[#63] Do all roads in fintech lead to license aggregation (Part 4): It's not about license aggregation, but stack specialization

The fintech ecosystem is maturing, and it's not just about random license aggregation anymore, rather, licenses that will allow for specialization in payments, NBFCs in BNPL, and Xborder

Hi folks. Welcome back to the 4th edition of this sub-theme in my newsletter: Do all roads in fintech lead to license aggregation?

While this initially started out just as a thought exercise to try to understand what the play is for a lot of these fintechs, the answer to this question atleast is: yes. All roads in fintech do lead to license aggregation. This isn’t a bad thing. Rather it’s a good thing. It means that there are regulations, structures, and frameworks around being able to operate, less “fly by night operators” and more legitimate licensed entities operating, not in a grey, but in either black or white.

And linking it back to a previous piece I had written: If everyone is a PA, then what do the original PA’s do, it seems to be that originally the play was having the OPTION to do everything, but now, as the ecosystem has evolved, the differentiation lies in being able to really focus on a few core value additions. And how fintech stacks will evolve.

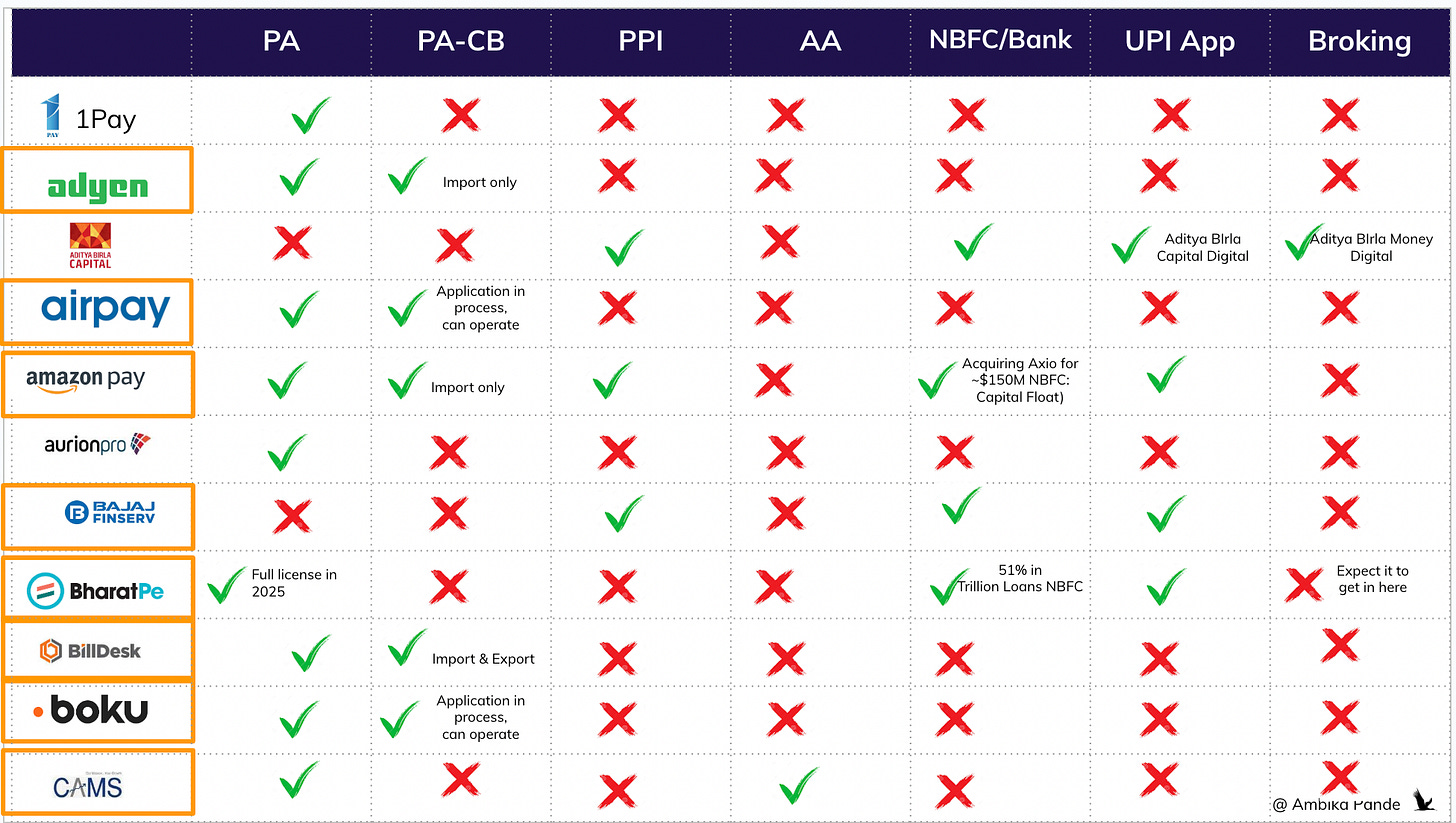

But before we get into that, let’s take a quick look into how the license holdings have evolved since Jan 2025. A key note, in this edition of this theme, I’ve expanded the licenses evaluated. Earlier I looked at fintechs across 6 licenses: PA, PA-CB, PPI, NBFC, AA, & UPI App. Now, I’ve added one more to the list: a broking license from SEBI (and I’ve broadened this to include AMC players also, such as Navi).

Note: License status is as of 16th April 2025

In Jan 2025, I looked at a sample of 66 fintechs. Then, 41% of the sample had 1 license, and ~59% had more than 1. Here, the sample I’ve looked at is 70 fintechs / financial services players (some key additions as Revolut, which got its PPI license, and Aditya Birla, with a PPI license as well). That skew has shifted in April: 40% of players have 1 license, and 60% have more than 1. And this is not just because I’ve added another license to the analysis, most players who had multiple licenses are the ones who had a broking license, or went and got them. Ex: Paytm, Groww already had. Cred applied for one in late 2024, and Mobikwik got its broking license approved in 2025. So these players may have moved buckets, but it’s not like they added to the “1 license bucket.”

To see the detailed list of the 70 fintechs in the sample, and the status of their license across the 7 licenses, go right to the end of the article to the Appendix section.

To check out the piece I had written in Jan 2025, see the below link:

[#54] Do all roads in fintech lead to license aggregation: Part 3

Note: License status updated as of 27th January 2025

So what are the major changes & updates from the January 2025 update?

1) The skew emphasis has shifted further→ even more fintechs have more than 1 license. In October this was ~54% with 1 license. In Jan ‘25 this was ~41%. And now in April it’s gone down to 40%.

Since standalone players have a lesser right to win, and the existing market is saturated, I actually expect a lot of fintechs to probably start giving these licenses back. There are many players with just 1 license, and just 1 license doesn’t seem to be enough anymore.

This isn’t a new insight, and it’s something that has been trending over the last year now (atleast this is something that I’ve been tracking). The way I look at it, is that while yes of course, the fintech landscape in India is maturing, and hence this aggregation is happening, this is also a challenge for newer fintechs to scale. Fintech in India will consolidate, if they haven’t already, with the top 3-4 players owning the market. The rest will have to figure out what to do.

Take payments. Out of the sample I’ve looked at, 27 players have only 1 license. 20+ of these players have a PA license in some stage of approval. There’s no way all of them will be able to operate profitably. How will they operate standalone? Bigger players like Zoho will be fine, but payments was never a core business. They probably got in here as a “just in case.” But fintechs -> players such as Gokwik, which specializes in “fast checkout solutions,” have applied for a PA. Even if it does get it, what exactly is it’s moat?

In fact, apart from the top few (which are B2B first) such as Razorpay, PayU, Cashfree, Eazebuzz (maybe, reportedly it is profitable) CCAvenue, Billdesk, the rest 40+ players will have to figure out what they want to do. Acquisition / shutting down seems to be the only way out. I’d question why even an acquisition, since bigger players have both the tech & distribution.

2) It’s clear that UPI can’t be a standalone business model, and at this point is just table stakes. Instead of seeing new standalone UPI players, I expect to see existing players integrate UPI into their services. And existing UPI players will continue to expand.

All UPI apps are getting into broking: Mobikwik -> Broking license in 2025. CRED -> applied for a broking license through its subsidiary Spenny in ‘24. Navi has an AMC. Paytm & PhonePe have their own broking plays. This is a new license I’ve looked at, and hence calling this out. This will continue to happen, with existing UPI Apps wanting to get into broking, to own a piece of that market. The margins seem to be much better on the broking side of things, with players such as Zerodha, Angel One, Groww, Upstox, 5Paisa all reportedly being profitable.

B2C, non UPI players (Groww is one example) will get into the TPAP side of things to own the experience more. How they decide to get into this is a strategic call they will take: My view -> a TPAP license requires the party to have a lot of UPI features, that they may not really need or fit in their use case (such as P2P etc). But owning the experience either through UPI Meta (which allows users to save their UPI IDs on checkout, like how you can save tokenized cards on checkout), or through UPI Plug-in would be a start.

The reverse is also happening-> B2B players getting into UPI to own the payment experience. Case in point: CCAvenue getting NPCI approval for their TPAP “RediffPay.” PhonePe & Paytm have their PA + UPI App play. Gpay & CRED which were UPI App first, went and got a PA license. PineLabs has a B2C App -> Fave, though this isn’t on UPI (yet). Razorpay is reportedly investing in Pop (according to Inc42).

There haven’t been any key movements in the last 3 months. But some call outs are:

1) Revolut getting a PPI license:

Probably because this is one of the easier licenses to get in India, as compared to the PA & PA-CB which has to do with money movement, AA, which is to do with accessing data from banks, and the NBFC license, which existing Indian start-ups have struggled to get because when they applied, their HQ was not in India. My sense: they’ve got the PPI license, and are probably testing out the waters before applying for a PA-CB license which will allow them to serve their core value prop of being a global neobank.

2) Aditya Birla getting a PPI License -> the NBFC, PPI & UPI App credit play:

Aditya Birla also launched a UPI App. My view: this is probably a larger play, where they as an NBFC can disburse a loan to the user, but disburse it into the PPI wallet, which the user can see on the UPI App. And this wallet can be used to pay (kind of like a credit line) on UPI rails, since now PPI on UPI linkages are allowed. Some caveats: the PPI needs to be a full KYC wallet, and all disclosures to the user need to be transparent and clearly communicated. Bajaj Finance is another NBFC with a PPI and a UPI App. DMI Finance is an NBFC, and has a PPI, but doesn’t have a UPI App yet. It has acquired Zestmoney - the BNPL start-up in a fire sale in early 2024, so it does have interest in the whole BNPL play, and it’s possible that it goes after the NBFC + PPI + UPI App model also.

What I feel will happen in fintech is some sort of business model specialization:

1. The payments play: Full stack payments will include online, offline, PA, UPI App & Infra:

I see more acquisitions happening in the payments side, especially for the B2B first players. Payments isn’t just online or offline anymore, it is about owning each touchpoint where the payment passes through. Few reasons for this:

1) The CCAvenue -> Getting a TPAP license, and potentially Razorpay investing into Pop: This strengthens the hypothesis of a combined PA + UPI App play, for the checkout to own more of the payments vertical.

2) Offline players, with UPI / B2C Apps such as PhonePe, Paytm, and PineLabs getting into the online side of things suggests the fully blown omni play. And with Razorpay building its own acquiring switch, PayU buying a stake in Mindgate, which has both the acquiring and issuing switches, this will expand to include infra.

3) Standalone offline players such as Mswipe & Innoviti will not be able to just operate offline only anymore. Both of these players have a PA-Online license, in fact MSwipe has a PA & a PPI license. But the offline tech is very different from online. And since the online space is so crowded, I expect some sort of acquisition / merger to happen here by online players who are not on the POS side. Some suspects here are: PayU, Cashfree (which recently raised ~$50M), and Easebuzz (which recently raised $30M). For some players, this has already happened: Razorpay acquired Ezetap in 2022 (now called Razorpay POS).

2. Cross border specialization. Whether the PA-CB license, and thus cross border needs to be in the full stack of payments, or can operate standalone, is something I’m still on the fence about, but I’m leaning towards operating standalone:

My view: the global TAM for cross border is massive, and margins are 3x those of domestic payments. There are also specific needs for specific corridors, and specific target segments, and thus, it’s possible that start-ups JUST operating in the xborder space may not really need to get into other pieces of payments. Bigger players obviously have gone ahead and either got one, or applied for one. Below is the status of some key players which have both a PA & PA-CB (note: most have more than this, have just looked at the existence of PA & PA-CB)

Adyen: PA, PA-CB (import only)

AmazonPay: PA, PA-CB (import only)

Billdesk: PA, PA-CB (import & export)

BriskPe: PA-CB (in principle auth granted and can operate). No PA, but is invested in by PayU ($5M seed round in 2024)

Cashfree: PA, PA-CB (import & Export)

Pay10: PA, PA-CB (import & export)

PayU: PA, PA-CB (application in process, can operate)

Razorpay: PA, PA-CB application in process, can operate)

An interesting one here is Pay10, I expect it to probably get acquired by a bigger player looking for the PA-CB license.

Some standalone players doing cool stuff here are Infinity, and if you’re looking for a player to provide Xborder solutions, I’d say, definitely check them out.

In terms of standalone players, who seem to only have gone after a PA-CB license, there are 6 players.

It’s possible we see more standalone players here building for specific corridors. Neobanks such as Zolve, which have gone after the India-US corridor could possibly go after the PA-CB license as well. There’s a snapshot of the players who ONLY have PA-CB below, and I expect more players to just be in this space.

BriskPe: In principle granted, and can operate

Payoneer: Application in process, cannot operate

PayPal: Application in process, can operate

Skydo: in principle granted, and can operate

Wise Payments: Application in process & can operate

Xflow: Application in process but cannot operate

Note: For those players who have a PA-CB license in process and are tagged as “cannot operate,” my understanding is that they are still providing services, and will do so until they hear something from RBI. They are probably providing this under the OPGSP guidelines, it’s not that they cannot operate at all, it’s just that they cannot operate as PA-CBs yet. The OPGSP guidelines (Online Payment Gateway Service Providers) were a precursor to the PA-CB framework, for facilitating Xborder payments for good & services. In OPGSP, the banks owned the relationship and the liability and were assisted by fintechs → banks owned the merchant relationship, and held the funds in their own account. Under the PA-CB, fintechs own the relationship (under RBI’s supervision), and can hold the funds temporarily in their own escrow account, and own the merchant relationship, but because of this they also have greater regulatory burden!

A reason I say that players will probably specialize here is because it’s not just about getting a PA-CB in India. You have to build for specific corridors, and get licensed in the specific end country. Let’s take Singapore as an example. If you want to solve for an import (money going out of India) or an export flow (money coming inside India) you need to get a required license in both India, and Singapore, and be both FEMA & RBI Master Directions compliant, and be partnered with an AD1 bank (which allow banks to convert currencies and process international payments). Examples of AD1 banks are: HDFC, ICICI, Axis, SBI, Yes Bank and so on

And usually these licenses require an on ground team in that local geography and very strong knowledge of how payments work in that region.

And if you’re solving for multiple corridors, it increases the complexity of the regulations & partnerships / own license required. In the snapshot below I’ve outlined at a high level what an import & export flow looks like for the India - Singapore corridor.

3. The NBFC + PPI + UPI App play

I talked about this briefly in the previous section, but broadly, I see NBFCs such as Aditya Birla, Bajaj, and maybe even DMI getting into to BNPL play by getting a PPI full KYC wallet, approving a loan, and disbursing it into the PPI Wallet. And then linking that PPI on UPI rails, and allowing the customer to use it as a faux credit line. That’s also the only play I see left for a PPI Wallet (apart from maybe something like a spend management tool). With UPI coming in, the play is all but dead for PPI. PPI may work for players such as AmazonPay, and maybe Flipkart, with its growing SuperMoney (UPI App) play, that’s just because of the sheer amount of volumes they process. PPI could be a marketplace play, and limited to the top 3-4 marketplace players, and that’s it. Otherwise, it’s dead.

Other players such as Jupiter, Slice are here → which started out with a neobank play, but because of the RBI’s stance against neobanks, had to pivot. Jupiter is now trying to buy a stake in SBM India, and Slice has merged with North East Small Finance Bank. Ideally, we should have a neobank model in India, with digital banking licenses being another category of license (such as how Nubank got in Brazil, with the Brazil government making an exception), but unfortunately that’s not a possibility today. To check out my article on neobanks in India, see the link below:

[#40] The case for neobanks in India: what can we learn from global successes such as Nubank?

Traditional banks are slow to innovate. This is a fact. And they’re slow with good reason: in the world of fintechs, with constant innovation, speed, and shipping products, sometimes it may be good to have an institution that moves slowly, and with temperance, especially since they’re the backbone of the financial industry.

4. The AA license play will remain finite

I’ve written a piece on the problems with India’s Account Aggregator (AA) Network, you can check it out below.

[#44] Open Banking: What's missing in India's Account Aggregator framework?

Open Banking is being highly touted as one of the key themes that will evolve in fintech. That, along with CBDCs, and neobanks, are what are being predicted as the key drivers of growth going forward. But what is open banking? I’ve heard folks confuse it with neobanks, core banking systems and basically bank infra.

But TLDR, a big move that happened in the AA world, is that PhonePe gave its Account Aggregator License back, because it couldn’t onboard enough FIP (Financial Information Providers, such as banks on board). Now, I understand that Sahamati, the NPCI equivalent for Account Aggregators is building some sort of interoperable layer where both FIPs and AA’s can onboard at one time, and get access / share data with all the AA’s / FIP’s integrated. Example: AA -> one time integration -> Sahamati Router <-one time integration <- All FIPs. Kind of like BBPS

But there are still other issues: There is no monetization allowed for banks who are the providers of this information, so they are understandably not super supportive when it comes to sharing data, they share it only at certain times during the day, there are format & quality issues with the data and so on. This is unlike the GDPR rules where bank participation and information sharing is mandated.

So unless all this is solved, there may not be value in getting into the AA side of things for new players, especially if a fintech market leader such as PhonePe couldn’t figure it out.

5. UPI Apps will get into all B2C plays, bills are one example: But while they’re trying for broking & insurance they haven’t been able to scale these offerings, which may require specialization.

Bill payments are one example. Existing UPI Apps can directly integrate with NPCI, OR you can integrate with existing providers (such as Setu) for this. If you want to integrate directly with NPCI, you’ll need the license and approval from NPCI. But if you decide to go through a “BBPS as a service” provider such as Setu, you don’t need the license. Insurance is another example. PhonePe holds a Direct Insurance Broking License issued by the Insurance Regulatory and Development Authority of India (IRDAI). This license authorizes PhonePe to operate as a Direct Broker for both life and general insurance products

But the right to win for these UPI first apps could be more from an ‘ad’ perspective because of their distribution power. That distribution being the right to win for broking or insurance hasn’t really worked out - investment / insurance first players such as Groww / Acko still dominate the market. There was a pretty good Ken article on this last month, here’s a snippet from the same;

“Yet, Phonepe Insurance has generated a meagre Rs 150 crore revenue in the last five years. The vertical hardly contributes 4% to the company’s top line. To make matters worse, the company is also coming to terms with a hard truth: you can automate payments, but insurance still needs a human touch.”

The company DNA & business know how matters, and hence even with UPI Apps, while the PA + UPI App play seems to be working, dominating other sectors such as investments and insurance may not be as easy as just “having distribution.” And hence the point I made earlier: Investment / insurance players may make moves on the UPI side to own more of the payment experience, but its an “experience” play. It’s possible that investment focused players such as Jar & Stablemoney get in here, but if they get into the UPI plug-in / TPAP play is a strategic question.

But all in all: Payments, NBFC lending, and Xborder seem to be the stack specializations that are coming up. UPI ownership is table-stakes, and how players decide to get in, either through a 3rd party stack, or through own TPAP is a strategic question.

Appendix: Status of Licenses across all major fintechs in India

A snapshot of what the combination looks like is below:

1 License Holder: 28 / 70 (40%)

21 have a PA license, 6 have just a PA-CB (in various stages of approval), and 1 has just a PPI

2 License Holders: 21 / 70 (30%)

PA + PA-CB: 10 / 21 (Ex: Adyen, Billdesk and others)

PA + PPI: 5 / 21 (Enkash, Unimoni, livQuik, Sodexo, Mswipe)

PA + UPI App: 2/21 (Gpay, CCAvenue)

PA + AA: 2/21 (Digio, CAMS)

3 License Holders: 11 / 70 (15.7%)

PPI, NBFC, UPI: 4/11:

Bajaj Finance, Jupiter, Slice

PA, PA-CB, PPI: 2/11:

Cashfree, Nium

4 License Holders: 5 / 70 (7.14%)

PA, PPI, UPI, Broking: 2/5:

PhonePe, Mobikwik

UPI, NBFC, Broking + 1 more: 2/5:

including PPI → Aditya Birla.

Including PA → Groww

5 License Holders: 5 / 70 (7.14%)

PA, PPI, NBFC, UPI, Broking: 3/5:

Cred, Jio, Tata. Note → these have the UPI, NBFC and PPI licenses for the lending NBFC play mentioned earlier

PA, PA-CB, PPI, UPI +1 more license: 2/5:

+ AA license: Pine Labs

+ NBFC license: AmazonPay

Orange outline is for those players who have > 1 license.

![[#54] Do all roads in fintech lead to license aggregation: Part 3](https://substackcdn.com/image/fetch/$s_!5-Qp!,w_1300,h_650,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F16919966-fc0f-48ba-9510-c26f74ed2638_1744x978.png)

![[#40] The case for neobanks in India: what can we learn from global successes such as Nubank?](https://substackcdn.com/image/fetch/$s_!G8yT!,w_1300,h_650,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F3d81c4d2-68c0-4341-8025-90f2bcf45e1e_1600x896.png)

![[#44] Open Banking: What's missing in India's Account Aggregator framework?](https://substackcdn.com/image/fetch/$s_!GClQ!,w_1300,h_650,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fab5b2adf-3720-45b7-9453-e2cd2dc6933e_1750x978.png)