[#41] From Free to Fee: Why does UPI need pricing to sustain innovation and growth?

Private players need to see revenue TAM to drive further innovation

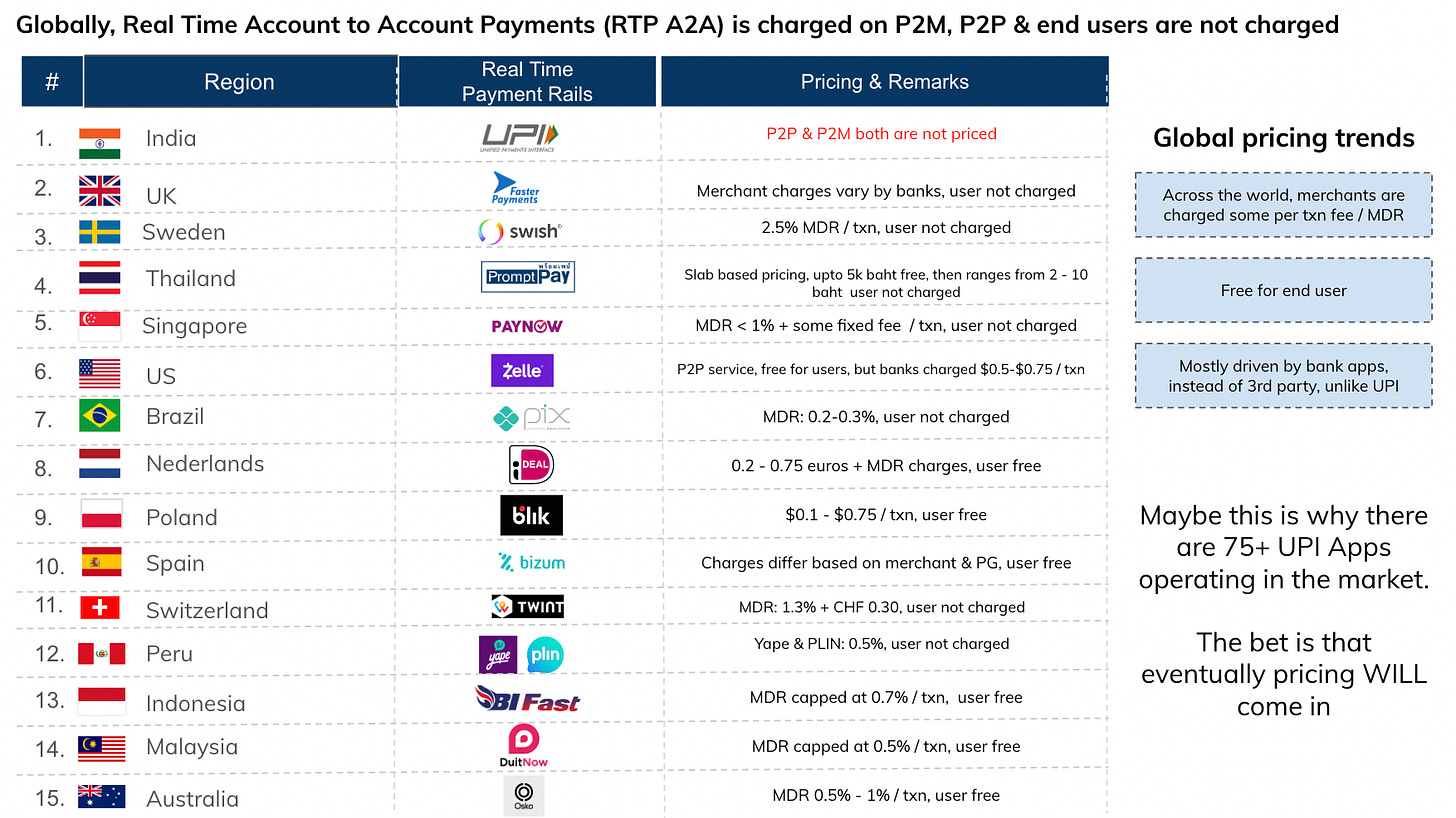

I’ve written a bunch of pieces in the past about how UPI is scaling, and how RTP A2A payments (real time, account to account payments) are the future of payments across the world. And this seems to be the story for a lot of your major regions. But there’s is one key difference across all your global analogues. There, the real time payments rail is priced. In India its not.

Across the world, RTP A2A payments are usually free for the end user, but P2M payments are charged

I’ve looked at 15 regions, including India. In all cases except for India, there is some sort of slab based pricing or some MDR % charge on P2M payments. And it’s free for the user, so the user in the case of P2M payments, doesn’t have to pay. By virtue of this, P2P payments are also not charged.

But in India, both P2P & P2M are not charged: the cost is borne by the participating players

Now in India, to drive adoption, initially, NPCI: the governing body mandated that it should be free to both the the user and the merchant. But that there is adoption, and we’re hitting ~15 Bn transactions per month, at a value of INR, which is 20.6 Lac Cr ($250B) per month, there is a cost of this as well: According to this article, the cost of 1 UPI transaction costs the ecosystem about INR 0.4. Who’s bearing this? The same stakeholders that are involved in a regular payment: the issuing bank, the acquiring bank, the network, the payment gateway, the UPI Apps, and other tech middlemen who are playing a role in authentication and routing of payments.

This isn’t to say that NPCI isn’t trying. PPI on UPI are now charged 1.1% MDR on transactions above INR 2k. Rupay Credit Cards on UPI have an MDR of 2%. Credit Lines on UPI have an MDR charge of ~1.2%, of which UPI Apps get 5bps. These are all recent developments that have come over the course of the last few years.

So then the expectation would be as this scales further, at some point, pricing on regular savings account UPI transactions will have to come in. And that’s probably the bet that all the 75+ UPI apps who are operating in the market are taking. That despite the small % that they stand to capture, since the top 4 apps control 95% of volume and value, even taking a small % of the large TAM is enough to operate sustainably.

But what is the TAM? And certainly all merchants, and all types of transactions may not be charged

Well to understand this, we first need to understand the breakup of payments in India. If we keep this in line with the global examples, then only P2M should be charged, not P2M. So what’s the break-up?

P2M transactions are more than P2P transactions: 60-40 skew

If we look at volumes, in terms of # of transactions, in September 2024, P2M volumes were at 9.35Bn transactions, while P2P volumes were at 5.69Bn. This currently split is ~60-40, skewed towards P2M. This is expected to further tilt in P2M volumes favour, projected to go to 75-25 in FY25.

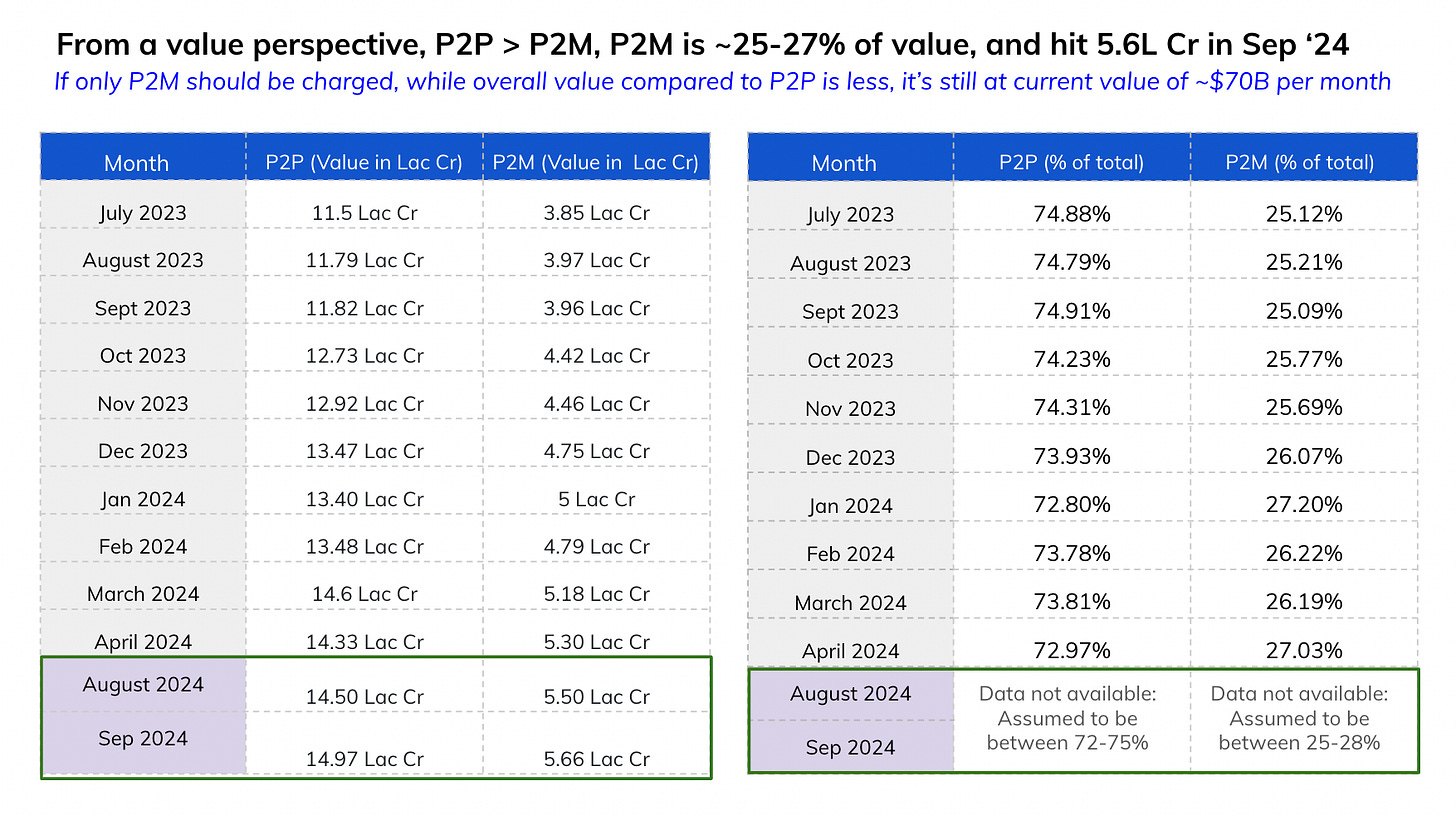

Reversed when we look at value: P2P contributes to 75% of total value coming through UPI Apps, but that’s still almost ~$70B that can be priced per month

From a value perspective, this is changed. Here, the value coming from P2P transactions is much higher, contributing to ~72-75% of total value. In September ‘24, out of a total of 20.6 Lac Cr transactions, P2P contributed about 14.97 Lac Cr, and P2M contributed was about 5.6 Lac Cr.

But even though P2M value is at ~$70B, this whole value will not be charged: RBI does not want to charge the micro merchants (also called P2PM)

So that’s another cut that we’ll have to take, within this $70B value of P2M per month. For the simplicity of calculation, I’ve assumed that that micro merchants have an AoV of < 2k, so only those transactions and values above 2k will be charged.

Of course, this isn’t entirely accurate, since you have players such as Zomato, Swiggy and a lot of E-commerce merchants who have AoVs of < 2k, but on the whole, directionally this should give us a good sense of how big the market is, and if there is even an opportunity here.

I’ve taken April ‘24 numbers, and extrapolated the % contribution of volumes and value to August ‘24. Overall the trends over the last year have been fairly consistent. And if we look at only the P2M transactions with volume and value > 2k, that still leaves a big market that can be leveraged for monetization.

As of August ‘24, the P2M market of transactions above 2k was ~400M transactions, and INR 3.7 Lac Cr, or ~$46B. This seems like a sizeable market: there is enough volume coming in through here to make money.

And this is driven by the retail digital payments landscape, projected to hit $7T by FY30, with UPI P2M ( AoV > 2k) contribution to be ~$1.6T

Keeping some of the assumptions and % break-ups the same, this is a potential P2M market of AoV > 2k of $1.6T, which is a massive TAM to tap into and make money.

So assuming this is the market, where are the top UPI Apps trending?

The Top 3 apps have the scale, and are doing more than 1Bn transactions a month, and more than $10B of volumes ( 1 Lac Cr ) per month. So from a scale perspective, even without monetization on UPI, they’ll end up making money, by distribution other services, and ploughbacks, which is what PhonePe is doing: PhonePe reportedly made ~ 5064 Cr in FY24.

Thats for the big apps. What about the smaller ones? What’s their play? Any app not in the Top 3-4, doesn’t really have the scale in terms of value of transactions, although they may be getting there in terms of volumes of transactions. But thats actually the “not so good part” because while transaction costs are some fixed amount per transaction, revenue is made as a % of the transaction value. So the greater the number of transactions, and the lower your value, actually sets you up to lose more money.

Groww here actually operates most efficiently, because its transactions per month are pretty low compared to the rest, about 13Mn per month in September, but its value and AoV are much higher.

Directionally then, what does it cost UPI Apps to operate?

There’s a one time set up fee, that can range anywhere between 10L to 1 Cr, or even higher, depending on the level of sophistication wanted in the app. And then there is a monthly fee, charged in the form of cost / txn, with some sort of minimum billing, so that the tech providers can atleast cover the cost of infra.

From a cost perspective, since the cost of a UPI transaction in the ecosystem is 10p - 40p, I’ve kept this as the cost that UPI Apps are bearing per transaction, with a scale perspective: Apps with larger scale, are closer to a 10p / txn cost, while apps with smaller scale, are closer to the 40p / txn cost.

Here again, is where the advantage of a full stack play comes into the picture, and where the piece about license aggregation again becomes relevant:

You want to own as many pieces in the layer to be able to reduce costs, and increase monetization capability.

Below is a view of (directionally) what I think it costs UPI Apps to operate today. Do keep in mind, this is just the direct cost of a UPI transaction, other attributions have not been built in. This is also basis my own assumptions.

Using global examples: what sort of MDR can we expect to come in (in the future)?

Right now, the way cards are priced, is that broadly, the MDR charged is ~2%. (could be more depending on the type of cards). And then this is split between

1) The issuing bank: which makes 80% of this, or 1.5% of the 2% charged.

2) Network: makes ~10% of this, or 0.2%

3) Acquiring bank: Makes 10% of this or 0.2%. This is then broken up between the payment aggregator, payment gateway, and any other tech providers sitting in the middle.

Assuming that the MDR charged is ~0.3% (which is what Pix charges), and the break-up to each stakeholder is in the same ratio:

1) The issuing bank: which makes 80% of this, or 0.24% of the 0.3% charged

2) Network: makes ~10% of this, or 0.03%

3) Acquiring bank: Makes 10% of this or 0.03%. This is then broken up between the payment aggregator, payment gateway, and any other tech providers sitting in the middle.

4) UPI apps, I’ve assumed that they’ll get 50% of the acquiring bank share, which comes to 1-2 bps of transaction value. This is also in line with the amount UPI Apps get from Credit Line on UPI transactions, have kept that as a proxy.

Credit Line on UPI transactions: Out of 1.2% MDR charged, UPI Apps, will get 5bps. —> 5 bps as a percentage of the 1.2% MDR charged is ~4% contribution of total.

—> Here, 1-2 bps as a % of 0.3% MDR charged is ~5% contribution of total, so seems in line.

Of course, these are a lot of assumptions baked in, but directionally, in any transaction, I don’t expect UPI Apps to make more than 5 bps of total transaction value.

Assuming 1 bp of transaction value, @ 0.3% MDR for current UPI apps, scale is where they will monetize. And for other UPI Apps, its a game of managing higher AoVs

Take a look at the analysis below. Again, this is just basis UPI transactions, I have not attributed any other costs here. Based on assumptions taken, there are 2 strategies emerging:

1) Scale play:

PhonePe, Googlepay, and Paytm are in the green: they have scale on their side, with 1Bn + transactions per month. Their AoVs are between 1-1.5k, but thats because they are the UPI App for everything. I had written a piece on this previously, where I talked about how the battle for the “UPI App for everything” is over, and now its all about specializing in categories. You can check it out here:

2) AoV play, with lower scale

Cred & Groww, actually haven’t reached scale yet, in comparison to the top 3. But what works for them is that their AoVs are much higher: 3x - 7x higher than PhonePe, Googlepay, and Paytm. Because of that, they’re able to keep their revenue % up, and manage costs

And maybe thats a view new and upcoming UPI Apps need to take. To drive volumes, and manage costs, maybe focus on categories, which AoV is expected to be higher: such as travel, certain types of ecommerce, anything that is closer to an AOV of > 5k.

Of course, the below is basis a bare minimum MDR taken. If the MDR is higher, there is more buffer, and more opportunities for Apps to make money

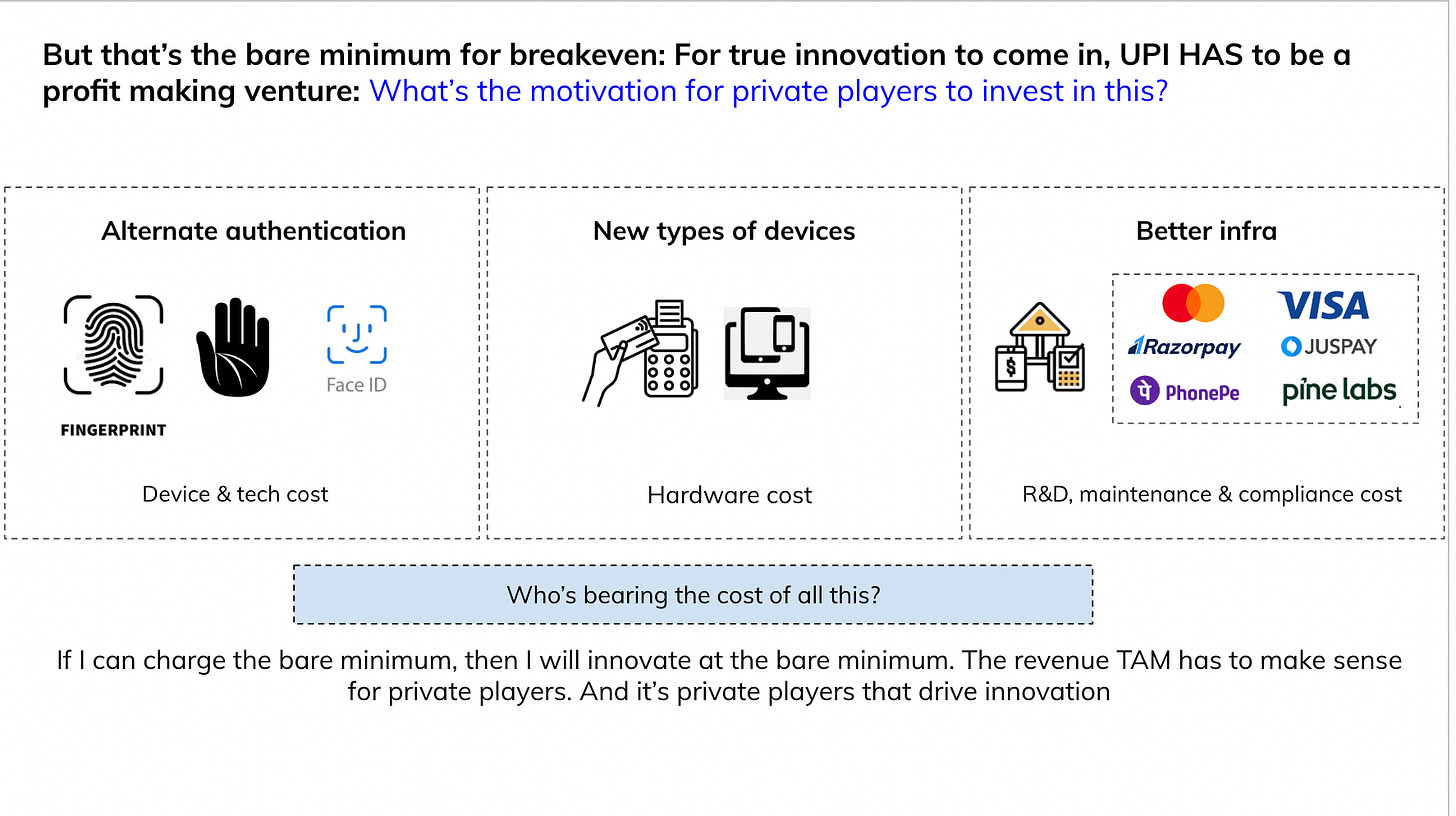

But here’s the conundrum: innovations cost money. And private players need to see profitability at some point in the future to invest more

At 0.3% MDR, it seems that everyone will just barely make money. But thats not enough. Private players historically have driven innovation: Thats been the case with UPI as well. But now that, atleast for the top apps, scale has been reached, customer adoption is there, for every additional innovation, be it on alternate forms of authentication (Mastercard launched “payments through palm scanners” at the Singapore Fintech Fest in 2024), new types of devices, and better infra, the concept of decreasing marginal utility kicks in. All of these solutions cost additional money, and eat into the already thinning margins of the payments industry. It slows down banks: if there’s no serious money to be made, they’ll move at their own pace.

Pricing is inevitable. It will have to come in, and as UPI takes a bigger share of the retail payments landscape, a “free method such as UPI” will not encourage, but rather, discourage innovation

Of course, that is the bet new UPI Apps are taking. That there will be pricing coming in. But it needs to come in sooner rather than later, because until then, UPI innovation will always be seen as a “customer adoption” tactic, rather than a money making tactic. And after the spectacular crashes of VC companies, who raised money on growth metrics, and were unable to back it up with sustainable financial metrics, everyone is looking very closely at the bottom line.

![[#37] Do all roads in fintech lead to license aggregation: Part 2](https://substackcdn.com/image/fetch/$s_!0EZL!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F2cc9aa1e-f79a-469c-9887-52c189f6637f_1634x918.png)

![[#38] Is the battle for the ubiquitous UPI app over? : What do the next few years look like for UPI Apps?](https://substackcdn.com/image/fetch/$s_!R6jp!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F698a0f5a-e30f-47a6-8be3-e000b9a13819_1600x892.png)

Definitely agree with your take. If banks are making money, it should flow to fintechs who make the UPI infra possible.

Here's the link of the episode: https://open.spotify.com/episode/2gqJNgxEa6nLMt5ZPCjXI7?si=7khjXDrdQl6-OskOL5WT1w

Heard this in one of Deepak Shenoy's podcasts (CEO of Capitalmind PMS) that UPI should be free because it enables banks to earn more float income. This additional income is more than enough to offset the costs to run UPI infra. Your take?

Great article, as always!