[#67] The great fintech valuation correction: When IPOs loom, multiples shrink

Fintech funding seems to be back, but with a dose of realism. Recent funding sees multiples on par with global equivalents. Established fintechs need to grow by ~50% to justify 2021 / 2022 valuations

Welcome to the 4th edition of the theme I’ve been tracking over the last year: Fintech Funding & IPO’s. You can check out the last article I wrote on this topic below:

Fintech funding is making a comeback in FY25, and it’s happening across the board. After a year of stagnation, we’re now seeing fresh momentum from seed to growth stages. Early stage activity is picking up with startups like Powerup.Money (a wealth-tech spinout from Uni Cards) and Yenmo (focused on Loans Against Securities). Meanwhile, Series A and B rounds are fueling scaling efforts for infra and distribution players like Easebuzz, Decentro, and Stablemoney. And at the growth stage, established fintechs such as Juspay, Cashfree, Groww, Cred, and Navi are raising capital to double down on market leadership, expansion, and long-term category bets.

In other fintech news (technically not relevant to this topic, but for the sake of being thorough calling out trends here):

Stripe made it’s second crypto / blockchain acquisition after Bridge. It acquired a wallet infrastructure start-up called Privy, which enables developers to integrate cryptocurrency functionality without requiring users to leave their applications or manage external wallets. So Bridge handles stablecoin rails and Privy handles wallet complexity - seems like Stripe is going all in - into stablecoin and betting big here

Chime, the US based neobank IPO’ed in June ‘25. It’s market-cap at IPO was $15 - 16B (well below its $25B valuation in 2021), and its FY25 revenues were $1.7B, giving its a revenue multiple of 9.41x. One more example of valuation before “saner” when coming to public markets. (an Indian example here of course is Mobikwik: was at $1B valuation in 2021, before being cut by 75% to ~$256M in FY25 right before IPO).

Aspora (formerly known as Vance) raised $93M across 3 funding rounds from Sequoia, Y Combinator and other investors, at reportedly a $500M valuation. They’re a cross border payments & neobanking start-up. But all this is the topic of a separate article, I’ve added it here since it is a funding announcement.

Razorpay officially announced majority investment of $30M in Pop, a UPI App, which did ~13M txns and INR 500 Cr in volumes in May ‘25. Again, the topic of a separate article, but this validates a previous hypothesis that i’ve talked about in an article (link below.

The hypothesis was: The full stack play around PAs (step 1 of checkout), UPI Apps (step 2 of checkout since majority volumes flow through UPI), and the infra (acquiring + issuing switch) seems to be playing out. All top PAs (Razorpay, PhonePe, Paytm, Pine Labs, CCAvenue) have consumer apps, and all top UPI apps (PhonePe, Gpay, Paytm, Cred) have PA licenses. I expect PayU & Cashfree to make UPI App moves either through in-house builds or acquisitions. Maybe Fampay could be an acquisition target, reportedly the co-founder is moving away from day to day operations. In fact, almost all challenger UPI Apps (PhonePe, Paytm, Gpay & Cred being the OGs) have non UPI focus, it was only Pop and and Fampay that seemed to be UPI focused. (numbers are of 2 months ago). And now Pop seems to be on its way to being acquired by Razorpay. Only Fampay is left

But back to the topic at hand. Let’s unpack the funding announcements

Segment 1: Payments & Super-Apps

Even Super-apps are into payments, but I’ve broken it down into players who are more B2B focused (payments) versus B2C (superapps).

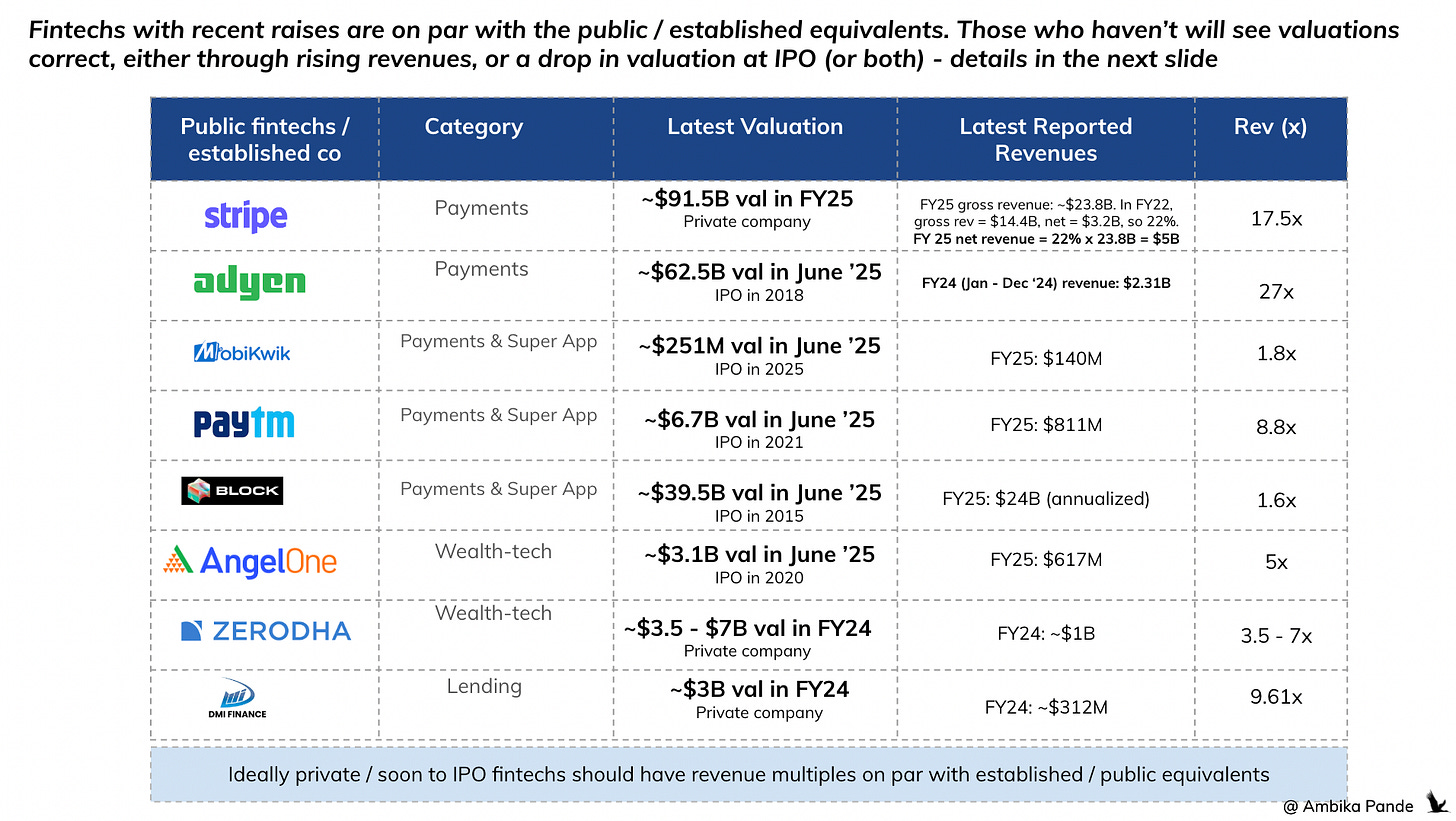

TLDR: fintechs that have recently raised are on par with the multiples of comparables, assuming that the numbers reported are net revenues. And those who haven’t raised need to grow revenues by 30-50% for the valuation to make sense.

1. Payments (more B2B focus)

The companies in this segment that have raised are below. All seem to have valuations corrected, and are on par with comparables and global equivalents

Cashfree : It raised a $53M round in Feb ‘25, at a valuation of $700M. With a target of $117M in revenue in FY25 (and at $76M in FY24), its revenue multiple is at ~7-9x

Easebuzz (PA): Raised a $30M round in FY25 led by Bessemer. It was valued at $200M. It’s gross revenues in FY25 were ~$77M (INR 650 Cr). This is a revenue multiple of 2.59x

PayU (PA): One of the giants, and leading players in the PA space. It raised ~$120M in FY25 from its parent company Prosus, and reportedly is valued at ~$4.2B (in FY24). Its FY25 annualized revenue is reportedly ~$474M, (H1 FY25 was $234M) and its revenue multiple is ~8.86x

Juspay (Payments Infra): Established payments infra company which actually played a key role in building UPI in India. They got a PA license last year. Their star product was the payment orchestrator, and while they’ve had some trouble, with top PA’s backing out integrating with it, they raised $60M in Series D in FY25 at a ~$1B valuation. Their FY24 revenues were $40M, and at this number, the revenue multiple is at ~24x, but I expect this to correct to <20x at their FY25 revenues (whenever released - this is just my ballpark number based on my own estimated). In FY22 when they last raised, they were at $440M valuation, and ~$13M revenues, so a multiple of 33x

2. Super Apps (majority B2C focus)

CRED: Cred is one of those fintechs that has been trying to do everything. They have a PA license, a PPI license, a stake in a NBFC (Parfait) and are trying to get a broking license as well. They raised ~$75M in a Series G round in FY25, at a valuation of $3.5B, which is a drop from $6.4B in FY22. Also, in FY22, Cred reported total revenues of ~$53.7M (INR 422 Cr), which was a whopping revenue multiple in FY22 of 128x! With the drop in valuation, and estimated FY25 revenues to be ~$360M, their FY25 revenue multiple has now dropped to ~9.72x!

Navi: Navi started out as a personal loan app, and then got into UPI, and into the AMC side of things as well. While there’s not been any fund raise (Sachin Bansal, the founder owns ~97-98% of equity, having infused the funds himself, presumably from his exit from Flipkart), they did try to raise ~$200M - $400M in FY24 at a targeted valuation of $2B. At FY25 revenues of $267M, this is a revenue multiple of ~7.49x

Takeaways: Revenue multiple of Super-apps and payments players that have recently raised are all at sub <10x!

1. Revenue multiples have dropped significantly after recent fund raises

Earlier, these numbers were close to 25x + in terms of revenue multiples. Juspay was at ~33x at its last fund raise while Cred was at 128x in 2021 - 2022. Makes you stop and wonder: What exactly was happening 3-4 years ago in the so-called “boom” in fintech funding? Seems that money was being thrown at obscene valuations, with the hope that at some point revenues would catch up with the numbers.

Maybe the logic was: raise now at a valuation that makes sense if revenues grow as projected over the next 3 years. But that rarely plays out. It's hard to predict 3 months ahead, let alone 3 years. And in a heavily regulated industry like fintech, raising at sky-high valuations forces startups into unsustainable growth mode. That’s when you see dark patterns, sub-ethical practices, ruthless cost cuts, and shady revenue recognition, anything to justify the valuation.

Now that the ecosystem has matured, the revenue multiples & valuations are now closer to global equivalents & public comparables. Which brings me to my next point:

2. These multiples for payments players are assuming that numbers reported are net revenues. If they’re gross, then the multiple should ideally be even lower than the 17x - 27x (which is what Stripe & Adyen are at, in terms of net revenue multiples).

Note: Gross revenues is usually the total revenue, which includes any pass through revenue etc. Example: In payments, the gross revenue would be the MDR% x the transaction amount. But the net revenue would be after subtracting any interchange fees, partner payouts, acquiring & issuing bank cut.

I’ve assumed that revenues reported are net revenues, not gross, since those are the numbers Adyen & Stripe report. I’ve tried to calculate what the gross revenue multiples here are, to see if there’s a way to benchmark if Indian fintechs are over / undervalued, assuming these are gross & not net revenues reported.

Adyen’s net revenue multiple is ~27x currently (~$62.5B valuation in June ‘25, and FY24 NET revenues (as of December ‘24) were ~$2.31B).

Stripe’s FY25 valuation is $91.5B, but its FY25 revenue isn’t publicly disclosed, so I’ve estimated it based on past metrics.

In FY22, Stripe processed $817B in TPV and earned $14.4B in gross revenue (~1.7% of TPV), with net revenue of $3.2B (~22% of gross). Assuming FY24 TPV was ~$1.4T, applying the same 1.7% gives ~$23.8B in gross revenue. At a 22% net take rate, that implies ~$5.24B in net revenue.

This puts Stripe’s valuation at:

17.5x net revenue multiple ($91.5B / $5.24B)

3.8x gross revenue multiple ($91.5B / $23.8B)

This net vs. gross revenue multiple is key when comparing Stripe to Indian fintechs and assessing relative valuation.

3. All the PA’s that have raised in FY25 are at revenue multiples of 5x - 9x. If the numbers reported are net revenues then they’re undervalued. If they are gross revenues, then probably on par / little higher than what they should be

Cashfree is currently valued at a 7–9x revenue multiple (I’m assuming this is based on net revenues, as they report "revenue from operations" and I’ve taken that to mean net revenue, but I could be wrong). Easebuzz is at ~3.59x (this is on gross revenue, which they have clearly called out. Assuming net revenue is ~20 - 50% of this, a net revenue multiple could be anywhere between 5x - 13x), and PayU India at ~5.69x although it’s unclear whether these are based on net or gross revenues. Juspay, at $40M in FY24 revenue, is at ~24x today, expected to correct to <20x with projected 40–50% revenue growth in FY25.

One key caveat in benchmarking these multiples is whether we’re comparing net or gross revenues, especially in payments, since net revenue seems to be anywhere between 20 - 50% of gross revenue, and this is can significantly change the picture - Stripe & Adyen numbers have both been calculated at a net revenue multiple. At a net revenue multiple, Indian fintechs in comparison seem to be undervalued. If the Indian fintech revenues reported are gross, then this story changes.

Another factor to consider: scale and geography. While Cashfree, Easebuzz, and PayU operate primarily in India, players like Adyen (100+ countries) and Stripe (45+) have scaled globally, partly explaining their higher multiples (Adyen at ~27x, Stripe at ~17x).

So assuming that ALL numbers reported are net revenues, while Indian fintechs may seem lower valued, they’re likely priced appropriately given their current scale and market depth. Global execution will be key if they want to close the multiple gap.

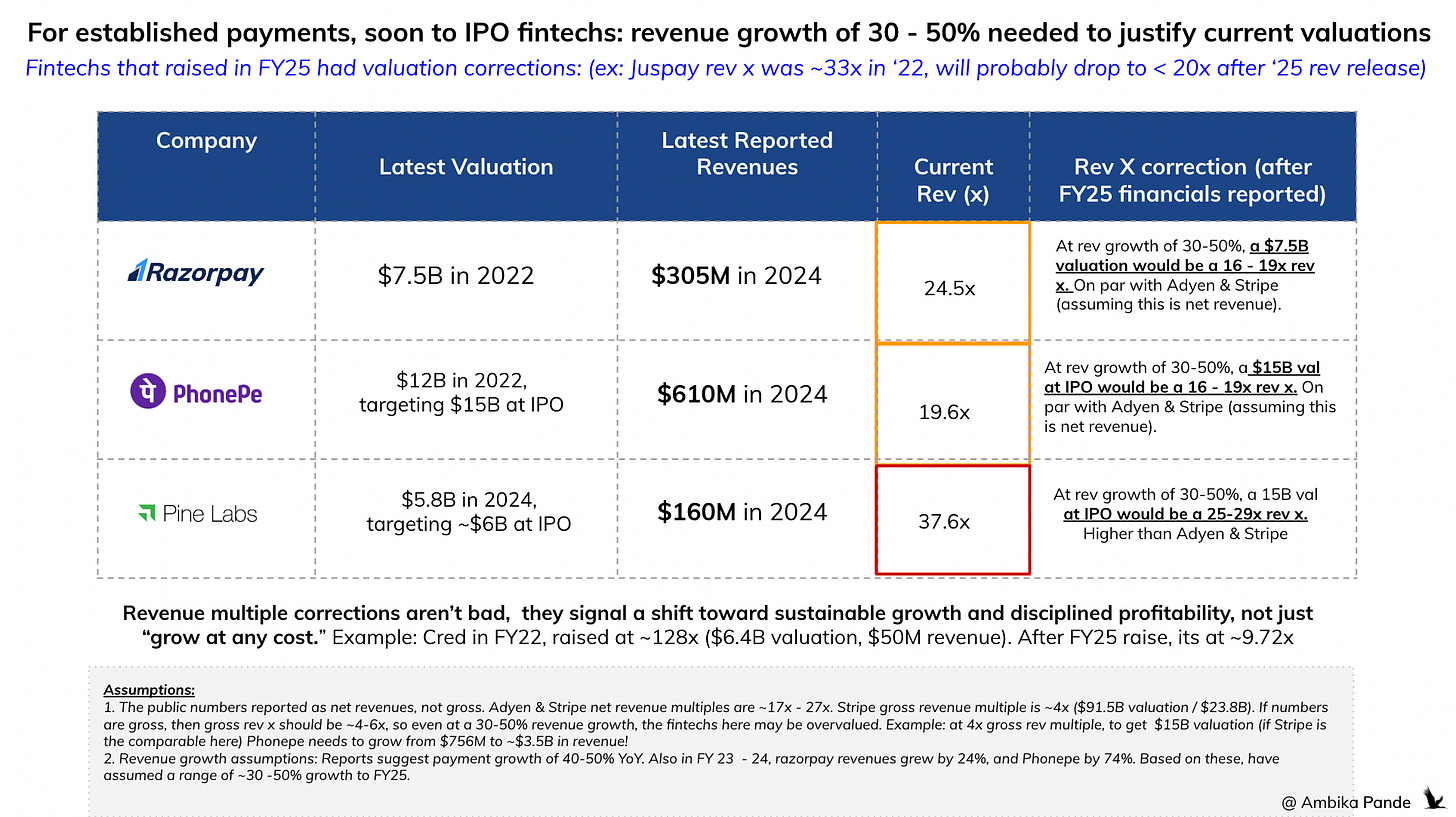

4. But if I were one of the bigger established fintechs, which are soon to IPO, I’d be concerned: basis valuation & revenues, they need to grow by ~30 - 50% for the multiple to make sense (and this is at a net revenue multiple)

Razorpay was last valued at $7.5B in 2022, with FY24 revenues of $305M, putting it at a ~24.5x revenue multiple. To bring this down to <20x, in line with Adyen and Stripe it would need to grow revenues by ~50% in FY25. This seems achievable: Razorpay grew ~24% in FY24 despite an RBI restriction on onboarding new merchants. According to Fortune India, it expects 40–50% YoY growth, making sub- 20x well within reach.

PhonePe, valued at $12B in 2022, reported $610M (INR 5064 Cr) in FY24 revenues. It’s eyeing a $15B IPO in FY25–26. Basis these numbers, its revenue multiple is ~19.6x. At 50% YoY growth (to ~$1.1B in revenue), its forward multiple drops to ~16.39x. Given ~74% growth from FY23–24, this trajectory looks realistic.

Pine Labs was valued at $5.8B in FY24, with an IPO target of $6B in FY25. FY24 revenues were $160M, up just 2% YoY. This brings its current revenue multiple to 37.5x! To justify a $6B valuation at a < 20x multiple, it would need to at a minimum double revenues in FY25 (~$320M, which would then bring its revenue multiple to ~18.75x).

But as I mentioned before, all these multiples assume net revenues.

If the reported figures are gross (as is common in payments), then the implied gross revenue multiples are on the higher side and should ideally be sub-10x, benchmarked to Stripe (~3.8x gross) and Adyen.

That said, these companies, Razorpay (online PAs), Pine Labs (offline POS), and PhonePe (UPI) are category leaders, and can command a premium multiple relative to global peers, especially as they scale towards IPO.

5. In Super-Apps, CRED & Navi are in the 7x - 9x range, which is on par with Paytm & Block

CRED is currently valued at a ~9.72x revenue multiple, while Navi sits at ~7.49x, and both in a similar range to global and local comparables.

Mobikwik, a PA + SuperApp that IPO’d in 2025, is not a top player in any single category. It has seen multiple valuation resets, down from $1B in FY21 to $256M pre-IPO, rising briefly to $569M post-IPO, and now back to $251M (June ‘25). At this level, its revenue multiple is just ~1.8x, and hence while I’ve included it here, I don’t think this is a meaningful comparison. And that’s another point: in the past we’ve seen bloated private valuations in early stages, but at the time of IPO, valuation then gets cut by ~75%.

Let’s look at Paytm, which IPO’d in 2021 and is the closest & best public comparable, also keeping its scale and traction in mind. As of June 2025, Paytm’s market cap was $6.7B with FY25 revenues of $611M (a 31% YoY decline), implying a revenue multiple of ~8.28x. Cred & Navi have both been scaling (if I take UPI payments as a proxy) faster than Paytm.

Now compare this with CRED and Navi, both of which are top UPI apps:

In May ‘25, CRED processed INR 55,000 Cr, and Navi processed INR 21,000 Cr via UPI.

Navi’s lending AUM stood at INR 11,000 Cr in June ‘24.

UPI growth (Apr ‘24 to Apr ‘25): Paytm grew just 7%, CRED by 15%, and Navi by a staggering ~4500%.

Given this, CRED’s recent valuation reset seems well-aligned with fundamentals and market performance. Navi’s growth, particularly in lending and UPI is also starting to justify its valuation. And Navi is also a lending fintech - in fact it originally started out as a personal loan app, which could also qualify it at a 5x - 6x multiple (which is where lending fintechs are, as discussed in the next section). But it’s UPI scale & focus suggested that it may be better in the super-app section, and its 7.5x multiple is justified.

If we zoom out to global benchmarks, especially neobanks and super-apps (CRED and Navi are India’s closest equivalents), Chime offers a useful reference. The US-based neobank IPO’d in June ‘25 at a $16B market cap on FY24 revenues of $1.7B, a revenue multiple of ~9.41x. This lines up well with where CRED and Navi are currently valued, suggesting Indian B2C fintechs are now trading at global-comparable multiples.

Segment 2: Wealth-tech

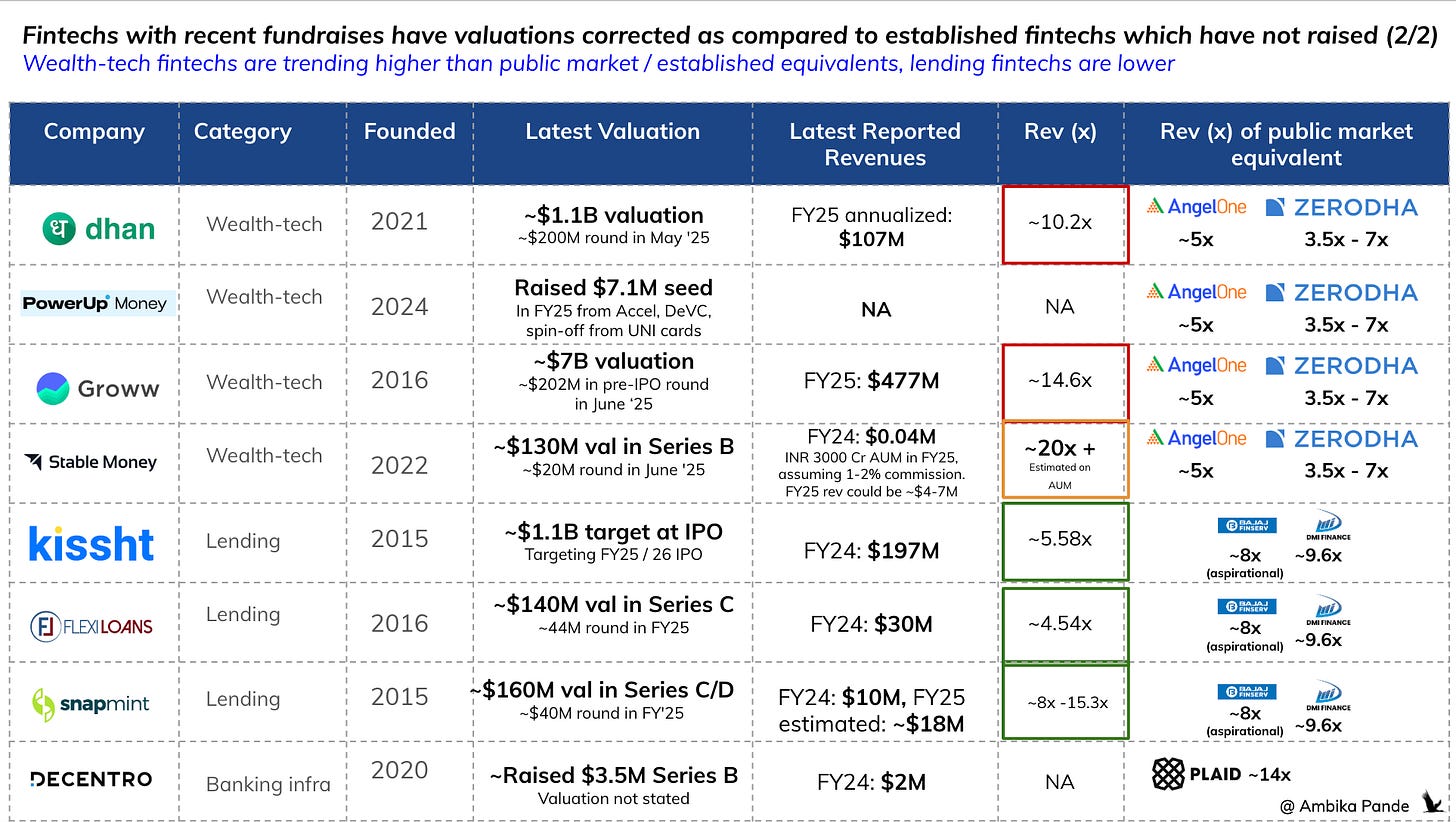

TLDR: Fintechs which have raised here are at higher multiples than public / established fintechs. But wealth-tech is expanding into not just plain broking & passive investing, but AI powered recommendations, wealth advisory & portfolio management. User experience and customer management matters here, so players who do this well could command a higher premium for a stickier customer base.

The companies in this segment that have raised in FY25 are:

Dhan (Broking): Raised a $200M round in May ‘25 at a $1.1B valuation. Its revenues in FY25 (annualized) were ~$107M . Its revenue multiple is ~10.2x

PowerUp.Money: This is a seed stage fintech start-up offering wealth advisory services, which was spun off from UNI cards. They raised a $7.1M round in FY25. No real data on valuation or revenues (that I could find, but they are still very early)

Groww: Groww is one of the big fintechs that are supposed to IPO in this / next year. A broking start-up (is it a start-up anymore?), it raised $202M in FY25 in pre-IPO funding, at a valuation of $7B. It’s targeting a valuation of $7-8B at IPO. In FY25, it reported ~$477M in revenues, which is a 31% growth, and ~$213M in profits, which is a 3x growth in profitability. It has 13 - 15M users. Its revenue multiple is ~14.6x

Stablemoney: A start-up offering users a way to invest in FDs. They raised a $20M Series B in June ‘25, at a valuation of $130M. In FY24 their revenues were $0.04M. They haven’t reported their FY25 revenues, but their FY25 AUM was reportedly ~INR 3000 Cr ($350M). Assuming a 1-2% commission, the revenues could be ~$3.5M - $7M, which is a 18 - 36x revenue multiple. I’m assuming this would be around 20x - 25x. Again, these are my own estimates, but they do have a 2M user base, which is a significant number of users that they can monetize

Takeaways: wealth-tech start-ups that have recently raised are at higher multiples as compared to Zerodha & AngelOne (3.5x - 7x), which are established / public wealth-tech companies

Dhan, Stablemoney & Groww are at 10x - 20x revenue multiples. This is 2x higher than what Zerodha & AngelOne are at. Zerodha is valued at anywhere between $3.5 - $7B, with FY24 revenues of $1B. AngelOne IPO’d in 2020, and has a market cap of $3.1B in June 25, and FY25 revenues of $617M (refer to the table in the previous section), which is ~5x revenue multiple. AngelOne reportedly has a user base of ~36M, Zerodha has ~15M. In comparison, Dhan has ~1M, Stablemoney has ~2M, and Groww has 13 - 15M users.

My take: Wealth-tech today isn’t just about transactions, it’s becoming wealth advisory, powered by AI. Take Zerodha: In FY25, they launched an MCP server that lets users connect their Zerodha account to Claude, enabling natural language queries like “What’s my account balance?”, similar to how you can connect and query your Google Drive on various LLM chats. Groww is also moving in this direction with its acquisition of Fisdom, and new wealth management offerings for HNIs, and this is also the value prop of Power.Up Money.

These newer fintechs can bake in advisory layers natively, driving higher engagement and monetization per user. That, to me, justifies a 10–15x revenue multiple, even if it looks richer than legacy comparables.

I had written more on where wealth-tech is headed, check it out below.

[#61] The Next Wave in Wealth Management: Acquisitions, niche TGs & consolidated net worth

There's been activity in the investing and wealth management space lately

Segment 3: Lending

TLDR: Lending fintechs seem to be on par / a little lower with established NBFCs which makes sense, just seeing the sheer scale at which some of the bigger players operate. I also expect more investor interest in lending fintechs as well as increased unsecured lending volumes, as an outcome of relaxed capital reserve requirements on unsecured credit AND RBI cutting the repo rate from 6.5% to 5.5% in FY25

In FY25, the following BNPL / lending start-ups have announced fund-raise or IPO plans:

Flexiloans: Flexiloans has its own NBFC (Epimoney) and also lends through partner NBFCs. Its B2B - it provides loans to SMEs. They raised a $44M round in FY25, at a $140M valuation (Series C). It’s FY24 revenues were $30M, giving it a revenue multiple of ~4.5x. They’re profitable, in FY24, they had profits of ~$352k. Their profit (x) is ~400x basis FY24 numbers, but I expect this to come down since they recently raised.

Snapmint: It has its own NBFCs and also lends through partner NBFCs. It is B2C focused, it’s value prop being “Easy EMI.” It raised $40M in FY25 at a $160M valuation. Its FY24 revenues were $10M, giving it a revenue multiple of 15.3x. In FY25, the revenues are projected to be between $17 - $18M, so this will probably come down to < 10x. Edit: August 2025: Their FY25 revenues were $18.5M, so its Rev (x) was ~8.5x. They’ve become profitable in FY25, with profits of ~$1.7M, from a ~$3M loss in FY24. Their profit (x) is 90.6x

Kissht: It’s a B2C lending business, with its own in-house NBFC (OneEMI) and partner NBFCs. It’s targeting a FY26 IPO at a $1.1B valuation, and its FY25 revenues were $197M, giving it a revenue multiple of 5.58x. Its FY25 revenues could decreased to $159M (INR 1353 Cr), taking this to ~6.9x. They’re also profitable, they were at ~$19M profit in FY25. Their profit (x) is 58.7x

Edits: August 2025

Fibe: B2C lending business, which raised a ~$26.5M debt round in August 2025. It was valued at ~$300 - 400M in it’s Series E round in 2024, and as of now, is estimated to be valued at ~$600 - $650M. It’s profitable - made $12M in profit in FY24 (profits spiked almost ~20x from FY23). Their profit (x) is 50.5x

DPDZero: This is not specifically lending, but it’s lending adjacent, because it’s collections. They raised ~$7M in their Series A funding around in August 2025. DPDzero operates an AI powered platform that automates and streamlines debt collection for financial institutions. In FY2024, its revenues were $976k, and in FY25 its valuation reportedly was ~$18.5M (Rev x of ~20x). and Two points here:

But what is interesting to me here is that they’re raising not just to expand their tech capabilities but to also establish a nationwide network of professional field collection agents. So this goes to the earlier thesis that I’ve talked about in previous pieces: collections can never be 100% automated, you need that “feet on street” presence.

Collections tech as a space is seeing interest: Rezolv raising $3.5 million from 3one4 Capital and CredResolve securing $1.1 million led by Unleash Capital in FY25. I expect at some point these start-ups will also get into field collections if they haven’t already.

Takeaway 1: I’ve taken comparables here as Bajaj Finance & DMI Finance - Bajaj for scale (8x revenue multiple), and DMI Finance since it partners with BNPL players (9.6x revenue multiple) and also bought Zestmoney, which are at 8x - 9.6x, all seem in line here

Bajaj Finance (June '25): $68B market cap on ~$8.2B revenue → FY25 profits of ~$1.8B

8.3x revenue multiple

34x profit multiple

DMI Finance: Raised $575M from MUFG in FY24; Valued at ~$3B in FY24, FY25 revenues of ~$314M → 9.6x multiple, profits of ~$46M in FY24

9.61x revenue multiple

~64x profit multiple (probably will come down to ~40x)

1. Just basis revenue multiple, these lending fintechs seem fairly valued if compared to scaled comparables

Kissht (5.58x) and Flexiloans (4.54x) seem fairly valued—perhaps even slightly under—when benchmarked against established peers. Snapmint, with projected FY25 revenues of $18M (FY24 revenues were ~$10M, so this is an expected ~80% growth in revenues), is currently at an ~8.8x multiple, which also feels justified given its scale and growth trajectory.

2. But profit multiples show a different story.

Since there is a lack of P/E comparables here since start-ups are private, but all of these fintechs have now turned profitable, I thought I’d take a look at what their profit multiples (valuation by profit) looks like. Bajaj is at 34x, and DMI is at 64x.

Kissht: 58.7x

Flexiloans: ~400x (will be lower, since FY25 details are not reported)

Snapmint: ~90.6x

Fibe: 50.5x

All much higher than Bajaj. Little lower than DMI, but they haven’t reported their FY25 numbers yet.

3. Now let’s look at context through AUM comparisons:

Kissht (FY25 AUM): INR 4,000 Cr (~$470M)

Flexiloans (FY24 AUM): INR 2,000 Cr (~$235M). They were targeting INR 4000 Cr AUM by end of FY25

DMI Group (DMI Finance + DMI Housing) (FY24 AUM): INR 14,550 Cr ($1.74B), with ~84% in retail lending

($1.46B)Bajaj Finance (Dec '24 loan book): INR 4.1 lakh Cr (~$48B)

Given the much larger scale and capital access of players like Bajaj and DMI, it makes sense that newer digital lenders operate at slightly lower revenue multiples. Their current range reflects a realistic market positioning while leaving room for premium as they scale.

Takeaway 2: Lending start-ups seeing investor interest and raising could be an outcome of relaxing capital reserve requirements (from 125% back to 100%), and repo rate cuts by RBI from 6.5% to 5.5%, which makes capital cheaper, and injects more liquidity in to the market

The RBI has cut the repo rate from 6.5% to 5.5% between February and June 2025.

Since the repo rate is the rate at which the RBI lends to banks, this makes capital cheaper for banks. In turn, banks can lend to NBFCs, especially non-deposit-taking ones like Snapmint, FlexiLoans, and Kissht at more favorable rates. These NBFCs rely heavily on bank or market borrowings, so lower interest rates directly improve their cost structures and margins, making them more attractive to investors.

Another big tailwind: the reversal of the 125% risk weight on unsecured lending back to 100%.

In November 2023, RBI had raised the risk weight on unsecured loans from 100% to 125%, effectively increasing the capital banks and NBFCs had to hold to make the same loan. For example, to lend ₹100 in unsecured credit, lenders now had to reserve ₹125 instead of ₹100, making unsecured lending more expensive and less attractive. These costs are often passed down the chain, from banks to NBFCs, then to LSPs and finally to customers, resulting in higher rates and potential drop in demand or quality. I had written a piece about this in 2024 when the risk weights were first increased from 100% - 125% and the implications. You can check it out here

But between February and April 2025, RBI reversed this move, bringing risk weights on NBFC exposure back to 100%. This restored capital efficiency for banks lending to high-quality NBFCs and freed up capital in the system.

It has made lending more viable again and is likely driving a rise in both investor interest and lending volumes among digital lenders with their own NBFCs. I expect growth in unsecured credit, and also more investment announcements in lending fintechs as an outcome.

Takeaway 3: Lending enabling start-ups continue to see interest - aka the collections tech. Although, will this remain standalone, or a full stack play remains to be seen

Lending 1.0 was your traditional lending, doing it through PDF & documents, mostly through offline agents. Distribution happened by banks & NBFCs, and this is where Bajaj Finance scaled up, where they put an agent in almost every store

Lending 2.0 was digital lending & LSP, where your LSP plays managed to scale distribution both online & offline. Players such as Pine Labs built your brand EMI stacks on POS, ShopSe targeted offline, with both CC EMI, and new to bank plays. The Zestmoney’s and Axio’s of the world scaled up in online, taking FLDG, and distributing BNPL to more customers. This also included Slice & Jupiter that tied loans to PPI wallets, using them as a faux credit card. When the FLDG crackdown happened, and the DLG guidelines came in, all of this was stopped, and the LSP model as a standalone play has been struggling. Things also came to light - these weren’t the most sustainable models, lack of profitable customers, rising NPAs, and so on. Approval rates also dropped, since earlier, because the LSPs were giving FLDGs, lenders weren’t doing their own due diligence, since losses were covered. Now, after FLDG being capped at 5%, banks are back to doing their own risk underwriting, which put a dampner on approval rates, and credit disbursals, from LSPs at least. (although there are ways around this, you can open a deposit with the bank, and put 100% of the funds you want to disburse in that account. And then through a separate account / agreement, the bank agrees to give you the supply of that much credit)

Lending 3.0: This is where the fintech NBFCs have scaled. Case in point: Flexiloans, Snapmint, Fibe, Kissht. All of these are NBFCs, and I assume they do some serious lending on their own books, so they can take credit decisions. And this is where the surrounding tech catches up to allow them to lend better:

Slice and dice through customer data better to find those “good customers” - the credit insights play

Get access to customer data more easily to be able to make decisions: the account aggregation, data supply play, alternate data / signals

Collect more efficiently: collections tech, better visibility on DPDs & delinquent loans etc.

The big thing to remember here is that higher DPD isn’t bad. It’s only bad if you can’t manage the risk. Nubank for example (and I wrote a piece on this, #40: What can we learn from neobanks). TLDR: While Nubank takes on more risk than traditional banks, and this is what the tech enabled NBFCs will do, as long as they can predict it better, and manage it, that still makes sense. And their profits are proof of sustainability, they made ~$1.9B profit in FY24.

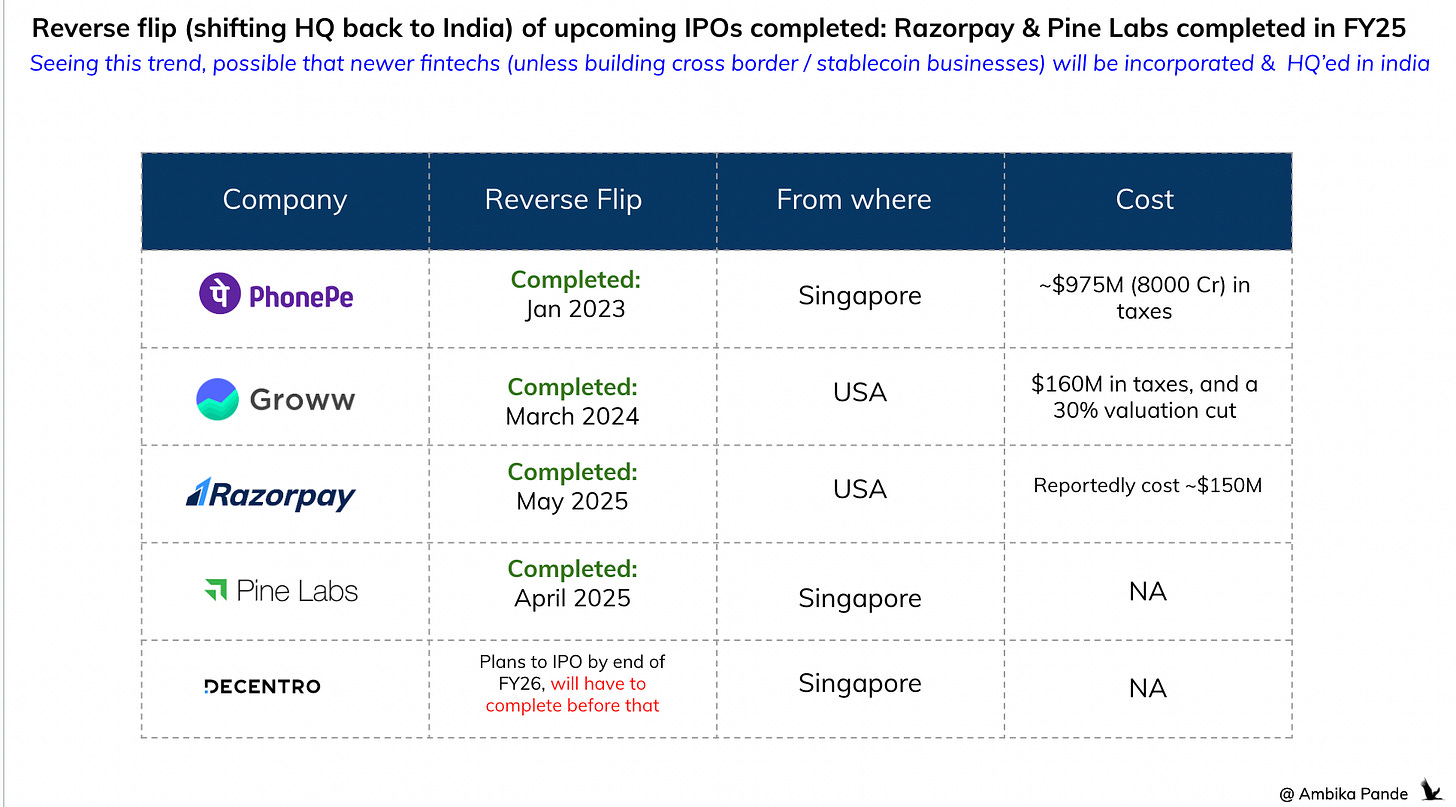

Blockbuster IPOs of upcoming fintechs: All have completed their reverse flips

To be able to list in Indian markets, start-ups need to relocate their holding structure back to India. Instead of being a US company with an Indian subsidiary, the structure is “flipped” where the Indian company becomes the parent, and the US company becomes the subsidiary or is dissolved. And all shareholders then get shares of the Indian entity. PhonePe & Groww completed their flips in 2023 and 2024 respectively. In 2025, both Razorpay & Pine Labs completes theirs as well: Razorpay from the US to India, and Pine Labs from Singapore to India.

Note: Apparently Decentro (a banking API infra company) which raised its Series B in FY25 of $3.5M, and had FY24 revenues of $2M also plans to reverse flip from Singapore, and IPO by the end of FY26.

So. Fintech funding is back, but with a dose of realism. Newer entrants are raising at sensible revenue multiples, aligned with public and global comparables. And in contrast, larger fintechs that haven’t raised recently may need to show 30–50% revenue growth to justify their 2021–22 valuations.

![[#51] Decoding Fintech IPOs: Part 2 (India Focus)](https://substackcdn.com/image/fetch/$s_!G63h!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fc289218c-34d8-446c-b0c3-bb6df9ec0047_1914x1072.png)

![[#60] The UPI Dilemma: What happens when the infra and the apps are commodities?](https://substackcdn.com/image/fetch/$s_!lwZZ!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fa696dca4-050f-4c95-80a7-c6e9129ce3ee_1906x1070.png)

![[#61] The Next Wave in Wealth Management: Acquisitions, niche TGs & consolidated net worth](https://substackcdn.com/image/fetch/$s_!D5-U!,w_280,h_280,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F943e6ab4-1a60-4fef-baf6-465ed60b4ecc_1574x890.png)

Detailed & full of insights as always