p_TJ!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fa87978f5-6a8c-4ea7-890d-b809cfc59802_1630x846.png)

![[#33] Eating is entertainment: Zomato’s Q1FY25 results, and future growth ambitions](https://substackcdn.com/image/fetch/$s_!wDJw!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F1b7791f6-4d50-47d6-91fd-688df632d293_1350x902.png)