Zomato’s Q1 FY25 report (April - June 24) recently came out, and the results made the Zomato stock price shoot up by 12%, from Rs 228 to Rs 268 per share. In the past couple of quarters, They’ve also made some interesting announcements.Earlier, they were a company that seemed poised to get into the fintech business: They had obtained a UPI App license from NPCI, a PA license from RBI, and an NBFC license. They’ve started relinquishing these, indicating they’re moving away from the fintech dream, and focusing more on the dining and events business, which is recently indicated by their launch of District - a one-stop destination app for going out , and bid to buy Paytm Insider - Paytm’s ticketing business for reportedly INR 1500 - 2000 Cr.

Eating is entertainment is the view Zomato seems to have adopted, and now with these moves, they’re very clearly focusing on moving into other entertainment verticals, not just food.

I went through the report, to understand what has been happening over the last quarter, and if there is any insight on what Zomato is focusing on.

So let’s look at the topline metrics first:

Gross Order Value (GOV)

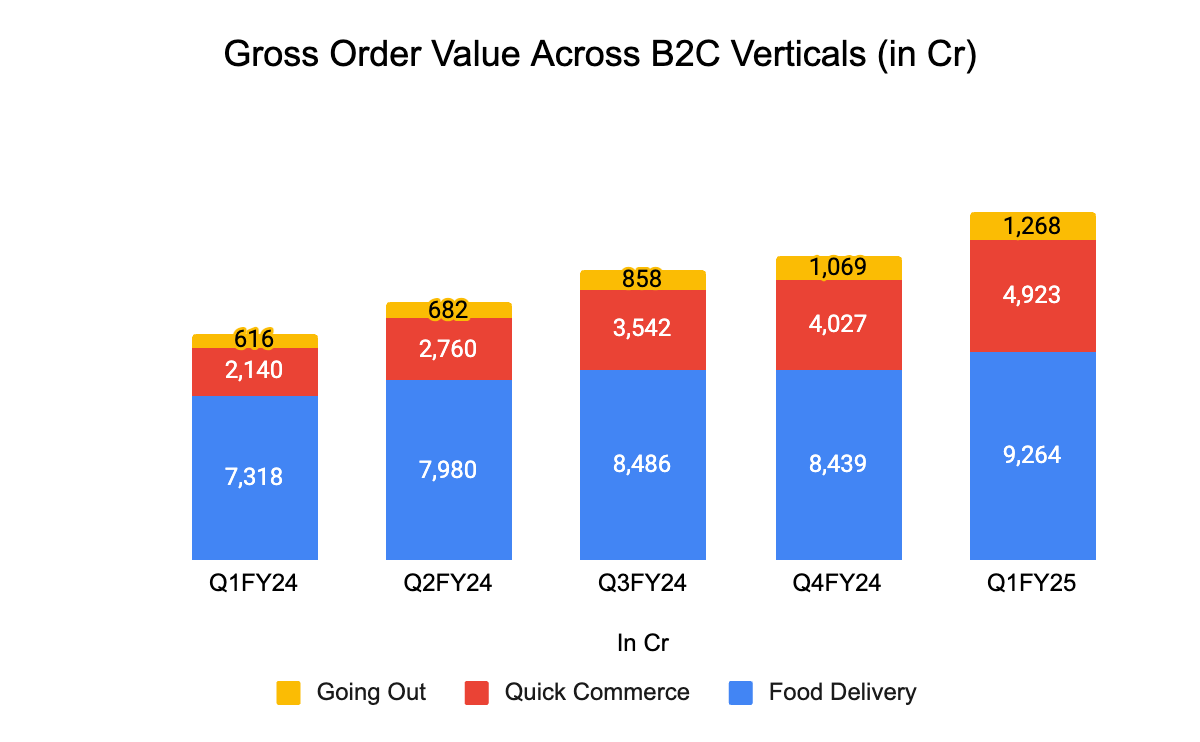

Zomato’s gross order value (for their B2C business) is the Food Delivery vertical - the business we all know and love at Zomato. Then comes their Quick Commerce business, which is Blinkit (formerly known as Grofers). It was bought by Zomato in 2022 for INr 4447 Cr. Going out is primarily its Zomaland IP (Food and carnival event business), and the new “District” App will sit here also.

The total GOV from their B2C business verticals came to 15,455 Cr at the end of Q1 FY25, a growth of 14% from Q4FY24, and 53% from Q1 FY24. The proportion of GOV is also changing. Quick Commerce is rapidly eating up share from food delivery, and is probably why the expectation is on Blinkit to turbo charge the next phase of Zomato’s growth and valuation.

The growth also feeds into this story. Quick Commerce grew at 130% from Q1FY24 to Q1FY25. Food Delivery grew by 23%.

Revenues

B2B supplies here talks about Zomato’s Hyperpure vertical. Hyperpure by Zomato is a B2B platform for kitchen supplies and an end-to-end restaurant supply chain solution, operating as a one-stop-shop for the HoReCa (Hotels, Restaurants & Caterers) industry.

Zomato hit INR 4520 Cr of revenues in Q1FY25, a growth of 16% from the previous quarter, and a growth of 62% from Q1FY24!

The growth in revenues is primarily due to QC revenues, which have grown from 22% from the previous quarter, and B2B supplies, which has grown from 27%. While food delivery revenues over the last FY have been between 6-11%, Quick Commerce has consistently being growing > 20% QoQ. Even in terms of % of total revenue, quick commerce is catching up with food delivery. B2B supplies here contribute to 26% of total revenues.

The proportion of revenues from each segment is changing, with QC & Hyperpure increasing their contribution.

Hyperpure focus: Possible expansion of the B2B segment into restaurant infra

From its annual & quarterly report, it seems that Zomato is focused on driving growth rather than profitability from its B2B business, which is Hyperpure.

It contributes to almost 1/3rd of the total revenues of Zomato, and aims to solve things such as poor quality supply, and the fragmented supply chain, and quick delivery. From what I also understand, they’re also focused more towards the mid level restaurants, since that is where more of the problem exists. Hyperpure has established warehouses in cities to solve for flexible delivery slots, and has a large network of farms and vendors to help source supply.

A natural expansion seems to be then also building tech and payment infra for restaurants to be able to manage their operations better. Which is the value proposition for Hyperpure. Some immediate things I can think of are:

1. White-labeled / branded tech to handle not just inventory and logistics, but also internal operations, payroll, order management etc

2. Supply chain financing: While Zomato does not want to get into the lending business anymore, this could be an opportunity for supply chain financing players to work with Zomato to be able to help their restaurants finance their orders.

3. I see an opportunity for Zomato to be something like Toast, which is a US based restaurant point of sale and management system, which also has synergies for their offline entertainment, food carnival and going out business.

So what are the key metrics if we compare the Quick Commerce Vs the Food Delivery Business

Let’s look at food delivery first:

Food delivery makes money through

Commissions from the restaurant: 20-25% of order value

Platform fees: This started out as Rs 2 in 2023, and then increased to Rs 3, and is currently at Rs 6 per order. This can be hiked if there are lots of orders being placed

Customer delivery fees: I estimate this to be somewhere between Rs 20 - Rs 40 per order depending on location. Zomato claims to give this over to the delivery partner, but chatter on social media suggests otherwise.

Zomato Gold: Restaurants pay a monthly charge to be included in Zomato’s offer portfolio and customers pay a subscription fee for perks such as free delivery, and perks / discounts at Restaurants

Advertising revenue

As per Zomato’s FY22-23 annual report, the AOV of its food delivery business is Rs 407

Quick commerce on the other hand makes money through the following:

1. Commissions from orders listed on the marketplace: 8-15%

2. Handling Fee: Rs 4 per order

3. Delivery Fee: Rs 16 - 30 per order. It is reduced from Rs 30 to Rs 16 if the AoV of the order is greater than Rs 199.

4. Advertising revenue

5. Here’s where it gets interesting: the AoV of Zomato’s QC business is Rs 522. Greater than its food delivery business.

But what really drives this business? Apart from the number of users that is? The key metrics to look at here are:

1. AoV (because of % commissions)

2. Orders per customer (because of per order, delivery cost).

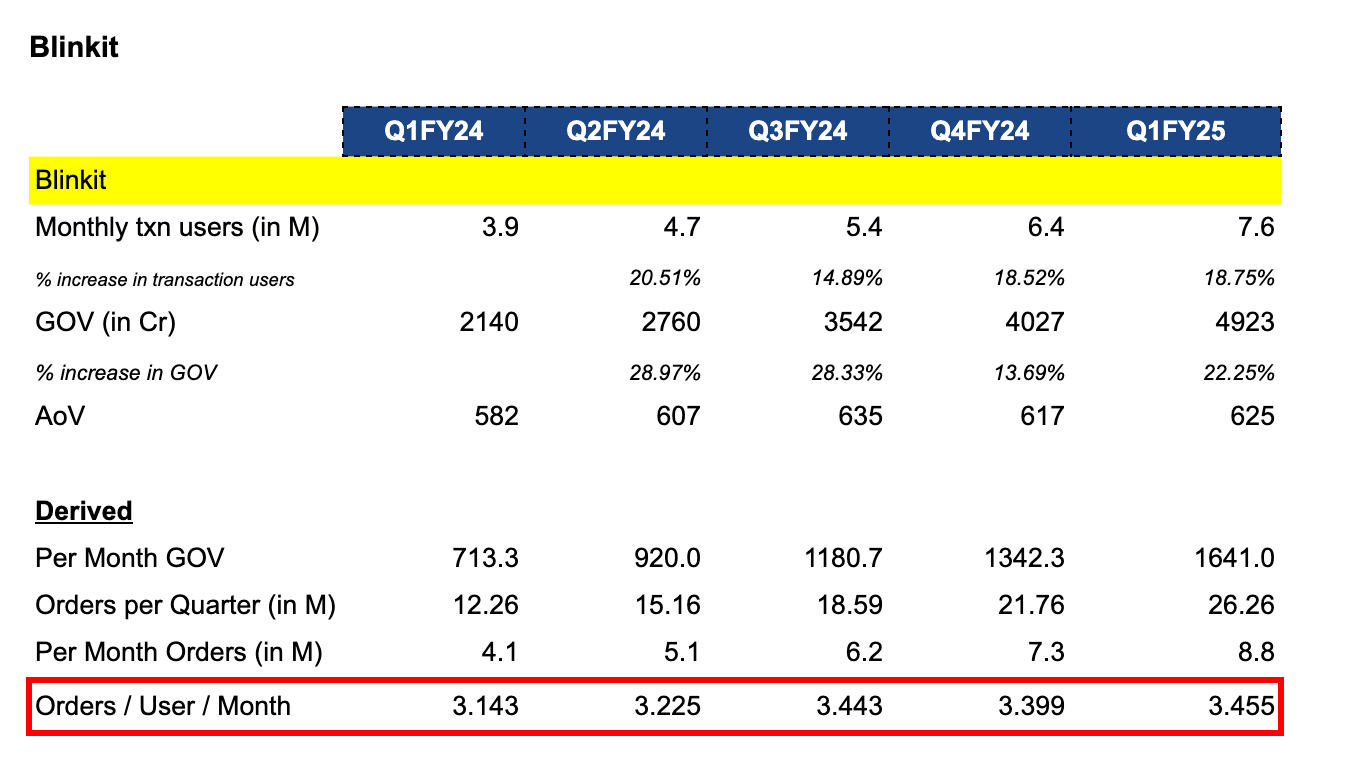

I’ve taken the liberty of deriving some of these metrics basis the numbers in the annual reports and the quarterly report.

On a monthly user basis, Blinkit is at 7.6M, while Zomato is 3x of that at ~20M.

As expected Blinkit has a greater order / customer metric because of the nature of the product it offer. As of Q1 FY25, it is at 3.4 orders per customer per month, as compared to Zomato, which has ~ 1 / user / per month.

But here is what is interesting: The AoV of customers on Blinkit is also much higher. As per the Zomato annual report, in FY23, Blinkit had an AoV of Rs 522, which is now at Rs 625. Zomato Food Delivery had an AoV of Rs 407, which I’ve assumed, even if it grows at the same rate, to be Rs 488 currently. You can check out the data below:

Blinkit Metrics

Zomato Food Delivery Metrics

And the way Zomato has built its business is that it is able to effectively use its Zomato Food Delivery App to send customers to blinkit. Blinkit can get onboarded using their Zomato credentials, and all their addresses etc are automatically saved, they don’t have to take an extra step. So effectively, the CAC of Blinkit is being optimized.

Zomato overall makes money on a per order basis. Blinkit is currently at ~8M orders per month. Zomato is at ~21M. And Blinkit is closing the gap. Take a look at Zomato’s orders as a multiple of blinkit below.

Zomato’s per order revenue is 3x that of Blinkit, and for both per-order revenues are increasing.

I’ve tried to derive the per order revenue that the food delivery business is making versus the quick commerce business. It’s understandable that Blinkit is increasing → its still scaling up its business. But food delivery, which is a scaled up business, is continuing to increase its revenue per order, probably due to add ons such as platform fee, customer delivery fee. So as a customer, I’d be a bit wary of the various costs that I’m being charged.

Revenue is growing way faster than growth of other metrics, can be inferred that charges per order and per user are increasing exponentially.

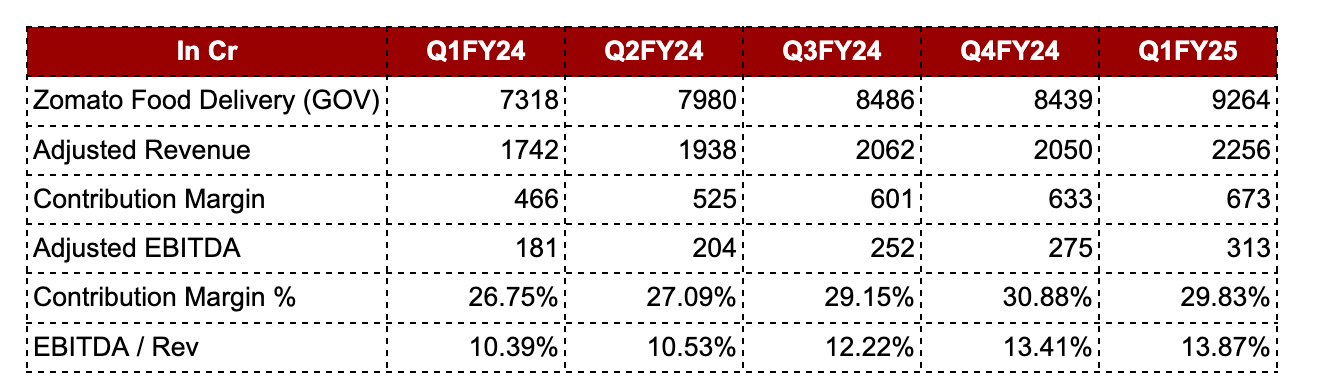

We can see the above point reflected here also. Zomato Food Delivery revenues are growing way faster than other metrics. AoV for Zomato Food Delivery increased from Rs 398 in FY22 to Rs 407 in FY23. Assuming this gets to even Rs 500, thats still 5% QoQ. Orders per user are at close to 1.2 orders per month, and have remained consistent. Users have grown at QoQ growth of 3.7%, currently at 20.3M monthly transacting users. Revenue has grown by 20%+ QoQ over the last 4 quarters. So while other metrics are increasing, Zomato Food Delivery is also charging way more on a per order and a per customer basis.

So if Blinkit is doing so much better across metrics, then what’s the catch?

Fixed Costs of operations

The fixed cost of actually operating these stores is quite a bit. According to Zomato’s annual report, the cost of operating the dark stores sits in the “others” cost column. Others. includes legal & professional fee, rental expenses, general & admin expenses, insurance costs amongst others. Post the acquisition of Blinkit, in the consolidated books of Zomato Limited, this cost also includes quick commerce related costs such as warehouse management & associated logistics cost, dark store related expenses, packaging charges, etc. These ‘Others’ costs, on an aggregate basis, increased by INR 550 Cr, from INR 270 Cr in FY22, to INR 830 Cr in FY23, mainly due to the quick commerce business. The variable costs here also seem to be higher. Both of these impact profitability. Let’s take a look at both:

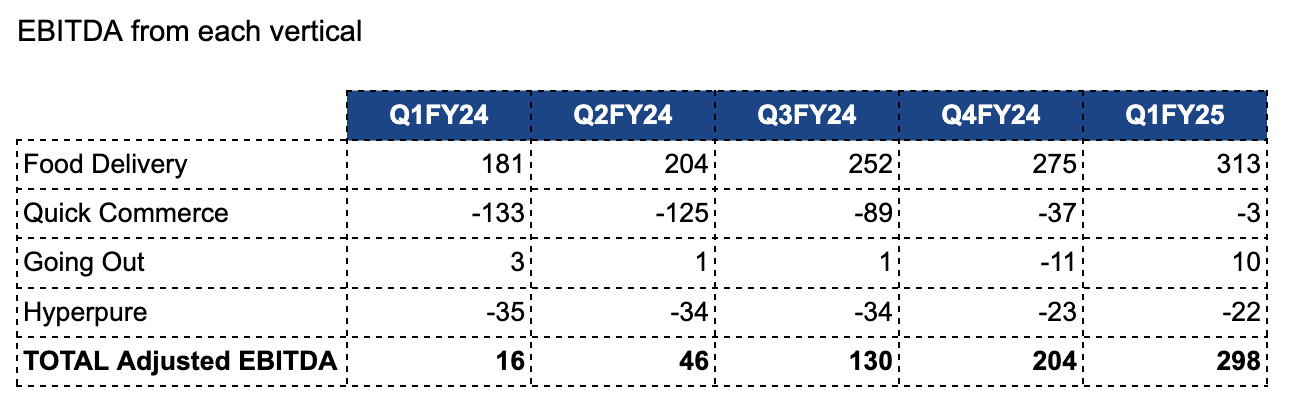

After variable costs, the food delivery vertical’s contribution margin is ~30%. Zomato’s food delivery business is profitable at an adjusted EBITDA level, at 13.87%, and has been increasing steadily, probably due to the increasing platform charges that they’ve now started to put onto the customer.

Compare that to Blinkit. Its contribution margin is currently at 21%, after variable costs. Not as much as food delivery, but that’s expected, because of the extra effort of finding the order in the dark store, packaging it, which they call “handling fees.” Where this P&L takes the hit is between the contribution margin and the EBITDA, or the fixed cost bucket, which is where I would assume a portion of the dark store operations and rental cost would sit. At the end of Q1 FY25, they had 639 stores, and aim to take this to 2000 (all in the top 10 cities) by the end of FY26, while remaining profitable. So there seems to be confidence in optimizing this cost.

Zomato is profitable , driven mainly by its food delivery business & treasury income. All other units are negative, or breaking even.

But what is interesting is that even though it is profitable to the tune of INR 253 Cr in Q1FY25, the reason for this is mainly due to its Treasury Income of INr 255 Cr, probably due to interest rate increases. Zomato had also given a loan to Blinkit prior to its acquisition to the tune of $150M, so I’m assuming there was some interest income that became due.

So what’s the conclusion?

1. Treasury Income seems to be a big reason for Zomato being able to post a 250 CR profit for Q1FY25. Their treasury income was INR 255 Cr for this quarter.

2. As a business, the scale up of its quick commerce business, and its food delivery, even when looking at metrics such as GOV, Revenue growth, and revenue per user & revenue per order growth is promising. But as a customer I’d be wary. Revenues growing faster than other input metrics means that you’re just charging more per order, both to the customer and the restaurant. I’ve already started becoming careful of orders, now resorting to checking bills every time I order for fear of some hidden charge that has been slapped on. There are also certain dark patterns in the app: things such as not showing the break-up of the bill unless you specifically click the drop down menu to see the charges. And if in a hurry, these are things that the customer will overlook - I know this is something that I’ve been guilty of, and you can only charge so much to the customer before the customer starts feeling cheated.

3. Blinkit fixed costs are what are bringing its EBITDA down. And while they are breaking even at an EBITDA level, as they scale up to their targeted 2000 stores, they have to keep looking at optimizations to be able to manage those fixed costs, which increased by 550 Cr as per Zomato’s annual report. Food delivery / Quick Commerce probably has space for 3 maybe 4 apps to work. Your “go-to” app, and a back-up App. For me it is Zomato / Blinkit and Swiggy. And from my own experience, Zomato / Blinkit probably does it best when it comes to speed of delivery and SKU selection. So its imperative to get this right, while scaling users, since once users make their choice, its hard to break that habit. We’re seeing the same thing play out in UPI Apps. Breaking that 50% + market share of PhonePe is not an easy task.

4. Hyperpure is a focus area for growth, and it's possible that they go deeper into Restaurant services, with white-labeled tech, supply chain financing, and other offerings. They could even eventually set up their own farms, and vendor network to optimize this part of their business, but that is a long term possibility.

5. Even though they have given up their NBFC license, this is probably also a product of the current environment, and negative views around NBFCs & lending. With the increased risk weights, its probably tougher for NBFCs to raise money. I see Zomato eventually getting back into this to power affordability, and co-branded plays in this space, which further feeds into the Zomato Ecosystem.

6. Eating is entertainment. By relinquishing its fintech & NBFC licenses, Zomato is very clearly doubling down into the eating and entertainment category, and also looking at expanding into the entertainment & ticketing vertical by buying Paytm insider at reportedly INR 1500 - 2000 Cr. They’ve already shown their focus here through Zomaland, and I expect more such events to continue happening, powered by their District App

"AoV of Zomato’s QC business is Rs 522. Greater than its food delivery business." That one input changes so much understanding of the usecases of QC.

-- Users are not buying last minute condiments, but full basket of goods.

?? High AOV, impulse categories are playing any role? Are those marquee viral-thread-creating consumer goods product really selling in big numbers and helping here?