[#47] UPI in Nov '24: Challenger apps Super.Money & Navi are challenging, but there is still much to do

Navi & Super.money have made moves, with Navi displacing Cred as #4 in # of txns, but AoVs and value processed still has a lot of ground left to cover

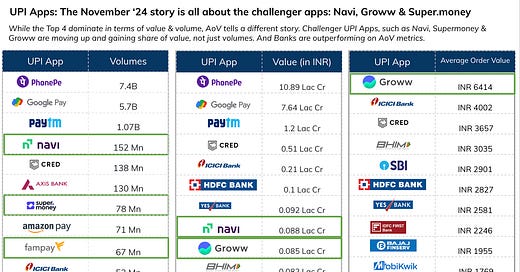

The November 2024 story is all about the challenger apps that are stepping up and “challenging” the incumbent apps so to speak: PhonePe, Gpay, Paytm and Cred.

I had written a piece a couple of months ago, where I tried to deep dive into what the play for challenger UPI Apps is: seeing that 95% of the market share in terms of volumes & value sits with the Top 4 Apps, and breaking the monopoly in light of user preference and behaviour is pretty hard.

A few key learnings came out of it:

The battle for the ubiquitous UPI app seems to have been won, as of now. PhonePe & Gpay especially with their superior stack, and experience have very solidly won the market with ~50% and ~35% market share in terms of value respectively.

There could be an opportunity for category specific UPI Apps: Groww, which seems to have carved out a category for itself in the investment & SIP space - its AoV and the SIP AoV are fairly similar: between INR 5k - 6k. Other apps such as Navi, which also has a personal loan arm could be focused on Credit, and Super.Money, which is part of the Flipkart group, could be ecomm, or specifically Flipkart focused.

You can check out my piece below where I deep dived into some of these questions

[#38] Is the battle for the ubiquitous UPI app over? : What do the next few years look like for UPI Apps?

A lot of the pieces I’ve done have been payment aggregator backwards: where I’ve focused on the key PA’s and worked backwards from there. This time I’ve tried to look at this UPI App backwards.

So what does November ‘24 look like for UPI Apps?

Well in terms of the market, the UPI value processed was INR 21.55 Lac Crore (~$262B), and the # of transactions were 15.48 B. And there have been some changes from the last time I did the analysis (for September 2024).

Navi has crept up to #4 in terms of number of transactions. In September 2024, they were at #5, with ~120 Mn transactions, right behind Cred, which had ~140 Mn transactions. It’s also showed up at #8 in terms of value processed in November (INR 8806 Cr), in September it was at #11. (INR 6547 Cr).

Super.Money, which in September 2024 was #18 in terms of value processed (INR 2167 Cr), and #15 in terms of transactions processed (49Mn), has gone to #15 in terms of value (INR 3130 Cr), and leapfrogged to 7th position in terms of number of transactions (78 Mn)

Check out the movement of both Navi and Super.Money. And Super.Money is especially impressive, seeing that it launched officially only about 4 months ago, in August 2024.

But while this is promising, the 4th position in terms of # of txns is low hanging fruit. And the fact that challenger Apps still have very low AoVs, still leave a lot of ground to be covered in terms of value processed

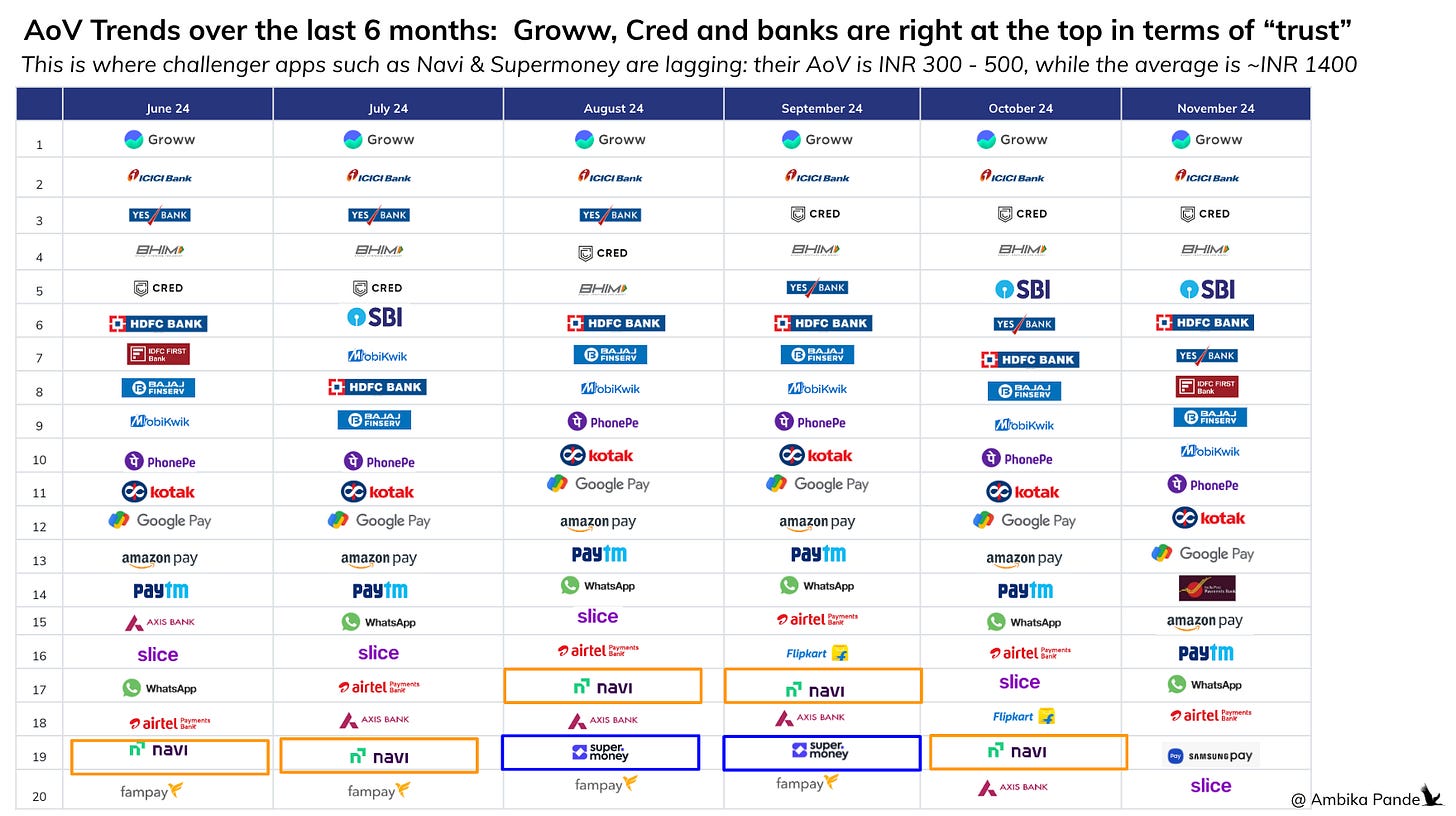

The average AoV of UPI in general is INR 1400. Except for Groww, and Fi to some extent, the others are below INR 1000. This increases the burden in terms of AoVs to get to value processed. And it also opens an interesting question up: that of trust.

Bank apps have much higher AoVs than consumer apps by fintechs (with the exception of Groww). One reason of this could be: people just trust banks more to make larger transactions. Its the same Quick Commerce Vs E-Commerce Vs Retail argument. I’m willing to index on experience and speed when the basket amount is small, and I don’t have too much riding on it. When the basket amount becomes bigger, thats when I prefer to go through a trusted merchant, which guarantees returns and refunds, or go offline to the store myself to buy the product. Same logic.

Another thought is: after seeing how low some of the AoVs of apps are, they’re probably using them for specific offers & cashbacks, but majority of the transactions are happening through the Top 3-4 apps.

So then the game is AoV: but to get there, you have to build trust. And this is one metric where the challenger apps are lagging. Navi & Super.Money have an AoV of INR 300 - 500. Compare that to the average (that is where Paytm, Phonepe, and Gpay sit) which is between INR 1.1k to 1.5k. And at the top, Bank apps, Cred & Groww are between INR 3k- 6k.

So you need to be specializing in higher AoV volumes, to drive usage, but for everyday use. Or somehow building trust to drive up the AoV. Or focus on categories that specifically have higher AoVs, may be a better way to bump up the values processed.

But then its a catch 22 situation: How do you drive habits and continuous usage, but that the same time focus on high AoV categories: the definition of which is that item that you probably don’t buy all that often?

One thought is B2B transactions: It’s still grossly under-penetrated in India, and whatever volumes come, come from banks

In contrast, the Brazilian equivalent, Pix has 40% of its volumes attributed to B2B transactions. In India, this is 0.13% of the entire UPI value processed: In November 2024 this was ~INR 2982 Crs out of 21.5 Lac Crores!

And all of this is driven not just from banks, but 1 bank in particular: ICICI Bank. Out of the 2982 Cr attributed to B2B transactions in November 2024, INR 2951 Cr came from ICICI bank.

But while UPI is great, and convenient, there are some challenges that come with B2B transactions:

1. Daily transaction Cap: The UPI transaction limit per day is Rs.1 lakh as per NPCI. However, the limit is Rs.2 lakh for transactions related to capital markets, insurance, collections and foreign inward remittances. And the UPI limit is Rs.5 lakh for Tax, Payments to educational institutions and hospitals, Payments to IPO & RBI retail direct schemes payment. It’s still pretty low though for a business transaction

2. Mobile App dependency: Businesses don’t really use mobile apps to make payments. Maybe there could be a petty cash sort of use case, but apart from that while the daily transaction cap can still be figured out, mobile app is tough.

So B2B seems tough as of now: Then we’re back to the category specific play

Groww with SIP, and AmazonPay with Amazon have seen success here. Which makes me feel positively about Flipkart UPI & Super.Money - by leveraging the Flipkart Ecomm base, there is a lot of potential to atleast reach the scale that Amazon is at (in November they were at ~INR 7900 Cr, Vs Super.Money’s 3130 Cr. In terms of # of transactions, Super.Money has already passed them (78Mn Vs 71 Mn).

Others category plays could be: Investment Apps, maybe a Fashion or a Quick Commerce App focused app, although the AoV on QC fairly low: close to INR 500 - 600. There aren’t that many categories that sit on the cusp of both reasonably high AoV & fairly frequent transactions.

One opportunity is Credit: Double down on offering credit (line or cards on UPI rails). But only Cred has pulled this off, and not through offering Credit on UPI, but by tapping into the more affluent base to use their app to pay their credit card bills

Cred is a prime example: It focuses on credit carded customers, and customers are probably paying their credit bills through Cred. This is also a more affluent base: read - only those who have credit cards. Cred has an AoV of INR 3500+. Another example is Kiwi, which specializes in Credit Cards on UPI. It’s market share is still pretty low, but its AoV’s are around INR 1400, which is close to the industry average, and higher than the so called “challenger app” such as FK, Navi, and Supermoney, all which ar around the INR 500 - 800 mark.

New age challenger apps are playing here: In fact Super.Money launched a co-branded Rupay Credit Card on UPI, in partnership with Utkarsh Bank. This is a secured card, which customers can activate by depositing amounts as low as Rs 100. (link). Still early days, but this could boost its AoV from INR 398, to atleast industry average.

Another thought is: an aggregator of UPI Apps could maybe help with distribution, but unsure how this would play out

The fact that 75+ UPI Apps are currently operating in the market, even though they have relatively low volumes: (take Kiwi, its a UPI App focused on Credit Card on UPI, and is barely at INR 100 Cr per month) means that there are people who see value in other apps, and not just the top few apps. It may not be the only UPI App they use, but in some cases, they do see a use-cases where they open it up to make a payment, instead of a PhonePe, or a Gpay.

In the past, I’ve written about how, to be able to actually achieve scale with a new payment method, distribution is key. For example: For BNPL to scale, they need to have partnerships with payment touch points such as checkout, and Payment Apps. Which is what Klarna & Affirm are now focusing on, Affirm is a method that is enabled and can be accessed through GooglePay. You can check out my piece here:

Is there a way to scale new UPI Apps by tying up with existing Apps? Example: if I launch a PopClub, and to enable discovery, explore some sort of partnership with an existing UPI App that already has distribution? I think of it like cards: folks who have multiple cards, use different cards at different merchants, depending on offers / reward points / or anything else that they might get.

But there’s no reason why an existing UPI App would lend its distribution to a competitor

But I can’t think of any reason why an existing App with scale would allow a new app to leverage its distribution. So then, if thats the case, then the other way to discover and onboard on new UPI apps are at checkout.

So then, the other way to win is to combine it with a PA / checkout play:

So then maybe the winning play, the ONLY winning play is a combined UPI App & Payment Aggregator strategy. Which has already started happening. All your top apps clearly have wisened up to this, and already applied for or received a PA license.

And maybe thats what we can expect from these challenger Apps soon. An application for a PA license, and the development of their own checkout.

At some point, new age UPI Apps (ex Kiwi, Rio.Money) who have raised money for an app only play will have a decision to make

If you’re not in the Top 10 of UPI Apps, and then you’re bleeding money in the name of “customer acquisition” and pricing at some point in the future. And the day monetizable methods take off, its probably going to be on the top Apps such as PhonePe & Gpay, not the bottom few.

And here’s the thing: more & more, a consumer app doesn’t seem to make sense from a standalone play perspective. You need to have other products. Ex: PhonePe with its PG expansion, Paytm with its loans. Even players like Navi & Super.Money, have other core businesses: Navi with loans, and Super.Money with its Flipkart affiliation.

Even if you look at global equivalents (of course, pricing is different in the US, with real time payments not really taking off due to the card & banking penetration), but even Nubank, which started out as a mobile first neobank on an app, was actually a bank. A payments app / consumer app is great for engagement & traction, but unless there is a solid business powering it: either a bank, NBFC, cross sell of financial products, its very hard to make this sustainable in its current avatar.

And that’s evident from the way all these fintechs are going after licenses. They want as many options and revenue streams as possible. Just having one core business is not enough. You need several.

[#37] Do all roads in fintech lead to license aggregation: Part 2

So, in May ‘24 I had written a piece on if all the roads in fintech lead to license aggregation, you can check it out below:

![[#38] Is the battle for the ubiquitous UPI app over? : What do the next few years look like for UPI Apps?](https://substackcdn.com/image/fetch/$s_!R6jp!,w_280,h_280,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F698a0f5a-e30f-47a6-8be3-e000b9a13819_1600x892.png)

![[#42] The Klarna IPO & LazyPay pause: What does the future of BNPL look like?](https://substackcdn.com/image/fetch/$s_!LIzr!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F58fadd95-7f95-4cda-a743-b6996f8f0979_1752x984.png)

![[#37] Do all roads in fintech lead to license aggregation: Part 2](https://substackcdn.com/image/fetch/$s_!0EZL!,w_280,h_280,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F2cc9aa1e-f79a-469c-9887-52c189f6637f_1634x918.png)

who is making money on all of this UPI usage?

It has turned into an expensive customer acquisition strategy than a solid business model. wdyt?

1. Do you think raising the cap on B2B payments would attract more players to focus just on B2B? Or is the real hurdle less about limits and more about B2B being seen as "unsexy"?

2. What’s your take on having a Pix-like MDR for B2B payments? Do you think it would work?

3. Does Credit on UPI also have transaction limit?