[#30] Do new age fintechs stand a chance against VISA?

What do fintechs / real time payment rails need to do to compete?

Is the real OG of fintechs VISA (& Mastercard)? That’s a conversation Nishant (Senior PM at Razorpay, you can reach out to him here) and I were having a couple of weeks ago. There’s a great podcast (Acquired - check it out here) which has covered the VISA founding story, and how it’s grown in great detail. It is ~ 3 hrs long, but it’s definitely worth a listen / read (they have a transcript too).

As fintech grows, and especially as new age payment rails powering real time payments (RTP) Ex: UPI: India, Pix: Brazil, PayNow: Singapore, Promptpay: Thailand and others, you can read about them in detail in my article here), a big question that has been in my mind, is that, is this the beginning of the end for VISA?

Well, let’s take a few steps back here, before we jump to conclusions. To basics then. VISA & Mastercard are payment networks, which connect the merchant to the issuing bank. They started out as a consortium of banks (led by Bank of America (BoFA) back in 1958 - it initially started out as a close loop system by BofA, offered by them and their franchises only to their customers), and then became an independent third party, by selling to banks the story that a small % of being THE go to payment method is a way better strategy, and provide ecosystem growth way better than a closed loop system.

Originally paying by cards was a big pain. The customer would present the card to the merchant with the details, the merchant would then call up their bank, give them the card and customer details. The merchant bank would then call up the issuing bank to check on customer details. The issuer bank would confirm yes / no, tell that to the merchant bank, and then the bank would communicate back to the merchant if they could or could not accept the payment.

VISA & Mastercard came in and provided a tech solution to all of this, essentially providing a way for the merchant to check with the issuing bank if the customer could make the transaction within seconds. Of course, now there are many products they offer: cross border solutions, open banking (Acquired Tink, an Account Aggregator equivalent based out of Sweden), payout solutions, fraud management, tokenization, and many others.

Visa started out a closed loop system, but the real growth happened when it became open loop

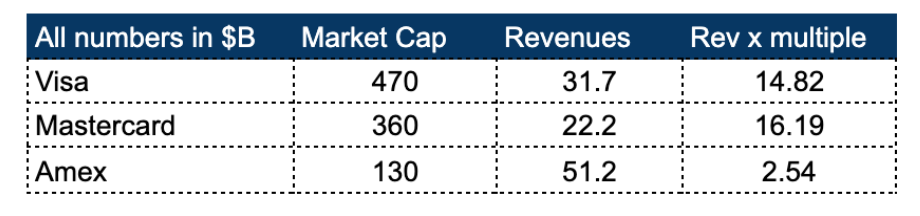

There’s a great post here that describes the different steps in a card transaction. But a key point to note is that VISA & Mastercard are open loop networks. Compare that to Amex which is a bit different. Amex control each leg of the transaction. They issue the cards themselves, and directly onboard merchants. With VISA, any partner bank can issue a VISA card. So, in a closed loop system, the growth is slower, but the revenue potential is higher. In an open loop system, growth is faster, but take rates are lesser. In theory. Let’s look at the overall revenue numbers of Visa, Mastercard, and Amex for FY23:

So while this may work for the top line revenues, Amex in FY23 has revenues of 1.5x - 2x that of Visa and Mastercard, but that doesn’t translate into the profit margin clearly. And that's probably because even though Amex controls more of the transaction, this also comes with an additional cost. And that’s what the market seems to think as well. VISA and Mastercard have market caps of 14-16x of revenue. Amex is at 2.5x.

So what does Visa’s business look like today?

Right off the bat, VISA makes a whopping ~50% margins on its revenue! Which you can see in the snapshot below. In 2023, its revenues were $32B, 50% of which flowed straight to its bottom line. And its cash & cash equivalents in 2023 were equal to about $17B.

Compare its margins to the top 20 companies in the world: Apple, Google, Microsoft, and even Nvidia, are between 20-35% net margins. And interestingly, Amex, which is a closed loop card network, unlike VISA and Mastercard, has net margins of 15.02%. So the hypothesis of a closed loop giving more monetization potential clearly doesn’t add up, as it isn’t reflected in the bottom line.

VISA’s scale allows it to play the volume game

The bps it earns just off processing transactions is ~0.2%. This is the network fee (explained in the next section).

VISA is strengthening its play in cross border, and changing around its pricing a bit. Hence the bps here are increasing, and may continue to do so as it scales up its cross border play

The total net income in the form of bps of volume VISA earns is ~10-12 bps. This is 2.5x - 3x of what payment aggregators / payment gateways earn.

The bps / volume is not high, but the volume play is something that is 50 years in the making. And As VISA scales its value added offerings, and as the mix of cross border and international volumes increases, it is possible that we see a positive increase in the net income bps / volume. You can see this in the snapshot below:

Visa Network Vs Real Time Payment (RTP) networks: RTP volumes on the rise, but margins are a question

1. Economics of a card transaction give a bigger share to the ecosystem, but because of that the load on merchants is more

Well, firstly, in a card transaction, the merchant is charged 2%, which is then split between the issuing bank (the bank of the customer who issued the card gets 1.6%), the network (in this case VISA gets 0.15 - 0.2%), the acquiring bank (merchants bank gets 0.2%). And then the 20 bps that the acquiring bank gets is split up between the various TSPs (Tech Service Provider) in the transaction (for example, in the case of payment gateways / aggregators, they make a cut too, which is why the net margins for the TSPs of the payment gateway side are so low. )

2. Economics of a RTP payment (taking Pix as an example): more favourable for merchants, but a smaller revenue pie

The total piece of the pie is much smaller. Let’s take Pix for example, which is the RTP in Brazil. The total MDR merchants are charged is 0.22%. That is 1/10 of what the MDR of card transactions are.

By simple math, assuming that this pricing comes to UPI and other RTP equivalents (UPI is free), RTP networks will have to process 10x of the volumes that VISA / Mastercard are currently processing to be able to generate an equivalent revenue channel for the ecosystem.

3. RTP systems have to scale to 10x volumes of VISA to provide equivalent money in the ecosystem

In terms of transactions, VISA clocked a total of 212B transactions in 2023. Compare that to Pix, which was at ~38B, and UPI which was at 117B. Clearly, in terms of transactions UPI (founded in 2016) & Pix (founded in 2020) are catching up to VISA, which has scaled to these many transactions in ~50+ years

All numbers are annualized (Pix launched in Nov 2020, so 2021 data is annualized based on 6M data)

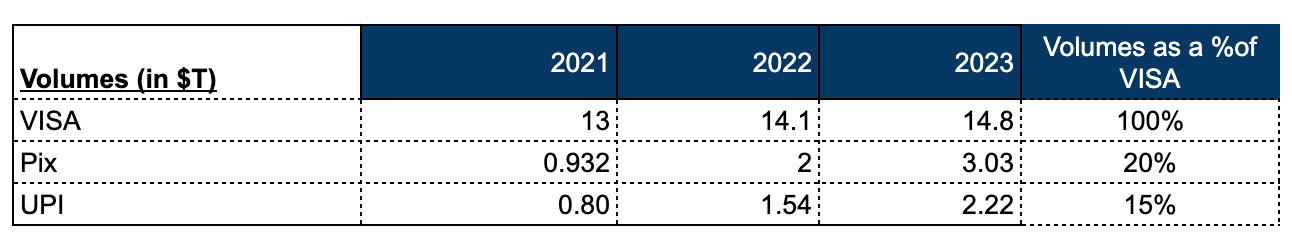

Even if we look at the transaction volume (in $T), while VISA is ~5x greater than Pix & UPI, the speed of growth that RTP networks are seeing far outstrip that of VISA.

But the issue isn’t the number of transactions or the volume. It’s the bottomline. In the earlier section, while looking at the financials, VISA is making a net margin (net income) of ~0.10% or 10 bps. And this is because the MDR charged on VISA payments is ~2%, so there is a bigger piece of the pie that all stakeholders can partake of. Compare this to RTP monetization models:

UPI currently cannot be priced, and operates at a loss right now. I’ve written about it in a previous article here. Pix pricing is 1/10 of what VISA is priced at. So while this is great for growth: merchants love this because it is priced lower, and customers love it because it is free, for other players in the ecosystem, it becomes hard to monetize, and become a profit making venture. Take the example of payment gateway / aggregators in India. They make ~5-7 bps as net revenue, because the % of RTP is growing, and skewing towards UPI, which is free. As UPI grows, and there is no monetization in sight, there are questions in the ecosystem if payment gateways as a standalone business will ever become a profitable venture.

And even if pricing comes in, at the scale of 0.2% (Pix), Pix will have to scale to 10x of the volumes VISA has, to generate the same amount of revenue for the ecosystem, and that too, in a limited number of countries, majority being in Brazil. VISA cards in comparison are accepted in 200 countries. And in terms of volumes, Pix will have to scale to 10x of $14.8T is a whopping $148T. For comparison: Brazil’s GDP currently is ~$2T.

Visa & Mastercard are making strategic bets through building their own plays in RTP, and strategic acquisitions

1. Local Card Networks on the Rise, but VISA & MC are going after TSP play in RTP

There are localized card network plays that countries / regions are building to reduce reliance on international companies, and optimize costs: current banks have to bear to cost of being affiliated with international card networks. Rupay in India is one example.

But Mastercard / VISA are making strategic inroads into powering the real time payments network. Take for example: Promptpay (Thailand), PayNow (Singapore). These real time payment rails are powered by a MasterCard product: Vocalink. And PLIN, a RTP rail in Peru is powered by Yellow Pepper, a VISA company). Yape, another RTP solution in Peru, is also powered by Visa.

This is probably a focus area for Mastercard and VISA going forward. And as more countries want to build their own RTP, MasterCard & VISA may pitch network effects to power their rails: By allowing VISA / Mastercard to build their rails, they will automatically be able to use this option to pay in any other country which has RTP rails powered by them.

2. Key acquisitions / investments done

Both companies are betting very strongly on cross-border transactions. In fact, a majority of VISA’s revenue now comes from international transactions.

What they are also betting on is the rise of open banking to streamline the payment process. Some key acquisitions/bids in the last 5 years:

Tink: Sweden, Account Aggregator (AA), Acquisition year: 2022, Amount: $2B

Plaid: USA (failed acquisition), AA, Tried to acquire in: 2020, Amount: $5B

Pismo: LATAM, Card issuing company, Acquisition year: 2023, Amount: $1B

Currency Cloud: UK, Cross Border payments, Acquisition year: 2021, Amount: ~$960M

So if VISA has such strong moats, profit margins, cash balance and acceptance, what can RTP rails do to take them on?

VISA (along with Mastercard) is so firmly entrenched in the ecosystem (tech investment, data, and distribution) that for a new card network to come in is next to impossible. But new innovations such as innovations on real time payments provide the glimmerings of an opportunity.

1. ++ features such as Rewards & Credit will drive adoption

We’re seeing early signs of this:

In India RBI introduced Credit on UPI (linkage of cards and issuing lines on UPI).

Pix Credit (in Brazil) is a process through which customers pay through Pix, and pay back their financial institution. Financial institutions can charge interest on this.

Pix can process different currencies including reward points.

And as I’ve talked about in my previous article, pricing on UPI is key for this. You need to incentivize 3rd parties to innovate on top of these rails. That’s what will create an ecosystem.

RTP also needs to strengthen current structures: Things such as robust chargeback systems, frauds (~125 Cr of frauds happened on UPI in FY23, and in fact UPI related scams account for 55% of total digital payment scams in India). These are table-stakes for UPI to scale volumes at the level at which card networks are operating.

2. Credit Solutions

You don’t need card networks to process credit. For example: BNPL is long touted as a CC replacement and eventually the economics can work out to be cheaper at scale (considering lesser parties involved). The five party model is reduced to 3: Just Issuing Bank, Merchant and a payment aggregator (entity connecting to issuing bank).

3. Inter-country RTP linkage for cross border solutions

ASEAN has already started this: where you can use your Indonesian App, scan a QR code in Singapore, and execute a real time transaction. This is a network that sits out of the purview of VISA / Mastercard (unless they have built it, as in the case of PayNow), and this is something that VISA itself sees as a massive threat. Right now this is happening through bilateral agreements (which India is also getting into), but as this scales, ideally there should be an easier way for a new country RTP rail to integrate with the existing network. That will really speed up this process.

4. Export RTP rail tech stack:

Pix & UPI are key examples here. To be able to scale volumes, they can do what Mastercard & VISA are doing, and become TSPs to countries who want to set up their own real time payment rails. According to this article NPCI has signed an agreement with the Bank of Namibia to set up UPI-like infrastructure for real time payments in Namibia. But NPCI should move fast on this. Mastercard and VISA are building their own solutions to power RTP for countries.

Both point 2 & 3 are all about payment method acceptance. Consumers want the assurance of knowing they can spend at just about any merchant around the world, online and offline, and earn interchange-funded rewards along the way. This is what makes VISA valuable. And this is what the new age RTP rails need to solve for.

Smartphone companies have an opportunity to use their customer distribution to leverage owning more legs of the payment, but this is a very long term play

Apple, with its customer distribution, and savings account / pay later features can play the role of the issuing bank. They already have mobile based offline payment acceptance solutions. In emerging countries, since scan and pay is preferred, they will have to figure out a scan & pay solution, and an answer to “why apple QR over others.”

And because the issuer account is also Apple, Apple can directly confirm to the merchant that the customer is good for the payment, instead of an extra check happening, where the merchant account has to check with the issuer and get a response.

By owning every step: customer device, offline device (on online they will have to partner with aggregators), customer and merchant accounts, this becomes an on-us transaction across all parties, providing more opportunity for profit, and cost optimization.

But this is a long term play, and one that requires significant investment and innovation, and winning the distribution play is a must. But investment isn’t an issue. Apple has ~$162B worth of cash reserves. And maybe this is something that it may invest in as it pursues its fintech ambitions.