[#56] FY25 Budget Implications on UPI (Part 1): MDR on regular UPI transactions is now essential

The FY25 budget has reduced UPI incentives to ~437 Cr, from 2k Cr in FY24, and credit is a fair bit away from paying for the ecosystem. MDR pricing on regular txns is needed to sustain the ecosystem

The FY25 - 26 Budget for India was presented on 1st February 2025. And it came with some interesting developments for UPI. A couple of things drew my attention, and it's something that could impact the ecosystem. They were:

UPI incentives slashed from INR 2k Cr in FY24 to INR 437 Cr in FY25: To promote low-value transactions ( < INR 2k) on UPI & Rupay, the government came up with an incentive scheme and has been setting aside a budget to financially incentive stakeholders over the past few years. In FY24, this was initially INR 1441 Cr, which was then increased to INR 2k Cr. For FY25, this has been drastically slashed by ~80%, to INR 437 Cr!

SEBI has proposed increasing daily transaction limit on capital market transactions from INR 2L to INR 5L: While in August 2024, certain categories, such as tax payments, payments to hospitals and educational institutions, and IPOs had a cap of INR 5L, capital market transactions such as mutual funds and stock trading was still capped at INR 2L. Now SEBI has proposed to increase this. (but the implications of this I’ll be discussing in the next edition of this newsletter, so please do subscribe and stay tuned!)

And this was something I was discussing with Fareed Ahmed (GTM & Product, UPI @ Razorpay, here’s his Linkedin)

Let's unpack the first one

#1) UPI Incentives slashed from INR 2K Cr in FY25 to INR 437 Cr in FY26

Incentives being slashed can mean two things. Either the expectation is that

The ecosystem starts sustaining itself through the priced products on UPI, such as Credit Cards / Credit Lines / PPI OR

MDR is coming in on regular transactions

According to this source, at current scales, the cost of 1 UPI transaction to the ecosystem is ~INR 0.4 or 40 paise. As of January 2025, at a scale of ~17B transactions per month, this comes to INR 676 Cr per month. And as scale increases, the costs per transaction will decrease, but the overall costs will increase, because of the greater number of transactions: UPI is projected to power 90% + of all digital payments by FY2027, we currently sit at ~83%.

The key question here is: while NPCI charges banks membership (it reported a surplus of INR 1134 Cr in FY24), banks can earn some money through float income, and obviously through their other lines of income, credit cards, lending, savings accounts etc, how do the UPI Apps, and the third party players (such as PAs) actually drive adoption and innovation on UPI? UPI had been around for a while before, but banks never really got into it, until players like PhonePe, Gpay and Paytm came in, and drove customer adoption. Even now, if you look at the top apps, in terms of transactions and value, most of them are fintechs. So how are they being compensated here?

The fact that incentives are being slashed is a positive: it could mean that somewhere the expectation is that UPI will start paying for itself

Let us look at the first option, that I had mentioned earlier. One expectation is that The priced instruments on UPI, such as Credit Cards / Credit Lines / PPI will be able to subsidise the regular savings account transactions, which can continue to be free. But is this even possible?

Since Credit Lines on UPI haven’t really scaled, and I question the use case of PPI (apart from things such as expense / spend management as

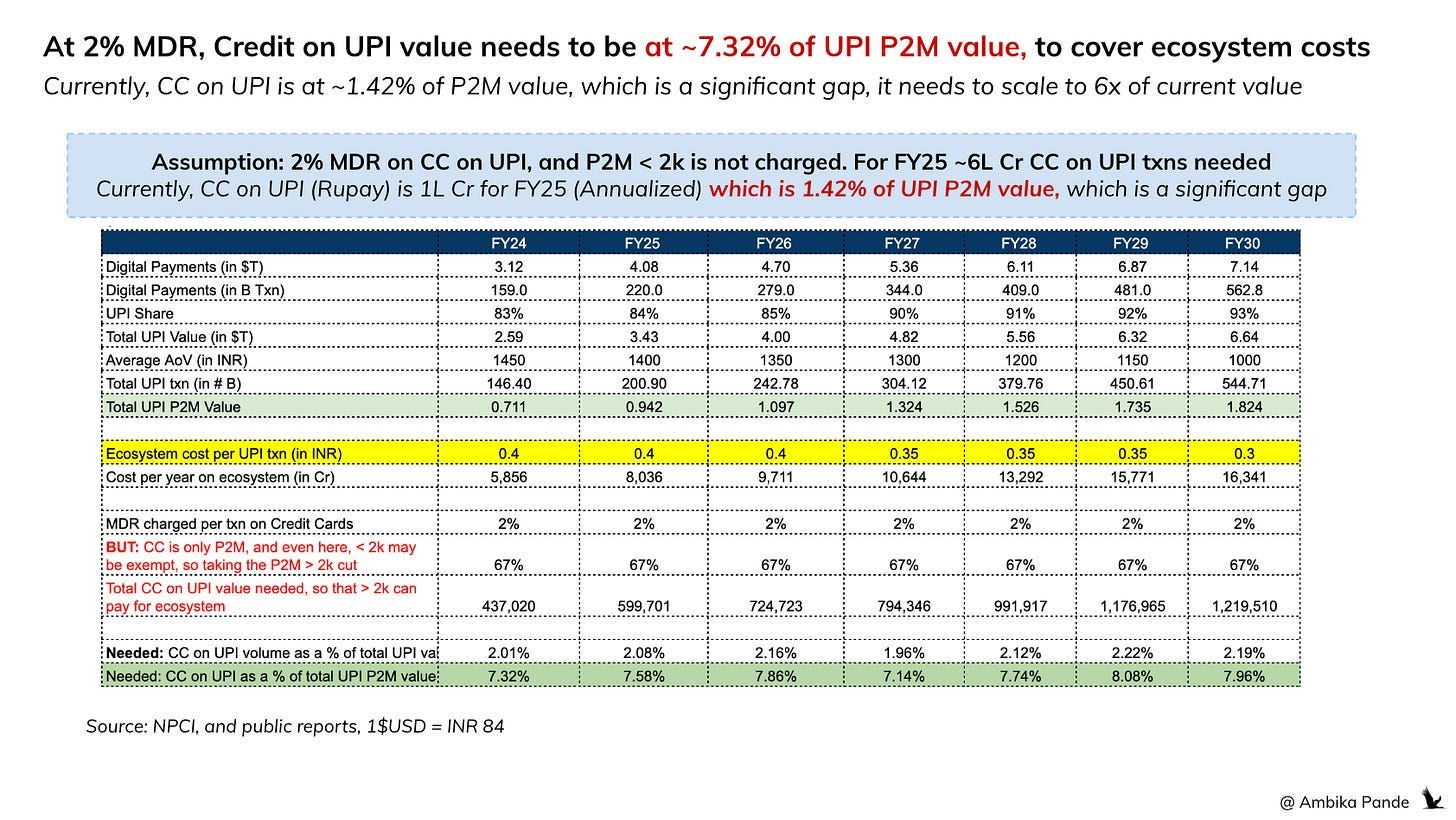

At 2% MDR, and assuming that only P2M txns > INR 2k will be charged, CC on UPI transactions need to drive a value of ~INR 6L Cr in FY25.

If we just do some quick math, the FY25 ecosystem cost of all UPI transactions is ~INR 8k Cr. (this is at a per transaction cost of Rs 0.4). And the MDR charged on CC on UPI transactions is 2%. The current break-up of P2M transactions attributed 67% of the value processed to transactions with a ticket size of > INR 2k, and I’ve assumed that to be the case for CC on UPI transactions as well. Back calculating this: the FY25 CC on UPI transactions needed to be INR 6L Cr, scaling up to INR 12L Cr in FY30.

And since all CC on UPI transactions are P2M, as a % of the UPI P2M value, this comes to 7-8%.

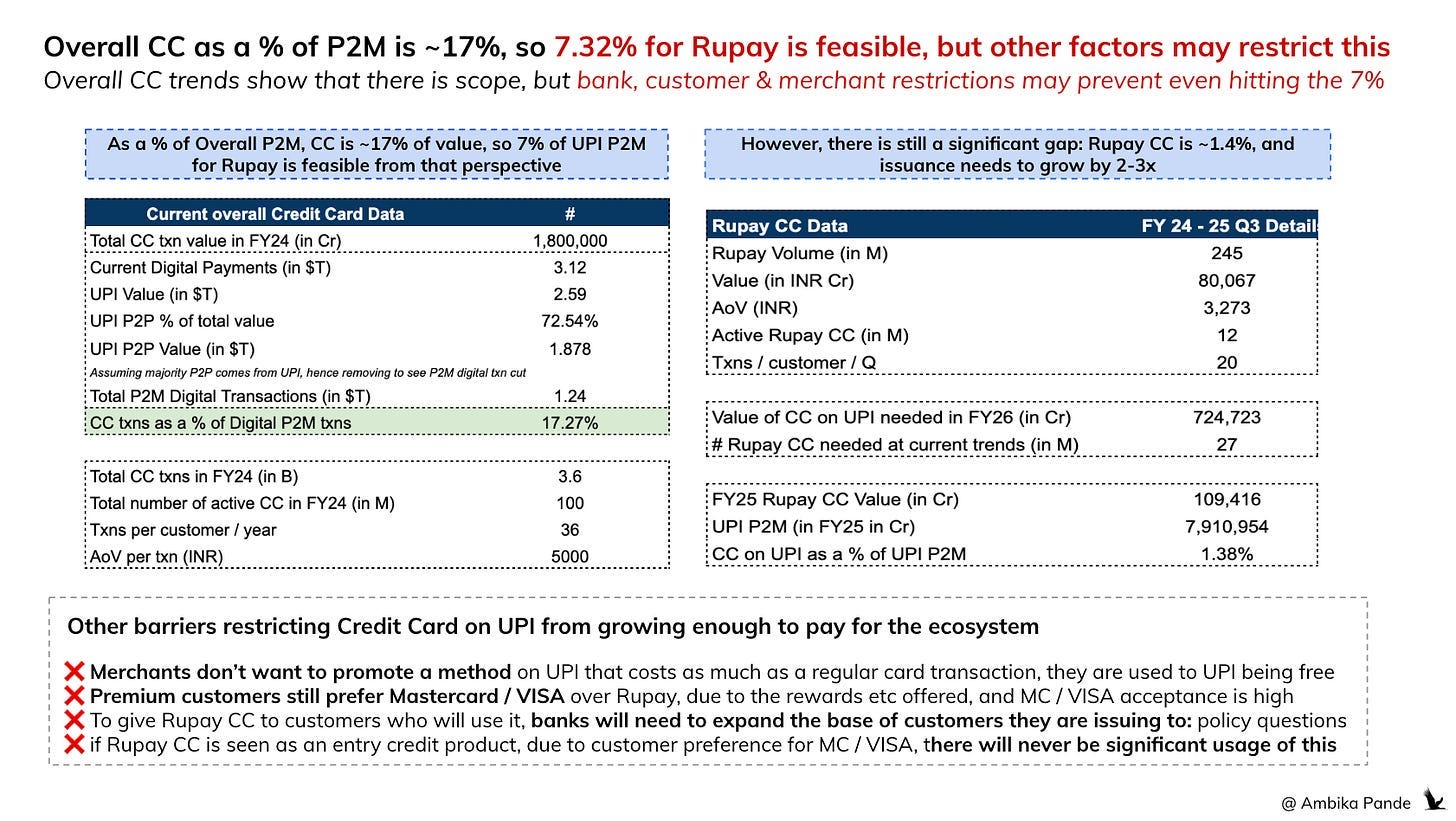

Doesn’t seem too bad, does it? And the fact that current overall Credit Card value (including Mastercard / VISA) is ~7% of total Digital payments, and ~17% of total P2M, there is feasible

The challenge here is that while it is feasible from a “potential perspective” if we benchmark it to current trends in the overall credit card market, there are other things that will be a barrier to this.

Let's look at the math first. The total Credit Card transaction value in FY24 was INR 18L Cr (~$214B). And the FY24 digital payments volume was ~$3.12T (The metrics are different, but I've done the conversions before calculating the % so don’t worry). Since the digital payments value includes the UPI P2P value as well, I’ve removed that from the overall Digital Payments to come up with a more appropriate P2M value number for the overall market. Since UPI values are ~83% of overall payment values, and P2P values are ~72%, I’ve taken those cuts, and then removed it, coming to a total P2M digital transaction value of ~$1.24T. Overall Credit Card transactions as a % of total digital P2M value (in Cr) comes to ~17.27%.

This number doesn’t seem too crazy, especially if I compare it to US numbers. According to this source, in FY24, 32% of total digital payments happened through Credit Cards. In the US, ~82% of people have a credit card, and only 4.5% are unbanked, so it's a more mature market. In fact, I’d expect the digital transaction attribution to credit cards to be higher, but digital wallets seem to be all the rage, such as Venmo / Applepay or GooglePay. However, a point to note here, is that all these digital wallets save cards within the wallet, and allow for quick scan & pay or tap & pay payments, so through indirect attribution, the credit card transactions in the US will probably be higher. But I digress.

Credit Cards on UPI in India though still have a long way to go: As a % of UPI P2M value, currently we’re only at ~1.38%. This needs to scale to ~7.3% for it to pay for the ecosystem

FY25 Rupay credit card value (annualized) was INR 1L Cr. And the total number of active cards are 10 - 12M. For this to scale to a 7% number, at current trends (AoV of ~INR 3k, and txns / customer/year is at 80) the number of issued cards needs to more than double, from 12M today to 27M in FY26. And by FY30, this number needs to be at ~50M issued Rupay Credit Cards.

As a market, there are a total of 100M credit cards issued as of today, majority of them being on VISA & Mastercard. Rupay has ~12% market share on this.

The problem here is that to scale credit cards on UPI in India, there are multiple moving pieces, and stakeholders who need to agree to this

Problem 1: Merchants. They’re used to UPI being a free method, and by enabling a Credit Card on UPI method that requires them to pay 2% MDR is not something they’re too keen to do. And while studies have shown that customers who pay with credit have increased AoV (1.2x) and frequency of transactions (1.5x), most of them are not as convinced by this story. But this is something that is solvable in my opinion: It’ll be driven by customer behaviour. The more customers use a credit card on UPI, the more likely they are to choose NOT to purchase if this isn’t an option, so as customer behaviour leans more towards a credit on UPI method, merchants have no choice but to enable this.

Problem 2: Customer preference is a question here. This is my own opinion, but most customers, given the choice between a Mastercard (MC) and a VISA and a Rupay, will pick the MC / Visa card. It’s still seen as a more premium card. Most customers are taking this card as an add on, and bulk of the purchases are still happening on MC / VISA card. It's possible that most customers see this as an entry level credit card of some sort, and then when they get a chance, switch over to a more “premium” one. To actually be able to drive usage, and spends on Rupay, banks need to 1) Position these cards as premium, and they still have a way to go here or 2) give Credit Cards on UPI to a new base of customers, which comes with policy issues. That was what Credit Lines on UPI aimed to solve, but there hasn’t been much movement here.

Problem 3: Banks need to be able to give this Rupay Card to customers who will actually use it (as mentioned earlier). This could mean opening up a new base of customers. It’s a work in progress, and banks are notoriously slow. However, banks are getting around this by giving FD backed cards: SuperCard by Super Money is one example, and reportedly Stable Money is coming out with one too.

Does Credit Card on UPI have potential? Absolutely. But it’s not going to be quick. And there’s another angle here. 82% of the US adult population has atleast one credit card, which drives ~32% of digital transaction value. 3 - 5.5% of the adult Indian population has a Credit Card. So just from a credit card penetration perspective, we have a long way to go.

A way this could work though, is if NPCI allows Mastercard and VISA cards to be linked to UPI rails. Then suddenly, majority of card spends can go through UPI, and MDR earned on these transactions can be distributed among stakeholders. The problem here is though, the day Mastercard and VISA can be linked on UPI rails, Rupay’s game is over. This takes away the differentiation that Rupay has, and essentially kills their game. Hence it’s unlikely that MC & VISA cards can be linked to UPI rails anytime soon

Based on this, CC on UPI paying for the entire ecosystem looks tough, so some sort of MDR will have to come in on regular UPI transactions

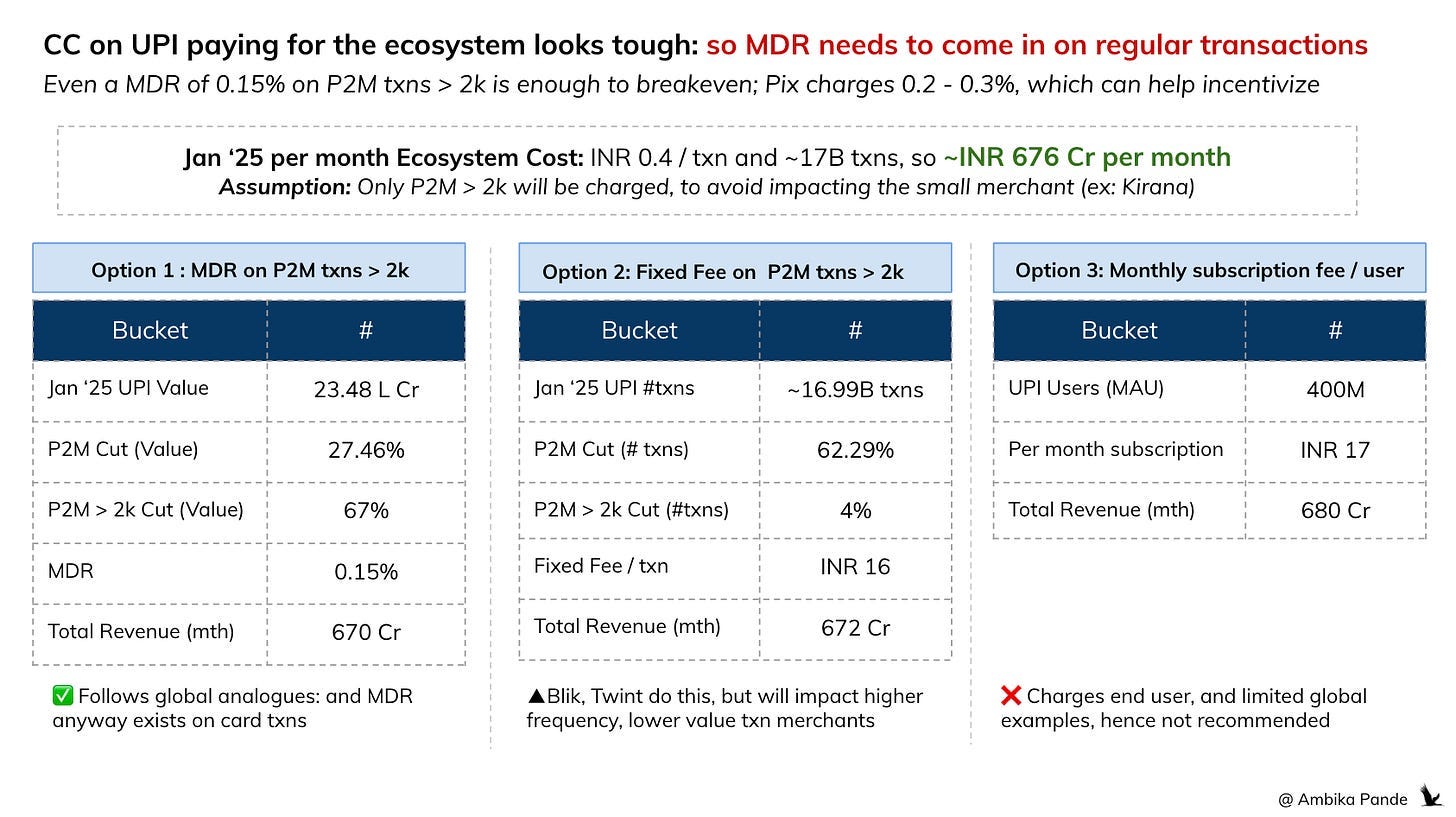

The January 2025 UPI ecosystem cost was approximately ~ INR 676 Cr based on assumptions taken. There are a few pricing models we can follow here. The caveat here is that small merchants should not be impacted, and assuming most small merchants have transaction amounts of < INR 2k, so only txns > INR 2k will be charged.

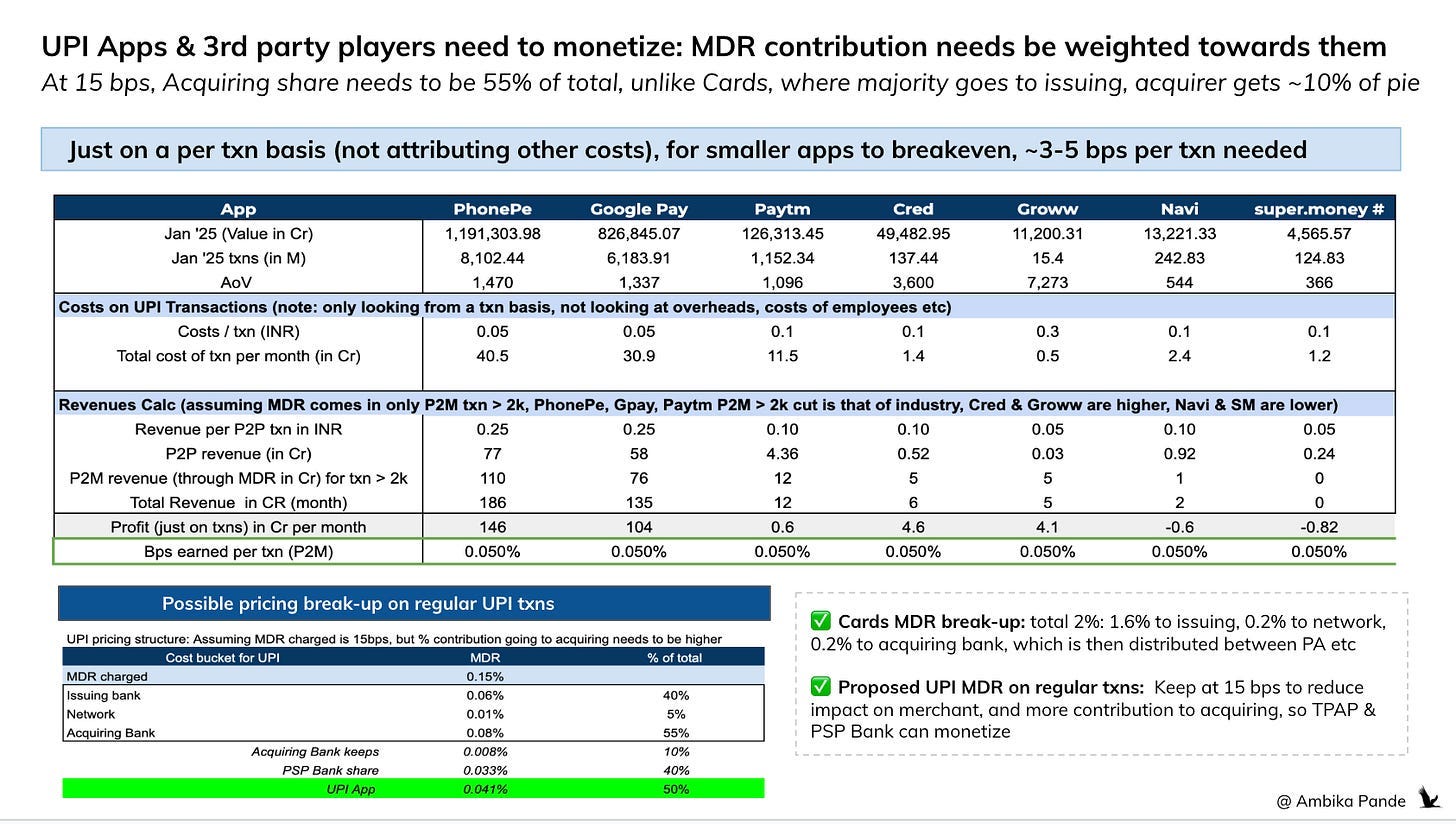

Refer to the image above for the calculations

I’ve also written an article in the past on pricing on UPI, you can check it out below:

Here are some options on how pricing can happen on UPI transactions:

Option 1: MDR on P2M transactions > INR 2k:

This is the recommended solution. It's a charge that already exists on other payment methods, and merchants, banks, and other stakeholders know what to do with it. Based on the cuts taken (P2M as a % of total value, and > 2k), to cover monthly costs at current scale, an MDR of 0.15% would be enough to breakeven.

Option 2: Fixed Fee on P2M transactions > INR 2k

This is a model followed by some UPI equivalents such as Blik (Poland) and Twint (Switzerland). Blik charges the merchant $0.1 - $0.75 / txn, and Twint charges CHF 0.3 (Swiss Franc) + 1.3% MDR per transaction. If we take the relevant P2M cuts on # txns, then at the current scale, this comes to INR 16 per transaction. It’s on the higher side, and that's also because the majority of P2M transactions are < 2k. If you look at the number of transactions, only 4% of the total number of transactions fall in the > INR 2k bucket.

And the problem with this is, this would really impact your high frequency, lower AoV merchants, like say, a D2C apparel brand, which would end up paying much more relevant to a merchant with a higher AOV, but lower frequency (such as luxury brands).

Option 3: Monthly subscription fee paid by the end user

Anything that requires the end user to pay isn’t that great, because its not great for adoption. But since this idea keeps getting thrown around now and again, I’ve taken a look at what this would be. If we assume 400M users on a monthly basis, at an ecosystem cost of INR 676 Cr, each would be required to pay a monthly subscription of INR 17.

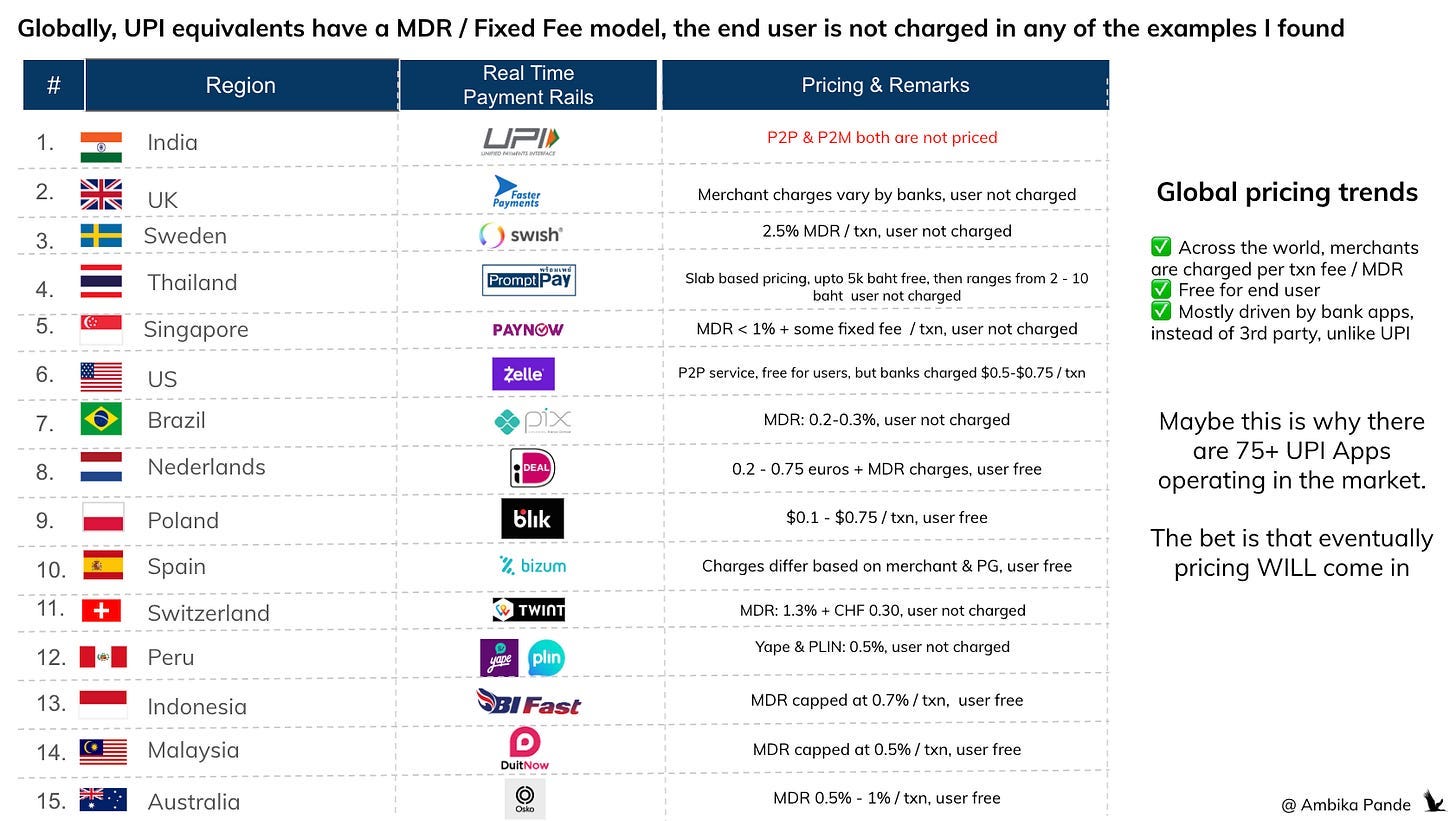

This is not recommended, and as far as I can tell, there is no global analogue for this. There are slab-based pricing models, fixed fee, and MDR, but very limited charge to the end user. You can check out the below examples of global Real Time Payments (RTP) and pricing:

And there’s another angle here: even at 0.15%. MDR, the % contributed to stakeholders needs to be in line with costs incurred

Pricing on cards is pretty standard. The MDR charged to cards is 2%. Out of this 1.6% goes to the issuing bank (which is the customer bank), 0.2% goes to the network (Mastercard, VISA, Rupay), and 0.2% goes to the acquiring bank. The acquiring bank share is then given to the relevant third party players: could be Payment Aggregators for example. For more details on card transactions, you can check out my article below:

The point being, that in a UPI transaction, you’ve got the UPI Apps & PSP banks that need to be compensated in accordance with costs, so at least they don’t lose money doing this. Bringing monetization here will also make the market more competitive: NPCI has been pushing the 30% market cap on UPI market share deadline from 2020. The deadline has now been extended to December 2026, and it’ll probably be extended further, if we look at current trends.

Because of the limited monetization angle, for years the experience on UPI has been stagnant on UPI Apps, because there is no major improvement or real enhancement happening as there is no major incentive for new players to innovate. And there’s a reason Mastercard and VISA are at the forefront of innovation (investing in new methods of authentication, cross border rails, blockchain technology and so on). Visa made ~$20B of profit in FY24, its share of MDR is ~0.2%. (of course, this includes its other revenue streams as well, its’s not just a payment rail anymore).

So, 2 options here: Either the MDR is increased, and the % to each stakeholder is kept the same as a card transaction, so that UPI Apps, PSP Banks, and other 3rd party stakeholders have enough margin to play with. But this will impact merchants.

Or, and this is a better option, just change the contribution % of each stakeholder.

Based on a directional calculation of the costs and revenue of UPI transactions from some of the top UPI fintech Apps in India as of January 2025, UPI Apps need to earn ~5 bps per transaction so they don’t atleast lose money on this (at scale)

The costs per UPI transaction to the UPI App can range from INR 0.05 to INR 0.8, depending on the scale, and the tech stack. (Again, these are estimates, so don’t hold me to this).

And from a revenue perspective, UPI Apps can make money through the remitter (another name for the issuing/customer bank) which pays them per P2P UPI transaction (Reportedly a larger UPI App gets paid INR 0.25 per P2P transaction from the remitter, there’s an excellent report I can DM anyone who is interested), or through MDR - if it comes in. Right now there’s only the budget incentive, which has also been slashed to 437 Cr for FY25. And looking at a per UPI txn cost to the ecosystem of even INR 0.1 (right now according to sources, its closer to INR 0.4), this is still at ~INR 2k Cr. So this incentive cannot cover it.

*I’ve done some quick calculations below, and have taken the below assumptions:

Per transaction P2P revenue (PhonePe has 50% market share, so obviously they have way more leverage to get a bigger cut from the remitter, apps like Groww, Super Money etc may not have that much)

P2M Value cut (I’ve kept all except Groww to be the industry cut which is ~27%. Groww I assume has majority transactions on investment & SIP, hence have assumed ~90% of Groww transactions to be P2M

> INR 2k cut in P2M Value: PhonePe, Gpay, Paytm kept at the industry cut, which is ~67% of total P2M transaction value is in the > INR 2k bucket. Cred, Groww are higher, since they have higher AoV, and Navi and Super Money are lower since they have lower AoV

2 & 3 are inputs into the P2M revenue calculation, happy to DM the sheet to anyone who wants to take a closer look at the calculations

And at an MDR of 0.15%, for UPI Apps to earn 5 bps per transaction (assuming a 50-50 split between the PSP Bank and UPI App), 55% of the MDR needs to be given to the acquiring side, which is then split between the acquiring bank, PSP, and UPI App,

You can check the image above for the calculations. I’ve played around with these numbers to see what makes sense. It has to make sense for all players in the ecosystem as well. But one thing is clear: for minimal impact to the merchant (and the end customer), it's better if the MDR stays as is, and we play around with who gets what and how much.

Again, I’ve not looked at other attributable costs, I’m just looking at this from a per-transaction basis. But based on the costs, and the potential revenue coming in from P2P, 5bps, or 0.05% per transaction seems to be enough, at least for the smaller apps to cover most of their costs. Obviously PhonePe, Gpay, at the scale they’re at will end up making a ton of money from this. But the point of MDR coming in is also so that the market becomes more competitive, and smaller apps can sustain.

But what is clear is that CC on UPI does have a way to go before it can (if ever) pay for the UPI ecosystem, and subsidise non credit transactions. So MDR on regular transactions does have to come in. Otherwise, with incentives reducing year on year, there is very little motivation for 3rd party stakeholders to innovate on UPI.

![[#41] From Free to Fee: Why does UPI need pricing to sustain innovation and growth?](https://substackcdn.com/image/fetch/$s_!mIxr!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fa50c5cdb-8fb0-48a5-bf3a-f6ab93a29d0f_1754x986.png)

![[#30] Do new age fintechs stand a chance against VISA?](https://substackcdn.com/image/fetch/$s_!jC4d!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F21e26316-030d-4975-8e84-8d3851549c8b_1156x726.png)

Great piece. There is so much I did not know, just saw the magic that happened on every qr code scan! Thanks for helping see the complete picture.

Thanks for shoutout, Ambika! hahah