[#51] Decoding Fintech IPOs: Part 2 (India Focus)

The India markets are readying. themselves for the wave of fintech IPO's scheduled to hit in the next 1-3 years

In FY24 I had written about Fintech IPO’s and how the public markets are valuing fintechs at much lower multiples as compared to the Fintech IPO wave in 2021. Several highlights:

1. Almost all the fintechs that IPO’ed in the wave of 2015 - 2021, with the exception of Adyen, in FY24 were trading at revenue multiples lower than what they IPO’d at.

2. On average, the fintechs that IPO’ed from 2015 - 2021, took 8 years to IPO. If we look at start-ups who are expected to IPO in 2025 - 2028, these technically have already passed the 8 year mark. Even if we look at it from the perspective of IPO-ing 12 years after inception, only Razorpay, PhonePe, Revolut and Plaid seem to have not broken that deadline. And thats because instead of just top-line growth, there is increased focus on profitability, or atleast a path to it.

You can read the detailed article below:

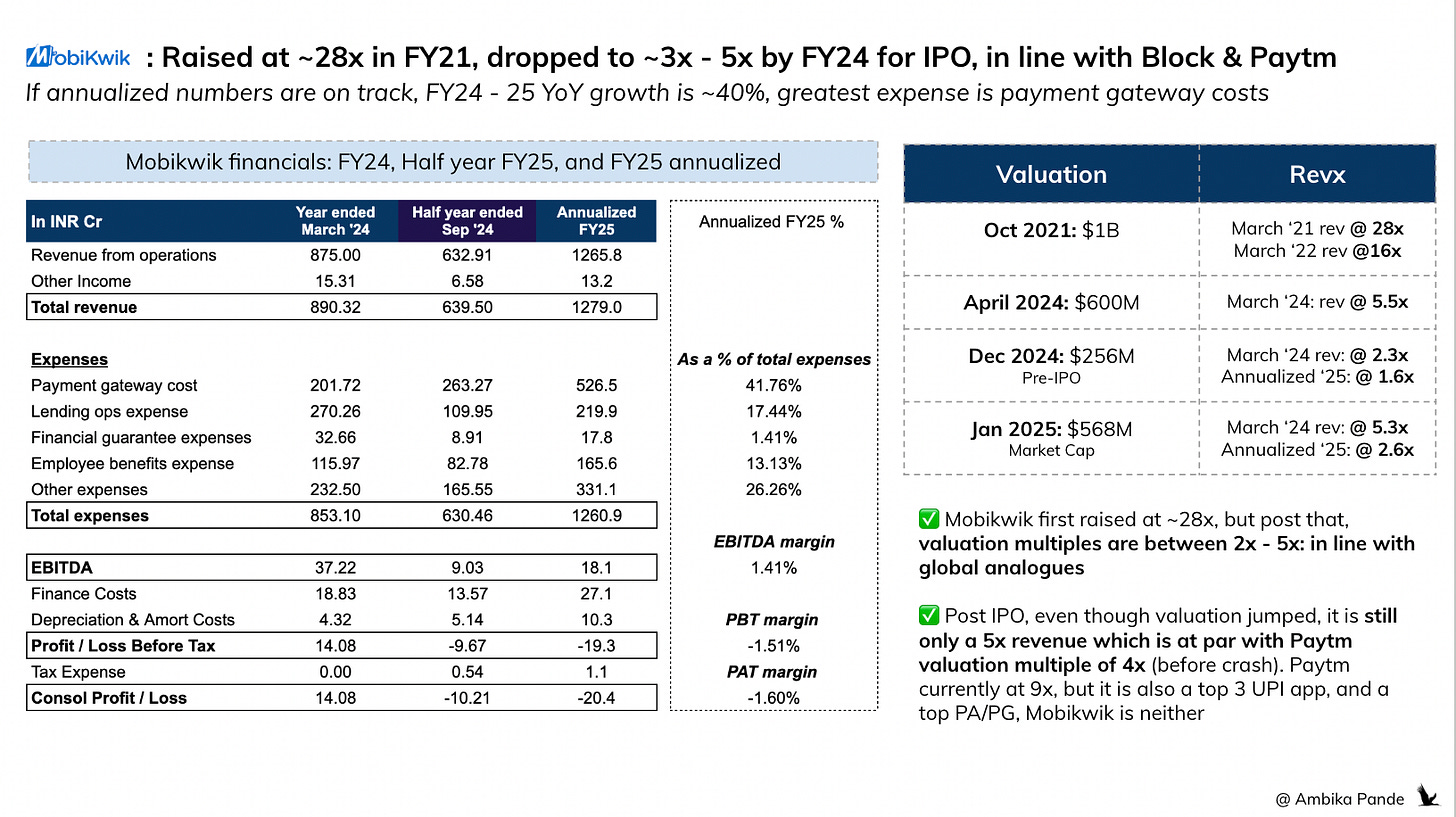

The only big Indian fintech that has IPO’ed has been Paytm, in 2021. Mobikwik, one of the OG fintechs IPO’ed in 2024, but this was after undergoing several valuation cuts. Which, we’ll deep dive into, in a bit.

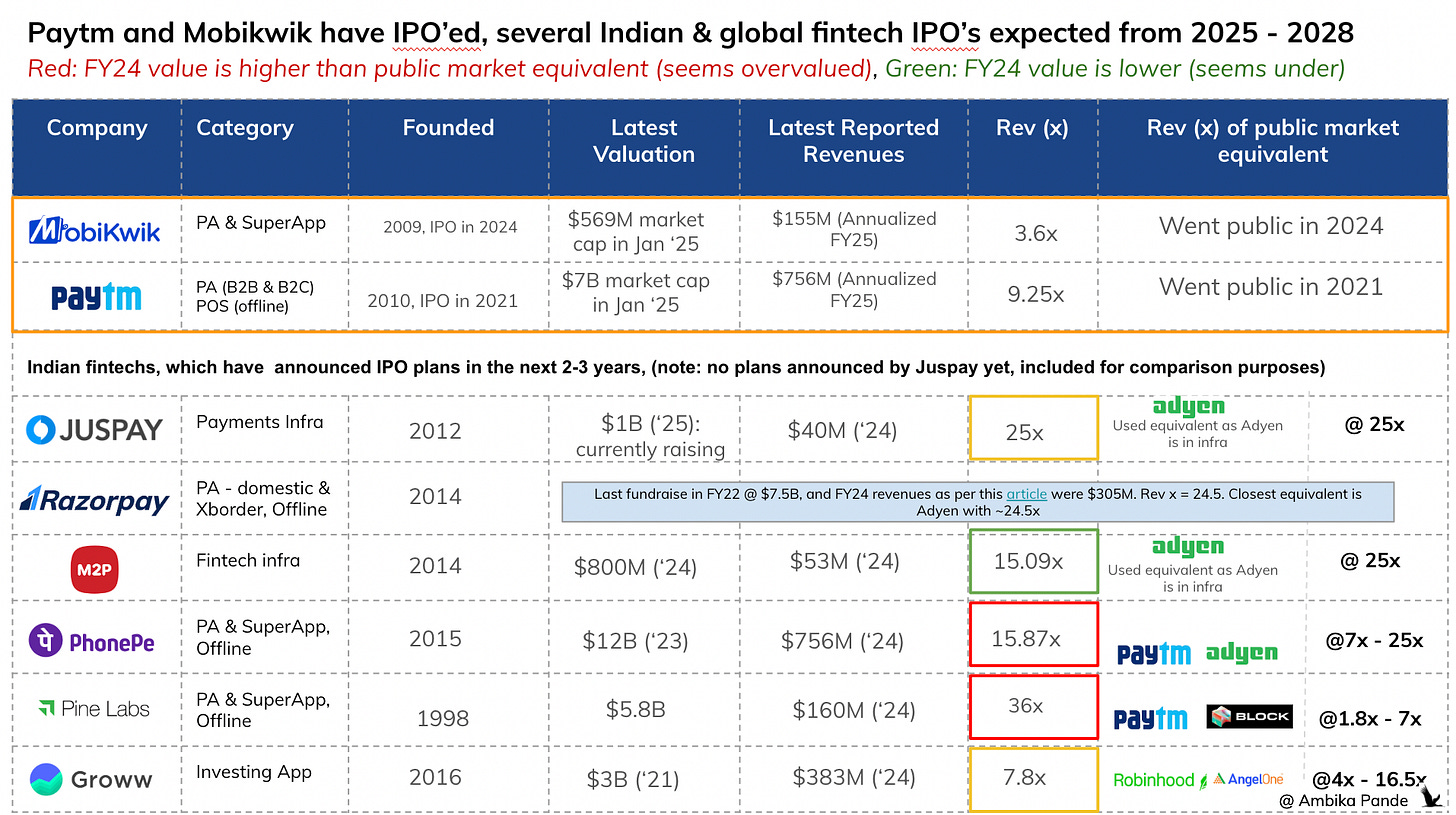

2025 - 2028 is when the “star” fintechs of India are expected to IPO: notably PhonePe, expected to be the blockbuster IPO, Groww, PineLabs, & Razorpay. Below is a snapshot of Indian fintechs projected to IPO, and their valuation, and revenue multiples in comparison to public equivalents, either Indian, or global.

Note: The public fintech multiples have been calculated basis market cap to net revenues. There isn’t visibility on if private fintechs have reported gross or net revenues. It’s possible that private fintech multiples are even higher than calculated, if the revenues reported are gross revenues.

Public Indian fintechs: Already IPO’ed

Paytm IPO’ed at a 55.6x revenue multiple in 2021! At revenues of ~$340M, it IPO’ed at a $19B valuation. And then it dropped to a 5x multiple right before the Paytm Payments Bank fiasco. It’s currently trending at a market cap of ~$7B, at ~annualized ~$1B revenue in FY25, so at a reasonable ~7x revenue multiple.

Mobikwik was valued at ~$1B in FY2021, at a 28x revenue multiple. Cut to 2024, where it underwent 2 valuation cuts before IPO, first to ~$600M in April 2024, which was a revenue multiple of 5.5x, and then to ~$256M in December 2024, which was a revenue multiple of 2.3x. This was in line with Paytm before its crash, and Block (a global equivalent), which is currently at 1.8-2x market cap to revenue). Yes, it rose post IPO to a market cap of ~$570M, but this was within a 2.5x - 5x range (depending on if you look at March ‘24, or annualized FY25 revenues). I’ve heard chatter saying, that Mobikwik performed really well at its IPO: it did yes. But this is in line with public equivalents, and this is after nearly a ~75% valuation cut.

I’d also say that unless they scale up / invest heavily on a couple of business verticals, and try to gain market share there, there could be limited upside here.

They are not a top PA, and their payment gateway costs don’t seem optimized: they’re at ~41% of total expenses. PhonePe in comparison has payment processing costs that contribute to ~15% of total expenses.

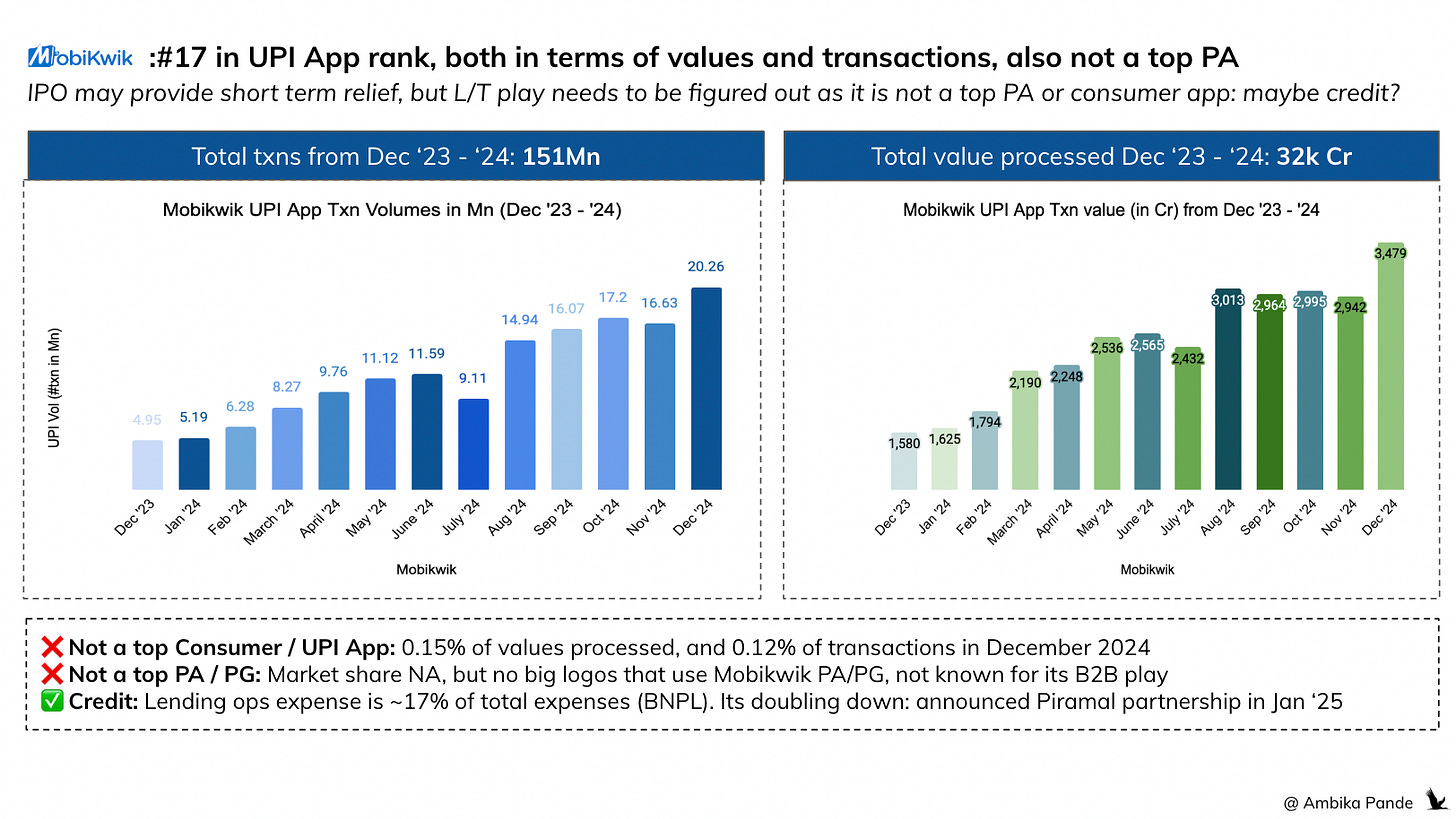

They’re not a top UPI App. They were unable to capitalize on the UPI boom, and transition from the wallet business to the real time payments business. They’re currently #17 in UPI Apps in India, processing ~0.15% of total value and transactions.

They seem to be doubling down on credit: they recently announced a partnership with Piramal, a leading NBFC to partner on unsecured lending. But unsecured lending is not very favourable in the current environment, because of the NBFC risk weights being increased.

Private fintechs, raising, or projected to IPO between FY 2025 - 2028

So there’s segment 1. Which has recently raised, or is raising such as M2P, or Juspay, is a few years away from IPO’ing, although they have announced IPO plans such as Razorpay.

Juspay: Technically Juspay hasn’t announced any IPO plans yet, but it is currently in the process of raising at a $1B valuation. Its last funding round was in 2021, where it was valued at ~$450M, in a deal led by Softbank. It’s probably raising to invest in its international plans, and to develop its PA platform, it acquired the license in early 2024. At $1B, at estimated ~$40M revenues, its at a 25x revenue multiple. There’s no exact equivalent to this, but Adyen, a global PA is a fair comparison, since it has a lot of infra plays. It’s on par with Adyen, at 25x. I would say, this may be overvalued a bit, since Adyen is present in almost ~100 countries, Juspay is still in the process of expansion.

Razorpay: Last raise was in 2022, at a valuation of $7.5B, and its revenues as per this article were ~$305M in FY24. This is a revenue multiple of ~25x, again, on par with Adyen. This is higher than Stripe, which is a private fintech, and a global equivalent. Quick calculations: Currently valued at $91.5B. In FY22 they had gross revenues of $14.4B. This was ~1.7% of total payment volume (TPV = $817B). If I do quick back of the envelope calculations, and take some assumption: in FY24 their TPV was $1T. 1.7% of this is ~$17B. Assuming their net revenues were ~50% of gross, this is ~$8.5B in revenue and ~10.76x in a rev multiple.

M2P: M2P recently raised ~$102M in September 2024, at a valuation of ~$800M for expansion plans. It’s reportedly also planning an IPO in 2-3 years. It’s at a revenue multiple of ~15x, with revenues of ~$53M in 2024.

Segment 2: Announced IPO plans, and will likely IPO in FY25 or FY26

In a reasonable valuation range, and seeing its scale, possibly undervalued

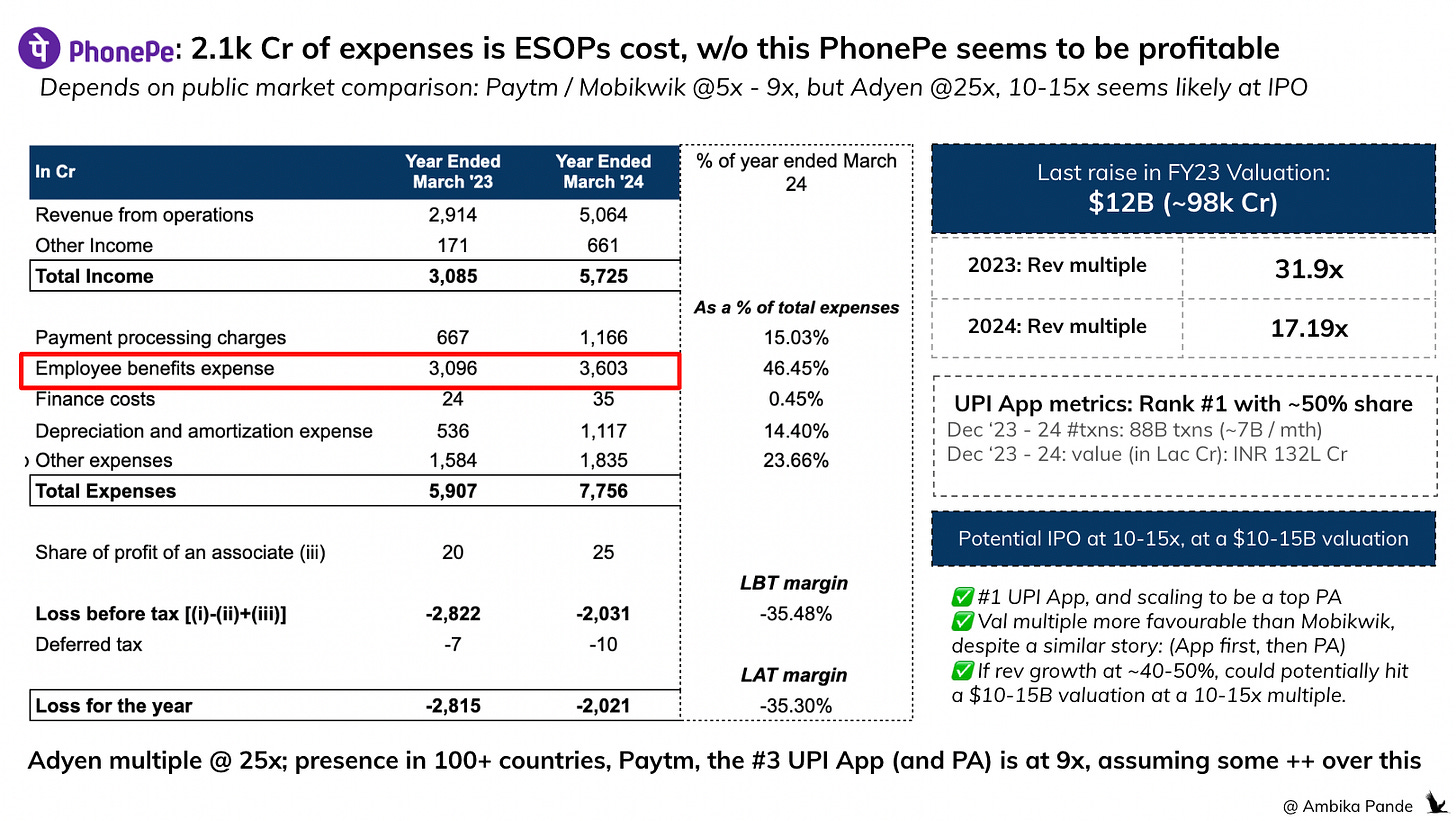

PhonePe is a big one. It was valued at a whopping $12B in its 2023 round, where it raised close to ~$1B. Its gearing up to IPO in the next couple of years. Its FY24 reported revenues were $756M, which is a revenue multiple of ~17x. I’d count its equivalent as Paytm, since PhonePe also started out as a consumer app, which then expanded in the PA business. And also Adyen, since Adyen is a global PA. While Paytm currently is at a revenue multiple of 7x, I’d say PhonePe is probably in the right valuation range, it is processing billions of transactions on the UPI side, almost ~7x volumes more than Paytm on a per month basis, and will probably get a premium for this.

Another reason why I think PhonePe, despite its valuation of $12B is not overvalued, is because its on the path to profitability: While it’s employee benefits expense is INR ~3600 Cr, 66% of this is actually the ESOPs cost. Without this, it profitable at about ~172 Cr. It’s revenues increased by ~74% from FY23 - 24. It’s also a top UPI App, processing 50% in both values and transactions. So that gives huge opportunity to

1) cross sell multiple products, which it has already started doing (insurance, loans etc), and 2) If tomorrow monetization comes in on UPI, which it should, if you compare UPI to international equivalents such as Pix, which charge ~0.2-0.3% MDR per transaction, I see the revenues & profitability sky rocketing.

In FY24 - 25, if revenues grow by another 40-50%, it could potentially IPO at a $10-15B valuation, at a 10-15x multiple. And I say this conservatively. It’s possible it lists at a multiple even higher than this.

Update as of March ‘25: It’s eyeing a target valuation of $15B, so above assumptions seem to be in the right direction

Valued on par with public (and private equivalents)

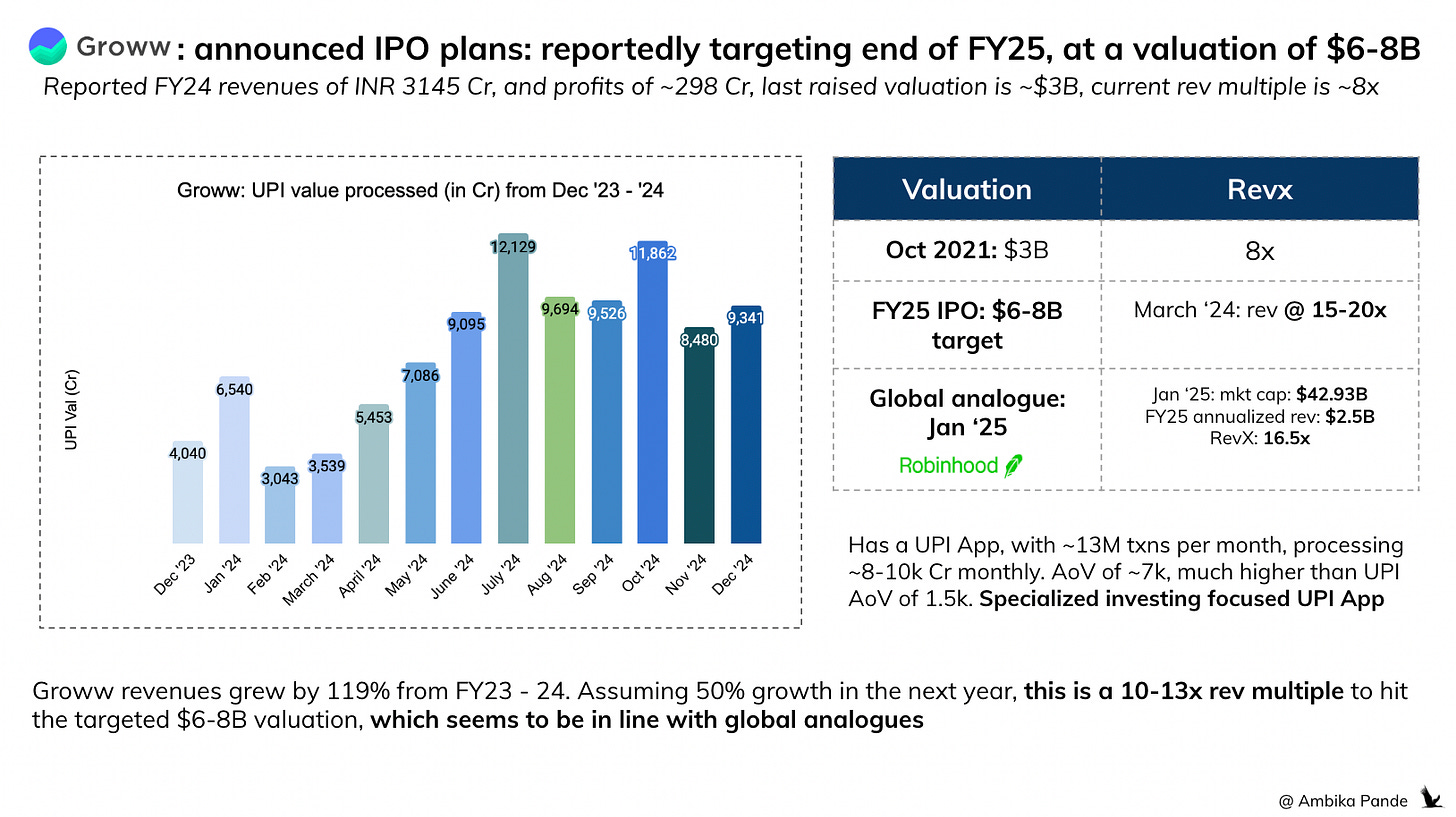

Groww is currently valued at ~$2-3B, with FY24 revenues of ~$383M, which a revenue multiple of ~5 - 7.8x. (Multiple depending on if its $2 or $3B, reportedly post reverse flip, its valuation was cut by ~30% from $3B to $2B) It’s also profitable to the tune of ~$40M, so it may get a premium for this, its looking to IPO at a $6-8B valuation in early FY26. Angel One is a public equivalent, which is at a curent market cap of $2.7B, and annualized FY25 revenues of $681M, which is a revenue multiple of ~4x. Meanwhile, a global example: Robinhood, is at a $42B market cap, with ~$2.5B in revenues; so a ~16x revenue multiple. Zerodha is another comparable, but it hasn’t gone public yet: Reportedly Zerodha is at a ~$7B valuation, at close to ~$1B revenues, so Groww seems to be in the ballpark of what equivalents are valued at.

Groww revenues grew by ~119%. Assuming it grows even 50% in the next FY, this is a 10-13x revenue multiple to hit a ~$6-8B valuation. This is in line with Robinhood, which is a US based investing app, but slightly higher than Zerodha & Angel One. However, one thing that Groww has, that these other players don’t is a UPI App. While its #18 in terms of #txns processed, at ~13M per month, this is also because it seems to have carved out a niche for itself within UPI. It’s AoV is ~INR 6-7k, which is the AoV of a monthly SIP. It’s processing close to ~INR 8k - 10k Cr every month, and is the #8 UPI App in December 2024 in terms of values processed. It also is an NBFC, and reportedly has a loan book of ~$115M as of June 2024; it provides personal loans of upto INR 10L, and charges ~13-48% interest p.a. These other streams of revenue (and of course the potential of UPI monetization at some point in the future) is why I’m bullish about Groww, and feel it’s probably valued at a reasonable multiple range.

Overvalued: Muted revenue growth, and growing losses.

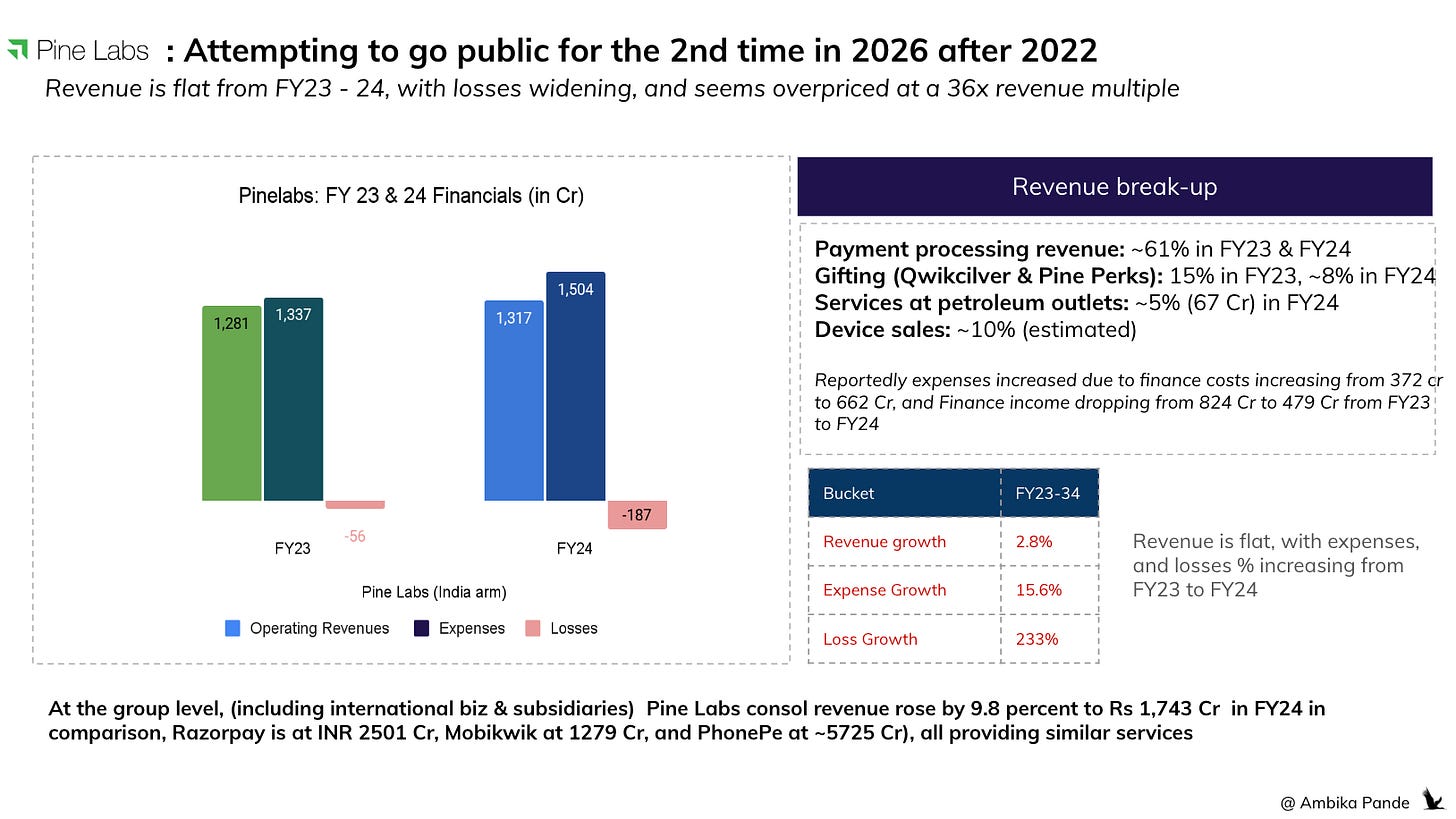

Pinelabs, was offline first. It’s a top player in the offline payments POS business, but still scaling on the online side. It’s got an online PA business called Plural, a consumer app called Fave, and an Account Aggregator and infra arm called Setu. It’s valued at $5.8B, with ~$160M revenues in FY24, which is a revenue multiple of ~36x. I’d say its overvalued.

Several reasons for this.

1) Its a market leader in the offline segment, not online. Online is usually easier to scale globally, while offline depends a lot on the local customer behaviours, and on ground payment preferences. Plural, its online PA, in my opinion, has not scaled much.

2) Unlike the others: PhonePe, which is on the path to profitability, and is arguably, the most scaled up fintech in India, and Groww, which is profitable, Pinelabs is not. In fact, its revenue grew only by 2.8% from FY23 - 24, and its losses have increased. In fact, its gifting segment: Qwikcilver contributed to ~111 Cr worth of revenue in FY24, versus ~INR 200 Cr in FY23. Qwikcilver is (or was) reportedly a market leader in the loyalty segment. Apparently it’s not being able to double down here.

What Pinelabs does have going for it is that it has the potential to do a lot. Its in the right place with all its licenses: It’s a PA, it has a PA-CB (cross border payment aggregator license), it has an AA license (through Setu), it has a consumer app business (through Fave App), and it has a PPI license (through its acquisition of Qwikcilver).

And maybe thats a way to measure the “potential” of a fintech. See how many licenses it has. But that cannot be a valuation input: execution matters. You can check out my piece on fintech license aggregation here:

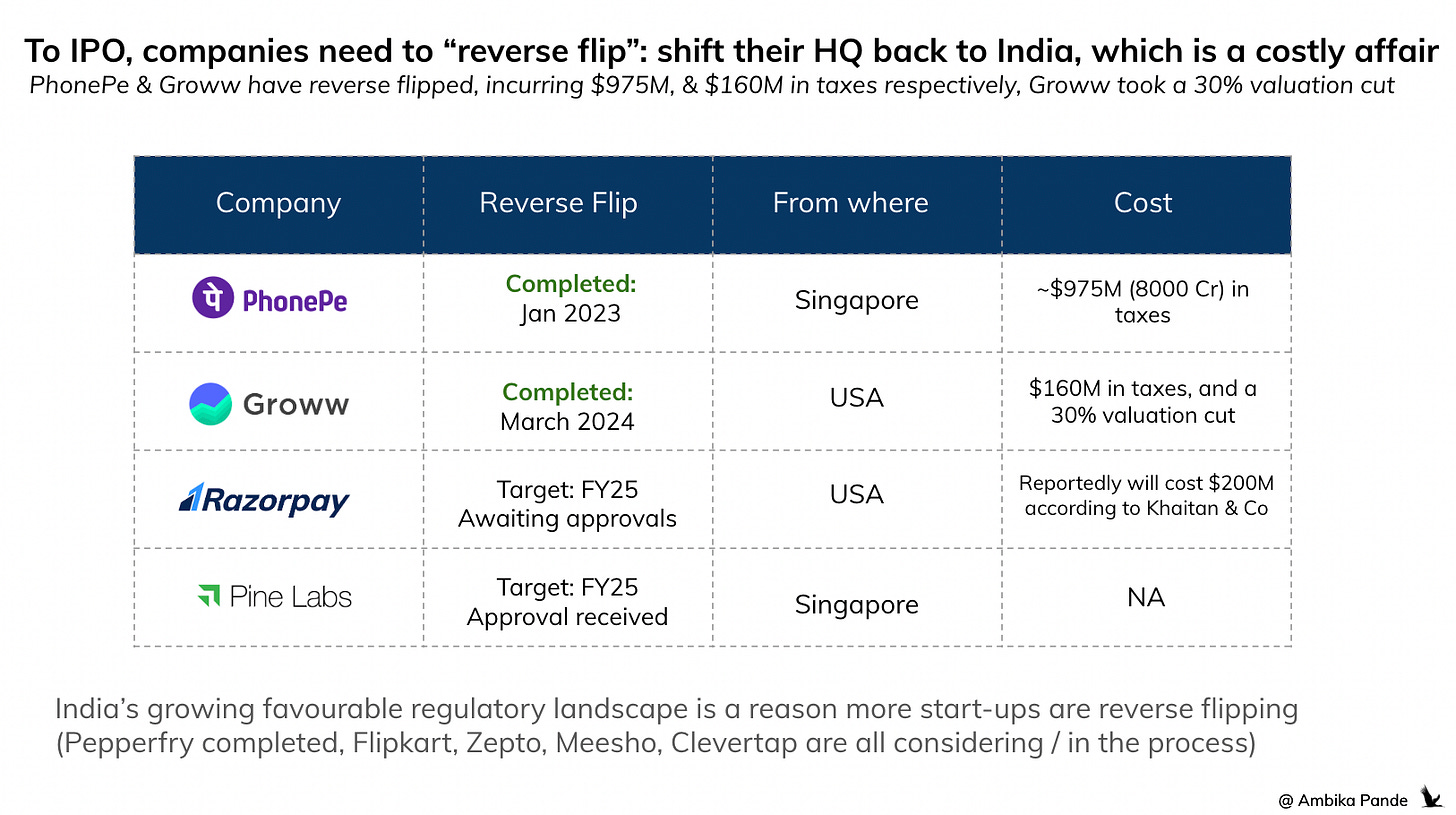

To IPO there is also a reverse flip angle, that is costly, both from a time & money angle

A lot of Indian companies, were headquartered in the US, but to list in the Indian market, they need to shift their legal registration back to India. This is a process that can take 6-18 months, but apparently now its faster.

Historically, merging an overseas entity with an Indian firm required approval from the RBI and the National Company Law Tribunal (NCLT), which was what took 6-18 months. The 2024 amendment, removes the need for NCLT approval, allowing a faster, simplified cross-border merger process between a foreign holding company and its Indian subsidiary. This only requires RBI approval, significantly reducing the time and complexity involved.

While PhonePe and Groww have completed their reverse flip, it cost them close to a $1B and $160M in taxes respectively. And according to this source, when Razorpay completes its shift from the US to India, it’ll cost ~$200M in taxes. And this is relevant to non-fintechs as well, companies like Clevertap, Meesho, Kreditbee, Eruditus, Zepto, Flipkart, and Khatabook are reportedly considering similar moves.

Going forward, its very possible that we see less companies incorporating overseas, and choosing to incorporate in India, to avoid this cost later.

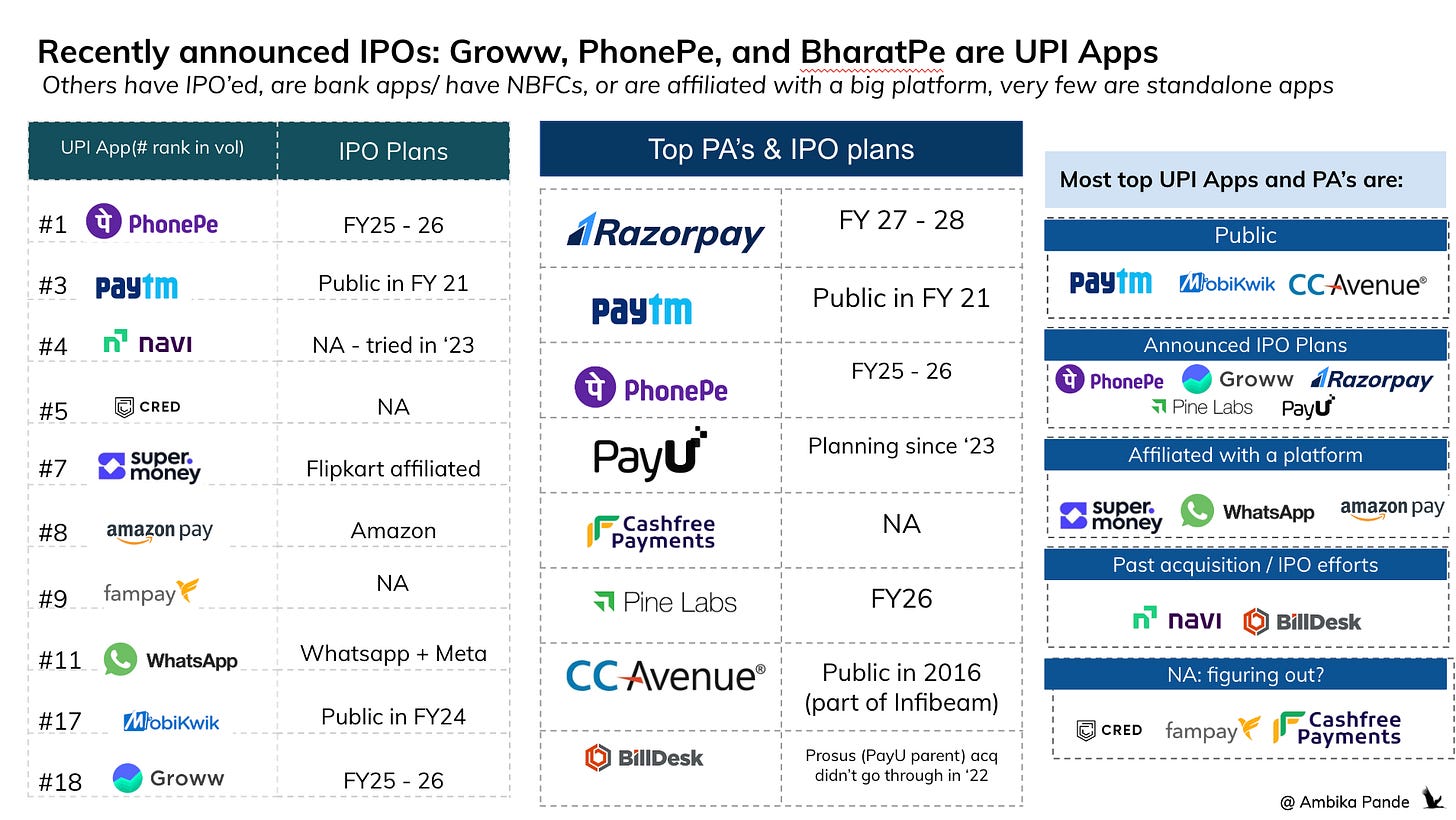

Most top UPI Apps & PA’s are on the road to IPO, or are affiliated with large platforms: others may be fundraising, or hoping for some sort of consolidation

UPI Apps: PhonePe is on the road to IPO, and Paytm has gone public. Gpay is obviously a part of the bigger Google unit. Navi tried to IPO in FY23. Super.money (Flipkart), Amazon, and Whatsapp are all affiliated with platforms.

The apps left, atleast in the top 20 are CRED, which while is playing the license aggregation game, has not announced any IPO plans as yet, and still seems to be trying to figure it out. The other is Fampay, which is a UPI app for “teenagers.” And any app that is not in the Top 20 is probably ripe for some sort of consolidation opportunity by a bigger player looking to get into consumer payments: Kiwi, Jupiter, Slice could all be possibilities here.

PA’s: Only Cashfree hasn’t really announced any IPO plans yet. Billdesk as well: but there was an acquisition attempt in 2022 by PayU that didn’t go through. Razorpay, Phonepe, PayU, CC Avenue are all either public, or are planning for an IPO.

Edit: 7th April 2025

1. Cashfree closed a ~$53M funding round in Feb '25, which valued it at ~$700M. In FY24 its revenues were INR 642 Cr (which is ~$76M). The revenues mentioned were stated as "revenue from operations" so I'm going to assume this means net revenue. So the (net) revenue multiple here is of 9.21x.

2. Easebuzz has raised funding of ~$30M in a Series A round led by Bessemer that valued them at ~$200M. Their gross revenues are reportedly ~INR 650 Cr (which is ~$77M). And the net revenues are ~$35M. So at a (net) revenue multiple, this is a ~5.7x multiple. Gross revenue multiple is obviously lower at 2.59x.

Update as of March ‘25: CCAvenue’s parent company acquired a 54% stake in the internet business Rediff Pay in August ‘24, and has received a TPAP (UPI App) License from NPCI in February 2025.

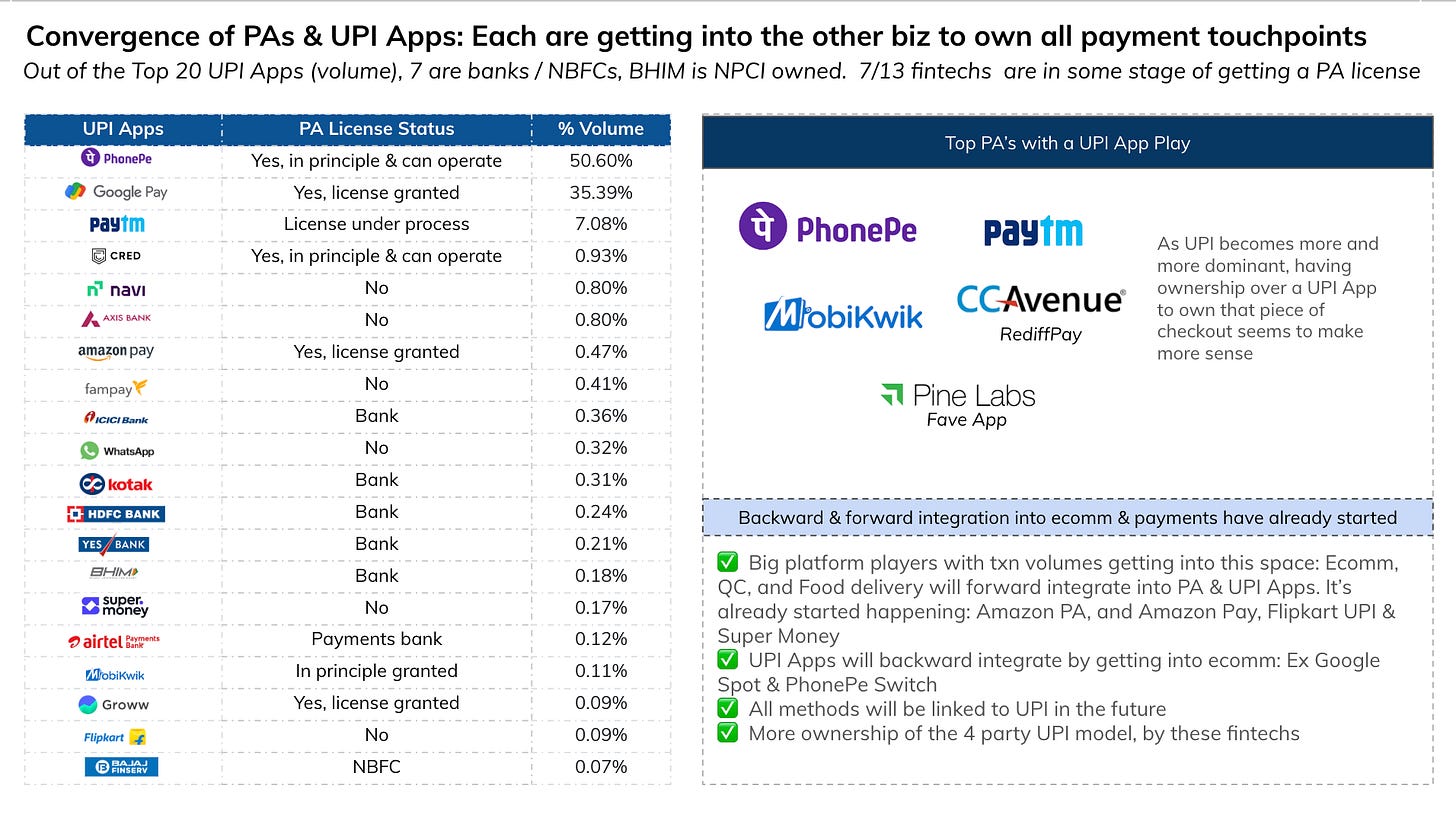

I had written in October ‘24 about how there seems to be convergence of UPI App & PA entities, with each getting into the other: PhonePe, Paytm, Cred, Gpay, Groww all are UPI Apps, and PA’s. I had talked about how my expectation is that this will continue to happen and that seems to the the case. You can check out the article below, and a snapshot of the status of PA licenses for different UPI Apps.

The Indian fintech ecosystem is maturing, and the upcoming IPOs are a sign of that.

And how these fintechs grow sustainably, and hopefully IPO in the next few years will inspire the next wave of fintech innovations & start-ups.

![[#24] Decoding Fintech IPOs - what does the market say about fintechs?](https://substackcdn.com/image/fetch/$s_!4SqL!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fdef88b7a-0b57-4956-a0fc-053252eaa333_1790x1006.png)

![[#37] Do all roads in fintech lead to license aggregation: Part 2](https://substackcdn.com/image/fetch/$s_!0EZL!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F2cc9aa1e-f79a-469c-9887-52c189f6637f_1634x918.png)

![[#38] Is the battle for the ubiquitous UPI app over? : What do the next few years look like for UPI Apps?](https://substackcdn.com/image/fetch/$s_!R6jp!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F698a0f5a-e30f-47a6-8be3-e000b9a13819_1600x892.png)

Amazing read!