[#54] Do all roads in fintech lead to license aggregation: Part 3

Cashfree, AmazonPay, PayU and more are acquiring PA-CB, PPI, and NBFC licenses to increase their Right to Win, while majority UPI Apps have other licenses to provide potential to augment revenue

Note: License status updated as of 27th January 2025

In October ‘24, I had taken a look at the different fintechs in the market, and had analyzed ~ 55 of them, to see which licenses they had, and as a whole, how many fintechs had how many licenses. And if they had multiple, then which ones were more coveted? The licenses that I had analyzed these fintechs across were:

1. PA (Payment aggregator)

2. PA - CB (Payment aggregator - Xborder). A point to note here is that there are licenses for Import only, Export only, and Import & Export

3. PPI (prepaid instruments, think wallets)

4. AA (Account aggregators → think open banking)

5. NBFCs

6. UPI Apps

You can check it out below:

What are the major changes from October ‘24 to Jan ‘25, in terms of license aggregation?

1) In October ‘24, 54% of the total sample of 55 had 1 license, and ~46% had more than 1 license. Now that skew has changed, more fintechs have 1+ license.

Now, while in Jan ‘25 the sample here has increased to 66, and that can contribute to some of the skew, 41% of the sample has 1 license, and ~59% have more than 1. So the skew emphasis has shifted → more fintechs have more than 1 license. Check out the snapshot below. The smaller fintechs (Gokwik, Eazebuzz etc), and the “cross border fintechs” (Skydo, Xflow, Payoneer) sit here, with either a PA, or a PA-CB license only.

Juspay is a big one (currently raising ~$100 - 150M at $1B valuation) that currently sits in the 1 license bucket. Seeing its international ambitions: reportedly setting up offices in Dublin, Ireland, Singapore, and expanding to SE Asia, and the US, I expect it to apply for the PA-CB pretty soon. Stripe is another one that sits here, but thats because in 2024, its PA-CB license was rejected / withdrawn. Wise, PayPal, Payoneer, also have just 1 license that they have / applied for, but thats the PA-CB, and that’s because they are primarily cross border focused.

2) There has been horizontal movement: Fintechs are aggregating more licenses. The most popular seems to be PA-CB, followed by PPI.

This makes sense. Not that any license is easy to get, but AA licenses are not easy, because of the data access (they are accessing sensitive customer data, even though it is masked, so privacy and security needs to be top notch), and direct integration with FIU’s (banks, credit cards, loans, investments and so on). For a fintech led AA, banks etc may not be okay with being onboarded as FIPs (Financial Information Providers) on a fintech AA. In fact, PhonePe is reportedly considering giving its AA license back because of this reason. And the NBFC license is tough to get for 2 reasons.

RBI is generally reluctant to give out NBFC licenses to fintechs because of the overlap in capital structures: RBI is generally not in favour of the same entity holding multiple NBFC licenses, which can happen here if the same investor is invested in multiple fintechs. However, this is news from 2023, it could change

RBI seems to be on a crusade to clean up the NBFC market in India. As of 2023, there were ~9480 registered NBFCs in India. A lot of these are inactive. RBI has also increased the NoF (Net Owned Fund) requirements, which in 2023 was INR 2 Cr. It has to increase to 5 Cr by March 2025, and 10 Cr by March 2027, to increase the ability of NBFCs to absorb losses, and manage risks.

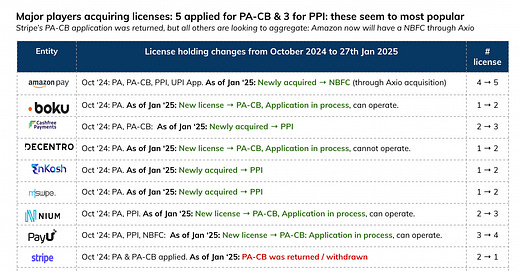

So what are the key movements between October 2024, and Jan 2025? (you can check out the table above)

AmazonPay: Will get an NBFC license through Axio acquisition for ~$150M, and take its licenses to 5 (PA, PA-CB, PPI, NBFC & UPI App), from 4 in Oct 24.

Boku: Is an international PA, and has now applied for a PA-CB license. I had predicted this last time. It now has a PA & a PA-CB license, taking its licenses upto 2, from 1 in the last quarter.

Cashfree (PA): It earlier had 2 licenses, the PA & the PA-CB. It has now added a PPI license to its kitty, bringing it to 3. In Jan ‘25, it raised $53M at a $700M valuation. It could use some of these funds to go after a license → while NBFC & AA may be hard, the UPI App one maybe be possible from a build / buy perspective

Decentro (API Banking): Earlier was a PA, now added a PA-CB, bring its licenses to 2

Enkash (spend management) got a PPI, bringing its # of licenses to 2. Earlier it had just a PA license.

Mswipe (Offline POS): In October ‘24, it just had a PA license. Now it also has a PPI license

Nium (Xborder PA), applied for a PA-CB license. Nium goes from 2 licenses (earlier PA & PPI) to 3.

PayU (PA) also applied for a PA-CB license. PayU goes from 3 licenses (PA, PPI, NBFC) to 4

Worldline: Earlier was a PA, now has also applied for a PA-CB license, bringing its licenses to 2.

Stripe: This is something that is really interesting. Stripe India’s PA-CB license was withdrawn /returned for some reason, and unlike Adyen, which seems to be doubling down in India, establishing India offices in Bangalore & Mumbai, Stripe seems to be withdrawing from India.

So what are the most popular license combos this time?

Lets look at it in terms of # of license buckets.

1 License: Primarily smaller players, or Xborder focused players applying for a PA-CB license. 27 / 66 players sit here.

I talked about this earlier in the piece. You’ve mostly got smaller players who have got a PA license, and are trying to maintain share (CC Avenue), or others who have acquired it, but are yet to start operations seriously. And then on the other hand, you have your PA-CB entites, which are primarily Xborder focused.

2 Licenses: Primarily a PA & PA-CB Play (10 / 21) or a PA & PPI play (5/21). Total 21 players sit here

PA & PA-CB is the most popular combo. These are mostly players who got a PA-CB, and then figured expansion into PA-CB makes sense as well to open up cross border flows. I expect GoKwik, CCAvenue, and Juspay to all go after a PA-CB license as well, they’re currently sitting on just 1 license, a PA.

PA & PA-CB (10/21, or 47% or the 2 license bucket)

Adyen: PA, and PA-CB (received, but import only). Note: import flows are → Indian customer, Foreign merchant. So money flow is India —> foreign market. Export flows are Foreign market —> India (money coming into India)

Airpay: PA-CB application is in process, but they can operate

Billdesk: PA-CB received, for both import and export flows

Boku: PA-CB application in process, can operate

Decentro: PA-CB application in process, CANNOT operate

Pay10: PA-CB received, for both import and export flows. This could be an acquisition opportunity for players who’re scaling up their operations, from a license perspective

Payglocal: PA-CB application in process, can operate

Paymate: PA-CB application in process, CANNOT operate

Unlimit & Worldline: PA-CB application in process, CANNOT operate

PA & PPI (5/21, or 23% or the 2 license bucket)

Enkash, Livquik, Mswipe, Sodexo, & Unimoni all have a PA & PPI. However, I would comment that a PPI license, in my opinion may not have that much value anymore, especially seeing how UPI has essentially cannabilized that use-case. NPCI is trying to bring it back, by introducing interoperability on PPI wallets across UPI Apps, but i doubt the opportunity. You can check out the piece I wrote on PPI interoperability below:

3 Licenses: 12 / 66 players sit here: Key players being Razorpay, Mobikwik, Cashfree

PA, PA-CB, PPI: Cashfree, Nium & Razorpay. Cashfree received its PA-CB license, and added a PPI license to its arsenal. Both Nium & Razorpay have their PA-CB application under process and CAN operate. I expect both Cashfree & Razorpay to move into the 4 bucket license soon, by going after a UPI App, a NBFC, or an AA license soon, since they’re bigger fintechs. With Nium HQ’ed in Singapore, it may be limited in terms of the licenses it can get.

UPI App, NBFC, PPI: Jupiter, Slice, Bajaj. Seems to be a NBFC / neobank favoured combo. A UPI App for consumer distribution, a PPI as a pre-funded wallet of sorts, and the NBFC as the source of funds is a combo that would allow these fintechs to give some sort of credit to the customer, which can then be linked to UPI rails, and used in a convenient way.

Policybazaar (PA, AA, NBFC) & Mobikwik (PA, PPI, UPI App) also fall here. I’m not too sure of what Policybazaar’s play is here. But with Mobikwik, I expect it to go after an AA & a NBFC license soon, to be able to support its credit ambitions. It’s recently tied up with Piramal to offer personal loans, and it seems to be credit focused. It’s lending ops expense annualized in FY25 is ~17% of total expenses.

For a deep dive into Mobikwik financials, you can check out my article below, it covers Mobikwik, and other IPO’ed / soon to IPO fintechs in India:

4 Licenses: 5 / 66 players sit here: PayU, CRED, PhonePe, Tata, & Jio

PA, PPI, NBFC, UPI: Cred, Jio & Tata sit here. Jio & Tata are not surprising. Jio has ambitions to get in everywhere. Cred is the only pure play fintech that sits here. Their UPI App & NBFC verticals are scaling: ~50k Cr value of UPI transactions in December ‘24 (#4 in terms of value processed), and and reportedly, its NBFC has done INR 632 Cr ($77M) of lending on its books. The NBFC point —> its an NBFC called Parfait Finance. The majority is not owned by Cred (~23.6% owned), but Kunal Shah, through his Newtap technologies, which owns ~76.4%. This NBFC is what funds Cred Cash - its short term personal loans. And Cred seems to be doubling down here → reportedly Kunal Shah is planning to invest $63M into Newtap to bulk up its lending business further. The others: PA, & PPI not developed / scaled.

PA, PA-CB, PPI, NBFC: PayU

PA, PPI, AA, UPI App: PhonePe seems to be focused on its upcoming IPO. But I expect it to reapply for a NBFC license, since with 50% + market share of the UPI value & volumes in India, its a significant distribution channel. But its giving back its AA license reportedly. Still stays with 3 though, if that happens.

5 Licenses: 2/66: AmazonPay & PineLabs

PA, PA-CB, PPI, AA, UPI: PineLabs. PineLabs is the big PA that sits here. Lots of potential to scale. The only license missing here is the NBFC license. I expect if / as PineLabs scales its UPI App as a form of distribution, there is potential to go behind credit, and cross sell this to the end customer. Affordability (Brand EMIs etc) are a big offering of PineLabs, so the credit focus in the future makes sense. They do need to double down on their online PA & PA-CB offering, which hasn’t scaled as much as their offline business. But just from a potential / license perspective, they are in the right position. Whether they do it, time will tell.

PA, PA-CB, PPI, NBFC, UPI: AmazonPay. AmazonPay has / is in the process of acquiring a NBFC through its acquisition of Axio for ~$150M.

Another key point to note here is that these licenses have a cost: actual monetary cost, and a cost of compliance

To apply for a PA, PA-CB, PPI, NBFCs, and AA, entities need to have some minimum net-worth requirement that needs to be maintained.

PAs need INR 15 Cr at the time of application, scaling to 25 Cr in 3 years.

PA-CBs need a minimum INR 15 Cr net worth requirement at the time of application

NBFCs need a minimum Net Owned Fund of 5 Cr by March 2025, and 10 Cr by March '2027

AA applicants need a Net Owned Fund of INR 2 Cr.

And the headache of staying compliant is separate. As licensed entities, they are subject to audits, and have a duty to periodically send reports of business operations. This isn’t a problem for bigger players, who already have some of these processes set up. But for smaller players entering the market, its a note of caution. As the Indian fintech ecosystem matures, having stringent reporting processes, and being set from a compliance perspective is key, if you want to run any sort of fintech business.

So license aggregation is happening: and I expect as smaller companies scale, and bigger companies reverse flip, those serious about their fintech ambitions will go after the PA-CB, NBFC, and UPI App Licenses.

PA-CB is the newest kid on the block, wrt to licenses. And atleast by looking at who has got what license, it seems that international PAs are applying mostly for the import only license (Adyen, Amazonpay, which solve for outward remittance). While domestic PA’s (Cashfree, Pay10) are going for both the import & export license. Of course, lot still to be solved here, but I see FY25 as the “year of the PA-CB license.” With crossborder having ~3x of the margins that domestic payments have, more fintechs will want to get in here. The challenge is that PA-CB also requires a minimum net worth of INR 15 Cr, so it may be something either very Xborder focused players go for, such as Xflow and Skydo, or / and something bigger players pursue. But this is something that players will go after.

NBFC’s & AA for reasons I’ve mentioned is a tough license to get.

What’s left is the UPI App license, which your bigger fintechs sitting in the 3 & 4 license bucket may go for.

There aren’t too many blockers here, from a tech / compliance perspective, especially for domestic players; I say this relatively, when compared to a NBFC / AA type license. The challenge here is distribution. In a market where PhonePe (50%), Gpay (35%), and Paytm (5%) control 90% of the market, even a large fintech with scale coming in may find it tough to find a foothold. So instead of building from scratch, it may be easier to buy an existing UPI app for scale. And seeing that there are ~75+ UPI Apps operating, with ~15 of them being fintechs, this may be a consolidation / acquisition opportunity in the horizon.

I also expect crossborder / international players, which have consumer apps, but not UPI apps, to get into the UPI App game, if they are serious about India. Wise & PayPal are two players which have applied for a PA-CB license, and CAN operate. They’re both international players, so I expect they have applied for an import flow in the PA-CB license, and I would not be surprised if they go after the UPI App game in India.

Even looking at licenses UPI App backwards, very few UPI Apps are standalone. All have some other licenses to provide potential for alternate streams of revenue

Note: PhonePe may reportedly give back its AA license, bringing its total licenses to 3.

If I look at the top UPI Apps in December 2024, almost all of the top apps have atleast 2 licenses, if not more. Just looking at the Apps with 1 license: BHIM doesn’t really count because its developed by NPCI. Whatsapp & SuperMoney are part of bigger platforms: Meta & Flipkart, so monetization & burn may not be an immediate concern. But if we use Amazon Pay’s example → even though it is a part of a bigger platform of Amazon, it’s still getting sorted from a license perspective. While I’m still unsure of what Whatsapp’s positioning is in the market, its strengths seem to be on the P2P side. SuperMoney is doubling down on Credit, and a PPI & NBFC license could possible be on the cards, for the wallet funded by credit, and then distributed through the UPI App play. It’s under the Flipkart umbrella, and Flipkart has NBFC ambitions. It reportedly applied for a NBFC license in 2023.

The point here is even with pricing, UPI is supposed to be a “Digital Public Good.” And so UPI Apps have to find other ways to monetize

Thats why license aggregation is happening even from a UPI App perspective. There is limited pricing on UPI right now. You can check out my piece on UPI pricing below. TLDR: pricing needs to come in on regular UPI transactions (not just Credit & PPI), to be able to fund & drive innovation.

But even if pricing on regular UPI transactions comes in (savings accounts, not just credit cards), the point of UPI is that it is supported to be a public good. And thus pricing will always have a cap on it → UPI Apps will HAVE To find other ways to monetize. Even a Fampay for example, has got itself a NBFC. It’s very hard to have a standalone play in UPI , if you want to make money. And thats why in the future, I expect all UPI App fintechs: Whatsapp, Super.Money, FamPay, Mobikwik & Navi to all continue this story of license aggregation

License aggregation could potentially lead to some sort of consolidation in the market: a buy vs build approach

Top fintechs are consolidating licenses. In some cases, such as PA-CB, which is a new license, they will apply for a fresh one. And almost everyone is a PA at this point. So what’s left? PPI is one, but in my opinion, the value of a PPI is quite diminished because of UPI, so the use case escapes me. The key ones will be NBFC, AA & UPI Apps. So what’s the potential for consolidation here?

NBFC: There are ~9400+ NBFCs in India as of 2023. So there is definitely some sort of consolidation opportunity here. Like what we saw with Amazon Pay and Axio (Founded in 2013). And Cred buying Parfait Finance (founded in 1995), and renaming it to Newtap.

AA: I’d say there are approximately 15-16 AA’s in India. Setu obviously (bought by Pine in 2022), and then others such as Perfios (which acquired Karza in 2022), Finvu, CAMSFinserv, Digio (which is also a PA), and PhonePe (which is a UPI App, PA, and PPI). May be some sort of acquisition opportunity here, but fintechs may choose to apply independently as well.

UPI App: As of December 2024, there are 80+ UPI Apps operating in the market. While this also includes bank apps, a significant % of these will also be smaller fintechs. Example: Freo, Kiwi, Curie Money, INDMoney, Niyo, OneCard, and so on. Seeing the distribution, as I mentioned before, very tough for smaller apps to get a decent enough share of the market. It’s possible there is some buy opportunity here → bigger B2B fintechs may prefer to buy an existing app with some scale, instead of building their own. As we’ve established, a standalone UPI App is not the game anymore.

![[#37] Do all roads in fintech lead to license aggregation: Part 2](https://substackcdn.com/image/fetch/$s_!0EZL!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F2cc9aa1e-f79a-469c-9887-52c189f6637f_1634x918.png)

![[#50] UPI ecosystem developments in Dec '24: Whatsapp user cap removed, and PPI interoperability - too little too late?](https://substackcdn.com/image/fetch/$s_!Rl5A!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fbcf0d665-0f52-4723-97aa-61f848f94b39_1706x960.png)

![[#51] Decoding Fintech IPOs: Part 2 (India Focus)](https://substackcdn.com/image/fetch/$s_!uKJO!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fd2fef0b6-f2b7-4872-ba0e-f3afe7a97675_1630x918.png)

![[#41] From Free to Fee: Why does UPI need pricing to sustain innovation and growth?](https://substackcdn.com/image/fetch/$s_!mIxr!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fa50c5cdb-8fb0-48a5-bf3a-f6ab93a29d0f_1754x986.png)

I think PPI still makes sense for EnKash, Sodexo, LivQuick because it has more to do with Prepaid cards then wallets, which still have a massive and growing use case - expense management.

Hi Ambika, firstly thanks for making this great piece. It has time and again provided me with a great resource whenever I needed clarity studying FinTech. I would want to understand what is behind NAVI's growth as a UPI app? Apps like GPay and super.money have one-click payment so affinity is there, but PhonePe seems to give more of PayTM / superapp feel. So, what is making users' primary payment app?