[#39] Is the future of payments in the "Finternet" era powered by blockchain?

Recent investments & acquisitions by payment aggregators & payment networks seem to say that it is.

The news in the last 3-6 months has been full of established fintechs investing in stablecoins, and blockchain tech. Let’s look at a few notable players:

Stripe: Acquired Bridge, a stablecoin infrastructure platform in 2024 for $1.1B, to allow acceptance and settlement of payment in stablecoins. It has also partnered with Remote, which allows companies to pay their global contractors using stablecoins (pegged to the USD as of now).

Paypal: In 2024, announced that it conducted its first settlement in stablecoin to EY. Launched its own stablecoin, PYUSD in 2023, which is pegged to the USD 0.00%↑

Worldpay: In 2022, started offering merchants the option to settle in stablecoins

Robinhood, In 2024, it acquired the bitcoin exchange Bitstamp.

Mastercard:

Multi Token Network (MTN): Launched in 2023. To enhance interoperability among blockchain networks, so settlements and payment flows can happen across systems on different blockchains

Mastercard Crypto Credential: Launched in 2024. Universal identity standards, so that all parties involved in the transaction are verified, reducing fraud risk

VISA: Launched VTAP (Visa Tokenized Asset Platform) in 2024. This allows banks to create and experiment with their own fiat backed digital currencies in a sandbox environment. It also focuses on interoperability between different blockchain networks. It’s currently piloting this with BBVA bank.

Revolut: A Neobank, building its own crypto exchange called RevolutX in may’24, and reportedly is going to invest in its own stablecoin. I won’t be surprised if other Neobanks, especially those operating in multiple countries such as Revolut (40M+ users across 35+ countries) invest in their own crypto exchanges & stablecoins for more liquidity and better exchange rates. You can find a list of top neobanks across the world here:

And in April ‘24, there was a paper published on the Finternet, which aims to utilize distributed ledger technology, and tokenization, for more efficiency in financial system operations. So there is an increasing focus on cryptocurrency, and stablecoins, with some calling stablecoins as the next evolution in payments infrastructure. But to understand this, first we need to understand what these terms are.

So to basics. What are all these “crypto(ic)” terms?

Cryptocurrency: A cryptocurrency is a digital currency that exists on a decentralized network, such as a blockchain, and is encrypted using cryptography. It’s encrypted using public and private keys to authorize transactions. Think of a private key as one that only you have, and a public key that can be shared publicly. These are derived from each other. Example: A public key is like the address of your mailbox, and a private key is the the key to unlock the mailbox that only you have

Stablecoins: The problem with cryptocurrency that I’ve always had is that it’s not pegged to anything. What does it derive its value from? Either there’s some central entity (like the government for example) that says, hey this has value (“I promise to pay the bearer of this note Rs 1000 etc). Or there is some asset that gives it value. And that’s why it’s so volatile - it rises and falls a lot with customer perception. With stablecoins, this problem goes away. It is a digital currency that is pegged to an asset, so it’s not as volatile. Like the PYUSD stablecoin; its value is pegged to the USD. There are other stablecoins that are pegged to gold, silver, and other currencies. There are even stablecoins that are pegged to the value of shares of stock. You can check out the top stablecoins by market cap here, most of them are pegged to the US dollar.

What is a blockchain? I think of a blockchain as a network, where different systems operate and are plugged in. And it operates on something called distributed ledger technology: which means there is no single source of truth, but rather, each system that's plugged into the blockchain maintains a record of all the transactions that have happened, which allows for transparency, but also allows quick recon, refunds, etc because everyone has visibility of all the information: the information asymmetry that exists in systems today is solved for in a way.

What is a CBDC (Central Bank Digital Currency): Digital currencies that exist on a blockchain, i.e. utilize distributed ledger technology, but are controlled by a central authority, they are not decentralized.

So to summarize, stablecoins are a type of cryptocurrency, that are pegged to the value of a real world asset / currency. These exist on a blockchain, which is a type of network. The nature of the blockchain (distributed ledger technology) is what allows for fast transactions, reduced settlement, refund and reconciliation timings, and hence, especially for cross border transactions that take multiple days, this is seen as a potential solution. CBDCs are digital currencies that are not pegged to real currencies, but rather have the same value as fiat curency (ex: 1 INR = 1 e-rupee).

To understand why blockchain is touted as a solution for payment flows, its important to understand how existing payment flows work:

Existing payment flow (domestic): Can take upto T+4 days for settlement, but usually takes T+2

The banks are the cornerstones of this system. High level, all requests for authorization & fund transfer have to be routed through the acquiring bank to the issuing bank using payment processing rails: MC, VISA, UPI etc. And there is information transfer, because funds have to be transferred from bank to bank, and information from system to system, so settlements & refunds can take multiple days, and because of information asymmetry due to multiple points of failure, reconciliation also requires effort.

Existing payment flow (international): Can take anywhere from T+2 to T+5 days, with additional hops

There are additional regulatory hurdles, currency conversion requirements (if the customer is paying in one currency, but it needs to be settled in another currency to the merchant). In some cases, the issuing bank may not have a direct relationship with the acquiring bank, where the payment needs to be settled, so the payment needs to be routed through an intermediary bank.

If I had to reimagine this on a blockchain, what would this look like?

Well. Firstly, the cornerstone of blockchain technology is distributed ledger technology. Which means everyone is plugged into the same network, and has a view of all the transactions that are happening. So the whole concept of “interconnected financial systems” comes into play here. Some popular blockchains are your Ethereum, and Bitcoin, however with payment systems in play, banks should ideally build their own blockchains, or opt for private blockchains, for security.

So if we dumb down payments, what actually happens?

1) Authorization that the customer is who they say they are:

2) Confirming address where the funds need to be sent:

3) Fund transfer, from the issuing bank (customer) to the merchant’s bank.

In the middle, acquiring banks play the role of authorization requests, routing customer requests, handling recon, refunds, and then getting the money settled in their pool account, before settling with the PA Escrow. That’s just the way the payment system is structured. The merchant is onboarded on the acquiring bank (through the PA).

If no middle layer is needed to communicate with the issuing bank, and the rails are the blockchain, which is routing requests & keeping track of transaction history, then why can the PA / whatever entity is playing the infra layer of facilitating this communicate directly with the issuing bank?

Stripe acquired Bridge, leverages wallets to convert fiat to stablecoin and back: Bridge has facilitated this in the following way:

The user has to have a pre-existing Bridge account / wallet, and transfer funds into it (the merchant also has to be previously onboarded on Bridge)

Bridge then contacts its liquidity providers (exchanges) to lock in the exchange rate, and convert the fiat to stablecoins

The stablecoins are then added to the wallet

After the stablecoins are added to the wallet, the user initiates the payment, and the merchant wallet receives the payment in stablecoin

Bridge again contacts liquidity providers for conversion back to fiat '

After conversion, the fiat is settled to the merchant account

My own take on this: Wallets being handled by a third party such as Bridge are okay for now. I see it as a step in the right direction: How prior to UPI and Account to Account payments, real time payments were facilitated through wallets, where the wallet would be funded by the account, and then the wallet would be used for all transactions.

But ideally, as in UPI, all this should happen bank to bank, and there should not be a need for a “wallet intermediary.” The banks should be taking care of this: bank systems should be able to maintain customer accounts, that have interchangeable fiat and stablecoins / digital currency. And when there is a payment request, after authorization, the conversion / settlement in stablecoin should happen seamlessly in the back-end.

The Stripe & Remote partnership is similar:

Remote is a platform that allows companies to pay its contractors using stablecoins, that Stripe has integrated on its platform. However, this requires the merchant to complete a separate onboarding, and the customer to create a separate Metamask wallet to be able to receive the stablecoin currency.

Thinking about it customer backwards, the customer & merchant ideally shouldn’t even really play a role in deciding if the settlement should happen through stablecoins or fiat:

At a high level, this is what is happening:

1. Customer pays at merchant / PA

2. Fiat converted to stablecoins / CBDCs

3. Settlement happens between banks / systems using stablecoins / CBDCs

4. Stablecoins / CBDCs converted back to fiat

5. Transferred back to the merchant account

Breaking down the flows a bit more, this is what would happen:

1. Customer pays in fiat at the PA

2. Acquiring bank (where the merchant has been onboarded on through the PA) sends authorization request to issuing bank. Why is this needed? Well: If we assume that the customer is paying through fiat, and through a method of choice, then usually these authorization requests are routed through the acquiring bank to the issuing bank.

3. Issuing bank confirms auth to acquiring bank, which confirms to the PA

4. The customer proceeds and completes payment

5. At the backend, the issuing bank, ideally in the same, or separate system, maintains digital currency on a blockchain, against fiat, which are interlinked: that is: 1 fiat currency = 1 digital currency, OR it has partnerships with liquidity providers. After authorization, the stablecoin is transferred on the blockchain from the issuing bank system to the PA account. There is no need to have an acquiring bank to collect the funds here.

6. Why the PA account? Because merchant settlement needs to also happen in fiat, and the PA ideally should convert the stablecoin back to fiat, and then transfer it to the merchant account, the merchant bank should not need to do extra work to receive the settlement.

7. Since the blockchain records every transaction, this report should be automatically generated for each party at the end of every day, which includes settlements, reconciliation, and refunds.

8. A lot of blockchains support smart contracts: which can have the logic for refunds and reconciliations written into the code, and can self execute whenever the logic is met.

Option 1: Acquiring bank needed for routing authentication of fiat payment method

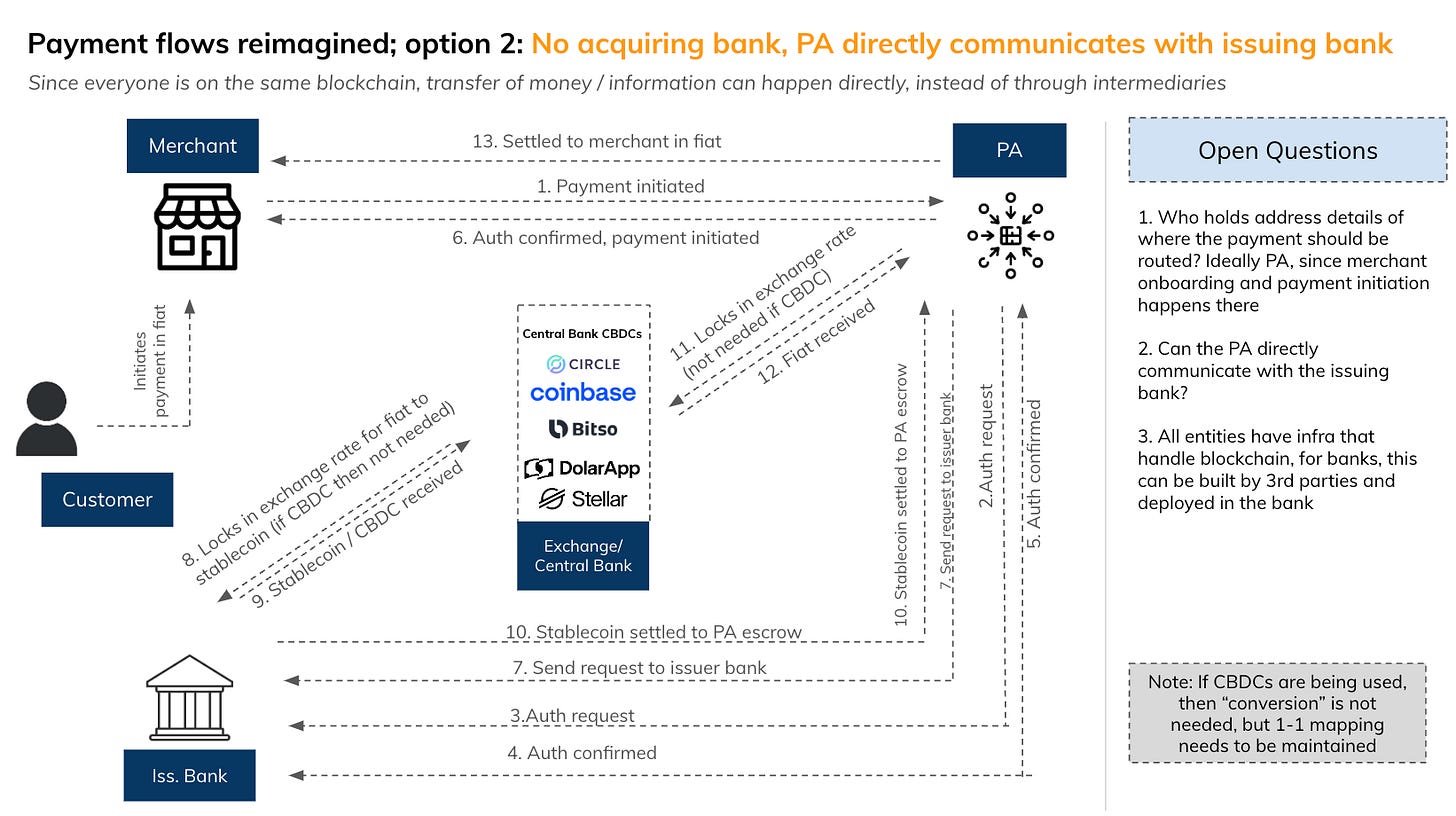

Obviously many things to be figured out here, but until a decoupled authentication system from payment method is not solved, the acquiring bank is needed to route authentication requests to the issuing bank. I do question the need for an acquiring bank pool account though: If everything is on the blockchain, the PA should be able to directly communicate with the issuing bank.

The only need for the acquiring bank could be from a security / regulatory perspective.

Note: If CBDCs are being used, then conversion to stablecoin & back is not required, but 1-1 mapping of fiat to CBDCs, and maintaining same at a customer level is needed

Option 2: Authentication decoupled from method, PA directly communicates with issuing bank

If the authentication is decoupled from payment method: Device based / biometric / public - private key based, then potentially the role of the acquiring bank is not required at all.

So what is needed for widespread adoption of blockchain based payments?

Separate systems on the blockchain, integrated with current payment systems for fiat:

These systems should be able to use the fiat and digital currency / CBDCs interchangeably. The payment aggregator would need to have an account that captures the money being transferred from the issuing bank, converts it to fiat, and then sends it to the merchant account. And both these banks, and the payment system would need to be either on the same blockchain, or blockchains that can be integrated with each other, and the stablecoin / CBDC would need to exist on all these blockchains.

Authentication decoupled from type of payment method:

Right now, authentication is closely coupled to the payment method used. Example: Card payments, through CVV + OTP (powered by the issuing bank ACS). UPI payments, through UPI PIN. When a customer selects to pay through fiat, at the back end, the authentication process ideally should be the same for all methods, and agnostic of existing payment methods / payment rails, otherwise it adds a layer of complexity here.

A central authority is needed to govern this, and hence the preference should be private over public blockchains

My personal opinion is that for something like this, a central governing authority is needed. Someone to regulate this, to confirm transactions, and have one source of truth. Public blockchains, by definition, are decentralized, and decisions are taken either through Proof of work, or Proof of Stake. But private blockchains usually have a central governing authority, and that's something that would be better in this case. In public blockchains anyone can join, and view transaction history. In private blockchains, you need to be authorized, and only a select few can actually view the transaction history. And that’s what the finternet also defines: The central bank as the final governing authority for these transactions.

This has already started happening: RBI is currently piloting the e-rupee, which is a digital currency (a CBDC) wholly issued and regulated by the RBI. It exists on a blockchain, i.e. it leverages distributed ledger technology for faster payments. And with a central authority, a Proof Of Stake model works, if all ownership can be tied back to it, so it has the final call on approving all transactions.

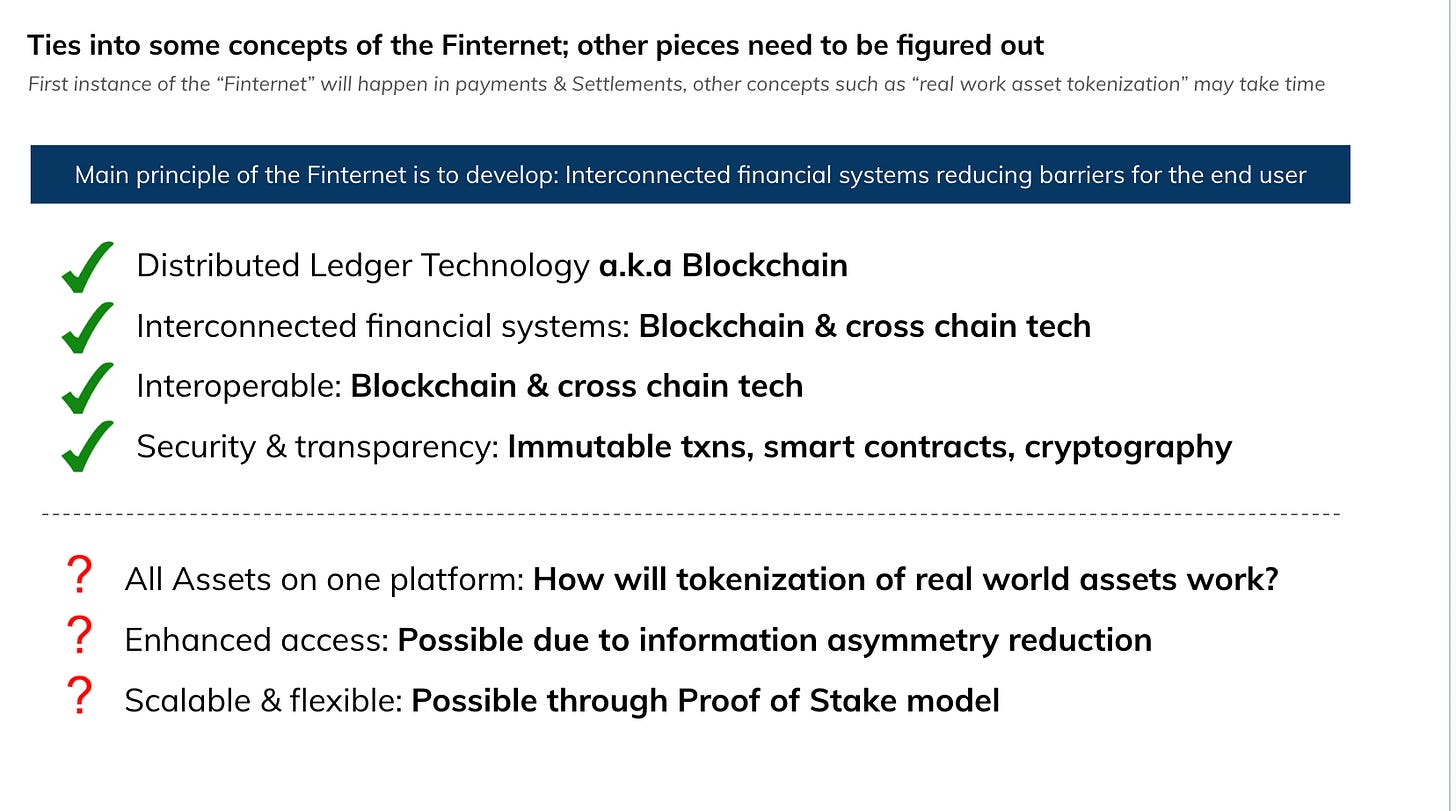

Blockchain powered payments tie into some concepts of the “Finternet”

In fact, after seeing the Revolut investment in its crypto exchange and its potential investment in its own stablecoin, it could very quickly start piloting on-us cross border transactions

On us transactions are those transactions where the payer and the payee have accounts in the same bank. Usually this becomes more cost effective, because it reduces the hops to complete the settlement. If Revolut has the Payer & Payee accounts, its own crypto exchange, and its own stablecoin, its able to solve for:

1) Optimized communication with the exchange for sourcing stablecoins for the fiat

2) Optimize exchange rate costs, and make it more cost effective for the customer / merchant / itself

3) Solve for liquidity, since its the issuer

4) Conversion from stablecoin to fiat and back again, and seamless settlement into the customer account: As a neobank, it’ll have to maintain a blockchain account against the fiat account, but since it has ownership of this leg, unlike a payment aggregator, it’ll be able to manage this more seamlessly.

Revolut as of 2023 was at 590M transactions per month, and processing over $250B worth of payments per year. At that scale, even 0.01% of cost is ~$25M. So apart from general settlement speed, especially for cross border flows it can stand to optimize quite a lot of on the costs. As as customer / merchant facing platforms such as Revolut & Robinhood continue to build, they’ll probably solve for a lot of the customer experience and adoption as well.

But the key takeaway: The Finterent revolution has already started, and the first instance of this will be in payments & settlements .

CBDC: Governments are already experimenting with this, and platforms such as Mastercard & VISA are building solutions to allow seamless launch of bank’s own fiat backed digital currencies. In India, RBI is already piloting the e-rupee.

“Blockchain as a Service” to build and customize blockchains based on use-cases: Public blockchains already exist. AWS, Microsoft, IBM, Oracle have already started offering these.

Infrastructure to support storage and conversion of fiat to blockchains: Bridge offers this capability: It leverages its liquidity partners such as Coinbase, Bitso to lock in exchange rates, and convert from fiat to stablecoin. There are other platforms such as TransFi, BVNK, Moonpay, Circle that offer these capabilities.

Bank infrastructure on blockchain & integrated with fiat: To be able to store customer deposits in the form of digital currencies on the blockchain: this still needs to be figured out

![[#40] The case for neobanks in India: what can we learn from global successes such as Nubank?](https://substackcdn.com/image/fetch/$s_!G8yT!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F3d81c4d2-68c0-4341-8025-90f2bcf45e1e_1600x896.png)