[#68] The UPI bottleneck: Full stack ambitions, zero MDR reality

UPI is evolving from just a method, to an experience, and full stack seems to be the way to win, with UPI Apps, and UPI switches being built / acquired. But without MDR, the ecosystem is stuck.

There have been two big updates in the UPI ecosystem over the last month:

Razorpay announced its investment in Pop Club, a UPI app, to the tune of $30M

The government confirmed there are no plans to introduce MDR on UPI, keeping it “free.”

Let’s unpack both. And btw, for previous articles, where I’ve deep dived on the above themes, you can check out the below links:

Razorpay’s Acquisition of Pop Club: The PA-UPI Convergence

After months of speculation, Razorpay finally confirmed its investment in Pop Club. This is part of a broader trend where Payment Aggregators (PAs) and payment players are trying to monetise the massive UPI volumes on their platforms by building or acquiring their own UPI apps. And something I’ve tried to unpack in previous articles:

From a first principles perspective though, what’s the point of owning a UPI app for a checkout player?

Helps consolidate more of the user experience. The PA has ownership of the checkout (in the case of standard checkout, the PA owns the UI as well, and in the case of a S2S integration, the merchant owns the UI), but regardless there is some control.

The way consumer apps are going, eventually all payment instruments will be linked to the consumer app, and in India atleast on UPI. This is something that has already happened in the US, Europe etc, where cards & other instruments are saved on the consumer app, and that is the payment method.

In India, UPI payments can only happen on your phone - the way it works is that the NPCI CL (common library) which is responsible for the page on your phone screen where you enter your UPI PIN, can only be embedded in the mobile app. There hasn’t been a solve for direct integration with NPCI servers for this. And because the volume of UPI payments in India as a % of all digital payments will soon touch 90% (currently at ~70%), this means that majority of payments, instead of happening on checkout, actually happen outside the checkout - which means the merchant & the PA have limited visibility here.

Ownership of the UPI App (and eventually all payments app) solves this issue of “dual checkout,” and can give more visibility on where failures and drop offs happen. It also lays the ground for innovations: such as bringing these UPI payments within the app, or making it more seamless.

There’s another play here: you can also show visibility of this method at checkout better. Example: with a lot of BNPL players & other methods, a big part of the strategy is being VISIBLE to the customer at checkout, to drive awareness, and thus, transactions. Now, if the PA also owns the UPI App, it can 1) show the UPI App as a preferred method and 2) Show other methods linked to the UPI App, such as Pop Coins, or Cred coins for example, for the user to redeem, creating an ecosystem of a sort.

This was inevitable and something that we had predicted six months ago. Look around now. Out of the top 10 UPI Apps, 7 have a PA in some stage of approval. And vice-versa: Out of the top 8 PA’s in India, 6 have some sort of play in a UPI / consumer app, either through acquisition / investment (such as Pinelabs & Razorpay), or by getting their own TPAP license: such as CCAvenue for Rediffpay.

More ownership over the payment experience isn’t the only reason though, this also has a play in owning more of the experience, and then charging more basis that.

For merchants, yes. This makes sense. Hence platforms such as Amazon getting in here: Amazon is a PA, launched Amazon Pay, a TPAP to facilitate UPI payments through its platform. Flipkart had launched Flipkart UPI some time ago which allowed a more seamless in-app experience. Now it’s focused on SuperMoney, it’s UPI App, and I’m pretty sure it’ll get into a PA play soon enough. For PA’s, what’s the play?

Seems like a desperate play to own more of the stack to maybe get leverage and charge more? Earlier I would have said (and I did say) that this was a way to capitalize on MDR, but the government has come out saying that UPI will be free now and in the future.

So the play here for PA’s has to be full stack. And by owning more legs, you can own and customize the experience, and make it into a “value added service.” And then that’s what you charge for. Not the UPI method itself, but the ability to give a better experience. And maybe that’s what they can charge a premium for. Again, this is all hypothetical. No one has really scaled this: including a PhonePe, which is probably the player with the bigger scale on both PA & its UPI App. Paytm was the closest to this when they had their payments bank running: they had the payer leg, which was the Paytm TPAP (and switch), the acquiring leg, which was Paytm checkout + paytm switch (for merchant onboarding), and some piece of the remitter side: since I’m sure some users did have a Paytm Payments bank account. Of course, they fell apart when the payments bank shut down, and Paytm’s numbers have been dropping ever since

What’s next? Even though this hasn’t scaled yet, it’s still early days here. Following in the fullstack payments trends, I expect bigger PAs like Cashfree, Easebuzz (even though they claim profitability), and PayU to move in this direction. Acquiring a UPI app seems to be the natural next step, although if this actually works is anyone’s guess. But there’s probably another reason for this: there are only so many UPI Apps that can operate in the market. The best time to get in here and launch would have probably been a few years ago: if you’re launching now, you’re probably too late. So even those players who are late to the game are probably throwing their hat in the ring and saying hey: might as well. And since there is some ownership of checkout & a merchant audience, there could be a way to drive UPI app downloads, and transactions, from a PA push atleast.

And looking at the 75+ UPI Apps that do operate (including bank apps), I expect a lot of consolidation and shutting down. In fact, 6 months ago, the NPCI website had mentions of 40 TPAPs. Now the list only has 36. From an acquisition perspective, FamPay feels like an obvious target. Kiwi and other emerging players are also potential candidates. Pop got invested in / acquired by none other than Razorpay.

The second point is that the government has come out and said: Hey! Actually, we’re NOT introducing MDR on UPI (this is regular txns using savings accounts) and it’s going to continue to be free.

The government has made it clear: UPI will continue to be free for users and merchants. And while on the surface, this sounds good, we’ve reached an inflection point where unless there are actually margins here stakeholders can play with, innovation can, and has stagnated.

I’ve written about this before (and you can check it out at this link: Why do we need MDR on UPI, #60 of the Painted Stork), but TLDR:

Assuming that currently a UPI transaction costs the ecosystem ~40p per transaction (link to source here), at 18B transactions per month, this comes to ~INR 676 Cr costs per month.

There are 2 ways to make sure that stakeholders make money here. One is that you charge MDR on all transactions (like what internationally is the norm). Or, 2, and this isn’t done anywhere, but expect that the credit transactions on UPI in India which are charged (2% on Rupay CC on UPI) and 1.6% on Credit Lines on UPI are enough to power the entire ecosystem.

Can the credit card on the Rupay system power the entire UPI transactions, which include P2P & P2M? I mean. Anything is possible, but just looking at numbers, we’re a long way away from this to happen.

Let’s break it down.

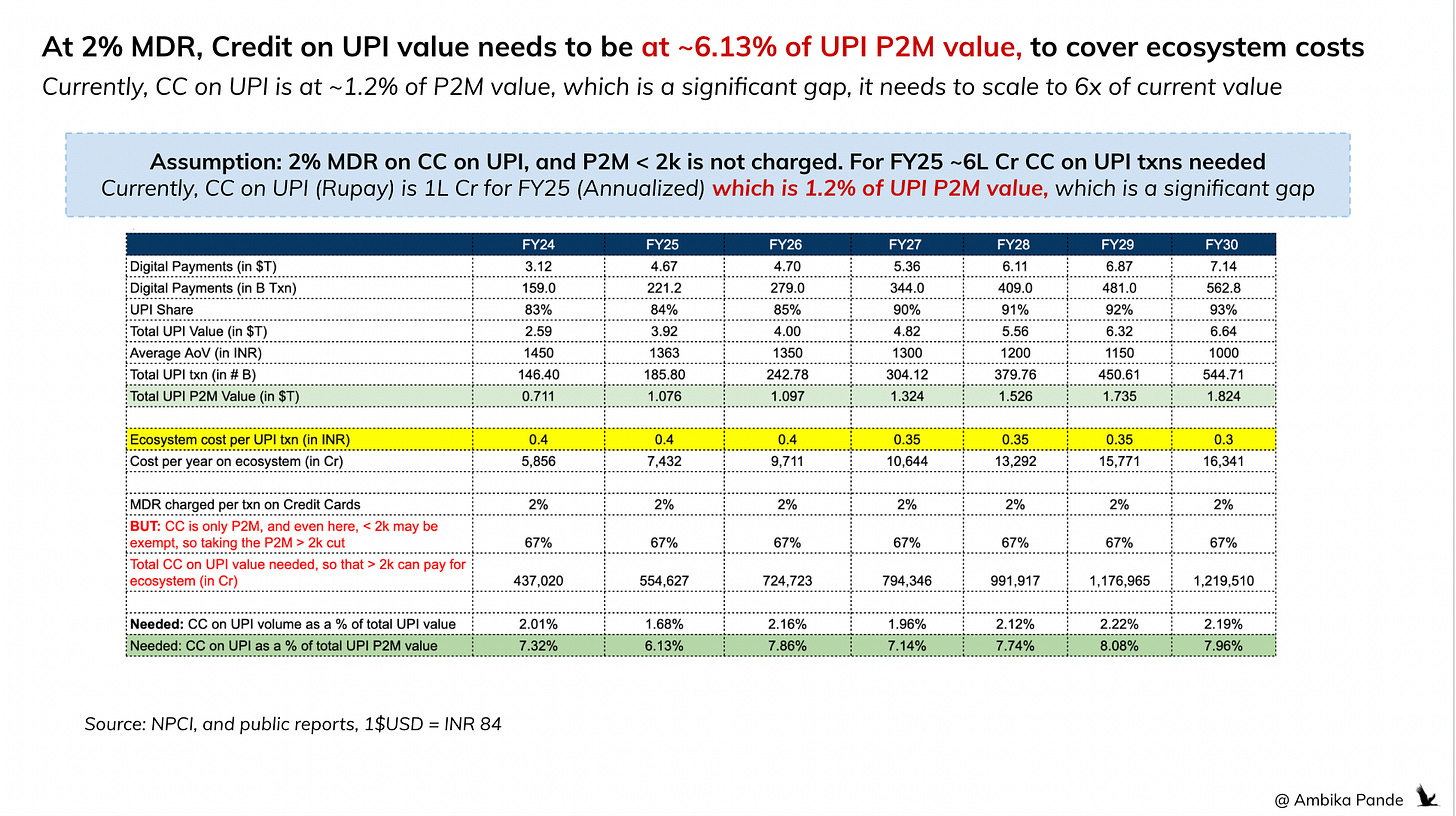

Basically the costs per year for the ecosystem (calculated at INR 0.4 per UPI transaction) come to some INR 7k Cr per year.

For credit to be able to fund this, I’ve basically back calculated, and ~ INR 5L Cr of Rupay CC on UPI transactions are needed so that the 2% MDR can pay for the ecosystem.

So basically ~8% of total UPI P2M transactions need to be on CC on UPI.

Currently we’re nowhere near this: annualized for FY25, this is ~ INR 1L Cr. As a % of UPI P2M, this is ~1.21% (UPI P2M transactions in FY25) are ~INR 91L Cr.

Is it possible? Sure. But it’s going to take a lot of time. Multiple reasons for this.

1) Merchants don’t want to promote a payment method that gets them to pay for a method that was previously free. However there is an ecosystem push to get merchants to enable this, so maybe this reason isn’t the major blocker for why we’re some time away from credit transactions paying for the ecosystem. But a lot of merchants are voluntarily turning this off on their QR payments, especially when the ticket size is greater than INR 2k. In fact, we’ve personally found it disabled at offline locations (bike showrooms, restaurants).

2) The bigger problem here is: actually giving customers a credit card. ~10% of India right now has a credit card (~100M credit cards in circulation in FY24). Rupay credit cards issued are ~10M + from reports. This is a form of credit. Revolving, instant credit. Getting customers to increase spends on these cards first requires customers to actually get this card.

So then, you need more customers to get credit cards on UPI. Which then becomes an underwriting question. There are two segments you can go after:

1. Give more add-on rupay cards to your existing credit card base.

Here’s my take. As a UPI user, the biggest advantage a Rupay card can give me is being able to make UPI transactions using a card, and then reconciling at the end of the month, instead of having 50+ transactions on my bank statement which becomes hard to manage and keep track. # of transactions may increase here, but I’ll still treat it for my small unorganized spends. The bigger spends, for flights, ecommerce etc, I’ll probably still keep on my Mastercard / Visa credit for perks.

2. Open up the base and give more credit to newer customers.

Banks need to relook at their underwriting policy to make this happen. This is what BNPL players solved for, by packaging short term personal or consumer loans, putting a experience layer around it, and selling it as a credit line. At the back, this was actually always a loan, and never revolving credit. Banks are pretty particular about who they give this to.

So both of these ways seem tough, and the responsibility cannot be on credit on UPI alone to make this work.

Although (and more on this later) it looks like UPI Apps with distribution are now going and launching co-branded cards and building a rewards layer over this so that they can drive CC on UPI transactions through their platform, and make some money.

I’m not saying we need to introduce a 2% MDR like cards, but there has to be some monetisation to sustain the ecosystem and fund innovation.

And also, if there is no MDR, then who exactly is going to bear the costs? UPI incentives in FY25 reduced from INR 2k Cr in FY24 to INR 437 Cr for FY25. This may get revised, but the point is, even INR 2k Cr isn’t enough to break-even on the ecosystem costs, which are probably closer to INR 5k Cr for FY24, and INR 9k Cr for FY25 (and you can check the assumptions I’ve taken for the calculations above). Majorly, I see these as two types of cost.

1. Ecosystem infra cost that stakeholders bear

It costs banks money to process UPI transactions (as per a previous article and some sources, this can be between 10p - 40p per transaction at an ecosystem level at scale), I’m assuming anywhere between 2.5p - 10p cost to the banks of the this (1/4th of the cost - but please note, that this is directional). Not a lot. But we’re also doing 16B transactions every month. This is 16 Cr cost PER month at an ecosystem level, that banks are bearing. Then, there are other charges:

2. NPCI Fees: switching costs and membership fees to use UPI rails

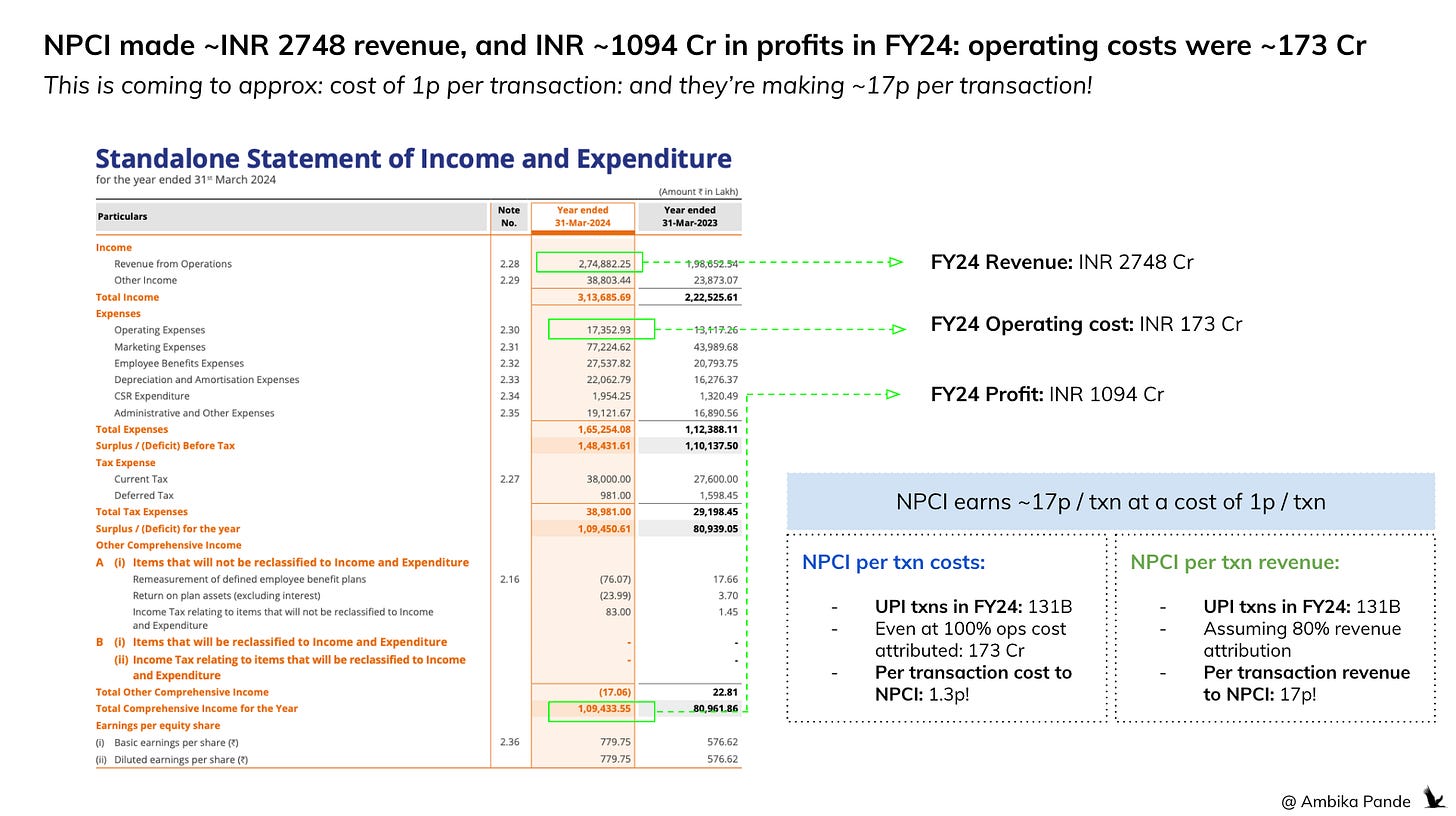

As per PIB report, in FY24 the total UPI volume was upwards ~131B transactions. And in the same year, as per NPCI’s annual report, the total revenue of NPCI was close to INR 2748 Cr. Majority of this was driven by UPI, and so I’m assuming ~80% of this is INR 2160 Cr. (note, this is an assumption). This is through a combination of the below.

Through a switching fee (that is on a per transaction basis) that banks have to pay NPCI on P2M transactions, for facilitating the payment

Onboarding / certification fees for new PSP Banks & TPAPs

Annual membership fees

Now, I don’t know how much of the INR 2160 Cr is attributable to which of the above, I’ve tried to look at what this would come out to be, if seen at a per transaction level. Quick maths here: INR 2784 Cr x 80% / 131B comes out to INR 17 paise per transaction. So NPCI has made ~ 17p per transaction on UPI in revenue.

And here’s another angle: NPCI was profitable to the tune of INR 1094 Cr in FY24. And it’s operating costs were INR 173 Cr. So if I look at this as a per transaction cost level: in FY24, again, assuming 80% of cost attribution here to UPI, that comes to ~1p of cost per UPI transaction. Since NPCI also runs BBPS, IMPS, Rupay etc, at an aggregate level, this cost is even lower.

Just to be clear, I’m not saying NPCI shouldn’t make money.

They do maintain the infra and the APIs, and this is important. But that’s the point! If we assume that this “charging of fees” by NPCI is needed for infra maintenance and driving innovation like launching new features circle, one world, launching in new geographies, working on new flows etc, then the same logic should apply to other stakeholders in the ecosystem.

There’s another implication no MDR and it’s to do with the full stack play (with indirect impact on innovation) & the UPI Switch

As PA’s move toward a full-stack play, the strategy is no longer limited to owning the merchant experience or building a UPI app. It’s now about owning the infrastructure layers in the middle, the plumbing that powers payments. To go omnichannel and serve merchants better across both online and offline use cases, PAs are increasingly building out capabilities in payment routing, fraud and risk management, and custom checkout experiences. A major part of this evolution is the move into UPI switches, the critical infrastructure that sits inside a bank, connects to NPCI, checks customer details, validates the PIN and processes UPI transactions.

Owning the UPI switch gives PAs significant advantages: more control over merchant onboarding, reconciliation, and refunds, as well as faster go-to-market for new UPI flows like credit lines, recurring mandates, or single-block-multiple-debit. We’ve already seen this play out : Razorpay has built its own acquiring switch, Setu (which was acquired by Pine Labs), has an acquiring switch stack, Paytm built its own, while PayU acquired Mindgate, which powers the UPI switches for SBI and HDFC, the two largest PSP banks in India.

But deploying a UPI switch requires a bank partner. These switches aren’t standalone SaaS products; they sit inside a bank’s infra stack. So PAs need a sponsoring bank to allow deployment. Until now, banks have been relatively open to onboarding multiple switches. But with MDR on UPI off the table, banks are bearing the infra costs, compliance overhead, and operational burden without any direct upside. This raises two important questions:

First, how many acquiring switches does a bank really need?

If the answer is, not more than 1, or maximum 2, then what will convince the bank to get more that those switches deployed? The only way the bank will do it, is if there is limited to no additional overhead & costs for his

So, if PA wants to deploy its own switch, will the bank now start charging for it?

Historically, it’s likely that switch TSPs charged the bank for deployment. But given the rising complexity and limited monetization, that model may flip. As owning a UPI switch becomes table stakes for PAs that want full-stack control, access to a bank's infrastructure could soon come at a premium. And now with no MDR, who will bear the costs then? Certainly not the banks.

Which then again leads to the strategic question: PA’s may not want to get into this and take additional costs on something that is already a cost centre. So then, lack of ownership = less control, less innovations, and slower speed of innovation.

While yes, what is true is that UPI needs to evolve from a payment method into an experience, and that is what will make money, you still need funds for that: at a bare minimum.

UPI is not just a payment method, it has to now become an experience.Think of what cards give us, and the innovations happening there, driven primarily by Mastercard & Visa.

Seamless acceptability: features such as Tap & Pay (enabled through NFC devices and cards)

One-click or no-OTP flows: again, fraud checks are happening in the backend

Biometric authentication: this is currently being piloted by both mastercard and Visa

Credit cards: revolving credit, and Credit card EMIs.

And the biggest, the stickiest value add: rewards, and the BIG reason why cards are still relevant, and have not been eaten up by UPI

If the ecosystem doesn’t have funds, then why would they even look at building out experiences on top of this?

Slice is now launching it’s Rupay CC on UPI, and it seems like instead of owning infra in banks, the winning play could be just - getting a bank, which is easier said than done

Slice launched a UPI ATM this year, but this isn’t an innovation per se, and while Slice claims that a UPI ATM cost will be cheaper, I’m not sure how that would work. Currently the cost of a regular txn on an ATM is upwards of Rs 18. Even with UPI, the cost of land, rent, electricity, security, cash management etc remains the same. So not sure where the optimizations are happening

However, what Slice, with its merger of North East SFB does have going for it now, is that with ownership of a bank, and of distribution, the full stack play actually starts making sense here. Slice originally started out as an issuer of prepaid cards, which were used by customers as faux “credit cards.” Now, finally, after its merger with North East SFB, it’s set to launch its own Rupay CC, and because it has a bank in-house, this can probably be more seamless.

I’ll give you perspective: Today, all banks combined together issue 4-5L Rupay cards every month. But remember the Slice story from a few years ago? Slice’s target audience was young professionals, college students, GenZ etc and they alone were issuing upwards of 4 lakh cards every month! But they had to shut down as they were not completely compliant. Now after acquiring a bank they can issue their cards again, and if they can scale to where they were at: 4L cards, then it could be a success story waiting to happen. Jupiter, another neobank, has reportedly been in discussions with SBM, to acquire some % in their Indian subsidiary. And maybe then, that’s where we’re going to see fintechs head, for payments.

Earlier the play was owning bits of infra in the bank. Now, if that becomes tough, they may change gears and try to acquire a bank. From an economics point also, this makes sense. Out of a 2% MDR, now, slice will get the TPAP cut, and the issuing bank cut as well. So, going by what the issuing bank cut is in regular CC transactions, that is 1.5% + whatever else they can get, if they own the PSP leg as well.

And this credit card on UPI play is where we’re seeing UPI Apps atleast place their bets.

I remember Fareed and I having a conversation on this a few months ago: that ideally every UPI app and end customer distributor should launch their own CC on UPI, and what’s stopping PhonePe? And now PhonePe has come out with exactly this, and a custom built rewards play on top of this. Razorpay now has this play through an investment in Pop, through the Pop Rupay CC on UPI (powered by Yes Bank).

The challenge here? I’m not sure how this would work exactly, but if every distributor goes after this, and wants to launch their own card, then those apps which have the customer base will stand apart: again, leading to some concentration risk. I’m not sure how RBI plans to govern this: from what I understand, while no prior approval is required from RBI to launch a co-branded card, it’s possible that with a lot of fintechs entering the fray here, there will be some new regulations that come in, where some sort of co-branded license has to be approved.

What I do see here is that existing CC on UPI Apps such as Kiwi, who already have some distribution, bank partnerships etc, look like possible acquisition targets. Maybe something Cashfree, PayU and Easebuzz can consider, especially after their recent funding rounds in FY25.

Note: There are other things on credit such as:

Credit lines on UPI: great as a concept, never took off

EMI on UPI: Pix has leveraged this, again, not taken off

But these seem to be in early stages, and as of now, its credit cards on UPI that has to pay for the ecosystem.

Another point to note here: you’ve got a lot of non-fintechs such as Zomato, Tata Neu etc which are also launching co-branded cards. This doesn’t have a lot to do with the fintech / UPI / full stack play, but more to drive loyalty. These co-branded cards enable users to get extra rewards when spending on that specific brand platform AND give those brands visibility on spends across platforms, not just that brand, for better user profiling. This is more to do with the ecomm to fintech play, because of synergies, and you can read more about it here: #66: Ecomm to fintech - a proven path. Fintech to ecomm - still a question.

A side note: One way to monetize the ecosystem could be to allow Mastercard & VISA linking to UPI, but this would not bode well for Rupay, and hence it’s probably not going to happen anytime soon, if at all

We’re also leaving money on the table by not properly enabling Mastercard and Visa tokenisation on UPI. Charge them more, let them link, that would bring in more revenue. Fund the ecosystem. Maybe allow some fee relief for other stakeholders. But if this happens, it’s game over for Rupay on UPI, and especially with the focus, not just in India, but in a lot of countries to move away from Mastercard and Visa rails, and focus on building a domestic card network, it’s unlikely we can look at this as a form of monetization.

With limited MDR, we’re also leaving a UPI rewards angle on the table.

With UPI still operating in a near-zero MDR regime, we’re not just stifling monetization, we’re also leaving a powerful rewards engine on the table.

Think about why credit cards continue to dominate high-value consumer spending despite UPI’s massive reach: it’s the rewards. Cashback, points, lounge access: these aren’t just user perks, they’re core to credit card economics. Out of the ~2% MDR that a merchant pays, ~1.5% goes to the issuing bank, and about 75% of that funds user rewards. It’s a tight loop: spend generates MDR, MDR funds rewards, rewards drive more spend.

Now contrast that with UPI. Today, apps are self-funding rewards to drive usage. That means burning their own cash for every ₹10 cashback or scratch card. I studied this with Amazon Pay UPI, it’s a great case study in how unsustainable that model is. Without margin on each transaction, you’re just burning money in exchange for short-term growth.

Introduce even a small MDR: say 10–15 bps (global case studies suggest a 25 - 30 bps) and the game changes. Merchants, banks, and TPAPs suddenly have visibility into unit economics. That margin can be recycled into user rewards in a sustainable way not as a burn, but as a reinvestment from actual revenue. Just like credit cards.

Even debit cards used to offer rewards back when there was MDR on them, although limited. But once debit MDR was capped at near-zero, those rewards disappeared too. The message is clear: no margin, no loyalty flywheel.

Prior to 2012, Debit card MDR was capped at 2%. That’s when banks also offered rewards on debit card spends, funded by MDR. Post 2012, RBI, to drive card acceptance slashed debit card MDR to 0.75 - 1%. (RBI circular). And that’s when rewards reduced.

But the point being: If we want UPI to compete not just on reach but also on retention and engagement, it needs a reward system that doesn’t rely on burn. A small MDR unlocks that, not just for TPAPs, but for the ecosystem as a whole.

For this to work long-term, there has to be MDR. Even a small MDR, like 0.3% in Brazil’s Pix system, could change the game. And this is the case globally: the real time payments system is charged, in no case is it completely free.

The few bps that merchants / users will end up paying is a very SMALL price to pay for bypassing the hassle of cards & cash.

And surveys miss the point: People often quote surveys saying 75% of users won’t use UPI if it’s no longer free. But those surveys ask the wrong question. Ask this instead: “Would you pay Rs. 1 per Rs. 500 transaction to use UPI?” I’d bet most people would say yes. It’s too valuable a payment method to abandon over a tiny fee.

It’s a really short sighted decision to say: “Hey we want to keep UPI free.”

In fact, this money also makes merchants & other stakeholders more likely to give back to the ecosystem. If you’re giving a merchant a chance to make money, there is a lot more scope to give cashbacks, offers and other things that will eventually drive MORE users to use UPI.

And all of this by the way leads even more into the UPI monopoly problem. The players who are currently in here, and have the leverage to actually negotiate with banks & other stakeholders to make money (ex: PhonePe) will ALWAYS have the advantage. And for the incumbents with distribution, they will get the best deals with banks, launch the most CC on UPI, and get most volumes funnelled through their app. So the 30% market share cap that NPCI wants, will never see the light of day.

What’s the endgame here? Is the goal to just keep UPI free forever?

Free isn’t always good. And if there isn’t a structured way to fund this, then the taxpayer will end up paying for this anyway. So it’s anyway going from the end customer’s pocket. Might as well put MDR and incentivize those stakeholders actually powering this, and not just NPCI

When there’s money in the ecosystem:

There’s more competition.

There’s more innovation.

Everyone has a reason to invest and improve the experience.

This isn’t just a UPI issue, it’s a broader Digital Public Infrastructure (DPI) challenge. We need to solve monetisation early, like in the Account Aggregator framework, before it becomes a bottleneck for growth.

And stop thinking of “free” as good. It’s never free. Someone is always paying for it.

![[#56] FY25 Budget Implications on UPI (Part 1): MDR on regular UPI transactions is now essential](https://substackcdn.com/image/fetch/$s_!5OAU!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fbdadd201-6844-4b81-b0f1-aadc51680154_1600x903.png)

![[#60] The UPI Dilemma: What happens when the infra and the apps are commodities?](https://substackcdn.com/image/fetch/$s_!lwZZ!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fa696dca4-050f-4c95-80a7-c6e9129ce3ee_1906x1070.png)