[#61] The Next Wave in Wealth Management: Acquisitions, niche TGs & consolidated net worth

Acquisitions seem to be in the horizon, and while DIY investing has scope, there are systemic & behavioral issues that may never get 100% automated.

There's been activity in the investing and wealth management space lately

1. Groww looking to acquire Fisdom, and launching its own wealth management arm for HNIs: Groww is a broking app, which also has a PA, a NBFC (which has a loan book of $115M as of June 2024), and is a UPI App, and is doing anywhere between INR 8k - 10k Cr per month on UPI. It is reportedly looking to acquire Fisdom, (at a valuation of $140 - 160M) which apart from stock and mutual fund investment solutions (which Groww also offers), also offers wealth & portfolio management services (which by definition is more for the HNI base). And it’s part of a larger wealth management play that Groww is going after, in light of its upcoming IPO - in March ‘25 it announced plans to independently launch an omnichannel play focused on HNI’s, offering wealth management, and alternate investment opportunities, under the brand ‘W.’

2. Volt Money, which is an app focused on Loans Against Securities, and founded in 2022 was acquired by DSP, a mutual fund house, in March ‘25.

3. Smallcase, a platform democratizing thematic and model-based investing for retail investors in India, in March ‘25 secured $50M in Series D funding led by Elev8 Venture Partners. Note: One of the investors in smallcase is Zerodha

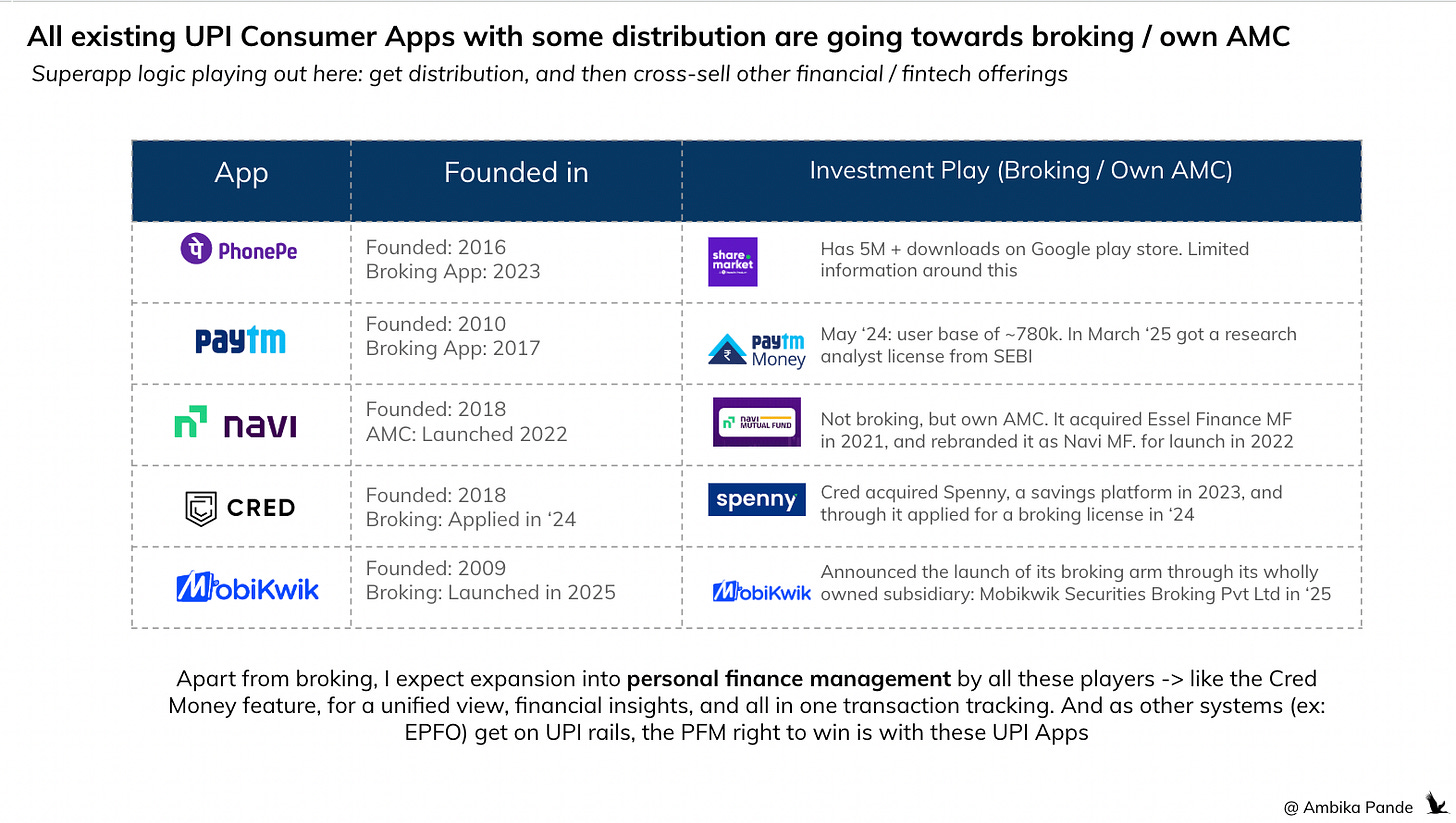

3. Scaled up consumer UPI apps which have distribution on their side are getting into broking & own AMC plays: PhonePe, Paytm, Navi are launching / have launched their own wealth management / investment plays. PhonePe -> Share.Market, Paytm -> Paytm money. It also looks like these broking / UPI Apps are launching their own AMC plays: Zerodha launched its AMC in 2023, Groww acquired Indiabulls AMC in ‘21, and rebranded it as Groww MF, and launched in ‘23. Navi acquired Essel Finance Mutual Fund in 2021, and rebranded it as Navi Mutual Fund, you can buy units on it through the Navi App.

4. EPFO will allow instant withdrawals through UPI by Mid 2025. This is big → it means that you’ll be able to access your PF savings instantly, and withdraw upto INR 1L at a time.

Fintech superapps are all going towards broking: Cred applied for a stockbroking license in ‘24, and Mobikwik recently announced the launch of its broking arm

And it looks like the broking play is something a lot of UPI / fintech apps are going after. Cred, in 2024 applied for a stockbroking license through its subsidiary Spenny (a YC company, and acqu-hired by Cred in 2023). Mobikwik, this month announced the launch of its broking arm through its wholly owned subsidiary: Mobikwik Securities Broking Private Limited (MSBPL), a wholly owned subsidiary. So it’s the same full stack play that is on the UPI side playing out here: start out owning distribution and experience, and then slowly own more of the pie: and in this case, the mutual fund.

This seems to validate a previous thesis: that old UPI Apps are getting into the investing side, and newer UPI apps could be investment focused

I’d previously written an article on the rise of investment focused UPI Apps (with

, Linkedin here), and that’s because at-least in fintechs, investment / broking apps seem to be the ones that are profitable, and making money, through broking charges, and increased costs on F&O transactions. You can read about it below:Based on some of these new developments, and my past theses, here’s what I see playing out now

1) The first wave of investment apps were broking apps. Ex: Zerodha, and Groww, and now they’re looking at getting into full stack: experience, AMCs, and specific products for specific segments

A pure experience & distribution game, making it easier and convenient for users to buy and sell stocks, mutual funds, and F&O. Players such as Zerodha, and Groww have really thrived: they’ve understood the customer, cut down on pricing, and made investing mobile friendly.

Now, as they’ve started expanding, the first phase was forward & backward: own the investing experience through payment (UPI), and launch own AMC for larger margins

When they (not chronologically though) both backward and forward integrated, where they got into the experience side of things (such as UPI Apps / UPI Plug-ins), PA’s (in the case of Groww to process said payments), AMCs (Navi acquired Essel, Groww acquired India Bulls), and also NBFCs, to give personal loans / loans against securities and so on.

The second phase of expansion seems to be wealth management:

Where you offer portfolio management, analytics, insights, and some sort of omnichannel services in the case of Groww. Groww is doing exactly this: Fisdom offers Portfolio Management Services. Smallcase is invested in by Zerodha, which offers thematic investing. Overall wealth management allows these broking apps to diversity their revenues more, and create more lock in. I expect to see more plays here: and it’ll probably happen through some sort of acquisition play.

And they have a right to win over banks here, just in terms of customer experience, and tec capability. While I’m a loyal user of HDFC securities for trading and investment, I’ll be the first to admit that their customer experience, and just the ability to navigate and understand the platform leaves a lot to be desired. I’m not even talking about the ease of opening an account, communicating with the team, and getting a timely response. My personal experience has been: unless you know someone, who knows someone, good luck getting anything done. And this is true across the banking ecosystem, why do you think credit card and neobanking start-ups were all the rage ~ 5 years ago? (Jupiter, Open, Fi). Because this is a problem that exists. It’s a separate issue that RBI is not a fan of neobanks, and hence that idea never really took off. But I digress.

Below is a snapshot of some of the top broking apps. The market leaders such as Groww & Zerodha, as mentioned have already gotten into the AMC & NBFC plays. Them, and the upcoming apps, such as upstox, Dhan, 5Paisa etc will probably expand into wealth curation & management / thematic investing (such as how smallcase creates baskets of stocks / ETFs based on certain “themes” that the investor can select / create), and target the more affluent investor through Portfolio Management Services (PMS) and and AIFs.

Source: Entrackr

2) Loans Against Securities (LAS) are seeing a resurgence: Build and sell to MF houses / fintechs seems to be a play:

Unsecured loans have been going through their own issues. Things such as customer targeting, better underwriting, and optimizing collections are all things that need to be figured out, atleast for small ticket BNPL (and by small ticket, I mean under < INR 10k). The problem with BNPL is that while there are many takers, the cost of collections doesn’t really justify the revenue that the lender stands to make from a small ticket loan. While there is demand for it (Zestmoney at its peak was doing INR 400 -500 Cr per month), the problem is more around the supply and the general economics. It flew earlier because of FLDG (First Loss Default Guarantee), where fintechs would commit to covering some % of the lender loss in case the customer defaulted. Once the Digital Lending Guidelines came in (DLG), restricting FLDG to 5%, unsecured BNPL has dropped, since the TG, and the collections piece hasn’t really been figured out for small ticket loans. That’s why secured loans, and the loan against securities play is seeing interest: NPAs are solved for, and there is no collections risk here, so economically it makes sense. Zerodha Capital, Groww with its NBFC, and even Navi, with its own NBFC, and now it's AMC play (it’ll probably get into broking soon as well) are poised to win this.

This is where the Volt Money acquisition by a fund house - DSP is interesting. It could mean that there is a strong acquisition exit for LAS apps, not just by broking fintechs, but by MF houses themselves. Other players: Yenmo (invested in by YC), 50Fin, Quicklend etc, if they’re able to reach some scale will probably get snapped up by existing AMCs as well.

Not a standalone play since while there may not be collections risk, there are market risks, its a bit like buying stocks on margin. Eventually this needs to evolve to a in-house lending play, with your own NBFC, institutional players may be better placed to do this

The reason for this is the following (in my view): Loans Against Securities are secured loans, but they come with other risks: if the market is volatile, and the value of the shareholding drops, then the lender may sell the stocks, ask the lendee to repay the balance, or pledge more stocks to keep the Loan To Value Ratio below the approved limit.

This may not be the same market that unsecured loans are servicing, and may overlap more with the active traders who need funds to leverage themselves up more

My own view: I don’t think this is a market that a “person desperate for funds” will get into: rather, these are probably HNIs who need short term liquidity, or traders who want strategic leverage (it’s a bit like buying stocks on the margin). And if this is the case, then assuming that HNIs have their own relationships with the bank, this TAM may be just for active traders (engaging in atleast 1 trade per month) and not be that big in terms of # of users: ~15M users. In actuality it’ll be a subset of this. And if you remove the HNI cut in India: The top 10% control ~72% of the wealth in India. So in terms of dollar value, if we’re looking at the “mid market” active trader base, this may not be big enough for a standalone play, and works better as a Value Added Service for a full stack fintech, lender, or AMC. Even in the case of FD backed Credit, I see this as either a play by an existing full stack fintech / platform, or something that will get acquired soon enough. Ex: Super.money launched its FD backed card, but it’s backed by Flipkart (platform). Stablemoney on its website has mentioned that its FD backed CC is coming soon.

There are also infra players: Finsire is doing some cool stuff in this space, building out infra for a secured asset play. But will it be able to continue standalone, or will it make more sense in a full stack play is something that’s yet to be seen. My bet? They’ll probably get acquired by an existing fintech / bank / mutual fund house to further add to their offerings.

3) All consumer apps will get into broking, which has already started happening. and then depending on their vision, get into the AMC side of things, LAS and so on.

But this is more from a distribution sense: you already have the customer, so might as well offer them more things to make the product sticky. There isn’t really that much innovation left in broking. The problem with broking apps in India, is that now it’s a red ocean. The discount broking app market is stagnated, there are no new users coming in. For someone new, to break in,is not possible without providing some differentiated value vs existing players. And this incremental value is what players like Zerodha / Groww seem to be chasing, with their AMC, and wealth management plays -> by owning multiple legs, they can optimize customer experience, and give better “deals”

4) UPI Apps will win the personal finance management play:

Personal finance management is a part of wealth management, and more to do with consolidated visibility of all your investments / networth in one app. As UPI Apps get into broking, they get visibility on your investments as well. They already have your savings and credit accounts linked.

There is being solved by the Account Aggregator piece (not very well, but the hope is that it improves). While it is promising, the coverage of institutions is still patchy & UX, refresh cycles, and integration in the AA framework are inconsistent. Although there are players here such as Fold, which are trying to build exactly this, there is dependency on the AA system, and a lot of institutions aren’t onboarded / don’t share information here. Also most tools don’t give a true net worth dashboard with cash-flows, liabilities, insurances, ESOPs, etc, and this requires systemic change.

But recent news coming out, where the government aims to enable EPFO claims withdrawal on UPI rails, makes me think that all pension / insurance / government accounts will be linked to UPI rails for seamless payouts and management eventually. If that’s the case, then UPI Apps, by virtue of this linkage, get visibility to a lot of the net worth inputs of a customer (subject to customer consent obviously), and win the personal finance management game. But another question would then be: If UPI can link to everything, and the customer explicitly agrees to link each specific account, thus taking care of consent, then why do we even need an AA framework? But I’ll address that in another edition.

So then what’s the opportunity in investment / wealth management?

At an overall level, I personally think that the discount broking, the low hanging tech plays, getting distribution etc are won. And that’s why existing apps with distribution are getting here as well. The opportunity could lie in differentiated plays for niche target segments. The needs of the mass market: ease of investment into stocks, MFs, and FDs, Gold, Government Bonds etc has already been solved for, or can be solved easily by apps which have distribution.

Let’s take a step back and look at the customer TG first. (Note these are own estimates)

So, breaking it down, what seems to be solved / or on the way to being solved for are:

HNI / Ultra HNI bucket: is handled by private banks, through relationship advisors.

Mass market: Served by your mass market distribution: through a Groww / Zerodha and Paytm money etc. And there are also offerings for investing in other assets: Jar for gold, and Stablemoney for FDs. But this isn’t really a tech moat: It is something that existing apps can build, and they probably have a better right to win, because of distribution. (And hence my earlier thesis of consolidation happening in the market in the next few years). So even if standalone players build this out, eventually distribution will happen through your existing Apps (Example: Volt Money had partnered with PhonePe to distribute its LAS offering).

Opportunities left: Affluent base, which has the appetite to invest in riskier assets. What they lack is the knowledge, the time, and perhaps, the digital first experience, which may be more complex for these other assets.

Unsolved / partly solved:

1) International investment opportunities (for NRIs, or just for Indians wanting to invest in US stocks for example)

2) Alternate assets: Investing in crypto, start-ups, gold, fractional real estate and so on.

3) Active investing for the affluent / mass market, which has a higher risk appetite

International plays exist, or are coming up, and there is an opportunity to build niche flows across different corridors

Example: INDMoney, which differentiates by offering a platform to invest in US stocks. And Belong (invested in by Elevation Capital) offering investing opportunities to NRIs. Other platforms that provide international investment opportunities for Indians are Scripbox & Vested (which are more retail investor focused, although they do have premium features for HNIs), & Kristal (which is more HNI focused). SBI NRI is another, it facilitates NRI investments into India.

So plays here do exist. But there could be an opportunity to build more specific flows for specific corridors, and as regulations evolve, make it more digital friendly and seamless.

I’m not very bullish on alternate assets such as crypto, but there could be opportunities in alternate assets → experience & regulation could be barriers

Example: CoinDCX and other crypto exchanges, which facilitate crypto investments. Crypto is not a favoured asset in India because of the 30% tax. There were briefly platforms such as Tyke & Sateeq, that tried to create platforms for start-up investing - think of it as “crowdfunding start-ups” but lack of clarity on exits, and transparency in performance caused them to either shut down, or pivot. But assets such as Gold, real estate, commodity trading etc is still something that could have a lot of innovation left. Jar is one which has doubled down on the Gold investment + savings value prop. Rupeek is another, you cannot buy gold through their platform, but you can pledge your gold, and get loans, or a gold back credit line.

You can check out the snapshot below to see new (ish) plays here

But TLDR: The opportunity is now to build specific and niche flows, for a segment / or a product.

That’s how you’ll differentiate. And the way things are playing out: once you get some scale, the exit will probably be through an acquisition, especially if it’s a domestic play.

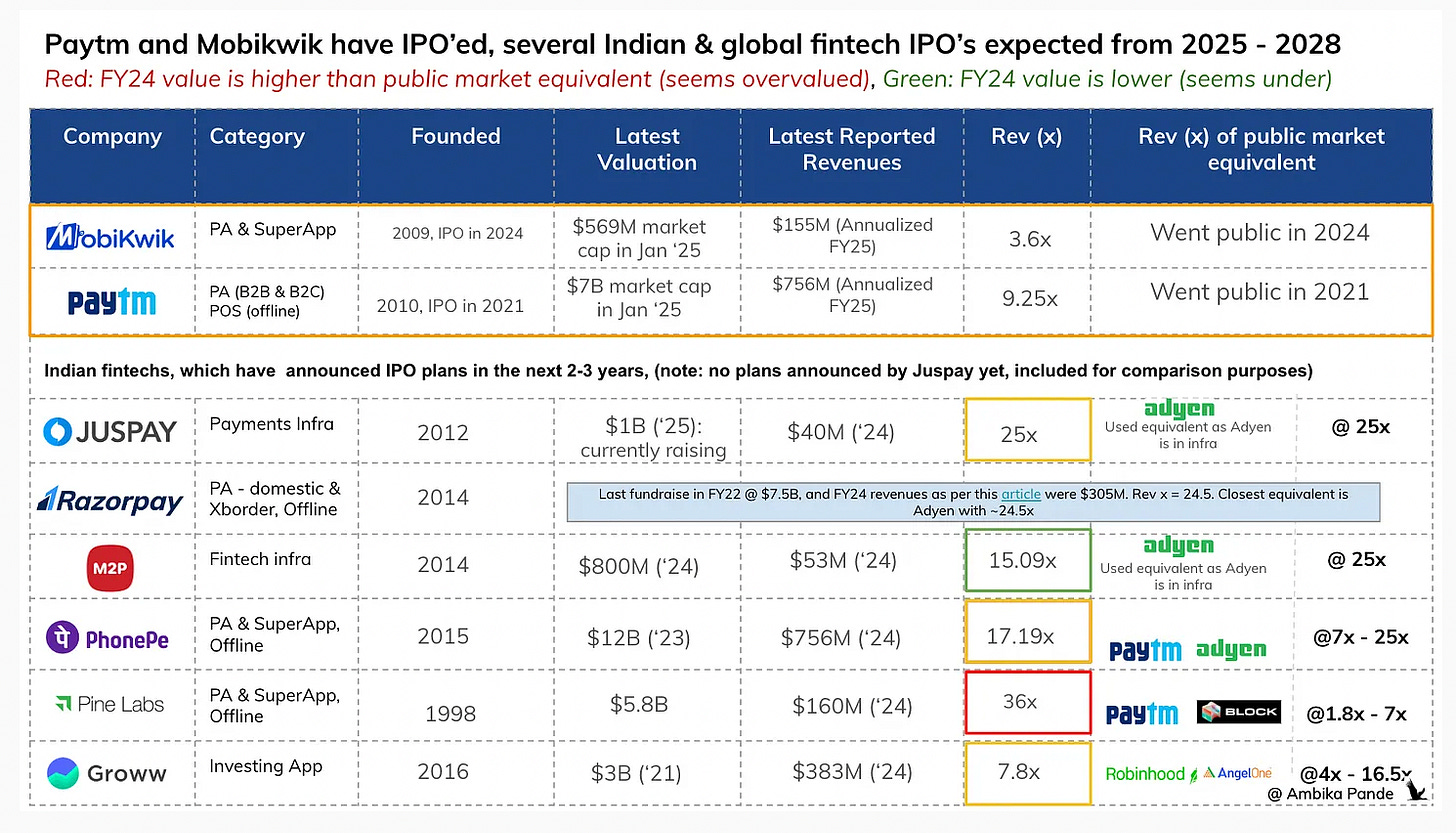

However, current multiples of the above apps seem pretty high compared to existing fintechs, and broking apps, I do expect to see some correction here

One thing that may change is the valuation multiples these newer apps get, the current numbers seem high when compared to existing investment apps. Take INDmoney: its revenue multiple is 75x. Compare that to Groww, & Zerodha which are at ~7-8x. Jar is another: it’s at ~54x. Stablemoney is even higher: ~183x. Compare that to Scripbox: It’s not UPI, its focus is more towards the premium investor bucket, but at a valuation of ~$135M, and revenues of ~$10M, its revenue multiple is a modest ~13.5x. Of course, the Jar’s & Stablemoney’s of the world will grow revenues, and thus, into these valuations, but if the exit here is acquisition, then there’s probably some correction that will happen here, and going forward, we may see some of these multiples to be more conservative.

Based on analysis of existing pre-IPO companies, if as a fintech your rev multiple is greater than 15x, you’ll have a hard time justifying it.

There’s a previous piece I wrote, where I analyzed some of the pre-IPO companies in India, which included PhonePe, PineLabs, Groww, and other bigger fintechs such as M2P, Juspay & Paytm.

On looking at market cap / revenue, and private valuations / revenue, one insight was that, as a fintech, if your valuation is more than 15x of your revenue, unless you’re a market leader by an overwhelming majority (such as PhonePe), you may find it hard to justify your valuation. And looking at smaller investment apps, and their valuation multiples: 40x and above!, as the market matures, and they raise additional rounds of funding, I expect this to correct.

So international investing, and alternate assets are being solved to some extent. What has not really been solved is active investing for the affluent base

Here’s the challenge: this base has the money. What they don’t have is time. These are folks who would probably prefer a digital first journey. And while they’re affluent, this base of ~40-60M users probably don’t have a personal finance manager, they will have to manage their investments themselves.

Note: when I talk about passive investing here, I’m not talking about passive funds, which are your index / NIFTY 50 funds. And similarly when I talk about active investing, I’m thinking more from the individual investor’s perspective, who wants real time research, a trusted knowledge source (such as stock tips) and execution support. Passive investing has been solved by your platforms already mentioned: Zerodha, Groww, through the convenience & experience play: in fact Zerodha, Groww, & Navi have launched their own passive funds.

DIY active investing → frequent buying & selling, automatic rebalancing of stock portfolio is still, and may never be 100% solved.

What has not been solved is DIY active investing -> which is more about frequent buying and selling, and involves things such as 1) Research and choosing your own assets (stocks, mutual funds, ETFs, bonds, etc., 2) Using online platforms or brokerages (like Zerodha, Groww, etc.) to buy/sell 3) Full control over risk, allocation, and decision-making. This is supported more by the YouTube / Instagram / Telegram channels that offer “stock tips” and blogs, or communities, but no personalized advisor.

AI may help with research, and general know-how, but the knowledge gap still exists, and at the end of the day, the LLM is not liable

Active investment / investment advice for the masses is still something that’s missing, but if this can even be solved through automation / AI is something I’m deeply skeptical about. I don’t think DIY investing can ever be automated. I’m willing to take the risk, but I don’t have the time and the inclination to do my own research, and invest on my own. While LLMs, and LLM chats have made this easier, there’s still a knowledge gap that exists, and unless you spend time in understanding the nuances of the information that AI is spitting out at you, you’re better off doing passive investing.

Even current apps: Zerodha, Groww, Navi are more focused on the passive investing experience, so automatic integration & smooth linkages between the preferred technical charts, and executing a trade may not be very well invested in

Another point I’d mention here is because current apps are more focused on passive investors, and the passive investing experience, they may not have invested in tools / the deep tech analysis that an active investor may need, and the product & tech linkages with this research.

Example: there are platforms such as Chartink that are very good for a niche technicals driven audience, there should be development of either equivalent features in-house, or linkages for smooth execution from the analytics platform, instead of juggling between multiple screens. And this could act as a differentiator, atleast for the active investor base. (According to this source, the number of active investors in India - defined as those who execute atleast 1 trade a month are ~20 - 40M. This tool will serve maybe a subset of this market, I’m looking at those traders who execute multiple trades a week. But even that base could be significant - multiple trades means more transaction fees that can be earned). But again, the above is for the active trader base with the time & inclination to execute these trades.

AI Agents theoretically could solve for automating active investing, but the trust barrier still needs to be surpassed

With AI & the AI Agent hype coming in, there is some excitement on the use cases this may have on active investing. But here’s the thing: The whole point of an agent is that it automatically executes on certain workflows. And in active investment, that’s the point -> you actively pick stocks, you capitalize on small movements in the market. To leverage that the agent needs to be autonomous, and have complete control over your funds, and decision making. I’ve written previously about LLM bias, and the dangers of automating using a LLM, when you don’t know what data, and how it’s been trained. Not sure if I trust an agent to do all this.

So as the market evolves, this is what I see happening:

1) Fintechs expanding into omni-channel and wealth management plays not just limited to stock broking.

This is already happening. I’ve talked about it in detail, so I won’t elaborate here. But the same full stack play, playing out in payments will play out here.

2) Build out flows for specific use cases, in alternate assets or international flows and then exiting through acquisition.

There’s a big acquisition play emerging for smaller apps, which focus more on customer acquisition, and experience, even on the domestic side of things. If they’re able to solve some specific use cases for customers: a specific TG such as what Belong is doing: giving Indians based in UAE an opportunity to invest in USD FDs, or other assets, or Volt, which is providing Loans Against Securities.

It’s something I had mentioned in my previous piece on investment apps as well: the opportunity in investing now lies in niche segments being served for. And because the segment is niche, and the “potential market” is smaller, they may present themselves as an attractive acquisition opportunity for bigger players. Look at Scripbox, and Vested Finance for example: their AUM may be high, but the potential size of the segment is low, which drives down valuation: Scripbox in ‘24 was valued at ~$138M. Compare that to INDMoney, while it’s targeting the smaller retail investor with lower ticket sizes, I’d venture to guess that the sheer size of the base drives up its valuation; it's reportedly valued at $625M. (Of course, the flip side of this is, it’s probably overvalued, its FY24 revenues were reportedly ~INR 70 Cr (~$8M), so that’s a ~75x revenue multiple)).

But if acquisition is the exit, there will be some correction from the valuation multiples that apps are getting today.

3) This is a personal opinion: but I’d love to see a wealth management play, which is like a “personalized investment advisor” for the affluent base, but it’ll require a human touch

I do feel there is an opportunity to build active investment platforms for the affluent base. Kind of what Dezerv tried to do, before it pivoted and went ultra HNI. Out of the ~40-60M base, there’s probably a 5-10M base that’s willing to pay an extra management fee for active management of assets. This can’t be a standardized tech play though, there will need to be a human element to it, and economics will have to be figured out. There’s definitely a need in the market for this (I may myself be a customer here) but if the ticket size, and the economics make sense is something that needs to be understood better.

Data analytics and insights can be automated → and as other systems such as EPFO are linked on UPI rails, the opportunity to give personalized insights will increase

Assuming that all accounts will be connected for payment / payout purposes on UPI rails, this is something that a UPI App could probably provide. Something like: I may ask the app: I want to buy real estate / gold that will appreciate xx in 10 years. What are possible opportunities, and how do I structure my investment? And the app is able to use my connected accounts, add the data layer of the account aggregators, and give me some sort of an answer. And this is something that wealth management apps are already going towards, I wouldn’t be surprised if all your UPI Apps, especially the UPI + Investing ones are going towards: Groww, Navi, Cred, INDMoney and so on. But again, this is more from a passive investing perspective.

Companies like smallcase are trying to solve the DIY & information piece, but it’s core philosophy is still passive

Smallcase, which I mentioned earlier, recently closed their Series D funding round of $50M. Think of smallcase as a platform that gives

Pre-built and diversified portfolios, and this can be around specific themes / strategies

DIY smallcases: users can build their own portfolios, so they have more control.

What smallcase has tried to do is automate some of this “active investing” by offering themed portfolios. Example: One smallcase is called “Insurance Tracker” that is a portfolio with exposure only to listed insurance companies (large / mid & small cap). Another is called “Digital Inclusion Theme” which aims to give investors exposure to companies benefiting from everything going digital (Sample companies in this smallcase are: CAMS, Zaggle, Swiggy, and PB Fintech).

But here’s the thing, smallcase is mostly solving for convenience, and maybe a bit of the knowledge gap. It’s not like an ETF, where you’re buying units of an asset that has exposure to multiple securities, so fundamentally, each unit has exposure to multiple securities (fractional ownership). It’s like a “cart system” where you can add multiple securities to your cart, or buy pre-set up carts, and buy them all together. There’s no personalized guidance really, investors are expected to do their own research and due diligence. And there’s no active rebalancing of your portfolio - Once a smallcase is selected or built, the platform does not actively manage or dynamically adjust the asset allocation in response to evolving market conditions. Rebalancing and adjustments are generally user-initiated, requiring investors to monitor and manually adapt their portfolios. While Smallcase does provide users with alerts and tools to rebalance their portfolio, the action of rebalancing is left to the user.

Also: smallcase is invested in by Zerodha. Not that this means Zerodha is calling the shots, but Zerodha and other investment apps have more focus on passive investing, especially with the launch of their index funds. So Zerodha investing here could be another tell about which customers smallcase is building for.

Not everything should, or can be fully automated. Example: collections tech companies all offer field collections & vendor management solutions apart from AI / ML analytics engines. Similarly here: a human touch is required

For the affluent base, which has the disposable income, and the risk appetite, but not the time or the knowledge, active investing needs a human element to it. It needs trust. It needs someone on-ground to monitor, to oversee, and to provide updates. This can’t ever be automated. But here’s my take: Not everything needs to be. Take collections tech, which is seeing a resurgence: Credresolve - a collections tech company, raised $1.1M in ‘25. Credgenics, a debt collections platform founded in 2018 raised $50M in ‘23 at a $340M valuation. In March ‘25, CreditNirvana - a debt collection start-up which was founded in 2019 was acquired by Perfios to expand their lending stack into a full-stack offering. CreditNirvana also offers products such as a “field collections app” and “collections agency and vendor management tools.”

Apart from analytics and digital collections, which make it more efficient, the fact that these “collections tech” companies offer solutions such as a “field collections mobile app” suggests that, while automation works, you will always need that field collections angle. And the same logic applies here: You need that human touch.

There’s a big market looking for personalized wealth advisory → whether the economics works out is where the innovation lies

There’s a big market that's looking for personalized wealth advisory, which cannot be solved by your family offices, and your bank relationship managers. I’d apply the same logic here. Will AI streamline this? Yes. Will it make it more efficient? For sure. But it won’t be able to solve everything. If a start-up comes in, and is able to use a combination of AI + domain experts and financial advisors, it could be a possible play. The problem here is that: if you’re going to earn management fees, the initial money to be made may not be that much -> as the customer grows, and increases their net worth, and investments, that’s when the money will kick in. And that’s why Dezerv pivoted, from the affluent base to the HNI base.

If someone can solve this, I do feel that it’ll be a big opportunity. But it’ll be slow growth in the start -> it’s not something that will grow exponentially in the start. And so it’ll need patience, and probably some sort of backing from a bigger platform. But that seems to be the case with all wealth tech start-ups now, since what seems to be left is the niche play.

And hence, coming to the same point as with other wealth / investment start-up opportunities: This, and all other opportunities will not be standalone plays, but will eventually need a bigger fintech / platform / AMC backing them.

(Edit: July 2025) However, seeing recent trends in AI, it’s very possible that this advisory layer gets outsourced to LLMs

Financial information source: In this case, the source of financial information still remain as banks, insurance providers, stock exchanges and so on.

Distribution & execution is key to become a data hub and drive usage: Apps can become centralized data hubs through offering sticky and habit forming services such as broking, and payments through the app, enabling usage and stickiness. Such as what Navi & Groww have done, by becoming TPAPs. They can also pull a 360 degree view of data on the app using data pipes such as Account Aggregators. And this can be done by any entity with which is regulated and holds a license under RBI, SEBI, IRDAI, or PFRDA. What will enable further differentiation here is the access to super specialized services - access to investments not available to everyone, building niche and specific execution flows (such as what Dhan & Sahi have done by focusing on the active trader market). Powering execution is key here

Affluent advisory will be outsourced to AI.

HNI advisory is a separate business (such as Dezerv, Waterfield; Dezerv raised $32M in July 2024 from Premji Invest. FY24 Val: $207M. Rev: $3M. Focused on PMS & curated debt for HNIs (69x);

Waterfield Advisors, a multi-family office platform, raised $15M in Feb 2025 from Jungle Ventures to expand UHNI coverage at a valuation of $85M. FY24 revenues were ~$5M (17x).

But mass affluent personalization and advisory may be outsourced to LLMs & AI. So apps seeing this and not execution as their moat may have to rethink their play

Credits:

This article is a collaboration with the Moxie Capital Team, and a shoutout to Parth Panchal (Investment Banking Analyst @ Moxie Capital) for working with me on this. Moxie Capital is an investment bank specializing in early to mid-stage fundraising and M&A advisory in the Fintech segment.

A special thanks to Atul Pande for his invaluable insights on investing & wealth management.

![[#57] The implications of SEBI’s proposal: UPI’s Role in Wealth-tech](https://substackcdn.com/image/fetch/$s_!pWq-!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F9daa502e-fa73-4c87-a896-0e2047749b2a_1456x814.png)

![[#51] Decoding Fintech IPOs: Part 2 (India Focus)](https://substackcdn.com/image/fetch/$s_!uKJO!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fd2fef0b6-f2b7-4872-ba0e-f3afe7a97675_1630x918.png)

Hello Ambika,

I hope this communique finds you in a moment of stillness.

Have huge respect for your work and reflective pieces.

We’ve just opened the first door of something we’ve been quietly handcrafting for years—

A work not meant for everyone or mass-markets, but for reflection and memory.

Not designed to perform, but to endure.

It’s called The Silent Treasury.

A place where conciousness, truth and judgment is kept like firewood: dry, sacred, and meant for long winters.

Where trust, vision, patience, resilience and self-stewardship are treated as capital—more rare, perhaps, than liquidity itself.

This first piece speaks to a quiet truth we’ve long sat with:

Why many modern PE, VC, Hedge, Alt funds, SPAC, and rollups fracture before they truly root.

And what it means to build something meant to be left, not merely exited.

It’s not short. Or viral.

But it’s a multi-sensory experience and built to last.

And, if it speaks to something you’ve always known but rarely seen heartily expressed,

then perhaps this work belongs in your world.

The publication link is enclosed, should you wish to experience it.

https://helloin.substack.com/p/built-to-be-left?r=5i8pez

Warmly,

The Silent Treasury

A vault where wisdom echoes in stillness, and eternity breathes.