[#60] The UPI Dilemma: What happens when the infra and the apps are commodities?

In today’s UPI ecosystem, infra is table stakes and apps are distribution. If you’re not building a full-stack payments play, a standalone UPI app just doesn’t add up

Recently there’s been a lot of buzz about Super.Money & Navi, both outpacing Cred which had been the #4 UPI App, in terms of number of transactions, and total value processed for the past few years. Now Navi, and Super.Money are the #4 & #5 UPI App respectively, although this is in terms of number of transactions. In terms of value, Cred is still #4 (INR 45k Cr in Feb ‘25), 3x more than Navi value processed, and 9.3x more than Super.Money value processed.

Super.Money especially has seen meteoric growth, from its launch in August 2024, where it did ~11.63M transactions, and now, in Feb 2025, where it did 139.1M transactions. There are some other updates in the system, and while they’re not the focus for this edition of the newsletter, they do impact how the UPI strategy in India will play out:

1. Initially, while the FY25 budget had only allocated INR 437 Cr for UPI subsidies, a cabinet meeting chaired by PMO has announced this to go upto INR 1500 Cr, and only for transactions < INR 2k. Two observations I have here:

While it’s great that we’re trying to support the ecosystem here, even if we look at this to cover the P2M transactions below INR 2k (i’m not even talking about the P2P piece), it’s not enough. Quick back of the envelope calculations: The total number of transactions in the number of txns < INR 2k in Feb ‘25 was 16.1B. P2M as a % of total UPI transactions is ~62%. And transactions with ticket size < INR 2k within P2M is 96%. So the total number of transactions which need to be covered is 16B x 62% x 96% = 9.5B / month. At a cost of 40p per transaction, annually, this comes to ~INR 4843 Cr. So 1500 Cr definitely isn’t enough to cover this.

This is only for txns < INR 2k, which were never meant to be priced, and should be kept free to protect the smaller merchants. Even in the model I had looked at earlier, P2M transactions < INR 2k should always be free, only transactions > INR 2k should be charged. Even if we take that cut, the MDR to break-even is 0.15 - 0.2%. This seems like a short term announcement, as a way to delay the decision. To read my piece on why MDR coming in is imperative, and the different pricing models / MDR needed to make the UPI ecosystem break-even, check the below article:

And another point here is if MDR keeps getting delayed like this, then for newer standalone UPI Apps to sustain will become hard. And even if it does come in, the view of the government is the UPI is a “public good” so margins are not going to be that high.

Unless you’re funded by a big player and can afford to burn money to acquire customers, you need to have a non-core UPI play. And hence why I think existing players will move here, but the scope for newer apps to come in, especially right now, may not be a lot.

2. PayU announced a 43.5% acquisition of Mindgate, which is a UPI Switch, which could roll up to a 100% acquisition in the future

Mindgate is a UPI switch that powers HDFC, SBI, BOB, Yes Bank, IndusInd, Citi, HSBC. Massive UPI play, since this acquisition gives them access to big acquiring banks. In fact, as per the NPCI website, out of the total 16.1B txns in Feb ‘25, as a Payer PSP, Yes Bank processed 5.1B txns, HDFC ~1.8B, and SBI: 1.6B. That’s ~50% of total Payer PSP transactions. Banks do have multiple switches, so it’s not that Mindgate will be powering all of these transactions, but Mindgate would be powering some % of them, which is significant. So suddenly, from not being a big player in the UPI ecosystem, PayU suddenly powers a lot of transactions through Mindgate.

Adding a quick snapshot of the UPI ecosystem, so for those of you folks who don’t understand what a switch is, and why this is big news, this will help.

The above is a snapshot of the full stack UPI play. This is the value chain:

Merchant PA: The customer comes here and initiates the UPI transaction

The PA launches the UPI App selected

The UPI App: The customer enters their details (PIN, and validates transaction amount), which is forwarded to the Payer PSP Bank

Payer PSP Bank: This is how the transaction is sent to NPCI. Only banks can directly connect to NPCI, so every UPI App has a Payer PSP Bank (with a switch deployed within the bank infra) that connects with NPCI. This Switch also validates the PIN, and checks the customer account balance, and then forwards all details to NPCI (UPI Rails) along with payee details, txn amount and so on

NPCI: Sends the details to the Payee PSP Bank to resolve the address. In this case, if the transaction has been initiated through a PA, then the Payee PSP Bank is the PA’s acquiring switch. The merchant has already been onboarded on this, so the Payee PSP then resolves the merchant's VPA and shares account details back with NPCI.

NPCI then sends a debit request to the remitter bank (which is the customer’s bank). This hits the issuing switch

The issuing switch conducts checks, and sends the debit request to the Beneficiary Bank, the bank confirms the debit to NPCI The issuing switch is the piece of infra that is deployed with the remitter (the customer who is sending the money - bank), and the beneficiary (the receiver, in this case, it is the PA PSP Bank).

The debit confirmation comes back from the remitter bank, and a credit request is sent to the beneficiary bank (which is the PA’s bank). The beneficiary bank confirms the credit status to NPCI

NPCI confirms the transaction success to the Payer PSP, which confirms to the UPI App. The Payer PSP confirms to the PA, which confirms to the merchant.

And if you look at the chain of events, and different stakeholders in the UPI transaction, that is why we are seeing, and we will continue to see more full stack plays. Especially since UPI is becoming the rails that power majority payment methods in India. Ex: Merchants becoming PAs. PA’s getting into UPI Apps. PA’s getting into Payee Side Switches. Even the whole issuing side play.

But what’s the play for new UPI Apps? Not merchants, not PAs, and not some payment player that has decided to get into UPI Apps?

Keeping the above points in mind and going to Super.Money, and its play, to see if we can understand what’s playing out there. I’d done a deep dive on Super.Money and its growth a couple of months ago, you can check it out here:

Here’s what’s interesting. Super.Money & Navi both are top apps in terms of number of transactions. In terms of value of transactions, while they’re rising, they’re still fairly far away from the Top 3 - 4 apps. Take a look at the snapshot below:

Here’s what I’m trying to figure out: What’s the strategy for these challenger UPI Apps?

Out of the total 75+ odd UPI Apps currently operating, out of which ~38 (as of Feb ‘25) are 3rd party apps, and I’m assuming more will come in, if certain fintechs or certain categories want to own more of the end to end experience. Case in point: A few weeks ago, I had written about how while I expect existing UPI Apps to get into investments, because of how lucrative that category seems to be, I also floated an idea, that we’ll see new UPI Apps coming in, which are investment focused. And now, with Juspay, Razorpay, and Bharatpe having launched their own “TPAP (UPI App) as a service” stacks, the process of becoming a UPI App is becoming simpler. Juspay always existed, but now with newer players, there will be more options, and competition, which will drive innovation, faster GTM / launch and so on. But then, even if I become a UPI App, what’s the end game here?

There are a two ways for a “UPI App first” strategy to play out:

Note: When I say, UPI App first, I mean players getting into the UPI App business, which do not have another core business. They’ve gotten into UPI Apps as a standalone business

1. Acquisition play: New players can gain scale by 1) leveraging cashbacks to drive # of txns or 2) quickly focus on growing through a niche use case, and then get acquired:

Lets look at the cashbacks & rewards piece first, since this is something new challenger apps are focusing on

Take a look at some snapshots of Super.Money, Navi and Pop, all challenger apps. The key focus here seems to be rewards: Super.money especially doing some sort of meme related competitions.

And this hasn’t really played out in the past: Amazon Pay (launched in India in 2019) being a key example: it tried to use cashbacks and rewards to position itself as the “app of choice” and “build customer behaviour” by targeting payment segments such as utilities, and fuel recharges. The logic here being: the customer will come for the cashbacks & rewards, and then stay because the habit to use AmazonPay has been built. That worked to gain market share, but not to unseat PhonePe & Gpay. Take a look at the AmazonPay case study below:

Amazon Pay: Metrics from 2021 to 2024

AmazonPay in 2022 really went after promotions and cashbacks to drive customers to their TPAP (link). Since then, they’ve been scaling back on their expenses, and trying to build a more sustainable business. And because of that growth, and % of market share has slowed. Take a look at the expenses below, they’ve dropped from 2022 - 2024.

In the first half of 2022, because of the spends, the rate of growth of txns, and value processed was higher. Since then, till 2025, while the number of transactions, and value processed has increased, this is also because the rate of UPI growth has increased. If you look at the % market share in both number of transactions & value processed per month, this has consistently decreased.

So cashbacks & rewards may help with awareness, and of course, Amazon Pay has the added advantage of being a marketplace, and a PA, so they can drive some organic awareness and distribution, and so, I’d question the habit forming hypothesis here. But that’s it. And the minute it’s removed, the metric takes a dip. Super.Money is probably going to use the same strategy here, and leverage the Flipkart machine. But others, which don’t have this will struggle.

The second is the the niche use case focus:

While not UPI, an example is Volt Money, which was a Loan Against Securities (LAS) player that got acquired by DSP, a Mutual Fund House. I don’t know how many niche UPI use-cases there are, (not too many) and in my opinion, credit isn’t really a differentiator unless you have an underwriting play, so not sure how apps like Kiwi etc will scale.

Another option could be category specific UPI Apps: but the only category this has worked out for till now is investment apps (Groww being a key example). And this market is now saturated, with all UPI Apps getting into broking as well: PhonePe, Paytm, Navi, Cred (through its subsidiary Spenny, has applied for a stock broking license in 2024), and even newer players such as INDMoney. This is a view that Pravin Jadhav - the founder of Dhan also echoes (in a podcast). The discount broking app market is stagnated, there are no new users coming in, people are eating into each other. For someone new, such as Dhan to get into the Top 10 in a year, his view is that it is not possible without providing incremental value vs existing players. And this is true for TPAP / UPI Apps as well

2. Start off as a UPI App, but proceed to a full stack play:

In my opinion, this isn’t a viable strategy anymore for newer apps at least. This strategy worked 5 years ago. Example: Phonepe & Paytm. PhonePe & Paytm both started out as UPI Apps, then became PAs, went offline through QR & now POS strategy, got into lending, made their own payment orchestrators, got into stock broking through their apps and so on. But this isn’t just a UPI strategy, this is a fintech strategy - PayU acquiring Mindgate being a case in point. Just looking at the cash burn, and the saturation of the market, I think it’s unlikely that this will happen (for new apps at least, Cred & Gpay both have a PA license), it’s more likely that existing bigger players get into UPI Apps. I’ve talked about this in the above section.

So then build, get scale fast, and then hopefully get acquired seems to make more sense.

But even in the case of an acquisition strategy, the opportunity for that to happen is finite.

There are not that many bigger fintechs in India who’d be able to make multi million $ acquisitions. (I’d mostly index on your PAs & bigger banks) And most of these have their own UPI Apps plays, or they’re probably better off just building their own. but thats a hypothesis.

So then what about newer apps? Is there an opportunity to actually build an app, which can function standalone, and scale it to get some meaningful traction → And if this is th egoal, then it cannot just be in terms of # of transactions (which as mentioned, can be gamed through rewards / cashbacks) but has to actually make the customer switch apps & make higher ticket size transactions through the app?

Well, to answer this question, let’s look at what’s happening now. Couple of observations:

1. Challenger UPI Apps are all focusing on # of transactions over transaction value…which drives down total value processed

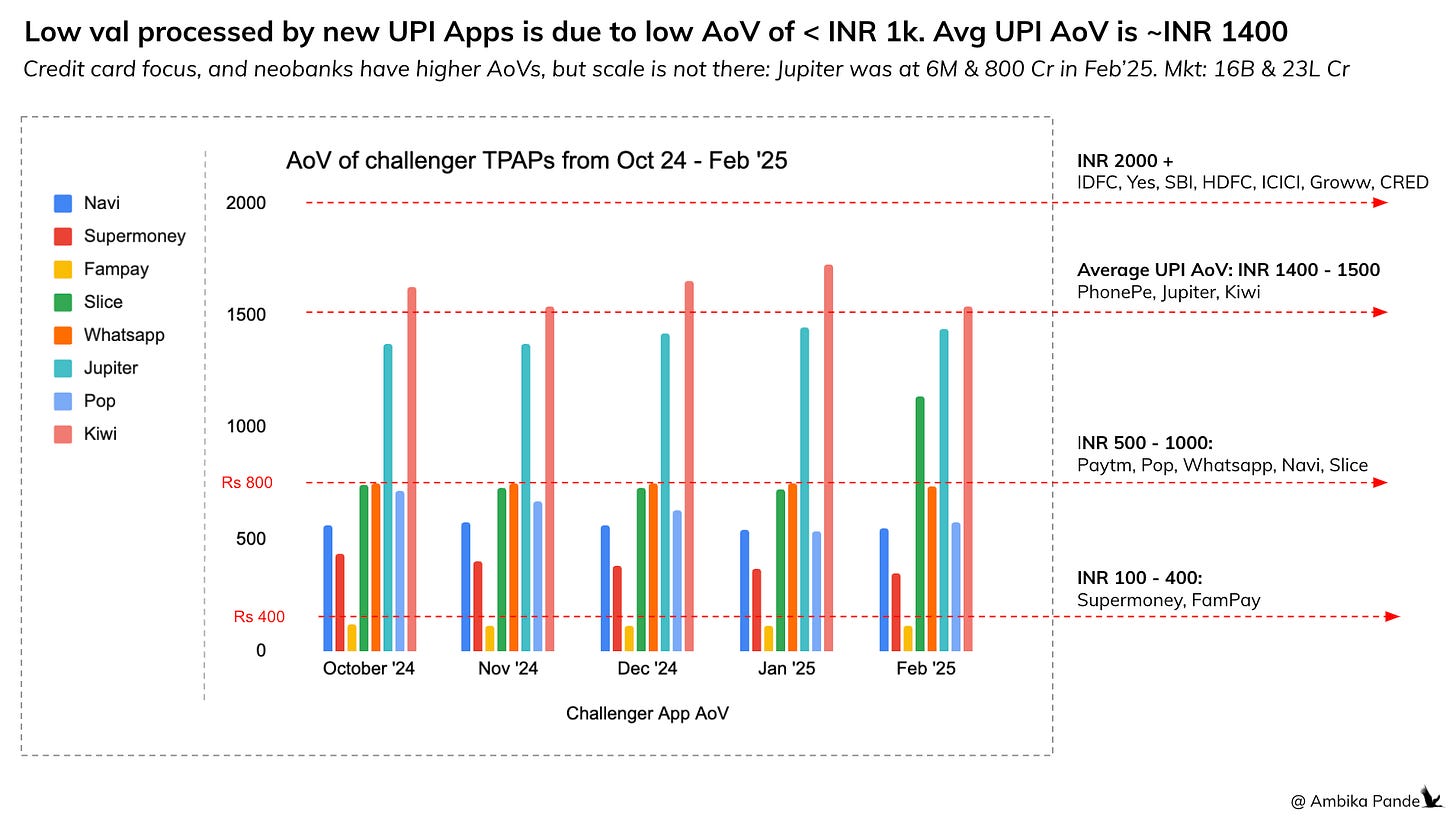

If you take a look at the data below, apart from Jupiter & Kiwi, which are going more towards being Credit Card focused, have AoVs on par with PhonePe. But ALL other challenger apps have AoVs < INR 1k. So one hypothesis here is that the cashback / rewards strategy is what is driving these smaller AoVs. Customers are incentivized to get some XX cashback per transaction, so they’re using these newer apps for smaller ticket transactions, but still depending on your established apps for their regular / higher ticket transactions.

And there’s another angle here: it’s a personal opinion, but usually I prefer to keep all my P2P transactions on one app, because shifting apps for this is a pain, and it becomes tough to keep track. For me it’s Gpay.

This isn’t a bad strategy, the challenge here is that tomorrow, it’s more possible that MDR, not a fixed fee comes in on transactions, in which case the value processed matters more than the number of transactions. Of course, the goal here is, get engagement, and a customer base first, and then focus on increasing the value processed. But this hasn’t happened in the past. I took a look at some top 3rd party UPI Apps, and bank apps, to see how their AoVs tracked over the years. It’s remained fairly consistent. Take a look at the slide below:

Even if I look at apps like Navi (yellow line), which launched its UPI App in August 2023, it started out with a AoV of ~ INR 550. It’s stayed the same. Look at Fampay. It’s Jan 2023 AoV was INR 137. In Jan 2025, its actually dropped to INR 117.

So what this is telling me is that this whole strategy of getting the customer “hooked” through using the app for lower value transactions, and then getting them to slowly move all their other purchases to the app has not worked in the past atleast. And this is something that was further echoed in the Amazon Pay case study we looked at earlier.

As I mentioned, when MDR comes in, it’ll be a % of the transaction value. And the total transaction value = number of transactions x AoV. So, either of these metrics will need to grow, and grow fast

In the past, there was MDR on UPI transactions, of ~0.3%, or 30 bps. Which is on par with global equivalents such as Pix. This was waived off in 2020, to promote adoption of this method, and then to cover costs, the government introduced the subsidies.

A. If we look at the scope to increase the number of transactions:

Now, just looking at the market share of apps, The top 3 have 90% of the share. As of Feb ‘25, PhonePe, in terms of number of transactions (which were ~16B), had ~47.54% market share. Gpay had 36.25% & Paytm had 6.70%. The next 3 apps: Navi, Supermoney & Cred, together have 3.7% market share of transactions. So, gaining enough scale from a number of transactions perspective, to bump up the total value processed looks challenging.

B. Looking at the possibility of increasing AoV:

Like I mentioned, it’s possible the play here is to get engagement first, and then focus on AoV to drive total value processed. But if you look at the slide above, AoV’s haven’t really increased or decreased for apps once they’ve launched. They’ve actually remained pretty stable once they’ve carved out a USP.

And the thing is, while we say “challenger UPI Apps” the fact is that most of them have a core business unit that is not UPI.

Super.Money is backed by Flipkart. Navi started out with lending. Jupiter is a neobank, trying to acquire a stake in SBM India. Slice has merged with NE Bank. Whatsapp is a part of Meta. You’re left with Fampay, which while has a NBFC, hasn’t really made that its USP, instead it’s focused on the teen / pre-teen segment. And Pop, which is still new. Check out the slide below:

So the takeaway here is that: the UPI market is saturated, and while it makes sense for existing businesses to come in here to expand to a full stack play, which will continue to happen (Ex: CCAvenue getting a license for its UPI App - RediffPay) it doesn’t make a lot of sense for a new standalone UPI App to launch randomly, with its core focus being UPI, or some other method linked to UPI, since there doesn’t seem to be much scope for it to function standalone.

The acquisition / merger play may work out for newer apps: the jury is still out on that. But examples in the market, such as CCAvenue, which is choosing to build its own, Amazon, which built its own TPAP (Amazon Pay), and Flipkart, which backed Super.Money, bigger players in the market choosing to build this in-house. So even if newer apps get acquired: this just shows its getting easier and easier to launch a UPI App in-house. So the acquisition opportunity is finite.

And while challenger apps have been able to chip away at the market share in the # of transactions and the value processed market, the question remains: how much scope is there?

But how much is possible is something that we’ll only know as this evolves. Its not worked out thus far.

The challenger apps have chipped away at some share. If you compare the data (of market share %) in both number of transactions, and total value processed, all the top 4 incumbents have lost share: PhonePe, Gpay, Paytm, & Cred are all down 0.3% - 1.31% in terms of number of transactions, and 0.05% to 0.91% in terms of value processed.

But as mentioned before: to gain significant market share, the cashback & rewards strategy won’t really sustain. At some point the app needs to start growing organically, through some need they’re solving for the customer.

And another point I’d add here is that there isn’t that much innovation left in UPI payments. And there's another perspective: innovation isn’t happening because UPI is a cost centre right now - it doesn’t justify innovation at this point, because of the limited revenue pool. So it’s a double whammy: limited innovation left here, which prevents new apps from building differentiators, and because of lack of revenue potential, there’s also an unwillingness to build these innovations out.

As the challenger apps seem to be playing the # txns game to drive engagement, it’s expected that they’ll have gained more share in this bucket. So then the question is not can they take market share from the incumbents. The question is 1) how fast can they gain this? And 2) is there scope to make this a meaningful share for standalone UPI Apps? I’m bearish on both the above, and hence my view, that even these newer standalone UPI Apps that may come in are looking for an acquisition play, by existing ecomm / fintech players.

We’ll see more full stack plays here (refer to the UPI txn flow slide above) but the scope for newer core UPI App is finite

We’ll see more full stack & consolidation plays here, with bigger players building their payee / payer side switches, maybe even venturing on the issuing side, and snapping up UPI Apps. But the scope for newer core UPI apps is finite. And unless there is some new innovation that comes in (CBDC scaling, stablecoins becoming the norm), it’ll remain finite

![[#56] FY25 Budget Implications on UPI (Part 1): MDR on regular UPI transactions is now essential](https://substackcdn.com/image/fetch/$s_!5OAU!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fbdadd201-6844-4b81-b0f1-aadc51680154_1600x903.png)

![[#50] UPI ecosystem developments in Dec '24: Whatsapp user cap removed, and PPI interoperability - too little too late?](https://substackcdn.com/image/fetch/$s_!Rl5A!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fbcf0d665-0f52-4723-97aa-61f848f94b39_1706x960.png)

thanks a lot for the detailed data backed analysis. great PoV.

I was curious to see where the allocation of 1500 crores came from. I did a slightly different calculation since I was curious to see the average xaction value. . I picked up the data from NPCI and calculated the MDR for all transactions from April 2024 to Feb 2025 in the 501-2000 Rs bucket . I assumed the MDR at 75p ( i.e.) made an assumption that all transactions were 500Rs. The figure was 799.75 crores for the entire period . If you use this figure then to calculate the average MDR is about 7.8 paisa. (i.e.) the average transaction is assumed to 52 Rupees in the 1-500 Rupee segment . So this is very different from the 40 paisa per transaction that was assumed in the article . Just a different thought experiment